Moma Mine Update

25 January 2012 - 6:00PM

UK Regulatory

TIDMKMR

Kenmare Resources plc ("Kenmare" or "the Company")

25 January, 2012

Moma Mine Update

Overview

* Demand for all products robust during 2011 with strong growth in prices

* 192,400 tonnes of finished products shipped in Q4 2011, up from 188,200

tonnes in Q3

* 83% increase in revenue to US$167.5 million (unaudited) in 2011 from US$91.6

million in 2010

* 225,600 tonnes of heavy mineral concentrate produced in Q4 2011, a 15%

increase on Q3 2011

* Ilmenite and zircon production up 13% and 12% respectively in Q4 from Q3

2011

* Production expansion project progressing with delivery of critical items to

Moma

Operations

Mining operations during the fourth quarter of 2011 produced 225,600 tonnes of

Heavy Mineral Concentrate (HMC), compared with 195,700 tonnes during the third

quarter, a 15% increase. The mineral separation plant produced 166,000 tonnes

of ilmenite and 12,500 tonnes of zircon, 13% and 12% increases respectively on

the third quarter.

Total production of HMC for 2011 was 842,900 tonnes. Final products volumes

were 636,800 tonnes of ilmenite, 43,500 tonnes of zircon (including 6,200 tonnes

of a secondary zircon product produced from a zircon rejects stockpile) and

6,500 tonnes of rutile.

730,400 tonnes of finished products were shipped during 2011, compared with

712,900 during 2010. These shipments generated revenues of US$167.5 million

(unaudited) in 2011, an increase of 83% from US$91.6 million during 2010.

While production for the year was planned to be below nameplate capacity due to

interruptions in mining to facilitate the expansion, a further reduction in

mining rate was experienced due to a band of clay-rich ore in the mine path.

While the clay band was anticipated prior to mining, the characteristics were

different to clays previously mined.

Partly in response to this development, a supplementary dry mining system has

been installed and commissioned. This system can currently feed 500 tonnes of

ore per hour to the Wet Concentrator Plant (WCP) and is being ramped up to

1,000 tonnes of ore per hour. By varying its production rate, this system will

serve to enable the mining operation to keep the WCP fully supplied with a

constant amount of ore over a range of orebody conditions.

The upgraded jetty facility has now been fully commissioned and is operating

successfully, allowing ships to be loaded during a much broader range of weather

conditions.

The pre-feasibility study for a Phase III expansion of the Moma Mine and design

of facilities for the production and export of monazite are progressing and due

for completion later this year.

Phase II Expansion

The new dredge, manufactured and tested in the USA, has arrived at Moma and will

be reassembled in the coming months. All of the pontoons which form the floating

base of the new WCP have also arrived at Moma and are being put into position in

the starter mining pond.

Expansion works at the Mineral Separation Plant (MSP) are continuing, with

substantial progress on civil engineering and steelwork on both the new Wet High

Intensity Magnetic Separation (WHIMS) plant and the auxiliary ilmenite plant.

However, the EPCM contractor, E+PC, part of the Aveng Group, has experienced

delays in issuing some drawings which impacted on the start of fabrication in

some areas. Whilst the project cost has not changed significantly, this delay

has regrettably extended the scheduled completion date of the expansion project

well into the second half of this year. Every effort is being made to minimise

this delay, including the employment of extra resources by E+PC and the

appointment of a new Project Manager to Kenmare's Owner's Team.

In December 2011, Kenmare concluded the documentation and execution of an

agreement with lenders which provided that, in addition to cash already

available in the Group, up to US$65 million of operating cashflow may be applied

to expansion costs.

Marketing

The demand for all our products was robust during 2011 and prices grew strongly.

The market price for ilmenite at the start of 2011 of around US$100 per tonne

increased three to four fold throughout the year, driven by tight market

conditions. Going into 2012, Kenmare has secured pricing for new contracts in

the range of US$300 to US$400 per tonne for the first half of the year.

Zircon prices more than doubled during 2011, with standard grade zircon prices

increasing from around US$1,000 per tonne to US$2,400 per tonne by the end of

2011. Rutile prices increased strongly during 2011 and market prices are now

above US$2,000 per tonne.

As a condition of the debt financing package which was used to fund Phase 1, the

Company entered into several fixed price supply contracts. All but one of these

contracts has now expired and this remaining contract has had the price revised

upwards with the agreement of the customer. New contracts entered into are

generally based on annual quantities with six-monthly review of prices.

In the fourth quarter of 2011, there was a slowdown in Chinese real estate

development resulting from policy instruments introduced by the Chinese

Government in order to prevent the real estate sector from overheating. This

resulted in reduced demand for pigment and zircon products. Commentators

believe that, having achieved their goals, the Government will gradually

withdraw these policy instruments. While the growth of the Chinese economy is

expected to be somewhat lower than that experienced during the last couple of

years, Chinese economic growth is still expected be substantial and sustainable,

leading to a strong pricing environment for ilmenite and rutile, with some

softening in zircon prices over the coming months. The Company is therefore now

in a position to more fully benefit from prevailing market conditions.

Board of Directors

On January 23, Charles Carvill retired from the Board of Kenmare and passed

Chairmanship to Justin Loasby. Mr. Loasby joined Kenmare's Board in August 2011

as a Non-Executive Director. He has extensive experience of African mining from

his former position as Associate Director at the European Investment Bank,

Luxembourg, where he led the EIB's financing of development of the mining sector

in Southern Africa and the Indian Ocean from 1994 to 2007, prior to which he

worked in investment banking in the City of London.

For further information, please contact:

Kenmare Resources plc.

Tony McCluskey, Financial Director

Tel: +353 1 671 0411

Mob: + 353 87 674 0346

Jacob Deysel, Operations Director

Tel: +353 1 671 0411

Mob: +353 87 613 9609

Murray Consultants

Joe Heron

Tel: +353 1 498 0300

Mob: +353 87 690 9735

Tavistock Communication

Paul Youens / Jos Simson

Tel: +44 207 920 3150

Mob: +44 7843 260 623

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Kenmare Resources via Thomson Reuters ONE

[HUG#1579855]

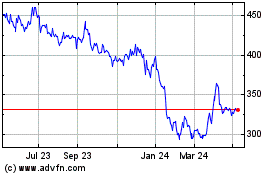

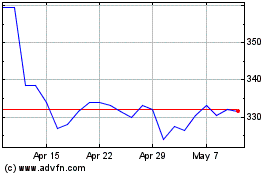

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jul 2023 to Jul 2024