TIDMGIF

RNS Number : 8352F

Gulf Investment Fund PLC

26 February 2018

26 February 2018

Legal Entity Identifier: 2138009DIENFWKC3PW84

Gulf Investment Fund plc

Interim Results for the six months ended 31 December 2017

Nick Wilson, Chairman, said:

"The six-month period was eventful and volatile. Following the

travel restrictions and other measures announced by Saudi Arabia,

UAE, Bahrain and Egypt on 5 June, the Qatar Exchange Index fell

sharply by 23% by the end of November. The subsequent recovery in

the Qatar Exchange was spirited, bolstered by optimism on GDP

growth and a continuing recovery in the oil price."

Highlights

-- Net Asset Value per Share fell by 1.30% compared to a fall in

the Qatar Exchange Index of 5.61%

-- Following a slight narrowing of the discount the shares rose 0.75%

-- Dividend of 3.0 cents per share for the year ended 30 June 2017 was paid on 9 February 2018

-- Change of investment policy from Qatar-focused to broader

Gulf focus took effect in December

-- Change of name from Qatar Investment Fund plc to Gulf Investment Fund plc

Nick Wilson added:

"The new investment policy means we have a wider investment

universe and more flexibility to identify attractive opportunities

in the Gulf Cooperation Council (GCC) region. The fund is still

predominantly invested in Qatar over the short term given that

Qatar is trading at an attractive valuation compared to other GCC

markets. We are monitoring developments in other GCC countries and

will be increasing exposure to other GCC countries as we identify

attractive investment opportunities.

"These markets are an attractive long-term investment

opportunity. Governments in the region are expanding their non-oil

sectors with infrastructure development and investment in the

social sectors. This non-oil growth is expected to have increased

to 2.6 per cent in 2017 as government budgets improve. Populations

continue to grow, fuelling personal consumption which should

benefit domestic consumer and services sector companies"

For further information:

Nicholas Wilson +44 (0) 1624 692 600

Qatar Investment Fund plc

Andrew Potts +44 (0) 20 7886 2500

Panmure Gordon

William Clutterbuck +44 (0) 20 7379 5151

Chairman's Statement

On behalf of the Board, I am pleased to present the interim

results for Gulf Investment Fund Plc for the six-months ending 31

December 2017.

Results

During the six months ending 31 December 2017, Net Asset Value

per Share ("NAV") fell by 1.30% compared to a fall in the Qatar

Exchange Index of 5.61% and a rise of 14.60% in the MSCI Emerging

Markets Index. The S&P GCC Composite Index fell by 1.05%.

Following a slight narrowing of the discount at which the shares

trade to NAV, the shares rose 0.75%, from US$0.8988 at 30 June 2017

to US$0.9055 at 31 December 2017. At the Annual General Meeting on

16 November 2017, QIF shareholders approved a final dividend of 3.0

cents per ordinary share in respect of the year ended 30 June 2017.

The dividend was paid on 9 February 2018 to ordinary shareholders

on the register as at 5 January 2018.

The six-month period was eventful and volatile. Following the

measures announced by Saudi Arabia, UAE, Bahrain and Egypt on 5

June, the Qatar Exchange Index fell sharply from 9940 to a low of

7664 at the end of November, a decline of 23%. The subsequent

recovery was spirited, bolstered by optimism on GDP growth and a

continuing recovery in the oil price. At the end of the period, the

Company had a total of 20 holdings: 13 in Qatar, 5 in UAE and 2 in

Oman.

Change in investment policy

On 16 October, the Board announced its intention to change the

investment policy of the Company from a largely Qatar-focused

investment strategy to a broader Gulf Cooperation Council ("GCC")

investment strategy.

Previously, the investment policy enabled the Company to invest

up to 15% of the Company in GCC countries (namely Saudi Arabia,

Kuwait, UAE, Oman and Bahrain) other than Qatar.

The change in investment policy removed the 15% limit and

enables the Company to increase its investment allocation to other

GCC countries and provide the Investment Adviser with a wider

investment universe and more flexibility to identify attractive

opportunities in the GCC region.

Alongside the amended investment policy the Board put forward a

number of proposals including:

(i) making a tender offer for up to 10% of the issued Share Capital of the Company

(ii) cancelling the discontinuation vote that was scheduled for

the 2018 annual general meeting and replacing it with a

continuation vote for the 2021 annual general meeting and every

three years thereafter;

(iii) making a tender offer to shareholders for up to 100% of

the Company's share capital in 2020 subject to Shareholder approval

to be sought in 2020; and

(iv) proposing to change the name of the Company to Gulf Investment Fund plc.

All of these changes were subject to the approval of the

Company's shareholders at an Extraordinary General Meeting (EGM),

other than the tender offer in 2020 which will be subject to

shareholder approval in 2020. The Extraordinary General Meeting was

held on 7 December 2017, at which a poll was called for on 8

December 2017 and all resolutions were passed.

Tender offer

Following the passing of the resolutions at the EGM on 7

December 2017 to give effect to the Tender Offer, 10,273,471 Shares

were tendered under the Tender Offer at the tender offer price of

USD0.9933 per share. These shares were cancelled leaving the

Company with 92,461,242 Shares in issue (excluding treasury

shares).

Related Party Transactions

Details of any related party transactions are contained in the

annual report as well as being addressed in note 8 of this interim

report

Post balance sheet events

Details of these can be found in note 14 following the

accompanying financial statements.

Outlook, risks and uncertainties

Fluctuations in oil and gas prices will continue to impact GCC

economies as countries deal with budget deficits. The geopolitics

of the region and, in particular, the dispute between Qatar and

other members of the GCC brings continuing economic

uncertainty.

The Board believes that the principal risks and uncertainties

faced by the Company continue to fall in the following categories;

geopolitical events, market risks, investment and strategy risks,

accounting, legal and regulatory risks, operational risks and

financial risks. Information on each of these is given in the

Business Review section of our Annual Report each year.

The Board continues to view the future of the Company with

confidence expecting healthy if slower growth in the region as a

whole, as growth in the non-hydrocarbon sector in a number of GCC

members helps to balance their economies.

Nicholas Wilson

Chairman

23 February 2018

Director's Responsibility Statement

The Directors confirm that, to the best of their knowledge:

a) the condensed set of financial statements has been prepared

in accordance with IAS 34;

b) the interim management report and Chairman's statement

include a fair review of the information required by the Disclosure

and Transparency Rule 4.2.7R (indication of important events during

the first six months and a description of the principal risks and

uncertainties for the remaining six months of the year

respectively);

c) in accordance with Disclosure and Transparency Rule 4.2.8R

there have been no related party transactions during the six months

to 31 December 2017 and therefore nothing to report on any material

effect by such a transaction on the financial position or the

performance of the Company during that period; and there have been

no changes in this position since the last Annual Report that could

have a material effect on the financial position or performance of

the Company in the first six months of the current financial

year.

d) in accordance with Disclosure and Transparency Rule 6.4.2,

the Company confirms that its Home State is the United Kingdom.

The interim financial report has not been audited by the

Company's Independent Auditor.

Nicholas Wilson

Chairman

23 February 2018

Regional Market Overview

Report of the Investment Manager and the Investment Adviser

Global stock markets ended 2017 on record highs, gaining US$9.0

trillion in value over the year, led by gains in both emerging as

well as advanced markets. The MSCI World index recorded a gain of

20.0 per cent during the year aided by strong emerging market

performance (up 34.9 per cent). However, the S&P GCC Composite

index closed the year down 0.5 per cent on concerns over recent

regional geopolitical tensions and the political purge in Saudi

Arabia.

31-Dec-2016 29-Jun-2017 1H2017 31-Dec-2017 2H2017 FY2017

--------------------- ------------ ------------ ------- ------------ ------- -------

Qatar (QE) 10436.8 9030.4 -13.5% 8523.4 -5.6% -18.3%

--------------------- ------------ ------------ ------- ------------ ------- -------

Saudi Arabia (TASI) 7210.4 7425.7 3.0% 7226.3 -2.7% 0.2%

--------------------- ------------ ------------ ------- ------------ ------- -------

Dubai (DFMGI) 3530.9 3392.0 -3.9% 3370.1 -0.6% -4.6%

--------------------- ------------ ------------ ------- ------------ ------- -------

Abu Dhabi (ADI) 4546.4 4425.4 -2.7% 4398.4 -0.6% -3.3%

--------------------- ------------ ------------ ------- ------------ ------- -------

Kuwait (KWSE) 5748.1 6762.8 17.7% 6408.0 -5.2% 11.5%

--------------------- ------------ ------------ ------- ------------ ------- -------

Oman (MSI) 5782.7 5118.3 -11.5% 5099.3 -0.4% -11.8%

--------------------- ------------ ------------ ------- ------------ ------- -------

Bahrain (BAX) 1220.5 1310.0 7.3% 1331.7 1.7% 9.1%

--------------------- ------------ ------------ ------- ------------ ------- -------

S&P GCC Composite 99.4 100.1 0.6% 98.9 -1.1% -0.5%

--------------------- ------------ ------------ ------- ------------ ------- -------

MSCI World 1753.0 1921.5 9.6% 2103.5 9.5% 20.0%

--------------------- ------------ ------------ ------- ------------ ------- -------

MSCI EM 858.4 1008.8 17.5% 1158.5 14.8% 34.9%

--------------------- ------------ ------------ ------- ------------ ------- -------

Brent 56.1 47.4 -15.5% 66.9 41.0% 19.1%

--------------------- ------------ ------------ ------- ------------ ------- -------

Source: Bloomberg, S&P Website

Geopolitical tensions between Qatar and its neighbours and lower

oil prices (down 15.5 per cent) were the key concerns for the

region during 1H2017. The Qatari market dropped 13.5 per cent since

the commencement of the blockade. The S&P GCC Composite index

rose marginally during the period. However, Saudi Arabia rose 3.0

per cent in 1H2017, following the news of its inclusion in MSCI

Emerging Markets watchlist and the promotion to Crown Prince of

former Deputy Crown Prince, Mohammed bin Salman. Kuwait and Bahrain

stock markets joined Saudi Arabia and ended the period in

green.

During 2H 2017, GCC markets witnessed high volatility, with the

S&P GCC Composite index declining by 1.1 per cent as investor

sentiment remained subdued. This was primarily due to increased

tensions between Saudi Arabia and Iran and the recent political

purge in Saudi Arabia. All GCC markets ended in the red, except for

Bahrain (up 1.7 per cent) during the 2H 2017. The Saudi, Dubai and

Abu Dhabi market dropped 2.7 per cent, 0.6 per cent and 0.6 per

cent, respectively. Qatari market gained 10.5 per cent during the

month of December, helping it to limit losses to 5.6 per cent for

the period. Kuwait was down 5.2 per cent. Crude prices closed 17

per cent higher in the quarter following the extension to the OPEC

agreement to December 2018.

Change of investment policy

The new investment policy removed the 15 per cent NAV ceiling on

the Fund investing in GCC countries outside Qatar. The Investment

Adviser now has a wider investment universe in which to identify

attractive opportunities in the GCC region.

The reference index for the Fund is now the S&P GCC

Composite Index (previously: QE Index), whilst not being a formal

benchmark for the Fund.

The Investment Adviser's task is to identify emerging investment

opportunities and positive fundamental factors that have not yet

been priced in by the market. The Investment Adviser follows a

top-down approach monitoring macro trends and identifying promising

sectors and companies in GCC countries.

The new investment policy commenced on 7 December 2017. As at

31st December GIF's allocation to Qatar was 85 per cent. We expect

to retain a significant overweight position in Qatar over the short

term while Qatar is trading at an attractive valuation compared to

other GCC markets. We are monitoring developments in other GCC

countries and will be increasing exposure to other GCC countries as

we identify attractive investment opportunities.

For the period since the adoption of the new investment policy

until 31 December 2017, GIF has outperformed the S&P GCC

Composite Index by 5.3 per cent as Qatar outperformed the rest of

the GCC.

Looking Ahead - GCC

The Investment Adviser believes that GCC markets are an

attractive long-term investment opportunity. Governments in the GCC

are expanding their non-oil sectors with infrastructure development

and investment in the social sectors.

The Investment Adviser has identified the following key themes

for investment in GCC.

-- Banks: The GCC banking sector tends to enjoy strong asset

quality and capitalisation, along with government support and

growth from infrastructure investments.

-- Real Estate & Housing Finance: Rising population and an

undersupplied residential market in most of the GCC countries is

expected to create robust demand for residential construction and

housing finance.

-- Healthcare & Education: Shortage of medical services and

education will continue to create a need for government spending on

social development and these sectors have seen high allocations in

recent government budgets.

-- Tourism: Governments in the GCC are promoting their countries

as tourist destinations. Tourism should drive demand for

hospitality, travel and infrastructure sectors and create

employment.

-- Retail: Rising population, high spending power and increasing

tourism should create opportunities for retail businesses.

-- Industrials: The petrochemical sector contributed c.30 per

cent to GDP in 2014 making it a key non-oil GCC export sector. The

world petrochemical market is poised to grow at 8.8 per cent

annually until 2022.

-- Localisation and Privatisation: GCC countries are encouraging

the transfer of knowledge and technology, and creating

opportunities in manufacturing, maintenance, repair, research and

development. Localization of business activity will be achieved

through direct investments and strategic partnerships with leading

sector companies. Privatization can improve productivity and the

quality of services in education, healthcare, transportation and

utilities.

Several GCC markets have been upgraded to emerging market from

frontier market status in recent months. Across the region

governments are seeking to encourage foreign investment. The

privatisation of public assets, easing of foreign ownership

restrictions and more transparency should accelerate the upgrade of

further GCC markets over the next years.

GCC nations are diversifying away from oil and gas. The US$100

billion Aramco IPO forms the centrepiece of the Saudi non-oil

diversification reforms alongside the US$500 billion plan to

develop the NEOM business and industrial zone linking with Jordan

and Egypt. The UAE plans to invest US$163 billion on renewable

energy projects. Qatar is expected to spend over US$200 billion

(from 2015 to 2021) on projects ahead of the FIFA World Cup 2022.

As part of the Kuwait Development Plan (KDP), the nation plans to

spend around US$160 billion over 500 projects, including

infrastructure, utilities and housing investments. Oman plans to

invest about US$35 billion on tourism related projects, which is

expected to double visitor numbers by 2040.

GCC countries, historically used to large fiscal surpluses, have

tightened their belts in recent years following oil price falls. As

a result, non-oil growth has started to be impacted. Recent higher

oil prices have provided more budget flexibility and as a result

non-oil growth is expected to have increased to 2.6 per cent in

2017, from 1.8 per cent in 2016.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Overall

Budgeted Expenditure Levels.

Most gulf economies continue to focus on education and

healthcare. Saudi Arabia has allocated 40 per cent of its budget to

these sectors, a trend seen across the GCC.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting GCC Spending on

Key Sectors.

Note: Key Sectors includes Education, Health, Infrastructure and

other social developments

The International Monetary Fund (IMF) expects the GCC to have a

current account surplus in 2017 as oil prices recover. Saudi

Arabia's shortfall reached 9 per cent of GDP in 2015, but is

expected to record a surplus of 0.6 per cent in 2017.

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting GCC Fiscal and

Current Account Balance as a per cent of GDP.

Other Recent Developments

India looks to boost Qatar LNG import volume

India's LNG imports are expected to rise by 10 per cent, to over

30 million metric ton per annum (MTPA) by 2020, versus 19 million

MTPA in 2016.

India is Qatar's third largest export destination. Currently,

the Qatar-India trade is around US$10 - US$10.5 billion, of which

US$9 - US$9.5 billion is the value of Qatar's exports to India,

mostly LNG and petrochemicals.

Qatar signs 15-year LNG deal with Bangladesh

Qatar's RasGas sealed a 15-year LNG Sales and Purchase Agreement

(SPA) with Bangladesh Oil, Gas and Mineral Corporation

(Petrobangla). RasGas will supply 2.5 million MTPA of LNG to

Petrobangla for 15 years.

Qatargas to deliver 1.5 million MTPA of LNG to Turkey's

Botas

Qatargas signed a medium-term SPA with Turkey's Botas to deliver

1.5 MTPA of LNG for three years starting in October 2017.

Qatargas and Shell sign new LNG deal

Qatargas also signed a SPA with Shell to deliver up to 1.1 MTPA

of LNG for five years. This deal provides Qatargas with access to

Shell's gas sales portfolio in the United Kingdom and continental

Europe, as well as the flexibility to manage LNG deliveries to its

global client portfolio.

Hamad Port eyes 35 per cent of region's trade in 2 years, says

transport minister

The US$7.4 billion Hamad Port, covering 30,000 square

kilometres, has already won 27 per cent of the regional trade in

the Middle East since opening in December 2015. Part of the port's

strategy is to gain 35 per cent of the total regional trade in 2018

thanks to its strategic location and superior facilities.

Qatar's Transport minister has praised the private sector's role

in the construction and operation of the Hamad Port, which was

responsible for 60 per cent of the work. The private sector will

have a major portion of the construction work of the second phase,

with projects worth QAR 5 billion to be completed and delivered

between 2020 and 2021.

Saudi retail market to top US$142bn in 2021

Saudi Vision 2030 will drive the Kingdom's retail market to a

record-high of US$142 billion by 2021, according to Alpen Capital.

As a result, research firm AT Kearney says the Kingdom has the

third-highest retail potential among emerging markets in Europe,

the Middle East, and Africa.

Saudi Arabia pays SAR 525 billion of private sector bills

Saudi Arabia has paid the majority of SAR 525 billion worth of

invoices from the private sector received within 60 days of

receipt, as the kingdom seeks to settle its dues that have caused

mayhem for contractors.

GCC construction projects value hits US$2.4 trillion

BNC Construction Intelligence estimated the total value of

21,893 active construction projects in the GCC at US$2.4 trillion

at the beginning of September 2017 as Gulf countries are determined

to carry out important infrastructure projects.

The urban construction contracts constitute 80 per cent of the

contracts awarded for all sectors in GCC and in dollar terms this

translates to 49 per cent of the total contracts awarded. The total

value of urban construction projects reached US$1.18 trillion

Dubai's industrial sector to grow by additional Dh18 billion by

2030

According to the Government of Dubai, under the Dubai Industrial

Strategy, the industrial sector is expected to grow by an

additional Dh18 billion by 2030, creating 27,000 jobs, with exports

forecast to increase by Dh16 billion.

Saudi Arabia to spend US$6.9bn on tourism initiatives

Saudi Arabia's National Transformation Program (NTP) 2020 has

approved 13 initiatives submitted by the Saudi Commission for

Tourism & National Heritage (SCTH) with a budget of over SAR 26

billion (US$6.93 billion). This amount will be allocated to tourism

and national heritage projects and initiatives implemented through

SCTH and its partners in the public and private sectors.

Moody's downgrades Bahrain, Oman ratings

Moody's Investors Service has downgraded Bahrain's long-term

issuer rating to B1 from Ba2 and maintained the negative outlook

while Oman's long-term issuer and senior unsecured bond ratings has

been downgraded to Baa2 from Baa1 and the outlook changed to

negative from stable.

According to Moody's view the credit profile of the Bahrain will

continue to weaken significantly in the coming years, predominantly

because despite some fiscal reform efforts there is a lack of a

clear and comprehensive consolidation strategy. However, the key

driver for Oman's rating downgrade was the country's limited than

expected progress towards addressing structural vulnerabilities to

a weak oil price environment, reflecting institutional capacity

constraints to address the large fiscal and external

imbalances.

UAE transport projects' valued at US$87 billion in 1H 2017

The total value of 481 active transport projects exceeded AED

321.49 billion (US$87.6 billion) in the first half of 2017,

according to BNC Network. Of these, 364 projects with a combined

value of $36.5 billion are road projects while 39 projects with a

value of $33.9 billion are rail projects.

Moody's puts Qatar's banks on negative watch amid regional

dispute

Moody's Investors Service changes its outlook from stable to

negative following Qatar's dispute with its Gulf neighbours stating

if the current rift between Qatar and its neighbouring Gulf

countries is prolonged, it could trigger outflows of foreign

deposits and other external funding leading to a liquidity crunch

in the banking sector.

The lifting of restriction on women driving in Saudi will have a

huge impact on the economy

Female participation in the Saudi workforce stood at just 19 per

cent in 2016, compared with 65 per cent for men, according to EFG

Hermes. The increase in women in the workforce will increase the

disposable incomes thereby increasing the purchasing power in the

economy. Saudi Arabia's National Transformation Programme, aims to

raise the percentage of the country's women in work to 28 per cent

by 2020.

Qatar to comfortably raise US$ 9 billion from bonds, says QFC

chief

Yousef Al Jaida, chief executive of the Qatar Financial Centre

(QFC) has stated that the Qatari government will comfortably be

able to raise US$9 billion through international bond issuance in

2018.

OPEC and Non-OPEC members agreed to extend oil production cut to

end of 2018

OPEC and non-OPEC members, including Russia, have agreed to

extend oil production cuts until the end of 2018 amid measures to

clear global glut of crude oil. The new agreement will be from

January 2018 to December 2018 and a review will be conducted in

June 2018 to assess the impact.

The deal could support the oil market and help oil prices to

maintain their recent strength, resulting in a better outlook for

revenue of GCC countries'.

Global gas consumption set to jump 53 per cent by 2040

Global gas consumption will increase by 53 per cent between 2017

and 2040, according to the Doha-based Gas Exporting Countries

Forum. Growth is expected to be led by non-OECD Asia, followed by

the Middle East and Africa. The share of natural gas in the global

energy mix will increase from 22 per cent in 2016 to 26 per cent in

2040.

In GCC, the combined value of the 361-active oil and gas

projects has crossed US$331.4 billion in November 2017, according

to the BNC Network, the largest and most comprehensive project

research and intelligence provider in the Middle East and North

Africa (MENA) region.

Most GCC central banks raise policy rates after Fed rate

hike

The central banks of four GCC countries, Saudi Arabia, UAE,

Bahrain, and Qatar, increased interest rates after the US Fed

raised interest rates by 0.25 per cent.

Moody's expects performance of the GCC banking sector to be

resilient in 2018

Rating agency Moody's expects the banking sector in the GCC to

deliver a stable performance in 2018, reflecting strong financial

fundamentals, particularly in the UAE and Saudi Arabia. Slow

economic growth, fiscal and geopolitical risks are expected to pose

challenges to profitability and loan quality of the region's banks,

but Moody's expects strong capitalization levels with high

loan-loss reserves to provide banks with strong loss-absorption

capacity.

Moody's forecasts that real GDP growth in the region will pick

up to around 2 per cent in 2018 from 0 per cent in 2017. Although

fiscal consolidation efforts in the region will persist, key

regional infrastructure projects such as the UAE Expo 2020, World

Cup Qatar 2022 and the Saudi National Transformation Programme

(NTP) are expected to support capital spending and credit growth,

which should expand by 5 per cent in 2018.

GCC consumer prices rise by 1.3 per cent

GCC countries have posted a 1.3 per cent rise in prices for the

12-month period ending October 2017, according to GCC-Stat, the

Statistical Centre for Gulf Cooperation Council (GCC) states. The

highest rise in prices were recorded for tobacco at 80.5 per cent,

miscellaneous 3.7 per cent, education 3 per cent and transport 2

per cent. On the other hand, prices for recreation fell by 3.7 per

cent, clothing and footwear fell by 1.4 per cent, and restaurant by

0.4 per cent.

Over the 12 months ending in October 2017, the country-wise

contributions to the overall GCC consumer price change were UAE (1

percentage point), Kuwait (0.2 percentage points), Bahrain, Oman

and Qatar (0.1 percentage point each), while Saudi Arabia recorded

a negative contribution of 0.1 percentage point.

GCC's insurance sector poised for strong growth in next five

years

Insurance industry across the GCC is poised for strong growth

during the next five years, mainly supported by the economic

diversification program undertaken by governments, supportive

population dynamics and changing regulations that have introduced

mandatory health insurance cover in many countries, according to a

recent forecast by Alpen Capital. The forecast projects GCC

insurance market to grow at a compounded annual growth rate (CAGR)

of 10.9 per cent from US$26.2 billion in 2016 to US$44 billion in

2021.

GCC construction market expands 30 per cent in 2017

The GCC construction market showed relative resilience in its

performance, recording a 30 per cent pick-up by the end of October

2017, according to the MENA Research Partners. With the value of

total active projects in the GCC at around US$2.6 trillion,

equivalent to 160 per cent of GDP, the regional construction market

presents sufficient depth and opportunities for investors and

regional market participants over the years to come. The UAE and

Saudi Arabia together account for 70 per cent of the value of

active projects. The value of completed projects during 2017 was

US$130 billion, versus US$100 billion for the full-year in

2016.

GCC food services sector to grow to US$29 billion by 2020

The GCC food service market is set to grow at a compound annual

growth rate (CAGR) of 8 per cent and is tipped to hit the US$29.3

billion mark by 2020, up from US$21.5 billion registered in 2016

and US$20.1 billion in 2015, according to Al Masah Capital Limited.

Key drivers include growing population, improving tourism sector,

rising disposable income, and changing dietary habits.

US$200 billion projects underway in Gulf hospitality sector

Over 2,000 hospitality and leisure projects are currently

underway in the GCC with a combined estimated value of US$200

billion. An estimated US$64 billion worth of related projects are

in the construction pipeline stage, highlighting the focus on

strengthening the regional tourism ecosystem.

Saudi Arabia reopens October domestic sukuk issue with US$1.78

billion

Saudi Arabia has issued SAR 6.68 billion (US$1.78 billion) of

Islamic bonds by reopening a domestic sukuk issue that it

originally made in October 2017. The first tranche, amounting to

SAR 1.05 billion, matures in 2022. The second tranche, due in 2024,

is SAR 3.53 billion, while the third tranche, due in 2027, is SAR

2.1 billion.

Abu Dhabi said to start selling treasury bills in 2018

Abu Dhabi plans to start selling treasury bills for the first

time in 2018 as it seeks to develop its local-currency debt market.

The government is working with international and local banks on how

the notes will be structured. Regular sales could follow once the

regulatory structures are in place.

Oman to delay VAT implementation until 2019, says local

media

Oman's Ministry of Finance has reportedly postponed the

implementation of value-added tax (VAT) until 2019, according to

Omani media reports. Citing ministry sources, the Times of Oman

reported that certain products, such as tobacco and energy and soft

drinks, will be taxed from mid-2018. Saudi Arabia and the UAE have

implemented VAT from 1 January 2018 at the rate of 5 per cent for

majority of goods and services.

Kuwait upgraded to FTSE Emerging Market Index

Kuwait's inclusion in the emerging-markets list by FTSE Russell

is anticipated to lead to inflows of c.US$700 million from

investors. The final weighting of the country and the stocks to be

included will be determined primarily by the liquidity for the

period preceding the actual inclusion. The weights will also depend

on whether the implementation will be in one or two phases.

According to Arqaam Capital Research and EFG Hermes, the weight of

Kuwait in the FTSE EM + China A All Cap Index will be around 0.5

per cent.

The move is anticipated to increase the attractiveness of

investors not only towards Kuwait but the entire GCC region.

Qatar: Corporate profits down 6.0 per cent in 9M 2017

The combined profit of Qatari listed companies was down 6.0 per

cent in 9M 2017 compared to 9M 2016. On a quarterly basis, the

combined profit of Qatari listed companies saw a decline of 1.1 per

cent in Q3 2017 compared to the same period last year.

Sector Profitability (net profit/loss in QAR 000's)

Sector 9M 2016 9M 2017 % change Q3 2016 Q3 2017 % change

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Banks & Financial Institutions 15,956,630 16,435,121 3.0% 5,263,469 5,634,019 7.0%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Services &Consumer Goods 1,575,139 1,317,356 -16.4% 473,262 454,914 -3.9%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Industry 5,991,646 5,480,100 -8.5% 1,770,002 1,880,189 6.2%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Insurance 999,405 440,884 -55.9% 240,057 (190,183) -179.2%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Real Estate 3,316,325 3,086,550 -6.9% 796,133 722,638 -9.2%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Telecoms* 1,831,769 1,558,684 -14.9% 369,911 461,904 24.9%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Transportation 1,656,605 1,126,373 -32.0% 502,291 345,522 -31.2%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Total 31,327,519 29,445,068 -6.0% 9,415,125 9,309,003 -1.1%

-------------------------------- ----------- ----------- --------- -------------- -------------- ---------

Source: Qatar Exchange; *Excluding Vodafone Qatar because of

31(st) March year end

Profits in the Banking and Financial Services sector rose 3.0

per cent in 9M 2017. Growth was driven by a 3.1 per cent rise in

net income of Qatari listed banks. During the first nine months of

2017 credit growth remained healthy, up 6.0 per cent, driven by

public sector growth (+12.5 per cent). Profit of conventional banks

rose 3.6 per cent during 9M 2017, compared to a 1.6 per cent rise

in the profits of Islamic banks. Qatar National Bank (QNB) reported

a profit growth of 6.2 per cent in 9M 2017. Qatar Islamic Bank, Al

Khalij Commercial Bank, Qatar International Islamic Bank, Ahli Bank

and Doha Bank also reported profit growth of 10.6 per cent, 6.7 per

cent, 5.1 per cent, 2.9 per cent and 2.9 per cent, respectively.

Commercial Bank of Qatar reported a fall in profit, down 48.1 per

cent, mainly due to a substantial rise in loan loss provisions,

while Masraf Al Rayyan Bank's profit remained almost flat.

Profits in the Services & Consumer Goods sector dropped 16.4

per cent during 9M 2017, primarily due to a decline in profits of

Qatar Fuel (-17.0 per cent), following new terms for fuel supplies

and an increase in pension contributions. In the same period,

Mannai Corporation, Salam International, and Qatar Cinema also

reported lower profits. However, Widam, Medicare, and Zad Holding

Co. reported a rise in profits in 9M 2017.

Profits in the Industrials sector dropped 8.5 per cent in 9M

2017, as most companies in the sector, excluding Qatar Electricity

& Water Co. and Mesaieed Holding, reported reduced profits.

Sector heavyweight Industries Qatar's profit fell 13.5 per cent on

reduced sales volumes, depressed fertiliser prices, and tightened

operating margins.

In 9M 2017, the profit of the Insurance sector fell 55.9 per

cent compared to 9M 2016, as Qatar Insurance Company and Qatar

General & Reinsurance Company reported profit drops of 57.2 per

cent and 81.4 per cent, respectively. Alkhalij Takaful also

reported 10.6 per cent fall in net profit during the same

period.

Real Estate sector profits in 9M 2017 declined 6.9 per cent,

driven by a significant drop in profits of Barwa, United Dev.

Company and Mazaya Qatar, but the drop was limited by a rise in

profits of Ezdan (up 9.1 per cent).

The Qatari Telecom sector comprises of Vodafone Qatar and

Ooredoo. Ooredoo reported a 14.9 per cent fall in profits in 9M

2017, mainly due to higher tax expense, increase in royalties,

lower foreign currency gains and challenging market conditions in

Qatar. Vodafone Qatar is excluded from this profit comparison,

since its fiscal year ends on 31 March.

In the Transportation sector, profits declined 32.0 per cent, as

Qatar Navigation Company and Qatar Gas Transport Company reported

profit declines of 52.2 per cent and 18.9 per cent, respectively in

9M 2017. However, Gulf Warehousing Company reported a 4.8 per cent

growth in profits for the same period.

Portfolio Structure

Country Allocation

As at 31 December 2017, GIF had 20 holdings: 13 in Qatar, 5 in

the UAE and 2 in Oman (Q3 2017: 28 holdings: 16 in Qatar, 9 in the

UAE and 3 in Oman). The Investment Adviser reduced exposure to UAE

to 8.0 per cent of NAV from 10.4 per cent. The cash weighting was

5.1 per cent (Q3 2017: 2.4 per cent).

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Country

Allocation (% of NAV).

Embedded image removed - please refer to the Company's website

www.gulfinvestmentfundplc.com for a chart depicting Sector

Allocation (% of NAV).

The Qatari banking sector (including financial services) is the

Fund's largest sector holding at 40.9 per cent of NAV. Qatari

industrials is second at 27.2 per cent of NAV (Q3 2017: 25.5 per

cent).

Qatar National Bank (QNB) remains GIF's largest holding at 17.4

per cent of NAV. Other holdings include Abu Dhabi Commercial Bank

(2.2 per cent of NAV), Dubai Islamic Bank (2.7 per cent of NAV) and

Emaar Properties based in UAE (2.0 per cent of NAV).

Top 10 Holdings

Company Name Sector % share of NAV

------------------------------ ---------------------------- ---------------

Qatar National Bank Banks & Financial Services 17.4%

------------------------------ ---------------------------- ---------------

Industries Qatar Industrials 9.8%

------------------------------ ---------------------------- ---------------

Masraf Al Rayan Banks & Financial Services 9.6%

------------------------------ ---------------------------- ---------------

Qatar Electricity & Water Co Industrials 9.4%

------------------------------ ---------------------------- ---------------

Ooredoo Telecoms 9.1%

------------------------------ ---------------------------- ---------------

Qatar Gas Transport Transportation 6.7%

------------------------------ ---------------------------- ---------------

Barwa Real Estate Real Estate 6.2%

------------------------------ ---------------------------- ---------------

Commercial Bank of Qatar Banks & Financial Services 6.0%

------------------------------ ---------------------------- ---------------

Gulf International Services Industrials 4.3%

------------------------------ ---------------------------- ---------------

Qatar National Cement Co Industrials 3.6%

------------------------------ ---------------------------- ---------------

Source: QIC

GIF's top 10 holdings were unchanged from 3Q 2017. The holdings

in Qatar Gas Transport and Ooredoo were increased while holdings in

Qatar National Bank and Masraf Al Rayan were reduced.

Profile of Top Five Holdings:

Qatar National Bank (17.4% of NAV)

Qatar National Bank (QNB) is a high-quality proxy stock for

Qatari economic growth given its strong ties with the public sector

and access to state liquidity. QNB is a dominant state-owned

participant in the Banking sector and plays an important role in

the development of the Qatari economy and in funding key

infrastructure projects. The largest shareholder in QNB is the

Government of Qatar through the Qatar Investment Authority (QIA),

with a 50% equity stake. The government is strongly committed to

support QNB, thus enhancing its economic importance. QNB is the

largest bank in Qatar with total assets of QAR 811.1 billion

(US$222.8 billion) as at 31(st) December 2017. For FY2017, QNB

reported a 6.2% YoY growth in net profit to QAR 13.1 billion

(US$3.6 billion). QNB is well positioned to reap the benefits of

the rapid expansion of the domestic economy and has been growing

its presence in overseas markets as well. The bank, through its

subsidiaries and associate companies, operates in more than 31

countries, through more than 1,230 branches, supported by more than

4,300 ATMs and employs more than 28,200 staff.

Industries Qatar (9.8% of NAV)

Industries Qatar (IQCD) is a holding company with interests in

petrochemicals via 80% owned Qatar Petrochemical Co., fertilizers

via 75% owned Qatar Fertilizer Co., steel via its wholly owned

subsidiary Qatar Steel Co. and fuel additives via 50% owned Qatar

Fuel Additives Co. For 9M2017, the company's net profit declined

13.5% YoY to QAR 2.4 billion (US$0.7 billion) on reduced sales

volumes, depressed fertiliser prices, and tightened operating

margins. IQCD expects operational performance to improve with the

on-going cost optimization programs.

Masraf Al Rayan (9.6% of NAV)

Masraf Al Rayan (MARK) has three main business divisions, namely

retail banking, wholesale banking and private banking. Besides

this, the bank offers investment banking and treasury products.

MARK had a network of 13 branches in strategic locations across

Qatar, and a total of 80 ATMs. As at end December 2017, its

financing assets stood at QAR 72.1 billion (US$19.8 billion). In

FY2017, MARK reported a net profit of QAR 2.0 billion (US$0.6

billion).

Qatar Electricity & Water Co. (9.4% of NAV)

Qatar Electricity & Water Co. (QEWS) was established in 1990

as the first private sector company engaged in electricity

production and water desalination businesses. The company is the

second largest utility company in the North Africa and Middle East

region. In Qatar, the company enjoys a c.62% market share in the

electricity business, while in the water desalination business it

commands a 79% market share. Over the past decade, the company has

been the key beneficiary of rapid development in Qatar, coupled

with the growth in population, resulting in increased demand for

electricity and water. Additionally, the company is setting up

presence overseas, with the establishment of Nebras Power Company

(60% owned by QEWS), which invests globally in new and existing

power generation and water desalination projects. QEWS has long

term purchase agreements with government-owned Kahramaa; hence, the

company has a low-risk business model, with secure and visible

earnings and cash flows. For 9M2017, the company reported net

profit of QAR 1.2 billion (US$0.3 billion).

Ooredoo (9.1% of NAV)

Ooredoo (ORDS) is a leading international communications company

delivering mobile, fixed, broadband internet and corporate managed

services tailored to the needs of consumers and businesses across

markets in the Middle East, North Africa and Southeast Asia.

Serving consumers and businesses in 10 countries, Ooredoo delivers

leading data experience through a broad range of content and

services via its advanced, data-centric mobile and fixed networks.

Ooredoo has a presence in several markets such as Qatar, Kuwait,

Oman, Algeria, Tunisia, Iraq, Palestine, the Maldives, Myanmar and

Indonesia. The company reported revenues of QAR 24.5 billion

(US$6.7 billion) and net profit of QAR 1.6 billion (US$0.4 billion)

in 9M2017 and had a consolidated global customer base of 150

million customers as at 30 September 2017.

Economic Outlook

GDP growth in the GCC is estimated at 0.5 per cent in 2017.

Non-oil growth is expected to increase to 2.6 per cent in 2017 as

government budgets improve. Populations continue to grow, fuelling

personal consumption which should benefit domestic consumer and

services sector companies.

The IMF expects GDP growth to increase to 2.2 per cent 2018 with

non-oil growth easing to 2.4 per cent. Over the medium-term,

non-oil growth is projected at 3.4 per cent. The introduction of

VAT in the UAE and Saudi Arabia should generate additional

government revenues of 1.5-1.6 per cent of their respective

GDPs.

Some risks remain. The recent meeting between GCC officials has

made some progress towards a resolution of the seven-month

Saudi-led blockade of Qatar. The Investment Adviser believes that

the dispute will be resolved eventually but the timing is

uncertain. Increased tensions between Saudi Arabia and Iran and the

anti-corruption crackdown in Saudi Arabia could lead to short term

volatility in capital markets.

Valuations

Market Market Cap. PE (x) PB (x) Dividend Yield (%)

-------------- ------------ -------------- -------------- ---------------------

US$ billion 2018E 2019E 2018E 2019E 2018E 2019E

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Qatar 98.8 10.68 11.34 1.32 1.17 4.69 4.68

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Saudi Arabia 450.2 11.63 11.53 1.43 1.43 4.07 4.07

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Dubai 80.7 7.63 7.39 1.06 0.93 4.76 4.48

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Abu Dhabi 116.9 7.62 9.66 1.28 1.20 5.54 5.46

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Oman 14.3 9.48 9.48 0.95 0.95 NA NA

-------------- ------------ ------ ------ ------ ------ ---------- ---------

MSCI EM 10640.1 11.68 11.14 1.51 1.16 2.88 2.65

-------------- ------------ ------ ------ ------ ------ ---------- ---------

Source: Bloomberg, Prices as of 04 January 2018

Epicure Managers Qatar Limited Qatar Insurance Company

S.A.Q.

23 February 2018 23 February 2018

Consolidated Income Statement

(Unaudited) (Unaudited)

Note For the period from For the period from

1 July 2017 to 1 July 2016 to

31 December 2017 31 December 2016

US$'000 US$'000

------------------------------------------------------------------- ----- -------------------- --------------------

Income

Dividend income on quoted equity investments - -

Realised loss on sale of financial assets at fair value through

profit or loss (4,979) (4,719)

Net changes in fair value on financial assets at fair value

through profit or loss 3,392 13,417

Commission rebate income on quoted equity investments 12 - 12

Total net (expense)/income (1,587) 8,710

------------------------------------------------------------------- ----- -------------------- --------------------

Expenses

Investment Manager's fees 6 507 710

Other expenses 6 558 556

--------------------

Total operating expenses 1,065 1,266

------------------------------------------------------------------- ----- -------------------- --------------------

(Loss)/profit before tax (2,652) 7,444

Income tax expense - -

------------------------------------------------------------------- ----- -------------------- --------------------

Retained (loss)/profit for the period (2,652) 7,444

------------------------------------------------------------------- ----- -------------------- --------------------

Basic and diluted (loss)/earnings per share (cents) 3 (2.60) 6.41

------------------------------------------------------------------- ----- -------------------- --------------------

Consolidated Statement of Comprehensive Income

(Unaudited) (Unaudited)

For the period from For the period from

1 July 2017 to 1 July 2016 to

31 December 2017 31 December 2016

US$'000 US$'000

----------------------------------------------------------------------- -------------------- --------------------

(Loss)/profit for the period (2,652) 7,444

Other comprehensive income

Items that are or may be reclassified subsequently to profit or loss:

----------------------------------------------------------------------- -------------------- --------------------

Currency translation differences 184 85

------------------------------------------------------------------------ -------------------- --------------------

Total items that are or may be reclassified subsequently to profit or

loss 184 85

------------------------------------------------------------------------ -------------------- --------------------

Other comprehensive income for the period (net of tax) 184 85

------------------------------------------------------------------------ -------------------- --------------------

Total comprehensive (loss)/profit for the period (2,468) 7,529

------------------------------------------------------------------------ -------------------- --------------------

Consolidated Balance Sheet

(Unaudited) (Audited)

Note At 31 December 2017 At 30 June 2017

US$'000 US$'000

------------------------------------------------------- ----- -------------------- ----------------

Current Assets

Financial assets at fair value through profit or loss 1 96,216 102,124

Other receivables and prepayments 2,017 2,468

Cash and cash equivalents 13 3,630 10,670

------------------------------------------------------- ----- -------------------- ----------------

Total current assets 101,863 115,262

======================================================= ===== ==================== ================

Equity

Issued share capital 925 1,032

Reserves 4 100,489 113,138

Total equity 101,414 114,170

------------------------------------------------------- ----- -------------------- ----------------

Current liabilities

Other creditors and accrued expenses 5 449 1,092

Total current liabilities 449 1,092

------------------------------------------------------- ----- -------------------- ----------------

Total equity & liabilities 101,863 115,262

======================================================= ===== ==================== ================

Consolidated Statement of Changes in Equity

Share Capital Distributable Reserves Retained Earnings Other Reserves Total

(note 4)

US$'000 US$'000 US$'000 US$'000 US$'000

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Balance at 01 July 2017 1,032 86,486 25,425 1,227 114,170

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total comprehensive income

for the period

Loss for period - - (2,652) - (2,652)

Other comprehensive income

Foreign currency translation

differences - - - 184 184

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total other comprehensive

income - - - 184 184

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total comprehensive loss for

the period - - (2,652) 184 (2,468)

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Contributions by and

distributions to owners

Dividends payable - - - - -

Shares repurchased to be - - - - -

held in treasury

Shares subject to tender

offer (103) (10,205) - 103 (10,205)

Tender offer expenses - (83) - - (83)

Shares in treasury cancelled (4) - - 4 -

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total contributions by and

distributions to owners (107) (10,288) - 107 (10,288)

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Balance at 31 December 2017 925 76,198 22,773 1,518 101,414

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

* Retained earnings include realised gains and losses on the

sale of assets at fair value through profit or loss and net changes

in fair value on financial assets at fair value through profit or

loss. The level of dividend is calculated based only on a

proportion of the dividends received during the year, net of the

Company's attributable costs.

Share Capital Distributable Reserves Retained Earnings Other Reserves Total

(note 4)

US$'000 US$'000 US$'000 US$'000 US$'000

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Balance at 01 July 2016 1,194 103,904 36,177 1,068 142,343

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total comprehensive income

for the period

Profit for period - - 7,444 - 7,444

Other comprehensive income

Foreign currency translation

differences - - - 85 85

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total other comprehensive

income - - - 85 85

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total comprehensive profit

for the period - - 7,444 85 7,529

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Contributions by and

distributions to owners

Dividends payable - - (4,116) - (4,116)

Shares repurchased to be

held in treasury - (370) - - (370)

Shares subject to tender

offer (141) (16,817) - 141 (16,817)

Tender offer expenses - (57) - - (57)

Shares in treasury cancelled (10) - - 10 -

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Total contributions by and

distributions to owners (151) (17,244) (4,116) 151 (21,360)

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Balance at 31 December 2016 1,043 86,660 39,505 1,304 128,512

----------------------------- -------------- ----------------------- ------------------ --------------- ---------

Consolidated Statement of Cash Flows

(Unaudited) (Unaudited)

Note For the period from For the period from

1 July 2017 to 1 July 2016 to

31 December 2017 31 December 2016

US$'000 US$'000

--------------------------------------------------------------- ----- -------------------- --------------------

Cash flows from operating activities

Purchase of investments (33,156) (26,528)

Proceeds from sale of investments 37,002 45,937

Dividends received - -

Operating expenses paid (1,071) (1,290)

Commission rebate - 12

Net cash generated from operating activities 2,775 18,131

--------------------------------------------------------------- ----- -------------------- --------------------

Financing activities

Cash used in tender offer (10,205) (16,817)

Tender offer expenses (83) (57)

Cash used in share repurchases - (370)

Net cash used in financing activities (10,288) (17,244)

--------------------------------------------------------------- ----- -------------------- --------------------

Net (decrease)/increase in cash and cash equivalents (7,513) 887

Effects of exchange rate changes on cash and cash equivalents 473 3

Cash and cash equivalents at beginning of period 10,670 1,447

--------------------------------------------------------------- ----- -------------------- --------------------

Cash and cash equivalents at end of period 13 3,630 2,337

--------------------------------------------------------------- ----- -------------------- --------------------

Notes to the Interim Consolidated Financial Statements

1 Investments

Investments are designated at fair value through profit or loss

on initial recognition. The Group invests in quoted equities and

quoted convertible bonds for which fair value is based on quoted

market prices. The quoted market price used for financial assets

held by the Group is the current bid price ruling at the year-end

without regard to selling prices.

Purchases and sales of investments are recognised on trade date

- the date on which the Group commits to purchase or sell the

asset. Investments are initially recorded at fair value, and

transaction costs for all financial assets and financial

liabilities carried at fair value through profit and loss are

expensed as incurred.

Gains and losses (realised and unrealised) arising from changes

in the fair value of the financial assets are included in the

income statement in the year in which they arise

31 December 2017 financial assets at fair value through profit

or loss: all quoted equity securities

Security name Number US$'000

-------------------------------------------- ------------- ----------------------------------------

Qatar National Bank (QNBK QD) 520,872.00 17,570

Qatar Electricity & Water Co (QEWS QD) 200,378.00 9,786

Industries Qatar (IQCD QD) 381,539.00 9,671

Ooredoo (ORDS QD) 373,821.00 9,278

Masraf Al Rayan (MARK QD) 962,055.00 8,922

Qatar Gas Transport (QGTS QD) 1,582,745.00 6,996

Barwa Real Estate (BRES QD) 727,723.00 6,352

Commercial Bank of Qatar (CBQK QD) 781,547.00 6,169

Gulf International Services (GISS QD) 925,137.00 4,493

Qatar National Cement Co (QNCD QD) 217,484.00 3,702

Dubai Islamic Bank (DIB UH) 1,705,000.00 2,873

ABU DHABI Commercial Bank (ADCB UH) 1,243,579.00 2,278

Emaar Properties Company (EMAAR UH) 1,098,408.00 2,072

Bank Muscat (BKMB OM) 2,032,580.00 2,067

Gulf Warehousing (GWCS QD) 122,250.00 1,410

Qatar United Development Company (UDCD QD) 263,727.00 1,038

Emirates National Bank of Dubai (ENBD UH) 300,000.00 670

Union National Bank (UNB UH) 450,000.00 467

Vodaphone Qatar (VFQS QD) 159,869.00 352

Ooredoo (ORDS OM) 36,631.00 50

96,216

-------------------------------------------- ------------- ----------------------------------------

2 Net Asset Value per Share

The net asset value per share as at 31 December 2017 is

US$1.0968 per share based on 92,461,242 ordinary shares in issue as

at that date (excluding 161,931 shares held in treasury), (30 June

2017: US$1.1113 based on 102,734,713 ordinary shares in issue,

excluding 493,445 shares held in treasury).

3 (Loss)/earnings per Share

Basic and diluted (loss)/earnings per share are calculated by

dividing the (loss)/profit attributable to equity holders of the

Group by the weighted average number of ordinary shares in issue

during the period:

31 December 2017 31 December 2016

----------------------------------------------------------------------- ----------------- -----------------

(Loss)/profit attributable to equity holders of the Company (US$'000) (2,652) 7,444

Weighted average number of ordinary shares in issue (thousands) 102,065 116,114

----------------------------------------------------------------------- ----------------- -----------------

Basic (loss)/earnings per share (cents per share) (2.60) 6.41

----------------------------------------------------------------------- ----------------- -----------------

4 Other Reserves

Distributable Retained earnings Foreign currency Capital redemption Total

reserves translation reserve reserve

US$'000 US$'000 US$'000 US$'000 US$'000

--------------------- -------------------- ------------------ -------------------- -------------------- ---------

Balance at 1 July

2017 86,486 25,425 (216) 1,443 113,138

Foreign exchange

translation

differences - - 184 - 184

Retained loss for

period - (2,652) - - (2,652)

Dividends paid - - - - -

Shares repurchased - - - - -

into Treasury

Shares subject to

tender offer (10,205) - - 103 (10,102)

Tender offer

expenses (83) - - - (83)

Shares in Treasury

cancelled - - - 4 4

Balance at 31

December 2017 76,198 22,773 (32) 1,550 100,489

--------------------- -------------------- ------------------ -------------------- -------------------- ---------

5 Trade and other payables

31 December 2017 30 June 2017

US$'000 US$'000

------------------------------- ----------------- -------------

Dividend payable* - -

Due to broker - 649

Management fee payable 250 278

Administration fee payable 58 56

Accruals and sundry creditors 141 109

------------------------------- ----------------- -------------

449 1,092

------------------------------- ----------------- -------------

* a dividend of US$ 0.030 per Ordinary Share was announced, this

was approved by shareholders at the Annual General Meeting on 16

November 2017 and was paid on 9 February 2018 to ordinary

shareholders on the register as at 5 January 2018 (the "Record

Date"). The corresponding ex-dividend date was 4 January 2018.

6 Charges and Fees

31 December 2017 31 December 2016

US$'000 US$'000

Investment Manager's fees (see below) 507 710

Performance fees (see below) - -

------------------------------------------------ ----------------- -----------------

Administrator and Registrar's fees (see below) 114 114

Custodian fees (see below) 53 67

Directors' fees and expenses 167 145

Directors' insurance cover 15 16

Broker fees 26 27

Other 183 187

------------------------------------------------ ----------------- -----------------

Other expenses 558 556

------------------------------------------------ ----------------- -----------------

Investment Manager's fees

Annual fees

The Investment Manager was entitled to an annual management fee

of 1.25% of the Net Asset Value of the Group, calculated monthly

and payable quarterly in arrears. The Investment Management

Agreement was subject to termination on 31 October 2013 with a

revised agreement coming into effect from 1 November 2013. The

revised agreement sees the annual fee reduce to 1.05% of the net

asset value of the Company further reducing to an annual fee of

0.90% of the net asset value of the Company from 1 November 2016

subject to termination on 31 October 2019.

Management fees for the period ended 31 December 2017 amounted

to US$506,755 (31 December 2016: US$710,101).

Performance fees

As a result of the amended Investment Management Agreement which

came into effect on 1 November 2016 the Investment Manager is no

longer entitled to a performance fee.

The Investment Manager is responsible for the payment of all

fees to the Investment Adviser.

Custodian fees

The Custodian is entitled to receive fees of US$7,200 per annum

and US$25 per processed transaction from Gulf Investment Fund

PLC.

In addition the Custodian is entitled to receive fees of 8 basis

points per annum in respect of Qatari securities held by the group

and 10 basis points per annum in respect of non-Qatari, GCC

securities held by the group and $45 per settled transaction

(Qatar)/$50 per settled transaction (GCCC excluding Qatar).

Custodian and sub-custodian fees for the period ending 31

December 2017 amounted to US$53,095 (31 December 2016:

US$66,582).

Administrator and Registrar fees

The Administrator is entitled to receive a fee of 12.5 basis

points per annum of the net asset value of the Company between US$0

and US$100 million, 10 basis points of the net asset value of the

Company above US$100 million.

This is subject to a minimum monthly fee of US$15,000, payable

quarterly in arrears. The Administrator receives an additional fee

of GBP1,200 per month for providing monthly valuation data to the

Association of Investment Companies.

The Administrator assists in the preparation of the financial

statements of the Group and provides general secretarial

services.

Administration fees paid for the period ending 31 December 2017

amounted to US$113,626 and US$33,032 for additional services (31

December 2016: US$113,588 and US$32,129 respectively).

Directors' Remuneration

The maximum amount of remuneration payable to the Directors

permitted under the Articles of Association is GBP200,000 per

annum.

Nick Wilson as non-executive chairman is entitled to receive an

annual fee of GBP47,500. He also receives an additional fee in

respect of his work regarding the Company's share buy-back

programme of GBP10,000 per annum.

Paul Macdonald as non-executive chairman of the audit committee

is entitled to receive GBP32,500 per annum.

David Humbles and Neil Benedict in their capacity as

non-executive directors receive GBP30,000 each per annum.

The Directors are each entitled to receive reimbursement of any

expenses incurred in relation to their appointment. Total fees and

expenses paid to the Directors for the period ended 31 December

2017 amounted to US$167,448 (31 December 2016: US$145,068).

7 Taxation

Isle of Man taxation

The Company is resident for taxation purposes in the Isle of Man

by virtue of being incorporated in the Isle of Man and is

technically subject to taxation on its income but the rate of tax

is zero. The Group is required to pay an annual corporate charge of

GBP250 per annum.

The Company became registered for VAT from 1 February 2011.

GCC taxation

It is the intention of the Directors to conduct the affairs of

the Company so that it is not considered to be either resident in

the GCC region or doing business in the GCC region.

Except for Kuwait the GCC countries do not impose withholding

tax on dividend distributions by companies to non-residents.

Capital gains made by the Company on disposal of shares in GCC

companies will not be subject to tax in the GCC region.

There is no stamp duty or equivalent tax on the transfer of

shares in GCC region companies.

Kuwait taxation

Since 1 January 2009 dividends paid on behalf of holdings in

Kuwait are to have withholding tax deducted at 15%.

8 Related Party Transactions

Parties are considered to be related if one party has the

ability to control the other party or to exercise significant

influence over the other party in making financial or operational

decisions.

The Investment Adviser is Qatar Insurance Company S.A.Q. It is

paid fees by the Investment Manager.

The Investment Manager, Epicure Managers Qatar Limited, was a

related party until 2 November 2017 by virtue of its ability to

make operational decisions for the Company and through common

directors. Following the resignation of Leonard O'Brien, the

Investment Manager is no longer a related party. Fees payable to

the Investment Manager are disclosed in note 6.

Epicure Managers Qatar Limited is a wholly owned subsidiary of

the Investment Adviser, Qatar Insurance Company S.A.Q.

9 The Company

Gulf Investment Fund plc (formerly Qatar Investment Fund plc)

(the "Company") was incorporated and registered in the Isle of Man

under the Isle of Man Companies Acts 1931-2004 on 26 June 2007 as a

public company with registered number 120108C.

Pursuant to an Admission Document dated 25 July 2007 there was

an original placing of up to 171,355,000 Ordinary Shares of 1 cent

each, with Warrants attached on the basis of 1 Warrant to every 5

Ordinary Shares. Following the placing on 31 July 2007, 171,355,000

Ordinary Shares and 34,271,000 Warrants were issued; the warrants

expired on 16 November 2012.

The Shares of the Company were admitted to trading on the AIM

market of the London Stock Exchange ("AIM") on 31 July 2007 when

dealings also commenced.

As a result of a further fund raising in December 2007, a

further 76,172,523 Ordinary Shares were issued, which were admitted

for trading on 13 December 2007.

On 4 December 2008, the share premium arising from the placing

of shares was cancelled and the amount of the share premium account

transferred to distributable reserves.

The Shares of the Company were admitted to trading on the Main

Market of the London Stock Exchange on 13 May 2011.

During the period 1 July 2017 to 31 December 2017, the Company

purchased none of its ordinary shares for a total value of US$Nil

to be held in treasury. 331,514 shares had been repurchased in the

period ended 31 December 2016 for treasury but had been held for

over a year and were therefore cancelled in the current financial

period. The buy-backs are effected through distributable

reserves.

On 8 December 2017 the Company's shareholders approved a change

in investment policy from a largely Qatar focussed strategy to one

which focusses more on a broader Gulf Co-operation Council

strategy.

On 27 December 2017 the Company completed a tender offer at a

price of US$0.9933 per share. Under the offer 10,273,471 shares

were cancelled with US$10,204,639 being paid to participating

shareholders.

The shareholders approved a dividend of 3.0 cents per share on

16 November 2017; this was paid to shareholders on 9 February

2018.

The Company's agents and the Manager perform all significant

functions. Accordingly, the Company itself has no employees.

10 The Subsidiary

The Company has the following subsidiary company:

Country of incorporation Percentage of shares held

---------------------------------------------- -------------------------- --------------------------

Epicure Qatar Opportunities Holdings Limited British Virgin Islands 100%

---------------------------------------------- -------------------------- --------------------------

11 Significant Accounting Policies

The Interim Report of the Company for the period ending 31

December 2017 comprises the Company and its subsidiary (together

referred to as the "Group"). The accounting policies applied by the

Group in these condensed consolidated interim financial statements

are the same as those applied by the Group in its consolidated

financial statements for the year ended 30 June 2017. The interim

consolidated financial statements are unaudited.

11.1 Basis of presentation

These financial statements have been prepared in accordance with

International Financial Reporting Standard ("IFRS") IAS 34 Interim

Financial Reporting. They do not include all of the information

required for full annual financial statements and should be read in

conjunction with the consolidated financial statements of the Group

as at and for the year ended 30 June 2017.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires the Board of Directors to exercise its judgement in the

process of applying the Group's accounting policies. The financial

statements do not contain any critical accounting estimates

11.2 Segment reporting

The Group has one segment focusing on maximising total returns

through investing in quoted securities in Qatar and the GCC region.

No additional disclosure is included in relation to segment

reporting, as the Group's activities are limited to one business

and geographic segment.

12 Commission rebate

The Company received 50% brokerage commission rebates for all

trades done through its DLALA Qatar brokers. However, during

previous periods the Company changed its Qatar broker to AHLI

brokers to take advantage of more competitive commission rates and

no commission rebate was received. For the period ended 31 December

2017 the Group used a mixture of the DLALA and AHLI brokerages and

received US$ Nil (2016: US$ 12,317).

13 Cash and Cash Equivalents

31 December 2017 30 June 2017

US$'000 US$'000

--------------------------- ----------------- -------------

Bank balances 3,630 10,670

Cash and cash equivalents 3,630 10,670

--------------------------- ----------------- -------------

14 Post Balance Sheet Events

Shareholders received a dividend of 3.0 cents per share on 9

February 2018.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BUGDDLSDBGIX

(END) Dow Jones Newswires

February 26, 2018 02:00 ET (07:00 GMT)

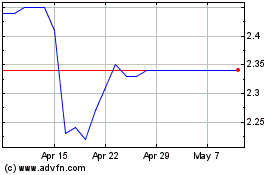

Gulf Investment (LSE:GIF)

Historical Stock Chart

From Mar 2024 to May 2024

Gulf Investment (LSE:GIF)

Historical Stock Chart

From May 2023 to May 2024