TIDMGSF

RNS Number : 8278C

Gore Street Energy Storage Fund PLC

15 June 2023

15 June 2023

Gore Street Energy Storage Fund plc

(the "Company" or "GSF")

NAV uplift and operational progress with dividend in line with

expectations

Gore Street Energy Storage Fund plc, the internationally

diversified energy storage fund, is pleased to announce its 5.9%

increase in unaudited Net Asset Value ("NAV") for the year ended 31

March 2023.

The Company's NAV continues to deliver strong and steady growth

despite recent pricing volatility in GB. Dividends announced for

the period have increased, and the Investment Manager secured

record prices in the T-4 2023 Capacity Market auction.

Net Asset Value

The unaudited NAV as at 31 March 2023, increased to 115.6 pence

per Ordinary Share from 109.1 pence per Ordinary Share at 31 March

2022, an increase of 5.9%. NAV Total Return, including dividends,

was 12.3% during the period. This is a particularly pleasing

performance and illustrative of the Company's differentiated

approach to this asset class, highlighted by its geographic

diversification and the Company's valuation policy as appropriately

set to reflect the resilient nature of our asset class.

The final quarter of the fiscal year (January - March 2023) was

also strong for the Company, seeing NAV increase by 1.8% from

113.5p at December-end 2022 and providing a NAV Total Return of

3.6% inclusive of dividends paid during the quarter, despite

challenging market conditions in GB.

GBP millions Pence per Ordinary

Share

NAV as at 31 March 2022 376.5 109.1

Gross Offering Proceeds 150.0 0.3

Offering, Fund and Subsidiary

Holding Companies Operating

Expense (17.3) (3.6)

Interest Income 3.6 0.8

Dividends (31.0) (6.4) [1]

Increase in NAV of portfolio

SPVs 258.0 53.5

Distribution from SPV 39.9 8.3

Capex and Acquisitions (223.4) (46.4)

NAV as at 31 March 2023 556.3 115.6

Financial and Operational highlights for the year ended 31 March

2023

-- NAV increased by 47.8% to GBP556.3m (31 March 2022: GBP376.5m).

-- NAV per share increased 5.9% to 115.6 pence (31 March 2022:

109.1 pence per share), with a NAV Total Return of 12.3%.

-- The Company has continued to achieve its dividend target from

IPO, with a total dividend for the reporting period of 7.5p (2022:

7.0p).

-- Portfolio capacity increased through acquisitions by 86.7% or

544.6 MW during the financial year.

-- Operational capacity increased by 59.9 MW or 25.8% during the year.

-- Portfolio revenue of GBP39.3m or GBP134,790 per MW/yr [2] .

This was generated by 19 revenue streams across four different

grids.

-- EBITDA of the operational portfolio increased by 19.1% to

GBP27.8m (31 March 2022: GBP23.3m). This represents an EBITDA of

5.77 pence per share.

-- During the reporting period, 63.5% of the portfolio's EBITDA

was secured outside Great Britain.

-- The Company raised GBP150m in an oversubscribed issuance in April 2022.

Key NAV drivers over the twelve-month period:

-- Capacity Market Contracts - Capacity Market (CM) contracts

were secured for both Great Britain ("GB") and Irish assets in the

February 2023 auctions. Six sites were awarded contracts worth

GBP63/kW/year for delivery from October 2026 under the T-4 auction

and are anticipated to deliver a combined value of c.GBP45m,

representing record-level T-4 auction pricing. This includes a

15-year contract awarded to the Middleton asset, expected to

generate GBP2.97m annually in CM revenues (subject to CPI

adjustments). The Company has 15-year CM contracts for its entire

GB construction portfolio. The two 50 MW assets in Northern Ireland

("NI"), meanwhile, secured CM contracts from 2022 until 2027, while

Porterstown in the Republic of Ireland ("ROI") secured a CM

contract for 2026-2027.

-- Discount rate - The weighted average discount rate across the

portfolio increased to 10.1% (FY 2022: 8.3%), in response to the

current macroeconomic environment. The Investment Manager has

updated discount rates based on their respective grid and stage of

development.

-- CPI assumptions - CPI has been revised per third-party

forecasts, with an updated long-term target of 2.5% from 2025

onwards. Changes to inflation rates, have impacted forecasted

revenues and operational expenses.

-- Asset stage - The Company's operational capacity grew by 26%

during the reporting period, reaching 291.6 MW, following the

successful commissioning of the Porterstown asset in January 2023

and the acquisition of operational assets on the ERCOT grid

(Texas).

-- Operating performance - GBP39.3m in revenue was generated

during the reporting period, averaging GBP134,790 per MW/yr. Over

the 2022 calendar year, the Company achieved a consistently high

average revenue of GBP157,414 per MW/yr [3] .

-- Portfolio expansion - The Company made acquisitions totalling

544.6 MW during the period. This comprised of 144.65 MW of projects

on the ERCOT grid in Texas, 200 MW in GB, and 200 MW on the

Californian grid (CAISO). The Company's geographical split is now:

42% in GB, 27% in Ireland, 12% in Texas, 17% in California and 2%

in Germany.

-- Portfolio revenue curves - Portfolio revenue curves across

geographies have been revised based on updated third-party

inputs.

Portfolio Update

Operational capacity increased by 59.85 MW, or 25.8%, reaching

291.6 MW during the fiscal year. A significant proportion of assets

under-construction/pre-construction (521.8 MW) are scheduled to

become operational within the following 18 months.

An overview of the portfolio's assets and their status as at 31

March 2023 is provided below:

Project MW / MWh Grid Location Revenue Status

denomination

-----------------------

Boulby 6.0 / 6.0 GB (Yorkshire) GBP Operational

------------ --------------------- -------------- -----------------------

Cenin 4.0 / 4.8 GB (Wales) GBP Operational

------------ --------------------- -------------- -----------------------

POTL 9.0 / 4.5 GB (Essex) GBP Operational

------------ --------------------- -------------- -----------------------

Lower Road 10.0 / 5.0 GB (Essex) GBP Operational

------------ --------------------- -------------- -----------------------

Mullavilly 50.0 / 21.3 NI GBP Operational

------------ --------------------- -------------- -----------------------

Drumkee 50.0 / 21.3 NI GBP Operational

------------ --------------------- -------------- -----------------------

Hulley 20.0 / 20.0 GB (Cheshire) GBP Operational

------------ --------------------- -------------- -----------------------

Lascar 20.0 / 20.0 GB (Manchester) GBP Operational

------------ --------------------- -------------- -----------------------

Larport 19.5 / 19.5 GB (Herefordshire) GBP Operational

------------ --------------------- -------------- -----------------------

Ancala 11.2 / 11.2 GB (Various) GBP Operational

------------ --------------------- -------------- -----------------------

Breach 10.0 / 10.0 GB (Derbyshire) GBP Operational

------------ --------------------- -------------- -----------------------

Cremzow 22.0 / 29.0 Germany EUR Operational

------------ --------------------- -------------- -----------------------

PBSL 30.0 / 30.0 ROI EUR Operational

------------ --------------------- -------------- -----------------------

Synder 9.95 / 19.0 US (ERCOT) USD Operational

------------ --------------------- -------------- -----------------------

Westover 9.95 / 19.0 US (ERCOT) USD Operational

------------ --------------------- -------------- -----------------------

Sweetwater 9.95 / 19.0 US (ERCOT) USD Operational

------------ --------------------- -------------- -----------------------

Stony 79.9 / 79.9 GB (Buckinghamshire) GBP Energisation scheduled

------------ --------------------- -------------- -----------------------

Ferrymuir 50.0 / 50.0 GB (Scotland) GBP Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Enderby 57.0 / 57.0 GB (Leicestershire) GBP Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Middleton 200 GB (Heysham) GBP Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

PBSL Expansion 60 ROI EUR Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Kilmannock 30 ROI EUR Under construction/

(KBSL) Pre-construction

------------ --------------------- -------------- -----------------------

KBSL Expansion 90 ROI EUR Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Cedar Hill 9.95 US (ERCOT) USD Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Mineral Wells 9.95 US (ERCOT) USD Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Wichita Falls 9.95 US (ERCOT) USD Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Mesquite 9.95 US (ERCOT) USD Under construction/

Pre-construction

------------ --------------------- -------------- -----------------------

Dog Fish 75 US (ERCOT) USD Under construction/

Pre-construction

-----------------------

Big Rock 200 / 400 US (CAISO) USD Under construction/

Pre-construction

-----------------------

Total: 1173.2

--------------------------------------------------- -----------------------

Dividend Declaration

The Board has approved a fourth interim dividend of 1.5 pence

per share, bringing the total dividend for the period ending 31

March 2023 to 7.5 pence per share (compared to 7 pence per share

for the full year ended 31 March 2022), in line with the Company's

progressive Dividend Policy. The ex-dividend date will be 29 June

2023 and the record date 30 June 2023. The dividend will be paid on

or around 17 July 2023.

Any such dividend payment to Shareholders may take the form of

either dividend income or "qualifying interest income", which may

be designated as an interest distribution for UK tax purposes and,

therefore, subject to the interest streaming regime applicable to

investment trusts. Of this dividend declared of 1.5 pence per

share, 1.5 pence is treated as qualifying interest income.

Notice of Results

The Company will announce its results for the twelve months

ended 31 March 2023 on Monday 17 July 2023.

Alex O'Cinneide, CEO of Gore Street Capital, the investment

manager to the Company, commented:

"I am pleased to report the continued growth of the Company,

driven by our successful diversification strategy. Our commitment

to expanding the portfolio across international markets has proven

out, resulting in strong financial performance and further

positioning us as the global leader in the energy storage

sector.

Our unique diversification strategy has allowed us to navigate

market challenges and capture new revenue opportunities across

different grid networks in uncorrelated markets. This approach has

not only mitigated the impact of lower revenue in the GB market in

2023 but also provided stability and consistent growth.

The Company's Irish assets have been particularly impressive,

generating outstanding revenues and bolstering our overall

portfolio performance, a trend that continued to the end of the

reporting period. Our entire operational portfolio has been

well-placed to capitalise on the seasonal variations in revenues

seen across all the markets in which we operate, showcasing the

resilience and effectiveness of our diversification strategy.

Over the period, we have strategically acquired assets in key

markets, further enhancing our operational capacity and expanding

our geographic presence. We are now operating assets in four

non-correlated energy systems, with construction taking place in

five grids. These acquisitions have delivered cash-generating

assets and positioned the Company for long-term growth as we tap

into the increasing demand for energy storage solutions

worldwide.

Appropriate valuation of the Company's assets has also enabled

continued growth, minimised fees for shareholders, and insulated

the Company from any potential revaluing of assets due to

short-term volatility in one grid. Our assets have been sized for

the market opportunity available in each grid and not built on

unfounded assumptions of new revenue streams suddenly

materialising.

Our strong performance is a testament to the expertise and

dedication of my colleagues in the Investment Manager, a committed

board of directors, as well as the continued support of

shareholders. Over the next twelve months, we are focused on our

portfolio along the following areas 1) bringing projects to

operation at the lowest cost per MW/MWh fully installed 2)

generating the highest revenue per MW/MWh in each of the markets we

are competing in 3) utilise our economics of scale to materially

increase EBITDA margin 4) creating increased capacity in our

existing projects over the original project size. We remain fully

committed to delivering value and maintaining our position at the

forefront of the energy storage sector."

For further information:

Gore Street Capital Limited

Alex O'Cinneide / Paula Travesso Tel: +44 (0) 20 3826

0290

Shore Capital (Joint Corporate

Broker)

Anita Ghanekar / Rose Ramsden / Tel: +44 (0) 20 7408

Iain Sexton (Corporate Advisory) 4090

Fiona Conroy (Corporate Broking)

J.P. Morgan Cazenove (Joint Corporate

Broker)

William Simmonds / Jérémie Tel: +44 (0) 20 3493

Birnbaum (Corporate Finance) 8000

Buchanan (Media Enquiries)

Charles Ryland / Henry Wilson / Tel: +44 (0) 20 7466

George Beale 5000

Email: gorestreet@buchanan.uk.com

Notes to Editors

About Gore Street Energy Storage Fund plc

Gore Street is London's first listed energy storage fund and

seeks to provide Shareholders with an opportunity to invest in a

diversified portfolio of utility-scale energy storage projects. In

addition to growth through exploiting its considerable pipeline,

the Company aims to deliver consistent and robust dividend yield as

income distributions to its Shareholders.

[1] 136.36m shares issued in April were eligible for only 5p of

dividends during the period since the fundraise in April.

([2]) Figure includes liquidated damages on late commissioning

of the PBSL project and based on operational MW as of 31 (st) March

2023.

[3] Figure excludes liquidated damages on late commissioning of

the PBSL project since project was operational in January 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFLSIIEDSEIM

(END) Dow Jones Newswires

June 15, 2023 02:00 ET (06:00 GMT)

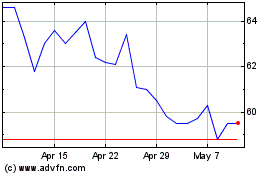

Gore Street Energy Storage (LSE:GSF)

Historical Stock Chart

From Apr 2024 to May 2024

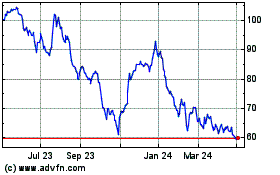

Gore Street Energy Storage (LSE:GSF)

Historical Stock Chart

From May 2023 to May 2024