TIDMFCSS

FIDELITY CHINA SPECIAL SITUATIONS PLC

Half-Yearly results for the six months ended 30 September 2021 (unaudited)

Financial Highlights:

* The net asset value ("NAV") of the Company decreased by -16.9% for the six

months ended 30 September 2021. The Benchmark Index decreased by -14.4%.

* The discount widened from 1.1% at the start of the reporting period to

9.2%, due to a share price total return of -23.7%.

* Recent regulatory events should be viewed as part of an overarching aim to

foster sustainable growth, boost social equality and ensure a balanced

economic model.

* History teaches us that these are usually the periods that offer the most

attractive opportunities. Corporate earnings for the market are forecast to

grow over 15% for the next twelve months, with the Company's portfolio

comfortably above this level.

Contacts

For further information, please contact:

Natalia de Sousa

Company Secretary

01737 837846

FIL Investments International

Portfolio Manager's Half-Yearly Review

THE PERIOD UNDER REVIEW - SOME COMMENTARY ON KEY EVENTS

Well-publicised concerns over increasing regulation were a major factor in the

Chinese markets' decline during the reporting period. However, the current

regulatory 'cycle' really began in the fourth quarter of 2020 when Ant

Financial unexpectedly cancelled its initial public offering (IPO). This was

followed by a series of anti-trust related measures in the internet sector,

including Alibaba paying a hefty fine of US$2.8 billion. The next area of focus

was on data and national security, culminating in a cybersecurity investigation

into Didi (which is still ongoing) and the suspension of new downloads of its

app. Outside the internet space, we saw policies focused on areas associated

with 'common prosperity', which affected the property, healthcare and education

industries - also dubbed China's 'Three Mountains'. The after-school tutoring

sector was most severely impacted with many businesses unable to survive the

restrictions imposed on certain core exam subjects and services.

Against this backdrop, the Company's NAV declined 16.9% in UK sterling terms,

while the MSCI China Index (the Benchmark Index) was down by 14.4% in the

six-month reporting period to 30 September 2021. The Company's share price fell

by 23.7% over the same period, reflecting a widening of the discount to NAV.

In trying to understand and analyse the government's actions, I believe it is

important to recognise some key points. First, the 'hand' of the government,

coupled with regulatory direction and implementation, is core to the investment

landscape in any market. This is particularly true in China. Therefore, one

needs to be aware of trends and the general direction of policy. We have

clearly had periods of tightening in the past, for example, government-imposed

restrictions around online gaming in 2018. In terms of future policy direction,

it is important to be cognisant of the long-term goals laid out in policy

documents like the Five-Year Plan when assessing how the regulatory landscape

could change and impact an industry's growth profile.

Second, many of these crackdowns are addressing problems that confront

countries globally. Big tech and related challenges around anti-trust and data

security are examples, as are the challenges around income inequality. While in

many cases we can trace the path of regulation, unlike in most other countries,

Beijing's implementation can be swift, which often roils markets.

The property sector has been under the spotlight of both policymakers and

investors for some time. Reining in property speculation is a crucial aspect of

President Xi's vision of a more equal society - think back to 2017 when he

commented that houses are 'for living in, not for speculation'. In this current

period of scrutiny, it is worth remembering the second half of 2020 when there

was a significant recovery in property sales in response to easy monetary

policy being rolled out to stave off an economic slowdown amidst the COVID-19

pandemic. After the strong rebound, new measures were announced to control

property developers. Of note, the 'three red lines policy' was imposed to limit

developers' leverage, with regulation targeting banks to control their overall

exposure to the property sector; and at the start of 2021, a centralised land

supply policy was implemented with the aim of controlling and lowering land

costs.

At the time of writing, the market remains nervous about the property segment

as no concrete plans have been announced by the authorities to assist with the

potential defaults of struggling developers - with Evergrande the leading

example of the sector's woes (the portfolio does not have any exposure to this

company). While it is likely that we will see some developers default, I feel

that the systemic risk remains low. Although comparisons to the situation in

the US around the financial crisis of 2008 can be drawn, they are very

different given the nature of the companies involved and the general control

Beijing has over the economy. In terms of Evergrande itself, it remains an

evolving situation. My base case is a government led restructuring, with a

focus on project completion and asset disposals to meet social obligations.

Broadly speaking, while I do not expect President Xi's drive towards a

healthier, less speculative property sector to be reversed anytime soon, one

should not be surprised to see some policy fine tuning in the near-term as both

property and land sales continue to slow down. All things considered; it is

reasonable to expect some level of policy normalisation in the form of faster

mortgage release in the not too distant future. More importantly, on the back

of a period of tightening, there is significant scope to loosen policy.

The slowdown in the property sector combined with weaker than expected credit

growth and the negative impact from the power shortage situation, have had a

detrimental effect on the wider economy with annualised gross domestic product

growth of only 4.9% in the third quarter of 2021. It should be noted that

economists and market commentators are broadly anticipating growth of around 8%

overall for the year as China's economy recovers from the effects of the

pandemic. Consequently, I believe there is good potential for greater monetary

and fiscal stimulus measures towards the end of this year.

PERFORMANCE AND PORTFOLIO REVIEW

Regulatory concerns weighed on technology-related shares over the period,

particularly in sectors such as communication services in the Company's

portfolio. Significant exposure in this sector was a key factor in the

Company's underperformance over the review period. In particular, the holding

in the Chinese short-video application company Kuaishou Technology detracted

from performance in light of negative regulatory news flow along with increased

competitive pressures which have resulted in higher-than-expected promotional

costs. Regulatory changes are also expected to impact its advertising network

business as data sharing with external parties becomes more difficult. However,

its short-video platform is still among the most popular social media companies

in China, ranking third in terms of total time spent online following Tencent's

Weixin and ByteDance's Douyin (both owned in the portfolio). It is also one of

the few internet companies that has robust growth in users. Also, in the same

sector, an exposure to Autohome, the largest auto internet platform in China,

detracted from returns. The slowdown in car sales, with chip shortages being a

major factor, have impacted promotional spend in the sector. However, I remain

positive given its value proposition to OEMs (original equipment manufacturers)

and dealers remains intact and would benefit from a recovery in car sales as

supply chain pressures alleviate.

21Vianet Group is one of the largest carrier-neutral internet data centre

("IDC") operators in China. However, its share price performance suffered with

concerns over growing competition in the IDC market and news of a large

shareholder announcing the sale of its stake. The latter is a short-term

overhang, and I remain positive on the mid-term outlook for the stock. IDC

demand is a structural growth story in China driven by factors such as

increasing usage of internet via mobile devices on the consumer side and

increasing demand for cloud and IT services on the enterprise side. Competitive

intensity is rising on the wholesale side of the business - mostly serving the

large internet companies - but this is now factored into forecasts and well

understood in the market. The company's management has been executing and

delivering on its ambitious growth plans and earnings have either been in-line

with or exceeded expectations.

The portfolio's materials exposure also proved unrewarding over the period. A

holding in Asia Cuanon Technology, a leading paint producer, underperformed as

rising input costs negatively impacted margins. On the positive side, this

company is pushing through price hikes and industry dynamics remain unchanged.

I believe that the long-term story around industry consolidation is in place,

and the company will continue to gain market share in this highly fragmented

industry.

In terms of positive contributors, an overweight position in the healthcare

space, coupled with an underweight real estate exposure, benefited the

Company's performance.

Within healthcare, an overweight position in WuXi AppTec Group supported

returns. Policy-wise, as one of the 'Three Mountains', investors appeared

overly cautious regarding potential regulatory changes in the healthcare

sector. While I believe that we need to be concerned over pricing pressures in

the generic drug sector, the continued emphasis from the government on

developing the innovative drug sector remains very much intact. WuXi is a key

facilitator in this area, especially as more Chinese companies increase their

global market share and also license their products to global players.

Furthermore, I believe the prospects for China establishing itself as a global

hub for innovation in drug development will gain traction. WuXi AppTec's

management is very focused on its key strengths in talent attraction and

retention. Long-term revenue/ earnings visibility remains compelling, with over

30% compound annual growth rate ("CAGR") likely over the next three years.

Similarly, Bio-pharmaceutical company Hutchison China MediTech also added value

over the six-month reporting period as it made progress on what continues to be

an exciting development pipeline. The company is also building out its

commercial platform in China with strong sales growth recently announced in its

interim results. The announcement of an in-licensing deal with Epizyme also

looks to be a positive step towards the company leveraging its growing domestic

sales operation.

Meanwhile, in the consumer discretionary sector, an overweight exposure to Xtep

International proved rewarding. Chinese sportswear brands benefit from the

secular tailwind of growing disposable income and rising awareness and interest

in sports and healthy lifestyles. With the sector growing at low-to-mid teens

CAGR and policymakers' focus on increased sporting and exercising activities,

top local brands (as well as top foreign labels) are outgrowing the industry.

Whilst the long-term structural growth story regarding Chinese sports brands

remains attractive, given where valuations reached during summer, I took profit

and sold out of the holding.

Within industrials, the Company's exposure to CIMC Enric, a manufacturer of gas

equipment and liquid tanks with leading technology was positive. It has a

product mix and strategy well aligned with China's environmental goals. Clean

energy equipment is leveraged to the increase in gas consumption, as its

proportion in China's primary energy mix grows, particularly with a higher

proportion of LNG (liquified natural gas). Hydrogen-related equipment has

long-term option value. The company's joint venture with Hexagon of Norway in

advanced hydrogen engines as well as its first-mover advantage in hydrogen

energy products (including hydrogen cylinder, container, compressors, which

incidentally also share some commonalities from its existing gas business)

allow CIMC Enric to tap into the tremendous long-term demand in the green

hydrogen market, although the current earnings contribution remains limited.

THE CONTINUED FOCUS ON ESG AND SUSTAINABILITY

The evaluation of environmental, social and governance ("ESG") factors is a

core part of Fidelity's investment process and I continue to see progress

regarding the level of engagement and transparency with Chinese companies. In

particular, much has improved in areas such as board diversity and the

environment. Sustainability factors are key topics of conversation with

corporates and many management teams are looking at ways to generate a more

sustainable outcome for their companies.

ESG market scores, such as Morningstar's Sustainability Atlas, report that

China continues to lag most other major markets. Despite this, we are

encouraged by the fast rates of improvement we are seeing with China's

regulatory commission engaging with companies to improve the disclosure of ESG

metrics to align themselves more with the standards in Hong Kong - Hong Kong

ranks fourth in Morningstar's Sustainability Atlas and is the most sustainable

non-European market (the US ranks 13th out of 48 countries, while the UK is

15th).

Not only is this a good outcome globally, but I also believe better ESG

practices are a key source of performance for the portfolio over the

longer-term. In the past, I have referred to Fidelity's proprietary ESG ratings

system whereby its internal analysts assign ESG ratings to investee companies.

For me, these ratings are far more 'up to date' than those of mainstream

ratings agencies and also better reflect the result of our direct engagement

with the companies that we invest in. Furthermore, I am pleased to highlight

that the scores of the companies in the portfolio are well ahead of the

Benchmark Index and continue to improve.

An ESG example in the portfolio is Beijing Oriental Yuhong Waterproof

Technology, a leading player in the waterproofing industry, which is a key

element in building construction. This company is extremely well managed, and

scores well across our key ESG metrics. It has a strong environmental

discipline, delivers high quality products, has good labour management, and

maintains strong interest alignment with a significant proportion of staff

being shareholders. By some measures, buildings are responsible for over 40% of

global emissions, and thus, building technology can be a major factor in

controlling and reducing emissions. It is also a major supplier of insulation -

a key area for potential reduction.

CURRENT POSITIONING

As discussed in the Annual Report for the year ended 31 March 2021, one of the

bigger shifts in the portfolio has been a reduction in holdings in the consumer

discretionary sector, mostly because of valuation levels, and an increase in

holdings in materials and industrials. The thesis around industry consolidation

in areas like building materials remains very much in place. However, I have

trimmed some positions given rising concerns over the residential property

slowdown and potential knock-on effects to the industry from the troubled

developers in the market.

In the financial space, I remain positive on the outlook for life insurance on

rising penetration over the mid-term. Near-term fundamentals generally remain

tepid, but I believe this is more than factored into what remain very

attractive valuations. Whilst I remain underweight the banking sector, I have

built a position in the Postal Savings Bank of China, which I believe is

undervalued given its strong, growing position in retail banking and wealth

management helping to drive superior returns relative to the sector. We are

encouraged by the clear focus of the new management team, including a strong

emphasis on growing its green financing.

After the significant recent correction in technology related names, I feel

that the risk/ reward payoff is now tipping much more in our favour in these

companies. While there is still risk of new regulation, as we think about what

could come next, there is a good chance that we are near or close to a "peak"

in terms of negative news flow. As discussed earlier, the government has

ambitious long-term goals in areas of economic development and innovation.

Clearly these will be difficult to achieve without a vibrant private sector. At

the same time, valuations for many companies have moved to historical lows and

look even more compelling when we compare them to global peers.

As is often the case with broad-based corrections, some stocks with lesser

regulatory risk have also been sold off, presenting opportunities.

Interestingly, this includes some smaller companies that could actually benefit

since most of the new regulation focuses on larger companies. As I have added

to some long positions, and closed some of the short positions, net gearing for

the portfolio has increased and, at the time of writing, was around 23%.

Also contributing to the higher leverage is the addition of three new unlisted

holdings. Tuhu Car is the number one brand for independent auto aftermarket

product and services in China. It greatly improves efficiency through an

Online-to-Offline model by combining its outstanding online platform to offline

branded franchisees. Cutia Therapeutics is an emerging leader in the

dermatology and medical aesthetics space in China, an area of great growth

potential. Beijing Beisen is a first-class HRM (human resource management)

software company. It is the clear leader and should continue to take market

share from its competitors due to its superior cloud and integrated solutions

for talent management. Despite the market correction, I still feel positive

about the outlook for the unlisted portion of the portfolio and the progress

being made in the respective businesses. I am pleased with and appreciative of

shareholders approval of the proposal at the AGM in July 2021 to raise the

limit on unlisted stocks to 15% of Net Assets plus Borrowings, given the

flexibility that this provides to capitalise on potential new opportunities. As

at 30 September 2021, the level of investment in unlisted securities was 11.3%.

The unlisted investments in the portfolio contributed 1.7% to the Company's NAV

return during the six month reporting period.

Looking forward, it is important to be focused on the risks in China and to

follow regulatory developments closely. In addition, developments in the

property sector will be keenly monitored as this has been a significant driver

of both economic growth and of local government finances, and a major component

of the health of the consumer balance sheet. Clearly, we are at a turning point

for the sector - lower levels of activity are a given, but any significant

correction in prices could clearly impact the consumers' mindset. Higher taxes,

including property taxes, are other possibilities that will need to be

considered. Having said this, and as mentioned earlier in my report, when

coming out of a period of tightening there is significant scope for Beijing to

adjust its policies.

It has been a volatile period, but we have seen times like this before, and

most likely will see them again. While the combination of the risks I have

outlined above is negatively impacting sentiment towards China currently,

history teaches us that these are usually the periods that offer the most

attractive opportunities. Corporate earnings for the market are forecast to

grow over 15% for the next twelve months, with the Company's portfolio

comfortably above this level. Meanwhile, the market overall is trading on a

price earnings multiple that is attractive relative to history and relative to

other stock markets globally. On the ground in the region, Fidelity continues

to place key emphasis on growing and developing its research team to help

identify and analyse the best investment opportunities - both in the listed and

unlisted areas of the market. Furthermore, as we engage with companies, we note

that even those in the regulatory cross hairs generally remain positive and

resilient as they navigate the changing environment.

Details of the Company's Top 5 Holdings can be found below and include my

theses for investing in these positions.

I have always disclosed in the Annual Report that I am a shareholder in the

Company and in line with recommendations around disclosing one's "skin in the

game", I can confirm that I currently own 96,742 shares.

DALE NICHOLLS

Portfolio Manager

29 November 2021

SPOTLIGHT ON THE TOP 5 HOLDINGS AS AT 30 SEPTEMBER 2021

The top five holdings comprise 28.9% of the Company's Net Assets.

Industry Information Tencent Holdings

Technology % of Net Assets 10.7%

The Portfolio Manager remains positive on the Company's

holding in Tencent given its strong position in running the

dominant social network in China and the attendant benefits

of powerful network effects. As China's internet user growth

slows down, Tencent has carefully nurtured and enriched its

user experience, and its enviable user base distinguishes it

from global peers. Tencent recently consolidated its leading

position in internet gaming by mediating a merger between

Chinese game broadcasting platforms Huya and DouYu, thereby

securing a controlling stake in the new company after the

completion of the merger. The recent sell-off has brought

valuations to attractive levels.

Industry Consumer Alibaba Group Holding

Discretionary % of Net Assets 8.5%

Alibaba holds a leading position in the e-commerce market.

The company has built a comprehensive ecosystem that has

superior breadth and depth and is the foundation of the

highly sticky merchants and consumers base, which ultimately

supports its pricing power. Furthermore, the company built an

environment of continuous innovation which has enabled it to

expand and increase its addressable market. The pandemic has

accelerated the trend towards digitalisation, which is a

long-term driver of Alibaba's growth in the e-commerce

business. Its cloud business is also likely to continue its

strong growth trajectory, as more corporates use its

infrastructure to become digital ready. We also saw

anti-trust regulation in the technology space, which resulted

in a fine for Alibaba. The extent of the fine was largely as

expected and Alibaba fully intends to comply and look at ways

to further strengthen the customer value creation and

experience and introduce new measures to lower entry barriers

and costs of operations on its platform. Valuations are now

very attractive, particularly compared with global peers.

Industry Information WuXi AppTec Group

Technology % of Net Assets 4.7%

The company is a long-term beneficiary from increasing

pharmaceutical and biotech contract research and

manufacturing ("CDMO/CMO") demand globally. China's CDMO/CMO

business has significant investment potential, driven by a

structural shift from generic to innovative drugs in the

country's pharmaceutical market. WuXi has established a

talent pool with strong technical skills which has helped to

drive a loyal client base. Looking ahead, there is exciting

potential upside from new technology developments, such as

its cell/gene therapy business.

Industry Financials Noah Holdings

% of Net Assets 2.6%

The company is a leading independent wealth management

service provider in China offering comprehensive one-stop

advisory services. It offers a long runway for growth and is

well positioned in China's booming wealth management and

private banking industry. The business is transitioning from

selling high credit risk/implicit guarantee products to

standard/equity-oriented products. Broadening interest in

mutual fund markets supports the transition, as will any

shift in household assets away from the property market.

Industry Information 21Vianet Group

Technology % of Net Assets 2.4%

The company is one of the largest carrier-neutral internet

data centre ("IDC") operators in China. IDC demand is a

structural growth story in China driven by factors such as

the increasing usage of internet via mobile devices on the

consumer side and the increasing demand for cloud and IT

services on the enterprise side. While building upon its

traditional retail market, 21Vianet has kickstarted its

wholesale business from 2019, and this dual engine strategy

should put it in a strong position in the coming years. The

stock was derated recently on competitive and regulatory

concerns which appear to be overstated.

TWENTY LARGEST HOLDINGS AS AT 30 SEPTEMBER 2021

The Asset Exposures shown below measure the exposure of the Company's portfolio

to market price movements in the shares, equity linked notes and convertible

bonds owned or in the shares underlying the derivative instruments. The Fair

Value is the value the portfolio could be sold for and is the value shown on

the Balance Sheet. Where a contract for difference ("CFD") is held, the fair

value reflects the profit or loss on the contract since it was opened and is

based on how much the share price of the underlying shares has moved.

Fair

Asset Exposure Value

£'000

£'000 %1

Long Exposures - shares unless otherwise stated

Tencent Holdings (shares and long CFDs)

Internet, mobile and telecommunications service provider 191,546 10.7 102,984

Alibaba Group Holding (shares and long CFDs)

e-commerce group 153,022 8.5 84,339

WuXi AppTec Group (long CFDs)

Pharmaceutical, biopharmaceutical and medical device 84,967 4.7 3,381

outsourcing provider

Noah Holdings

Asset managers 47,410 2.6 47,410

21Vianet Group

Internet and data center service provider 42,114 2.4 42,114

Hutchison China MediTech

Pharmaceutical and healthcare group 41,079 2.3 41,079

China Pacific Insurance Group (long CFDs)

Insurance company 35,969 2.0 439

Beijing Oriental Yuhong Waterproof Technology (shares and

equity linked notes)

Waterproof system provider 35,030 2.0 35,030

SKSHU Paint Company

Paint manufacturing company 34,620 1.9 34,620

Pony.ai (unlisted)

Developer of artificial intelligence and autonomous driving 32,596 1.8 32,596

technology solutions

Zhejiang Dahua Technology

Provider of video surveillance products and services 28,711 1.6 28,711

China Life Insurance (shares and long CFDs)

Insurance company 28,220 1.6 2,086

HollySys Automation Technologies

Provider of automation control system solutions 27,994 1.6 27,994

DJI International Company (unlisted)

Manufacturer of drones 27,971 1.6 27,971

Full Truck Alliance (ADS and unlisted)

Provider of specialised freight trucking services 27,785 1.6 27,785

Trip.com Group (long CFD)

Travel services provider 27,690 1.5 1,157

China Lesso Group Holdings (long CFD)

Manufacturer of building materials and interior decoration 27,278 1.5 (6,666)

products

Chime Biologics Convertible Bond (unlisted)

Contract Development and Manufacturing Organization (CDMO) 26,284 1.5 26,284

Venturous Holdings (unlisted)

Investment company 25,986 1.4 25,986

Crystal International Group

Clothing manufacturer 25,851 1.4 25,851

--------------- --------------- ---------------

Twenty largest long exposures 972,123 54.2 611,151

Other long exposures 1,433,369 80.0 1,152,631

--------------- --------------- ---------------

Total long exposures before hedges (155 holdings) 2,405,492 134.2 1,763,782

========= ========= =========

Less: hedging exposure

Hang Seng Index (future) (104,350) (5.8) (620)

Hang Seng China Enterprises Index (future) (65,488) (3.7) (1,086)

--------------- --------------- ---------------

Total hedging exposures (169,838) (9.5) (1,706)

========= ========= =========

Total long exposures after the netting of hedges 2,235,654 124.7 1,762,076

========= ========= =========

Add: short exposures

Short CFDs (6 holdings) 50,751 2.8 2,648

Put options (3 holdings) 615 - 94

--------------- ---------------

Gross Asset Exposure2 2,287,020 127.5

========= =========

Portfolio Fair Value3 1,764,818

Net current assets (excluding derivative instruments) less 28,409

non-current liabilities

---------------

Net Assets 1,793,227

=========

1 Asset Exposure is expressed as a percentage of Net Assets.

2 Gross Asset Exposure comprises market exposure to investments of £

1,775,879,000 plus market exposure to derivative instruments of £511,141,000.

3 Portfolio Fair Value comprises Investments of £1,775,879,000 plus

derivative assets of £15,652,000 less derivative liabilities of £26,713,000

(per the Balance Sheet below).

INTERIM MANAGEMENT REPORT AND DIRECTORS' RESPONSIBILITY STATEMENT

UNLISTED COMPANIES

The Company is permitted to invest up to 15% of its Net Assets plus borrowings

in unlisted companies. The unlisted space in China continues to expand quite

markedly and offers excellent opportunities for patient and long-term

investors.

Since the year end, the Company has invested in three unlisted companies which

are Beijing Beisen, Tuhu Car and Cutia Therapeutics. As at 30 September 2021,

the Company had 11.3% of Net Assets plus borrowings in twelve unlisted

investments (31 March 2021: 7.4% of Net Assets plus borrowings in nine unlisted

investments).

GEARING

The Company has a three-year unsecured fixed rate facility agreement with

Scotiabank Europe PLC for US$100,000,000. The interest rate is fixed at 2.606%

per annum until the facility terminates on 14 February 2023.

To achieve further gearing, the Company uses contracts for difference ("CFDs")

on a number of holdings in its portfolio.

At 30 September 2021, the Company's Gross Gearing, defined as the Gross Asset

Exposure in excess of Net Assets, was 27.5% (31 March 2021: 26.2%). The level

of Gross Gearing is determined by the Manager within the limit set by the Board

of 30%. Net Gearing, which nets off short positions, was 21.9% (31 March 2021:

18.4%).

DISCOUNT MANAGEMENT

The Board believes that investors are best served when the Company's share

price trades close to its net asset value. The Board recognises that the share

price is affected by the interaction of supply and demand in the market based

on investor sentiment towards China and the performance of the NAV per share.

The Board has a discount control policy in place whereby it seeks to maintain

the discount in single digits in normal market conditions. Subject to market

conditions, it will authorise the repurchase of shares with the objective of

stabilising the share price discount within a single digit range.

The Company's discount widened from 1.1% at the start of the reporting period

to 9.2% at the end of the reporting period. In September 2021, the Board

authorised the repurchase of 440,000 ordinary shares into Treasury in an effort

to control the discount. Prior to that, the Company had not carried out any

share repurchases since September 2020. These share repurchases have benefited

remaining shareholders as the NAV per share has been increased by purchasing

shares at a discount. Since the end of the reporting period and as at the date

of this report, the Company has repurchased a further 576,229 ordinary shares

into Treasury. No shares have been repurchased for cancellation.

ONGOING CHARGE

The Ongoing Charge (the costs of running the Company) for the six months ended

30 September 2021 was 0.92% (31 March 2021: 0.97%). The variable element of the

management fee was a charge of 0.20% (31 March 2021: 0.12%). Therefore, the

Ongoing Charge including the variable element for the reporting period was

1.12% (31 March 2021: 1.09%).

MANAGEMENT FEES

With effect from 1 April 2021, the Board agreed a reduced management fee with

the Manager, FIL Investment Services (UK) Limited. The revised fee structure is

on a tiered basis of 0.90% on the first £1.5 billion of net assets, reducing to

0.70% on net assets over £1.5 billion. The variable element of +/- 0.20% from

the previous fee structure remains unchanged. At the same time, the fixed

annual fee of £100,000 for services other than portfolio management has been

removed. The revised fee will provide savings on the overall percentage costs

for shareholders assuming net assets remained constant.

BOARD OF DIRECTORS

Having served on the Board as a non-executive Director since 1 November 2011

and as a Senior Independent Director since 22 July 2016, Elisabeth Scott

stepped down from the Board at the conclusion of the Annual General Meeting

("AGM") on 20 July 2021. She was succeeded as a non-executive Director by

Alastair Bruce who was appointed to the Board on 1 July 2021 and as Senior

Independent Director by Linda Yueh from 20 July 2021.

As part of the Board's succession plan, Nicholas Bull will retire as Chairman

at the AGM in July 2022. Following a formal process, it was decided by the

Board that Mike Balfour will succeed him as Chairman at the conclusion of the

AGM. Mr Bruce will succeed Mr Balfour as Chairman of the Audit and Risk

Committee at the conclusion of the same AGM.

PRINCIPAL AND EMERGING RISKS

The Board, with the assistance of the Manager (FIL Investments Services (UK)

Limited), has developed a risk matrix which, as part of the risk management and

internal controls process, identifies the key existing and emerging risks and

uncertainties faced by the Company.

The Board considers that the principal risks and uncertainties faced by the

Company fall into the following categories: market, economic and geopolitical;

investment performance; pandemic; gearing; discount control; key person;

environmental, social and governance ("ESG"); and cybercrime risks. Other risks

facing the Company include tax and regulatory and operational (third party

service providers) risks. Information on each of these risks is given in the

Strategic Report section of the Annual Report for the year ended 31 March 2021

which can be found on the Company's pages of the Manager's website at

www.fidelity.co.uk/china.

These principal risks and uncertainties have not materially changed during the

six months to 30 September 2021 and are equally applicable to the remaining six

months of the Company's financial year.

Risks from emerging new variants of COVID-19 continue, including the

availability of suitable vaccines to tackle the new variants. Investors should

be prepared for market fluctuations and remember that holding shares in the

Company should be considered to be a long-term investment. These risks are

somewhat mitigated by the investment trust structure of the Company which means

that no forced sales need to take place to deal with any redemptions.

Therefore, investments in the Company's portfolio can be held over a longer

time horizon.

The Manager carries on reviewing its business continuity plans and its

operational resilience strategies on an ongoing basis. It continues to take all

reasonable steps in meeting its regulatory obligations and to assess

operational risks, the ability to continue operating and the steps it needs to

take to serve and support its clients, including the Board. The Manager has

appropriate business continuity plans in place and the provision of services

continued to be supplied without interruption during the pandemic and continues

to do so.

Investment team key activities, including those of portfolio managers, analysts

and trading/ support functions, have continued to perform well despite the

operational challenges posed when working from home or when split team

arrangements were in place.

The Company's other third party service providers have also implemented similar

measures to ensure that business disruption is kept to a minimum.

TRANSACTIONS WITH THE MANAGER AND RELATED PARTIES

The Manager has delegated the Company's investment management to FIL Investment

Management (Hong Kong) Limited and has delegated the role of company secretary

to FIL Investments International. Transactions with the Manager and related

party transactions with the Directors are disclosed in Note 15 to the Financial

Statements below.

GOING CONCERN STATEMENT

The Directors have considered the Company's investment objective, risk

management policies, liquidity risk, credit risk, capital management policies

and procedures, the nature of its portfolio and its expenditure and cash flow

projections. They have considered the liquidity of the Company's portfolio of

investments (being mainly securities which are readily realisable), the

projected income and expenditure and the loan facility agreement. The Directors

are satisfied that the Company is financially sound and has sufficient

resources to meet all of its liabilities and ongoing expenses and can continue

in operational existence for a period of at least twelve months from the date

of this Half-Yearly Report. Accordingly, they continue to adopt the going

concern basis in preparing these Financial Statements.

This conclusion also takes into account the Board's assessment of the ongoing

risks from COVID-19 and evolving variants as set out above.

By order of the Board.

FIL INVESTMENTS INTERNATIONAL

29 November 2021

DIRECTORS' RESPONSIBILITY STATEMENT

The Disclosure and Transparency Rules ("DTR") of the UK Listing Authority

require the Directors to confirm their responsibilities in relation to the

preparation and publication of the Interim Management Report and Financial

Statements.

The Directors confirm to the best of their knowledge that:

a) the condensed set of Financial Statements contained within this

Half-Yearly Report has been prepared in accordance with the International

Accounting Standards 34: Interim Financial Reporting; and

b) the Portfolio Manager's Half-Yearly Review and the Interim Management

Report above, include a fair review of the information required by DTR 4.2.7R

and 4.2.8R.

The Half-Yearly Report has not been audited or reviewed by the Company's

Independent Auditor.

The Half-Yearly Report was approved by the Board on 29 November 2021 and the

above responsibility statement was signed on its behalf by Nicholas Bull,

Chairman.

INCOME STATEMENT FOR THE SIX MONTHSED 30 SEPTEMBER 2021

Six months ended 30 September 2021 Year ended 31 March 2021 Six months ended 30 September 2020

unaudited audited unaudited

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000

Revenue

Investment income 4 26,069 - 26,069 21,012 - 21,012 17,614 - 17,614

Derivative income 4 10,815 - 10,815 11,689 - 11,689 10,967 - 10,967

Other income 4 15 - 15 80 - 80 70 - 70

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total income 36,899 - 36,899 32,781 - 32,781 28,651 - 28,651

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

(Losses)/gains on - (323,838) (323,838) - 725,388 725,388 - 441,177 441,177

investments at fair value

through profit or loss

(Losses)/gains on - (59,921) (59,921) - 266,752 266,752 - 166,289 166,289

derivative instruments

Foreign exchange gains/ - 1,316 1,316 - (12,401) (12,401) - (4,397) (4,397)

(losses) on other net

assets

Foreign exchange (losses)/ - (1,771) (1,771) - 7,825 7,825 - 2,879 2,879

gains on bank loans

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total income and (losses)/ 36,899 (384,214) (347,315) 32,781 987,564 1,020,345 28,651 605,948 634,599

gains

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Expenses

Investment management fees 5 (2,179) (8,600) (10,779) (4,119) (14,472) (18,591) (1,776) (5,337) (7,113)

Other expenses (732) (12) (744) (1,260) (108) (1,368) (594) - (594)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Profit/(loss) before 33,988 (392,826) (358,838) 27,402 972,984 1,000,386 26,281 600,611 626,892

finance costs and taxation

Finance costs 6 (1,067) (3,202) (4,269) (2,253) (6,758) (9,011) (1,334) (4,001) (5,335)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Profit/(loss) before 32,921 (396,028) (363,107) 25,149 966,226 991,375 24,947 596,610 621,557

taxation

Taxation 7 (1,579) 448 (1,131) (760) - (760) (1,164) 459 (705)

--------------- --------------- --------------- --------------- --------------- --------------- --------------- --------------- ---------------

Profit/(loss) after 31,342 (395,580) (364,238) 24,389 966,226 990,615 23,783 597,069 620,852

taxation for the period

========= ========= ========= ========= ========= ========= ========= ========= =========

Earnings/(loss) per 8 6.08p (76.74p) (70.66p) 4.70p 186.11p 190.81p 4.55p 114.20p 118.75p

ordinary share

========= ========= ========= ========= ========= ========= ========= ========= =========

The Company does not have any income or expenses that are not included in the

profit/(loss) after taxation for the period. Accordingly, the profit/(loss)

after taxation for the period is also the total comprehensive income for the

period and no separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Income Statement of the

Company. The revenue and capital columns are supplementary and presented for

information purposes as recommended by the Statement of Recommended Practice

issued by the AIC.

All the profit/(loss) and total comprehensive income is attributable to the

equity shareholders of the Company. There are no minority interests.

No operations were acquired or discontinued in the period and all items in the

above statement derive from continuing operations.

STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED 30 SEPTEMBER 2021

Share Capital

Share premium redemption Other Capital Revenue Total

capital account reserve reserve reserve reserve equity

Notes £'000 £'000 £'000 £'000 £'000 £'000 £'000

Six months ended 30 September 2021

(unaudited)

Total equity at 31 March 2021 5,710 211,569 917 248,491 1,676,791 39,499 2,182,977

Repurchase of ordinary shares 13 - - - (1,388) - - (1,388)

(Loss)/profit after taxation for the - - - - (395,580) 31,342 (364,238)

period

Dividend paid to shareholders 9 - - - - - (24,124) (24,124)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total equity at 30 September 2021 5,710 211,569 917 247,103 1,281,211 46,717 1,793,227

========= ========= ========= ========= ========= ========= =========

Year ended 31 March 2021 (audited)

Total equity at 31 March 2020 5,713 211,569 914 307,049 710,565 37,237 1,273,047

Repurchase of ordinary shares 13 - - - (58,558) - - (58,558)

Cancellation of ordinary shares from 13 (3) - 3 - - - -

Treasury

Profit after taxation for the year - - - - 966,226 24,389 990,615

Dividend paid to shareholders 9 - - - - - (22,127) (22,127)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total equity at 31 March 2021 5,710 211,569 917 248,491 1,676,791 39,499 2,182,977

========= ========= ========= ========= ========= ========= =========

Six months ended 30 September 2020

(unaudited)

Total equity at 31 March 2020 5,713 211,569 914 307,049 710,565 37,237 1,273,047

Repurchase of ordinary shares 13 - - - (58,558) - - (58,558)

Profit after taxation for the period - - - - 597,069 23,783 620,852

Dividend paid to shareholders 9 - - - - - (22,160) (22,160)

--------------- --------------- --------------- --------------- --------------- --------------- ---------------

Total equity at 30 September 2020 5,713 211,569 914 248,491 1,307,634 38,860 1,813,181

========= ========= ========= ========= ========= ========= =========

BALANCE SHEET AS AT 30 SEPTEMBER 2021

Company number 7133583

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

Notes £'000 £'000 £'000

Non-current assets

Investments at fair value through profit or loss 10 1,775,879 2,167,275 1,721,038

--------------- --------------- ---------------

Current assets

Derivative instruments 10 15,652 33,296 177,028

Amounts held at futures clearing houses and brokers 27,431 19,872 37,736

Other receivables 11 32,428 22,749 5,787

Cash at bank 53,778 66,404 6,320

--------------- --------------- ---------------

129,289 142,321 226,871

--------------- --------------- ---------------

Current liabilities

Derivative instruments 10 (26,713) (22,208) (50,724)

Other payables 12 (10,983) (31,937) (6,584)

--------------- --------------- ---------------

(37,696) (54,145) (57,308)

--------------- --------------- ---------------

Net current assets 91,593 88,176 169,563

========= ========= =========

Total assets less current liabilities 1,867,472 2,255,451 1,890,601

========= ========= =========

Non-current liabilities

Bank loan (74,245) (72,474) (77,420)

--------------- --------------- ---------------

Net assets 1,793,227 2,182,977 1,813,181

--------------- --------------- ---------------

Equity attributable to equity shareholders

Share capital 13 5,710 5,710 5,713

Share premium account 211,569 211,569 211,569

Capital redemption reserve 917 917 914

Other reserve 247,103 248,491 248,491

Capital reserve 1,281,211 1,676,791 1,307,634

Revenue reserve 46,717 39,499 38,860

--------------- --------------- ---------------

Total equity 1,793,227 2,182,977 1,813,181

========= ========= =========

Net asset value per ordinary share 14 348.18p 423.50p 351.76p

========= ========= =========

CASH FLOW STATEMENT FOR THE SIX MONTHSED 30 SEPTEMBER 2021

Six months Six months

ended Year ended ended

30 September 31 March 30 September

2021 2021 2020

unaudited audited unaudited

£'000 £'000 £'000

Operating activities

Cash inflow from investment income 22,289 20,241 14,444

Cash inflow from derivative income 9,511 11,794 11,079

Cash inflow from other income 15 80 70

Cash outflow from Directors' fees (91) (201) (120)

Cash outflow from other payments (11,729) (18,580) (6,855)

Cash outflow from the purchase of investments (443,154) (1,159,050) (529,431)

Cash outflow from the purchase of derivatives (701) (23,789) -

Cash outflow from the settlement of derivatives (282,358) (258,808) (27,290)

Cash inflow from the sale of investments 509,023 998,888 532,218

Cash inflow from the settlement of derivatives 219,747 539,536 62,383

Cash (outflow)/inflow from amounts held at futures clearing (7,559) 19,623 1,759

houses and brokers

--------------- --------------- ---------------

Net cash inflow from operating activities before servicing of 14,984 129,734 58,257

finance

========= ========= =========

Financing activities

Cash outflow from collateral, overdraft and loan interest (979) (2,140) (1,122)

paid

Cash outflow from CFD interest paid (1,320) (5,924) (3,758)

Cash outflow from short CFD dividends paid (1,716) (703) (465)

Cash outflow from the repurchase of ordinary shares (787) (58,558) (58,558)

Cash outflow from dividends paid to shareholders (24,124) (22,127) (22,160)

--------------- --------------- ---------------

Cash outflow from financing activities (28,926) (89,452) (86,063)

--------------- --------------- ---------------

(Decrease)/increase in cash at bank (13,942) 40,282 (27,806)

Cash at bank at the start of the period 66,404 38,523 38,523

Effect of foreign exchange movements 1,316 (12,401) (4,397)

--------------- --------------- ---------------

Cash at bank at the end of the period 53,778 66,404 6,320

========= ========= =========

NOTES TO THE FINANCIAL STATEMENTS

1 PRINCIPAL ACTIVITY

Fidelity China Special Situations PLC is an Investment Company incorporated in

England and Wales with a premium listing on the London Stock Exchange. The

Company's registration number is 7133583, and its registered office is Beech

Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey KT20 6RP. The Company

has been approved by HM Revenue & Customs as an Investment Trust under Section

1158 of the Corporation Tax Act 2010 and intends to conduct its affairs so as

to continue to be approved.

2 PUBLICATION OF NON-STATUTORY ACCOUNTS

The Financial Statements in this Half-Yearly Report have not been audited or

reviewed by the Company's Independent Auditor and do not constitute statutory

accounts as defined in section 434 of the Companies Act 2006 (the "Act"). The

financial information for the year ended 31 March 2021 is extracted from the

latest published Financial Statements of the Company. Those Financial

Statements were delivered to the Registrar of Companies and included the

Independent Auditor's Report which was unqualified and did not contain a

statement under either section 498(2) or 498(3) of the Act.

3 ACCOUNTING POLICIES

(i) Basis of Preparation

On 31 December 2020, International Financial Reporting Standards as adopted by

the European Union at that date were brought into UK law and became UK-adopted

international accounting standards, with future changes being subject to

endorsement by the UK Endorsement Board. There was no impact or changes to the

accounting policies from the transition.

These Half-Yearly Financial Statements have been prepared in accordance with

UK-adopted International Accounting Standard 34: Interim Financial Reporting

and use the same accounting policies as set out in the Company's Annual Report

and Financial Statements for the year ended 31 March 2021. Those Financial

Statements were prepared in accordance with International Accounting Standards

("IAS") in conformity with the requirements of the Companies Act 2006, IFRC

interpretations and, as far as it is consistent with IAS, the Statement of

Recommended Practice: Financial Statements of Investment Trust Companies and

Venture Capital Trusts ("SORP") issued by the Association of Investment

Companies ("AIC") in October 2019.

The AIC updated the SORP in April 2021. The Directors have sought to prepare

these financial statements in accordance with this SORP where the

recommendations are consistent with IAS.

(ii) Going Concern

The Directors have a reasonable expectation that the Company has adequate

resources to continue in operational existence for a period of at least twelve

months from the date of approval of these Financial Statements. Accordingly,

the Directors consider it appropriate to adopt the going concern basis of

accounting in preparing these Financial Statements. This conclusion also takes

into account the Board's assessment of the continuing risks arising from

COVID-19 and evolving variants.

4 INCOME

Six months Six months

ended Year ended ended

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

£'000 £'000 £'000

Investment income

Overseas dividends 25,063 20,257 16,964

Overseas scrip dividends 1,006 755 650

--------------- --------------- ---------------

26,069 21,012 17,614

========= ========= =========

Derivative income

Dividends received on long CFDs 10,764 11,444 10,776

Interest received on CFDs 51 245 191

--------------- --------------- ---------------

10,815 11,689 10,967

========= ========= =========

Other income

Interest received on collateral and deposits 15 80 70

--------------- --------------- ---------------

Total income 36,899 32,781 28,651

========= ========= =========

Special dividends of £nil (year ended 31 March 2021: £29,083,000 and six months

ended 30 September 2020: £nil) have been recognised in capital.

5 INVESTMENT MANAGEMENT FEES

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30 September 2021 (unaudited)

Investment management fee - base 2,179 6,537 8,716

Investment management fee - variable* - 2,063 2,063

--------------- --------------- ---------------

2,179 8,600 10,779

========= ========= =========

Year ended 31 March 2021 (audited)

Investment management fee - base 4,119 12,356 16,475

Investment management fee - variable* - 2,116 2,116

--------------- --------------- ---------------

4,119 14,472 18,591

========= ========= =========

Six months ended 30 September 2020 (unaudited)

Investment management fee - base 1,776 5,328 7,104

Investment management fee - variable* - 9 9

--------------- --------------- ---------------

1,776 5,337 7,113

========= ========= =========

* For the calculation of the variable management fee element, the Company's

NAV return was compared to the Benchmark Index return on a daily basis. The

period used to assess the performance was from 1 July 2018 until a three year

history was established. From 1 July 2021 the performance period is now on a

rolling three year basis.

FIL Investment Services (UK) Limited (a Fidelity group company) is the

Company's Alternative Investment Fund Manager ("the Manager") and has delegated

portfolio management to FIL Investment Management (Hong Kong) Limited ("the

Investment Manager").

From 1 April 2021, the base investment management fee is charged at an annual

rate of 0.90% on the first £1.5 billion of net assets, reducing to 0.70% of net

assets over £1.5 billion. Prior to this date, the investment management fee was

charged at an annual rate of 0.90% of net assets. In addition, there is a +/

-0.20% variation fee based on the Company's NAV per share performance relative

to the Company's Benchmark Index. Fees are payable monthly in arrears and are

calculated on a daily basis.

6 FINANCE COSTS

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30 September 2021 (unaudited)

Interest on bank loan, collateral and overdrafts 246 739 985

Interest paid on CFDs 392 1,176 1,568

Dividends paid on short CFDs 429 1,287 1,716

--------------- --------------- ---------------

1,067 3,202 4,269

========= ========= =========

Year ended 31 March 2021 (audited)

Interest on bank loan, collateral and overdrafts 529 1,585 2,114

Interest paid on CFDs 1,548 4,646 6,194

Dividends paid on short CFDs 176 527 703

--------------- --------------- ---------------

2,253 6,758 9,011

========= ========= =========

Six months ended 30 September 2020 (unaudited)

Interest on bank loan, collateral and overdrafts 278 834 1,112

Interest paid on CFDs 940 2,818 3,758

Dividends paid on short CFDs 116 349 465

--------------- --------------- ---------------

1,334 4,001 5,335

========= ========= =========

7 TAXATION

Revenue Capital Total

£'000 £'000 £'000

Six months ended 30 September 2021 (unaudited)

UK corporation tax 448 (448) -

Overseas taxation charge 1,131 - 1,131

--------------- --------------- ---------------

Taxation charge for the period 1,579 (448) 1,131

========= ========= =========

Year ended 31 March 2021 (audited)

UK corporation tax - - -

Overseas taxation charge 760 - 760

--------------- --------------- ---------------

Taxation charge for the year 760 - 760

========= ========= =========

Six months ended 30 September 2020 (unaudited)

UK corporation tax 459 (459) -

Overseas taxation charge 705 - 705

--------------- --------------- ---------------

Taxation charge for the period 1,164 (459) 705

========= ========= =========

8 EARNINGS/(LOSS) PER ORDINARY SHARE

Six months Six months

ended Year ended ended

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

Revenue earnings per ordinary share 6.08p 4.70p 4.55p

Capital (loss)/earnings per ordinary share (76.74p) 186.11p 114.20p

--------------- --------------- ---------------

Total (loss)/earnings per ordinary share (70.66p) 190.81p 118.75p

========= ========= =========

The earnings/(loss) per ordinary share is based on the profit/(loss) after

taxation for the period divided by the weighted average number of ordinary

shares held outside Treasury during the period, as show below:

£'000 £'000 £'000

Revenue profit after taxation for the period 31,342 24,389 23,783

Capital (loss)/profit after taxation for the period (395,580) 966,226 597,069

--------------- --------------- ---------------

Total (loss)/profit after the taxation for the period (364,238) 990,615 620,852

========= ========= =========

Number Number Number

Weighted average number of ordinary shares held outside 515,457,308 519,159,905 522,836,127

Treasury

========== ========== ==========

9 DIVID PAID TO SHAREHOLDERS

Six months Six months

ended Year ended ended

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

£'000 £'000 £'000

Dividend of 4.68 pence per ordinary share paid for the year 24,124 - -

ended 31 March 2021

Dividend of 4.25 pence per ordinary share paid for the year - 22,127 22,160

ended 31 March 2020

--------------- --------------- ---------------

24,124 22,127 22,160

========= ========= =========

No dividend has been declared for the six months ended 30 September 2021 (six

months ended 30 September 2020: £nil).

10 FAIR VALUE HIERARCHY

The Company is required to disclose the fair value hierarchy that classifies

its financial instruments measured at fair value at one of three levels,

according to the relative reliability of the inputs used to estimate the fair

values.

Classification Input

Level 1 Valued using quoted prices in active markets for identical assets

Level 2 Valued by reference to inputs other than quoted prices included in

level 1 that are observable (i.e. developed using market data) for the

asset or liability, either directly or indirectly

Level 3 Valued by reference to valuation techniques using inputs that are not

based on observable market data

Categorisation within the hierarchy has been determined on the basis of the

lowest level input that is significant to the fair value measurement of the

relevant asset. The valuation techniques used by the Company are as disclosed

in the Company's Annual Report for the year ended 31 March 2021 (Accounting

Policies Notes 2(l) and (m) on pages 70 and 71). The table below sets out the

Company's fair value hierarchy:

Level 1 Level 2 Level 3 Total

30 September 2021 (unaudited) £'000 £'000 £'000 £'000

Financial assets at fair value through profit or

loss

Investments 1,492,804 69,754 213,321 1,775,879

Derivative instrument assets 87 15,565 - 15,652

--------------- --------------- --------------- ---------------

1,492,891 85,319 213,321 1,791,531

--------------- --------------- --------------- ---------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities (1,706) (25,007) - (26,713)

--------------- --------------- --------------- ---------------

Financial liabilities at fair value

Bank loan - (75,582) - (75,582)

========= ========= ========= =========

Level 1 Level 2 Level 3 Total

31 March 2021 (audited) £'000 £'000 £'000 £'000

Financial assets at fair value through profit or

loss

Investments 1,954,626 46,185 166,464 2,167,275

Derivative instrument assets 1,098 32,198 - 33,296

--------------- --------------- --------------- ---------------

1,955,724 78,383 166,464 2,200,571

--------------- --------------- --------------- ---------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities (4,205) (18,003) - (22,208)

--------------- --------------- --------------- ---------------

Financial liabilities at fair value

Bank loan - (74,224) - (74,224)

========= ========= ========= =========

Level 1 Level 2 Level 3 Total

30 September 2020 (unaudited) £'000 £'000 £'000 £'000

Financial assets at fair value through profit or

loss

Investments 1,628,744 3,518 88,776 1,721,038

Derivative instrument assets 2,482 174,546 - 177,028

--------------- --------------- --------------- ---------------

1,631,226 178,064 88,776 1,898,066

--------------- --------------- --------------- ---------------

Financial liabilities at fair value through profit

or loss

Derivative instrument liabilities (1,115) (49,609) - (50,724)

--------------- --------------- --------------- ---------------

Financial liabilities at fair value

Bank loan - (79,999) - (79,999)

========= ========= ========= =========

11 OTHER RECEIVABLES

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

£'000 £'000 £'000

Amounts receivable on settlement of derivatives 21,835 11,627 -

Securities sold for future settlement 7,331 10,805 2,991

Accrued income 2,932 188 2,740

Overseas taxation recoverable 203 - -

Other receivables 127 129 56

--------------- --------------- ---------------

32,428 22,749 5,787

========= ========= =========

12 OTHER PAYABLES

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

£'000 £'000 £'000

Amounts payable on settlement of derivatives 4,770 20,111 -

Securities purchased for future settlement 2,697 8,866 4,397

Investment management, secretarial and administration fees 1,617 2,103 1,628

Accrued expenses 780 587 559

Amounts payable for repurchase of shares 601 - -

Finance costs payable 518 270 -

--------------- --------------- ---------------

10,983 31,937 6,584

========= ========= =========

13 SHARE CAPITAL

30 September 2021 31 March 2021 30 September 2020

unaudited audited unaudited

Number of Number of Number of

shares £'000 shares £'000 shares £'000

Issued, allotted and fully paid

Ordinary shares of 1 pence each

held outside Treasury

Beginning of the period 515,463,483 5,155 538,809,043 5,388 538,809,043 5,388

Ordinary shares repurchased into (440,000) (4) (23,345,560) (233) (23,345,560) (233)

Treasury

--------------- --------------- --------------- --------------- --------------- ---------------

End of the period 515,023,483 5,151 515,463,483 5,155 515,463,483 5,155

========= ========= ========= ========= ========= =========

Ordinary shares of 1 pence each

held in Treasury*

Beginning of the period 55,590,997 555 32,545,437 325 32,545,437 325

Ordinary shares repurchased into 440,000 4 23,345,560 233 23,345,560 233

Treasury

Ordinary shares cancelled from - - (300,000) (3) - -

Treasury

--------------- --------------- --------------- --------------- --------------- ---------------

End of the period 56,030,997 559 55,590,997 555 55,890,997 558

--------------- --------------- --------------- --------------- --------------- ---------------

Total share capital 5,710 5,710 5,713

========= ========= =========

* The ordinary shares held in Treasury carry no rights to vote, to receive a

dividend or to participate in a winding up of the Company.

During the period, the Company repurchased 440,000 (year ended 31 March 2021

and six months ended 30 September 2020: 23,345,560) ordinary shares and held

them in Treasury. The cost of repurchasing these shares of £1,388,000 (year

ended 31 March 2021 and six months ended 30 September 2019: £58,558,000) was

charged to the Other Reserve.

14 NET ASSET VALUE PER ORDINARY SHARE

The calculation of the net asset value per ordinary share is based on the

following:

30.09.21 31.03.21 30.09.20

unaudited audited unaudited

Net assets £ £ £

1,793,227,000 2,182,977,000 1,813,181,000

Ordinary shares held outside Treasury 515,023,483 515,463,483 515,463,483

Net asset value per ordinary share 348.18p 423.50p 351.76p

========= ========= =========

It is the Company's policy that shares held in Treasury will only be reissued

at net asset value per ordinary share or at a premium to net asset value per

ordinary share and, therefore, shares held in Treasury have no dilutive effect.

15 TRANSACTIONS WITH THE MANAGERS AND RELATED PARTIES

FIL Investment Services (UK) Limited is the Company's Alternative Investment

Fund Manager and has delegated portfolio management to FIL Investment

Management (Hong Kong) Limited. Both companies are Fidelity group companies.

Details of the current fee arrangements are given in Note 5 above. During the

period, management fees of £10,779,000 (year ended 31 March 2021: £18,591,000

and six months ended 30 September 2020: £7,113,000), and accounting,

administration and secretarial fees of £nil (year ended 31 March 2021: £100,000

and six months ended 30 September 2020: £50,000) were payable to Fidelity.

Fidelity also provides the Company with marketing services. The total amount

payable for these services was £117,000 (year ended 31 March 2021: £195,000 and

six months ended 30 September 2020: £109,000). Amounts payable at the Balance

Sheet date are included in other payables and are disclosed in Note 12 above.

At the date of this report, the Board consisted of five non-executive Directors

(as shown in the Half-Yearly Report) all of whom are considered to be

independent by the Board. None of the Directors has a service contract with the

Company.

The Chairman receives an annual fee of £45,000, the Audit and Risk Committee

Chairman receives an annual fee of £38,000, the Senior Independent Director

receives an annual fee of £36,000 and each other Director receives an annual

fee of £30,000. The following members of the Board hold ordinary shares in the

Company at the date of this report: Mike Balfour 65,000 shares, Alastair Bruce

7,300 shares, Nicholas Bull 110,804 shares, Vanessa Donegan 10,000 shares and

Linda Yueh 2,318 shares.

The financial information contained in this Half-Yearly Results Announcement

does not constitute statutory accounts as defined in section 435 of the

Companies Act 2006. The financial information for the six months ended 30

September 2020 and 30 September 2020 has not been audited or reviewed by the

Company's Independent Auditor.

The information for the year ended 31 March 2021 has been extracted from the

latest published audited financial statements, which have been filed with the

Registrar of Companies, unless otherwise stated. The report of the Auditor on

those financial statements contained no qualification or statement under

sections 498(2) or (3) of the Companies Act 2006.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

A copy of the Half-Yearly Report will shortly be submitted to the National

Storage Mechanism and will be available for inspection at www.morningstar.co.uk

/uk/NSM

The Half-Yearly Report will also be available on the Company's website at www.

fidelity.co.uk/china where up to date information on the Company, including

daily NAV and share prices, factsheets and other information can also be found.

END

(END) Dow Jones Newswires

November 30, 2021 02:00 ET (07:00 GMT)

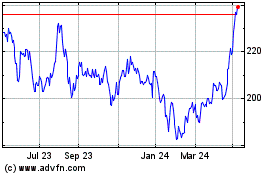

Fidelity China Special S... (LSE:FCSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

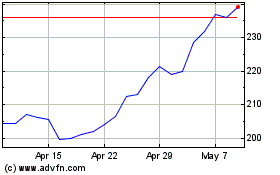

Fidelity China Special S... (LSE:FCSS)

Historical Stock Chart

From Apr 2023 to Apr 2024