TIDMMHN

Menhaden Capital PLC

(the "Company")

HALF YEAR REPORT

FOR THE SIX MONTHSED 30 JUNE 2016

FINANCIAL HIGHLIGHTS

Performance As at 30 June 2016 As at 31 December

2015

Net asset value per share 80.4p 83.9p

Share price 62.0p 77.0p

Discount 22.9% 8.2%

Total returns Six months to 30 June Period to 31 December

2016 2015

Net asset value per share (4.2%) (14.1%)

Share price (19.5%) (23.0%)

MSCI World Index (GBP) 11.0% (0.8%)

Six months to 30 June

2016

Ongoing charges* 2.1%

Source: Frostrow Capital LLP

* Ongoing charges are calculated as a percentage of shareholders' funds using

average net assets over the period and calculated in line with the AIC's

recommended methodology.

INTERIM MANAGEMENT REPORT

CHAIRMAN'S STATEMENT

Performance during the period

During the first half of the Company's financial year the Company generated a

small loss of 3.5 pence per share, which is equivalent to a 4.2% decline in the

Net Asset Value ("NAV") over the period. The drop in the NAV was primarily due

to market volatility and variable investor sentiment during the period.

Regrettably there was a diminution in the market value of each share, which

fell by 19.5% over the period at the end of which the share price stood at a

22.9% discount to the NAV per share.

Over the same period the MSCI World Total Return Index (in sterling), rose by

11.0%. By way of additional comparison, the WilderHill New Energy Global

Innovation Index (in sterling) rose by 2.6% and the AIC Environmental Sector

fell by 4.9%. The Board is very conscious of the level of the share price

discount to NAV per share and is keeping the situation under close review.

Analysis and more recent performance

Despite the decline during the first six months of the year, the Company's NAV

per share increased by 6.4% between May and June, and a further 4.9% from the

end of the period to 31 August 2016, being the latest practicable date before

the publication of this report, reversing the loss in the first half of this

year. This recent improvement includes the early effects of the UK's

referendum vote to leave the European Union, announced one week prior to the

end of the period. The portfolio has also benefited from positive

contributions during the period from companies such as Praxair, A.O. Smith and

Rockwell Automations, and lessons learnt. Our portfolio managers have provided

a comprehensive analysis of all the factors contributing to the Company's

performance during the period later in this report (pages 7 to 9).

Outlook

Despite a challenging start to the year, our portfolio managers firmly believe

that the long-term prospects for companies delivering or benefiting from the

efficient use of energy and resources are good. The Board has been encouraged

by recent improvements in the Company's NAV per share and believes that the

premise on which the Company was launched and its underlying investment

strategy remain valid.

Dividend

The Board's policy is to pay dividends as required to maintain UK investment

trust status. No interim dividend will be declared for this period. In line

with the prospectus, the Company's aim is to target an annual dividend yield of

2% of the average NAV.

Sir Ian Cheshire

Chairman

21 September 2016

Investment Themes

Theme Description

Clean energy production Companies producing power from clean sources such

as solar or wind

Resource and energy Companies focused on improving energy efficiency

efficiency (e.g. in buildings or manufacturing processes) or

creating emissions reduction products or services

Sustainable transport Companies in the transport sector focused on

helping to reduce harmful air emissions / distance

travelled

Water and waste management Companies with products or services that enable

reductions in usage / volumes and / or smarter

ways to manage water and waste

PORTFOLIO SUMMARY as at 30 June 2016

Investment Country Fair Value % of

GBP'000 net assets

X-ELIO * 1 Spain 9,398 14.6

WHEB Ventures Private Equity Fund 2 UK 6,197 9.6

LP*

Terraform Power United States 4,254 6.6

Alpina Partners Fund LP * 2 UK 3,154 4.9

Airbus France 1,858 2.9

Terraform Global Emerging Markets 1,823 2.8

Atlantica Yield United States 1,799 2.8

Rockwell Automation United States 1,785 2.8

A. O. Smith United States 1,761 2.7

Roper Technologies United States 1,672 2.6

Top 10 investments 33,701 52.3

Ecolab United States 1,667 2.6

Acuity Brands United States 1,663 2.6

Wabtec United States 1,658 2.6

Borgwarner United States 1,602 2.5

Safran France 1,584 2.5

Osmosis MoRE World Resources Global 1,542 2.4

Efficiency

China Longyuan Power China 1,537 2.4

Stericycle United States 1,464 2.3

Shimano Japan 1,450 2.3

Praxair United States 1,364 2.1

Top 20 investments 49,232 76.6

Johnson Matthey UK 1,116 1.7

Volkswagen Germany 986 1.5

Kingspan Ireland 966 1.5

Brookfield Renewable Energy Canada 764 1.1

Atlantica Yield - Bonds United States 141 0.2

Abengoa Senior Notes 8.5% 2016 Spain 138 0.2

Abengoa Senior Notes 8.875% 2017 Spain 135 0.2

Total investments 53,478 83.0

Net current assets (including cash) 10,847 17.0

Total net assets 64,325 100.0

1 Investment made through Helios Co-Invest L.P. X-Elio was formerly known as

Gestamp Solar.

2 Formerly WHEB Ventures Private Equity Fund 3 LP.

* Unquoted

Investment Business Description Theme

X-ELIO * 1 Developer and operator of solar energy products Clean energy

WHEB Ventures Growth capital fund managed by specialist green PE Resource

Private Equity Fund firm, Alpina Partners efficiency

2 LP*

Terraform Power Operator of contracted renewable assets Clean energy

Alpina Partners Fund Growth capital fund managed by specialist green PE Resource

LP * 2 firm, Alpina Partners efficiency

Airbus Aircraft manufacturer Sustainable

transport

Terraform Global Operator of contracted renewable energy assets in Clean energy

emerging markets

Atlantica Yield Owner and manager of contracted renewable energy assets Clean energy

Rockwell Automation Provider of integrated systems for process Resource

manufacturing efficiency

A. O. Smith Manufacturer of commercial and residential water Resource

heaters efficiency

Roper Technologies Manufacturers and distributes industrial equipment Resource

efficiency

Ecolab Provider of water, hygiene and energy technologies Water & waste

Acuity Brands Provider of LED lighting, lighting controls and related Resource

products and services efficiency

Wabtec Manufactures braking equipment and other transportation Sustainable

parts transport

Borgwarner Supplier of motor vehicle parts and systems Sustainable

transport

Safran Supplier of systems and equipment for aerospace, Resource

defence and security efficiency

Osmosis MoRE World Open-ended fund investing in resource efficient public Resource

Resources Efficiency companies efficiency

China Longyuan Power Manufacturer and producer of wind energy Clean energy

Stericycle Provides medical and pharmaceutical waste management Sustainable

transport

Shimano Manufacturer and distributor of cycling and fishing Sustainable

equipment and accessories transport

Praxair Provider of industrial gases Resource

efficiency

Johnson Matthey Manufactures catalysts, pharmaceutical materials and Resource

pollution control systems efficiency

Volkswagen Developer and manufacturer of passenger cars and light Sustainable

commercial vehicles transport

Kingspan Provider of insulation and building envelope Resource

technologies efficiency

Brookfield Renewable Open-ended fund investing in hydroelectric and wind Clean energy

Energy facilities

Atlantica Yield - Owner and manager of contracted renewable energy assets Clean energy

Bonds

Abengoa Senior Notes Operator and developer of renewable energy assets Clean energy

8.5% 2016

Abengoa Senior Notes Operator and developer of renewable energy assets Clean energy

8.875% 2017

INVESTMENT MANAGER'S REPORT

Portfolio update

During the first half of 2016, the Company's NAV per share decreased from 83.9p

to 80.4p. This represents a decline of 4.2% for the period. However, since the

end of the period the NAV per share has increased to 84.4p as at 31 August 2016

(being the latest practicable date prior to the publication of this report).

For the same period the MSCI World Total Return Index (in sterling) returned

11.0%. The performance of the index in sterling was largely driven by the

depreciation in sterling after the EU referendum in the UK. The same index in

US dollars returned 1.0%.

The Company's share price traded at a 23.5% discount to NAV per share as at 30

June 2016.

The contribution to the loss over the period is summarised below:

30 June

2016 Contribution

Asset Category % NAV %

Listed Equities 40.9 (1.9)

Private Equity 29.9 (0.1)

Yield 14.4 (1.2)

Cash 14.8 -

Ongoing charges - (1.0)

Net Assets 100.0 (4.2)

Listed Equity

The Listed Equity portfolio's contribution to the decline was 1.9% for the

period.

Renewable Energy

Two of the principal detractors to performance for the period have been in the

solar sector.

The first, SunEdison, contributed (2.6%) to the decline. While we continue to

believe in the long-term market opportunity in the development and operation of

solar and wind assets, the capital consumptive nature of SunEdison's business

model really required management to execute at a high level. We misjudged the

capabilities of the management team and, realising this, we decided in February

to withdraw from that position, and to transfer our exposure to SunEdison's two

associated yield companies, Terraform Power and Terraform Global. Since then

SunEdison has entered Chapter 11 bankruptcy, and the two yield companies have

ring-fenced themselves from their former parent to seek to protect their

shareholders' interests.

The second, Canadian Solar, which contributed (1.5%), is a vertically

integrated solar player that both manufactures panels and uses those panels in

the development of solar assets around the world. Canadian Solar has struggled

to protect its manufacturing margins as the market for solar panels has become

commoditised and over-supplied. Moreover, the business has struggled to find

buyers for its solar assets as the obvious buyers, the publicly traded yield

companies, have been buffeted by negative market conditions. In April we sold

our position in the company.

Resource and Energy Efficiency

Our top performing positions in the quoted equity category were all in the

resource and energy efficiency sector. Praxair, Rockwell Automation and A.O.

Smith's share prices all benefited from solid financial performance over the

period and each individually contributed 0.5% to the portfolio.

Sustainable Transport

Since the Volkswagen emissions scandal came to light, the company's share price

has declined dramatically - mostly in anticipation of the payouts the company

will have to make, especially in the US. We believe that the market has

overestimated the scale of the damage to Volkswagen. Sales have held up well

since the scandal, and in light of the scandal the company's entire

non-executive and executive management teams have been replaced. Volkswagen,

one of the world's largest vehicle manufacturers, has the potential to reduce

costs and improve margins and profitability. We believe that the company's

management team is now incentivised to step up to this challenge. More

significantly for us, the new management team has announced ambitious plans to

become the world's leading electric vehicles manufacturer. We therefore believe

that Volkswagen represents an enticing recovery play and an attractively valued

opportunity to gain exposure to the coming electric transportation growth wave.

Before the widespread electrification of transport arrives, however, the world

continues to rely on the internal combustion engine. We are therefore keen to

be exposed to the world's leaders in the production of engines that are less

polluting and more efficient. BorgWarner and Johnson Matthey, currently in the

Company's portfolio, provide products and technologies that reduce pollution

and enhance efficiency.

Airbus and its key engines supplier, Safran, are focused on producing engines

that are significantly more efficient and less polluting, and we have added

them to the portfolio during the period. Airbus represents an opportunity to

invest in a global duopoly with very high barriers to entry in a growing

industry - passenger volumes increase at 5% per year. Importantly, the Airbus

A320neo delivers a 15% fuel burn saving compared to current single aisle

aircraft operations, with targets to achieve a 20% reduction in fuel burn and

CO2 emissions by 2020. With improving governance, the depreciation of the euro

and a 10 year backlog we think Airbus will make a good addition to the

portfolio. Much of the efficiency gains achieved by Airbus can be attributed to

its supplier, Safran, whose new LEAP engine promises remarkable environmental

performance including 15% lower fuel consumption and a significant reduction in

ground noise. Safran also operates in a consolidated market with high barriers

to entry and we believe the market is undervaluing the significant value in its

installed fleet.

We believe these additions to the portfolio represent a good way of accessing

the sustainable transportation theme.

Private Equity

The Private Equity portfolio contribution to the decline was 0.1%.

Alpina Partners marked down the valuation of the WHEB Ventures Private Equity

Fund 2 portfolio in Q1, and our holding in this fund was therefore a

significant detractor for the period - costing us 1.9% of NAV. The write-down

was attributable to a changeover to new private equity valuation guidelines and

updated forecasts for one of the fund's most significant portfolio companies,

Green Energy Geothermal (GEG). Revenues are expected to be down this year on

last year due to contract delays. Nevertheless, the Alpina team assure us of

GEG's encouraging progress in East Africa and Indonesia.

The effect of this write down was partially offset by an increase in the

valuation of the Alpina Partners Fund, which contributed 1.6% to NAV, on the

back of the continued strong performance of advanced materials portfolio

company, Dolan.

X-Elio, our co-investment with the KKR infrastructure team, generated $32

million of EBITDA during H1 2016, slightly underperforming forecast due to a

large engineering, procurement and construction ("EPC") project in Egypt being

delayed. X-Elio's business model has three components: the development of new

solar assets; EPC for third parties; and the opportunistic acquisition of

existing operating solar assets around the world.

X-Elio is focused on developing new solar assets in three countries: Japan,

Mexico and Chile. The first projects in Japan have been completed and the

company has launched the construction of a new set of projects, while 28 MW are

under construction in Mexico. In total X-Elio will have 150 MW under

construction by year end. As of Q2 all of the company's operating assets are in

good shape and performing well. The appreciation of the dollar has contributed

1.3% to the portfolio from this position.

Yield Investments

Renewables Yield Investments

The Renewables Yield Investments portfolio's contribution to the decline was

0.2%.

The Company has a portfolio of four publicly traded yield companies. These

comprise Brookfield Renewable Energy Partners, Atlantica Yield and the two

SunEdison affiliated yield companies, Terraform Power and Terraform Global.

The major detractor from here was Terraform Global with a negative contribution

of 0.9% in the period. Terraform Global is the smallest of the yield companies

with the greatest exposure to emerging markets. The market has placed little

value on the portfolio as it goes through the process of disentangling itself

from SunEdison. However, we continue to believe that the assets are trading

below replacement value. Indeed, since 30 June 2016 to 31 August 2016,

Terraform Global has traded up 13.7%.

Absolute Return & Credit

The Absolute Return & Credit portfolio's contribution to the decline was 1.0%.

With regards to Abengoa, in mid-August a group of creditors including banks and

bondholders agreed a restructuring proposal with the company. The proposal

involves a write down of 70% on the old debt and the injection of EUR1.17 billion

of new money by bondholders and banks. Abengoa claims that the proposal is

being finalised and that the vote on the proposal should take place soon. The

deadline is 28 October 2016 and if the agreement is not approved by at least

75% of financial creditors and ratified by the controlling shareholders by that

time, the company will face liquidation

New Team Members

To strengthen our team research, analytic and due diligence capacity and

capabilities, we are pleased to welcome Luciano Suana as a fourth partner at

Menhaden Capital Management LLP and a member of Frostrow's Investment

Committee. Previously he was a Director for Barclays Capital in the Capital

Markets division where he ran the credit trading operations for Brazil out of

São Paulo. Before Barclays, Luciano was a Director at Dresdner Kleinwort in

London. There he focused mainly on infrastructure, utilities and real estate

assets as head of the Illiquids group. Luciano holds a Lienciatura in business

administration from Universitat Autònoma de Barcelona and was granted the

Premio Extraordinario de Fin de Carrera for outstanding academic performance.

Ben Goldsmith

Menhaden Team

21 September 2016

The Menhaden Team is comprised of the partners of Menhaden Capital Management

LLP: Ben Goldsmith, Graham Thomas, Alexander Vavalidis and Luciano Suana. The

Menhaden Team has been seconded to act for Frostrow Capital LLP from Menhaden

Capital Management LLP and together form the Investment Committee, which makes

all investment and divestment decisions in respect of the Company. Frostrow

Capital LLP is the Company's Alternative Investment Fund Manager ("AIFM").

REGULATORY DISCLOSURES

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Company were explained in

detail within the Prospectus issued in July 2015 and the annual report for the

period ended 31 December 2015. The Directors are not aware of any new risks or

uncertainties for the Company and its investors for the period under review and

moving forward, beyond those stated within the Prospectus and the Annual

Report.

Related Parties Transactions

During the first six months of the current financial year, no transactions with

related parties have taken place which have materially affected the financial

position or the performance of the Company.

Going Concern

The Directors believe, having considered the Company's investment objective,

risk management policies, capital management policies and procedures, the

nature of the portfolio and the expenditure projections, that the Company has

adequate resources, an appropriate financial structure and suitable management

arrangements in place to continue in operational existence for the foreseeable

future and, more specifically, that there are no material uncertainties

pertaining to the Company that would prevent its ability to continue in such

operational existence for at least twelve months from the date of the approval

of this half year report. For these reasons, the Directors consider there is

reasonable evidence to continue to adopt the going concern basis in preparing

the accounts.

Directors' Responsibilities Statement

The Board of Directors confirms that, to the best of its knowledge:

(i) the condensed set of financial statements contained within the half

year report has been prepared in accordance with Financial Reporting Standard

(FRS 102) applicable in the UK and Republic of Ireland, which forms part of the

revised Generally Accepted Accounting Practice (New UK GAAP) issued by the

Financial Reporting Council (FRC) in 2012 and 2013; and

(ii) the interim management report includes a fair review of the

information required by sections 4.2.7R and 4.2.8R of the UK Listing Authority

Disclosure and Transparency Rules.

In order to provide these confirmations, and in preparing these financial

statements, the Directors are required to:

* select suitable accounting policies and then apply them consistently;

* make judgments and accounting estimates that are reasonable and

prudent;

* state whether applicable UK Accounting Standards have been followed,

subject to any material departures disclosed and explained in the financial

statements; and

* prepare the financial statements on the going concern basis unless it

is inappropriate to presume that the Company will continue in business;

and the Directors confirm that they have done so.

Si Ian Cheshire

Chairman

21 September 2016

CONDENSED INCOME STATEMENT

Six months to 30 June 2016 Period ended

(unaudited) 31 December 2015

(unaudited) (audited)

Revenue CapitalGBP Total Revenue Capital Total

Note GBP'000 '000 GBP'000 GBP'000 GBP'000 GBP'000

Losses on investments at fair - (2,421) (2,421) - (10,757) (10,757)

value through profit or loss

Income from investments 5 309 - 309 611 - 611

Impairment of interest 5 - - - (206) - (206)

AIFM and Portfolio management 6 (93) (369) (462) (87) (350) (437)

fee

Other expenses (192) - (192) (221) (22) (243)

Net return / (loss) on ordinary 24 (2,790) 97 (11,129) (11,032)

activities before taxation (2,766)

Taxation on net return on (24) - (24) (24) - (24)

ordinary activities

Net return / (loss) on ordinary - (2,790) (2,790) 73 (11,129) (11,056)

activities after taxation

Return / (Loss) per Ordinary 7 0.0p (3.5)p (3.5)p 0.1p (13.9)p (13.8)p

share

The total column of this statement is the profit and loss account of the

Company. The supplementary revenue and capital columns are prepared under

guidance issued by the Association of Investment Companies' Statement of

Recommended Practice.

All revenue and capital items in the above statement derive from continuing

operations.

There are no recognised gains or losses other than those shown above and

therefore no Statement of Total Comprehensive Income has been presented.

CONDENSED STATEMENT OF CHANGES IN EQUITY

Share Share Special Capital Revenue Total GBP

capital premium reserve reserve reserve '000

GBP'000 account GBP'000 GBP'000 GBP'000

GBP'000

Issue of shares following 800 79,200 - - - 80,000

placing and offer for

subscription

Expenses of placing and offer - (1,829) - - - (1,829)

for subscription

Net (loss) / return from - - - (11,129) 73 (11,056)

ordinary activities after

taxation

Balance at 31 December 2015 800 77,371 - (11,129) 73 67,115

Six months to 30 June 2016

(unaudited)

Conversion of share premium - (77,371) 77,371 - - -

account*

Net (loss) / return from - - - (2,790) - (2,790)

ordinary activities after

taxation

Balance at 30 June 2016 800 - 77,371 (13,919) 73 64,325

* The share premium account was cancelled in June 2016 and the 'Special

Reserve' created.

CONDENSED STATEMENT OF FINANCIAL POSITION

As at 30 June 2016 As at 31 December

(unaudited) 2015

GBP'000 (audited)

GBP'000

Fixed assets Note

Investments at fair value through 53,478 63,709

profit or loss

Current assets

Debtors 2,306 204

Cash 9,282 3,371

11,588 3,575

Current liabilities

Creditors: amounts falling due (741) (169)

within one year

Net current assets 10,847 3,406

Net assets 64,325 67,115

Share capital and reserves

Share capital 800 800

Share premium account - 77,371

Special reserve 77,371 -

Capital reserve (13,919) (11,129)

Revenue reserve 73 73

Equity shareholders' funds 64,325 67,115

Net asset value per Ordinary share 8 80.4p 83.9p

CONDENSDED CASH FLOW STATEMENT

Six months to Period ended

30 June 2016 31 December

(unaudited) 2015

GBP'000 (audited)

GBP'000

Net cash (outflow)/inflow from operating (386) (194)

activities

Investing activities

Purchases of investments (8,605) (76,636)

Sales of investments 14,902 2,174

Net cash inflow / (outflow) from investing 6,297 (74,462)

activities

Financing activities

Issue of shares following placing and offer - 80,000

for subscription

Expenses of placing and offer for - (1,969)

subscription

Net cash (outflow) from financing activities - 78,031

Increase in cash and cash equivalents 5,911 3,375

Notes to the Condensed Interim Financial Statements

1 Financial Statements

The condensed financial statements contained in this interim financial report

do not constitute statutory accounts as defined in s434 of the Companies Act

2006. The financial information for the six months to 30 June 2016 has not been

audited or reviewed by the Company's external auditors.

The information for the period ended 31 December 2015 has been extracted from

the latest published audited financial statements. Those statutory financial

statements have been filed with the Registrar of Companies and included the

report of the auditors, which was unqualified and did not contain a statement

under Sections 498(2) or (3) of the Companies Act 2006.

2 Accounting policies

These condensed financial statements have been prepared on a going concern

basis in accordance with the Disclosure and Transparency Rules of the Financial

Conduct Authority, FRS 104 'Interim Financial Reporting', the Statement of

Recommended Practice 'Financial Statements of Investment Trust Companies and

Venture Capital Trusts' dated November 2014 and using the same accounting

policies as set out in the Company's Annual Report for the period ended 31

December 2015.

3 Going concern

After making enquiries, and having reviewed the investments, Statement of

Financial Position and projected income and expenditure for the next 12 months,

the Directors have a reasonable expectation that the Company has adequate

resources to continue in operation for the foreseeable future. The Directors

have therefore adopted the going concern basis in preparing these financial

statements.

4 Principal Risks and Uncertainties

The principal risks facing the Company together with an explanation of these

risks and how they are managed is contained in the Strategic Report and note 14

of the Company's Annual Report for the period ended 31 December 2015.

5 Income

Six months to Period ended

30 June 2016 31 December 2015

GBP'000 GBP'000

Income from investments

UK dividend income 37 8

Unfranked dividend income 269 342

Fixed interest income 3 261

Total income 309 611

Impairment of interest* - (206)

* As set out in the Annual Report for the period ended 31 December 2015 the

Abengoa Senior Notes are in default and an impairment provision of GBP206,000 was

made against the accrued interest on these investments.

6 AIFM and portfolio management fees

Six months to 30 June 2016 Period ended 31 December 2015

(unaudited) (audited)

(audited)

Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

AIFM fee 14 56 70 13 53 66

Portfolio management 79 313 392 74 297 371

fee

93 369 462 87 350 437

7 Return per share

The revenue and capital returns per Ordinary share are based on 80,000,001

shares, being the weighted average number of Ordinary shares in issue during

the six months to 30 June 2016 (period from the IPO of the Company to 31

December 2015: 80,000,001 shares).

The calculation of the total, revenue and capital losses per ordinary share is

carried out in accordance with IAS 33, "Earnings per Share (as adopted in the

EU)".

8 Net asset value per share

The net asset value per share is based on the number of shares in issue at 30

June 2016 of 80,000,001 (31 December 2015: 80,000,001).

9 Transaction Costs

Purchase transaction costs for the six months ended 30 June 2016 were GBP4,000

(period ended 31 December 2015: GBP115,000).Sales transaction costs for the six

months ended 30 June 2016 were GBP24,000 (period ended 31 December 2015: GBP2,000).

These costs comprise mainly commission.

10 Fair value hierarchy

The methods of fair value measurement are classified into a hierarchy based on

reliability of the information used to determine the valuation.

Level 1 - Quoted prices in active markets.

Level 2 - Inputs other than quoted prices included within Level 1 that are

observable (i.e. developed using market data), either directly or

indirectly.

Level 3 - Inputs are unobservable (i.e. for which market data is unavailable)

The table below sets out the Company's fair value hierarchy investments as at

30 June 2016.

Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

As at 30 June 2016

Investments 34,730 - 18,748 53,478

As at 31 December 2015

Investments 45,536 - 18,173 63,709

For further information please contact:

Frostrow Capital LLP

Company Secretary

0203 709 8734

www.frostrow.com

A copy of the Half Year Report has been submitted to the National Storage

Mechanism and will shortly be available for inspection at http://

www.morningstar.co.uk/uk/NSM

The Half Year Report will also shortly be available on the Company's website at

www.menhaden.com where up to date information on the Company, including NAV,

share prices and fact sheets, can also be found.

Neither the contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website (or any other website) is

incorporated into, or forms part of, this announcement.

ENDS

END

(END) Dow Jones Newswires

September 21, 2016 09:16 ET (13:16 GMT)

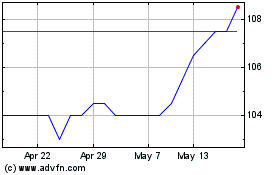

Menhaden Resource Effici... (LSE:MHN)

Historical Stock Chart

From Mar 2024 to May 2024

Menhaden Resource Effici... (LSE:MHN)

Historical Stock Chart

From May 2023 to May 2024