TIDMGOOD

RNS Number : 0218Z

Good Energy Group PLC

20 January 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Good Energy Group PLC

("Good Energy" or "the Company")

Strategic disposal of generation portfolio for up to

GBP24.5m

Good Energy Group PLC (AIM: GOOD), the 100% renewable

electricity supplier and innovative energy services provider, today

announces the disposal of its 47.5MW renewable generation asset

portfolio (the "Disposal") as part of an ongoing strategic shift to

energy and mobility services.

Transaction summary

As previously announced in a strategic update on 25 November

2021, the Company appointed KPMG LLP to lead a sale process for the

Company's entire 47.5MW generation portfolio. Following a

competitive process, the disposal of the portfolio has been

completed with Bluefield Solar Income Fund ("BSIF") who are advised

by Bluefield Partners LLP.

The Disposal is for a total consideration of up to GBP24.5m.

This consists of initial and deferred consideration elements:

-- Initial consideration of GBP16.4m, less distribution since the lockbox date of GBP0.7m. Cash proceeds of GBP15.7m

were received on completion.

-- Deferred consideration of up to GBP8.1m, will largely be calculated with reference to an agreed financial model

and based on the actual operational, technical, real estate and financial position of the projects. It is

anticipated that this process will be substantially completed, and payments made by the end of February 2022.

-- The transaction is at a premium to net book value. As of 30 June 2021, the portfolio was held on the balance

sheet at a net book value of GBP17.7m, with gross assets of GBP56.8m and debt outstanding of GBP39.1m. The

portfolio recorded pre-tax profits of GBP0.2m in the six months ended 30 June 2021.

-- The Company is now substantially debt free with a strong cash position, strengthening the Company's balance

sheet.

-- The 47.5MW generation portfolio provides around 15% of Good Energy customers' electricity and will continue to do

so via existing power purchase agreements.

-- Bluefield previously acquired the Good Energy developed West Raynham Solar Farm in 2015.

-- The Company was advised by KPMG LLP as financial advisor regarding the Disposal. Norton Rose Fulbright are its

retained legal advisors.

Investing for growth

-- Proceeds from the transaction will be used to accelerate and support further investments across both transport

and decentralised energy to deliver Good Energy's strategic plan. These investments will not occur all at once

and in the meantime, proceeds have further strengthened the Company's balance sheet.

-- The Company intends to participate in the current funding round being undertaken by its subsidiary Zap-Map. This

will allow Zap-Map to embark on its next course of commercial and development goals, which will crystallise its

leading position for its market services in the UK and initiate steps of international expansion to selected

territories.

-- The Company is currently building a new platform for its decentralised energy service business, to enhance

existing products and propositions and deliver new services for feed in tariff customers. This platform will

enable smart export for solar customers, and the ability to pay actual as opposed to deemed rates, providing

material benefits to the business and customers.

-- Good Energy is a supplier of 100% renewable power and an innovator in energy services. It has long term Power

Purchase Agreements with a community of 1,900 independent UK generators which underpin its commitment to

supplying renewable power and Uswitch Green Tariff Gold Standard and Which? Eco Provider accreditations. The

generation portfolio supplied approximately 15% of Good Energy's total customer demand. The Company will maintain

existing PPA arrangements with the sites after the Disposal and continue to expand relationships with more UK

generators.

Nigel Pocklington, Chief Executive Officer of Good Energy,

said:

"The sale of our generation portfolio at a premium to book value

is a transformational moment for Good Energy and a fantastic deal

for all of our stakeholders. We are using the capital from our

past, to invest in our future.

"Last year, we outlined our clear strategic direction to

capitalise on a rapidly growing market in decentralised, digitised

clean energy and transport services, based on 100% 'real' renewable

power.

"We are ideally positioned to benefit from this trend through

our investment in Zap-Map, the UK's leading EV app, and our growing

stable of other energy products and services.

"We expect to make further investments across both transport and

decentralised energy to deliver our strategic plan, which we

believe has massive headroom for growth.

"Alongside these investments into mobility and energy services,

this transaction reduces debt and further strengthens our balance

sheet, which is particularly important given the current volatility

in the energy market."

Neil Wood, Bluefield Partners LLP, said:

"Bluefield's success in this process is a mark of our commitment

to the UK renewables sector and drive to find high quality, highly

regulated assets for our shareholders. They are a great fit for our

existing operational portfolio."

Enquiries

Good Energy Group PLC Email: press@goodenergy.co.uk

Nigel Pocklington, Chief Executive

Charlie Parry, Head of Investor Relations

& CoSec

Luke Bigwood, Director of External

Affairs

SEC Newgate UK Email: GoodEnergy@secnewgate.co.uk

Elisabeth Cowell Tel: +44 (0)7900 248213

Investec Bank plc (Nominated Adviser

and Joint Broker)

Sara Hale / Jeremy Ellis Tel: +44 (0) 20 7597 5970

Canaccord Genuity Limited (Joint Tel: +44 (0) 20 7523 4617

Broker)

Henry Fitzgerald-O'Connor

About Good Energy www.goodenergy.co.uk

Good Energy is a supplier of 100% renewable power and an

innovator in energy services. It has long term Power Purchase

Agreements with a community of 1,900 independent UK generators.

Since it was founded 20 years ago, the company has been at the

forefront of the charge towards a cleaner, distributed energy

system. Its mission is to support UK households and businesses

generate, store and share clean power.

Good Energy is recognised as a leader in this market, through

our green kite accreditation with the London Stock Exchange and as

the only energy supplier with Gold Standard Uswitch Green Tariff

Accreditation for all tariffs.

About Zap-Map www.zap-map.com/live/

Launched in June 2014, with a mission to accelerate the shift to

electric vehicles (EV) and help the drive towards zero carbon

mobility, Zap-Map is the UKÕs leading EV mapping service. The

charging point map, available on desktop and iOS/Android apps,

helps EV drivers to search for available charge points, plan longer

journeys, pay for charging on participating networks and share

updates with other drivers.

Zap-Map currently has more than 320,000 registered users, and

over 95% of the UKÕs public points on its network. Over 70% of UK

EV drivers have downloaded Zap-Map, with growth in Zap-Map

downloads more than keeping pace with the rapid growth in the EV

market.

For more information, please visit www.zap-map.com.

Strategic rationale - acceleration of strategic shift to Energy

& Mobility services

The transaction follows the announcement on 25 November 2021

regarding the Group's intention to dispose of the generation

portfolio, through a managed sale process.

Prior to this announcement, the Company had outlined a clear

strategic direction to capitalise on a rapidly growing market in

decentralised, digitised clean energy and transport services based

on 100% 'real' renewable power. This strategic direction received

strong shareholder support throughout our successful defence of the

recent hostile takeover attempt.

The Company is accelerating its transition to an energy services

provider, leading in selected areas of electric transport and

decentralised generation as the energy transition continues to

gather pace. With 100% renewable energy remaining core to the

business, the Company will take several important steps towards

accelerating this strategic shift.

Details of the transaction

á Good Energy has divested the entire issued share capital of

Good Energy Holding Company No.1 Limited ("Holdco" or "Target")

(the "Transaction"). Holdco owns eight operational energy producing

assets through its subsidiary Good Energy Generation Assets No.1

Limited ("GEGAN").

o All figures have been completed as of 30 June 2021, with final

amounts calculated via a lockbox mechanism as at the completion

date.

o The long-term debt facilities provided by Gravis Capital

Partners (ÒGravisÓ) through GCP Green Energy 1 Limited, have

transferred with the assets as part of the Disposal.

á Total consideration of up to GBP24.5m, will be split between

an initial consideration and deferred consideration:

o Initial consideration of GBP16.4m, less distribution since the

lockbox date of GBP0.7m. Cash proceeds of GBP15.7m were received on

completion.

o Deferred consideration of up to GBP8.1m, will largely be

calculated with reference to an agreed financial model and based on

the actual operational, technical, real estate and financial

position of the projects. It is anticipated that this process will

be substantially completed, and payments made by the end of

February 2022.

o There are the following elements of deferred consideration.

Energy yield and power purchase agreements, technical assessments

of site conditions, asset life and finance and tax.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISUKSRRUKUAAUR

(END) Dow Jones Newswires

January 20, 2022 02:00 ET (07:00 GMT)

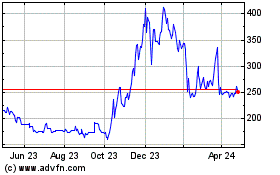

Good Energy (LSE:GOOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

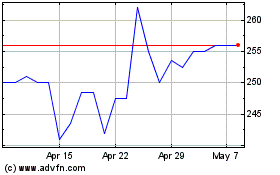

Good Energy (LSE:GOOD)

Historical Stock Chart

From Apr 2023 to Apr 2024