Ground Rents Income Fund PLC Disposal of Beetham Tower (3153H)

03 August 2021 - 4:00PM

UK Regulatory

TIDMGRIO

RNS Number : 3153H

Ground Rents Income Fund PLC

03 August 2021

DISPOSAL OF BEETHAM TOWER

Ground Rents Income Fund plc ("GRIO" or the "Company") announces

that it has sold its wholly-owned subsidiary, which owns the

freehold interest in Beetham Tower in Manchester (the "Property"),

to a private investor for nominal consideration. The disposal

releases GRIO and its subsidiaries from all current litigation and

freeholder obligations relating to the Property that was originally

acquired in 2012.

In 2014, a building defect was identified and, in January 2019,

the High Court passed a judgement requiring the freeholder, a

wholly-owned GRIO subsidiary to perform the repair. The repair

obligation defaulted to the freeholder following the collapse of

the original contractor, Carillion Construction Limited, who would

otherwise have likely been legally responsible for funding the

repair.

Resolving the complex repair issues and related litigation at

the Property has been a strategic priority for the GRIO Board of

Directors and Schroders since the latter's appointment as

alternative investment fund manager (the "Manager") in May 2019.

This has involved regular consultation with the building residents

and other stakeholders. Following extensive negotiations, the buyer

is expected to deliver a long-term repair solution for the

Property.

The disposal has the following financial impact with reference

to the unaudited interim results to 31 March 2021, released on 29

July:

-- Reversal of the specific GBP2.9 million provision which

reflected an estimate of the cost the asset owning subsidiary would

have incurred, were it to have proceeded with the remedial works

required to repair the Property, after recovery from third parties;

and

-- Increase in costs and expenses specifically relating to the

Property incurred since 1 April 2021 of approximately GBP300,000.

Schroders has not charged additional fees for work carried out in

connection with resolving the Beetham Tower litigation.

The Property has been a very challenging investment for the

Company but completion of the disposal is a positive step forward.

As set out in the interim results, the GRIO Board of Directors and

the Manager remain highly focused on delivering value for

shareholders.

For further information:

Schroder Real Estate Investment Management Limited

Matthew Riley 020 7658 6000

Singer Capital Markets (Broker)

James Maxwell / Kailey Aliyar 020 7496 3000

Appleby Securities (Channel Islands) Limited (Sponsor)

Andrew Weaver 01534 888 777

FTI Consulting

Dido Laurimore / Richard Gotla 020 3727 1000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISBLGDIGXGDGBD

(END) Dow Jones Newswires

August 03, 2021 02:00 ET (06:00 GMT)

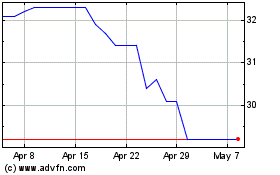

Ground Rents Income (LSE:GRIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

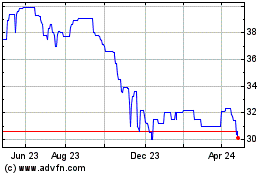

Ground Rents Income (LSE:GRIO)

Historical Stock Chart

From Apr 2023 to Apr 2024