TIDMMPLF

RNS Number : 6863K

Marble Point Loan Financing Limited

22 December 2022

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, TO U.S. PERSONS OR IN THE UNITED STATES, AUSTRALIA,

CANADA, SOUTH AFRICA OR JAPAN, OR ANY OTHER JURISDICTION, OR TO ANY

PERSONS, WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF APPLICABLE

LAW.

22 December 2022

Marble Point Loan Financing Limited

(the "Company" or "MPLF")

Changes to the Board of Directors

The Company today announces that the Board has appointed Thomas

Shandell as a non-executive director with immediate effect. No

information is required to be disclosed pursuant to LR 9.6.13 R

with respect to Mr. Shandell's appointment.

Additionally, the Company today announces that Thomas Majewski,

currently a non-executive director, has submitted his resignation

to the Company with immediate effect as the Company has waived its

right to 30 days' notice in accordance with Article 33.1.1 of the

Company's Amended and Restated Articles of Incorporation. With Mr.

Majewski's resignation, Mr. Shandell will serve as the Investment

Manager's nominee to the Board.

Enquiries:

Marble Point Loan Financing Limited

Investor Relations

Tel.: +44 (0) 20 7259 1500

Email: ir@mplflimited.com

Corporate Broker

Stifel Nicolaus Europe Limited

T: +44 (0) 20 7710 7600

About Marble Point Loan Financing Limited

Marble Point Loan Financing Ltd. (LSE Ticker: MPLF LN (USD);

MPLS LN (GBX)) is a Guernsey-domiciled closed-ended investment

company. MPLF's investment objective is to generate stable current

income and grow net asset value by earning a return on equity in

excess of the amount distributed as dividends. For more

information, please visit

the Company's website: www.mplflimited.com

LEI: 549300DWXSN5UC85CL26

MPLF is invested in a diversified portfolio of US dollar

denominated, broadly syndicated floating rate senior secured

corporate loans owned via collateralised loan obligations ("CLOs")

and related vehicles managed by Marble Point Credit Management LLC

("Marble Point") or its affiliates. Marble Point is an investment

adviser registered with the U.S. Securities and Exchange

Commission.

About Marble Point Credit Management LLC

Marble Point Credit Management LLC ("Marble Point") is a

specialist asset manager focused exclusively on leveraged loans.

Marble Point was founded by Thomas Shandell in partnership with

Eagle Point Credit Management, a leading investor in CLO

securities.

IMPORTANT INFORMATION

This document is for information purposes only and has been

issued by, and is the sole responsibility of, the Company. This

document and the information and views included herein do not

constitute investment advice, or a recommendation or an offer to

enter into any transaction with the Company or any of its

affiliates. Each recipient of this document should make such

investigations as it deems necessary to arrive at an independent

evaluation of any investment and should consult its own legal

counsel and financial, actuarial, accounting, regulatory and tax

advisers to evaluate any such investment. This document is provided

for informational purposes only, does not constitute an offer to

sell shares issued by the Company (the "Shares") or a solicitation

of an offer to purchase any such Shares in the United States,

Australia, Canada, the Republic of South Africa, Japan or any other

jurisdiction, and is not a prospectus. This document may not be

relied upon and should not be used for the purpose of making any

investment decision.

The Shares have not been and will not be registered under the

U.S. Securities Act of 1933, as amended, or with any securities

regulatory authority of any state or other jurisdiction of the

United States and may not be offered or sold in the United States

to, or for the account or benefit of, U.S. persons unless they are

registered under applicable law or exempt from registration. The

Company has not been and will not be registered under the U.S.

Investment Company Act of 1940, and investors will not be entitled

to the benefits of such Act.

Past performance is not a reliable indicator of current of

future results. The value of investments may go down as well as up

and investors may not get back any of the amount invested. The

value of investments designated in another currency may rise and

fall due to exchange rate fluctuations in respect of the relevant

currencies. Adverse movements in currency exchange rates can result

in a decrease in return and a loss of capital.

No recipient may forward, reproduce, distribute, or make

available in whole or in part, this document (directly or

indirectly) to any other person. The distribution of this document

in certain jurisdictions may be restricted by law and recipients of

this document should inform themselves about and observe any such

restrictions and other applicable legal requirements in their

jurisdictions. This document, and the information contained

therein, is not for viewing, release, distribution or publication

in or into the United States, Australia, Canada, the Republic of

South Africa or Japan or any other jurisdiction where applicable

laws prohibit its release, distribution or publication, and will

not be made available to any national, resident or citizen of the

United States, Australia, Canada, the Republic of South Africa or

Japan. The distribution of this document in other jurisdictions may

be restricted by law and persons into whose possession this

document comes must inform themselves about, and observe, any such

restrictions. Any failure to comply with the restrictions may

constitute a violation of the federal securities law of the United

States or the laws of other jurisdictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

BOABKBBQOBDDNBB

(END) Dow Jones Newswires

December 22, 2022 13:30 ET (18:30 GMT)

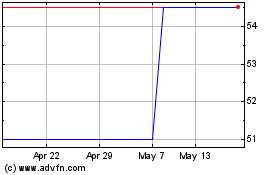

Marble Point Loan Financ... (LSE:MPLS)

Historical Stock Chart

From Nov 2024 to Dec 2024

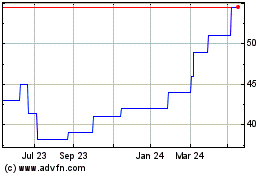

Marble Point Loan Financ... (LSE:MPLS)

Historical Stock Chart

From Dec 2023 to Dec 2024