TIDMORCP

RNS Number : 3052E

Oracle Power PLC

29 June 2023

29 June 2023

Oracle Power PLC

("Oracle", the "Company" or the "Group")

Final Results for the year ended 31 December 2022

Posting of Annual Report

Notice of AGM

Oracle Power PLC (AIM:ORCP) is pleased to announce its audited

results for the 12 months ended 31 December 2022. The Company's

Annual Report for the year ended 31 December 2022, together with

formal Notice of the Company's 2023 Annual General Meeting ("AGM"),

will be made available on the Company's website at

www.oraclepower.co.uk/investor-relations/aim-rule-26/ and are being

posted to shareholders today.

The AGM will be held at the offices of Charles Russell Speechlys

LLP, 5 Fleet Place, London EC4M 7RD on Wednesday, 26 July 2023 at

11:00 a.m.

For further information:

Oracle Power PLC +44 (0) 203 580

Naheed Memon - CEO 4314

Strand Hanson Limited (Nominated Adviser &

Joint Broker)

Rory Murphy / Matthew Chandler / Rob Patrick +44 (0) 207 409

3494

Global Investment Strategy UK Limited (Joint

Broker) +44 (0) 207 048

Samantha Esqulant 9432

Buchanan (Financial PR) +44 (0) 207 466

Bobby Morse / Oonagh Reidy / Abigail Gilchrist 5000

CHAIRMAN'S STATEMENT

I am pleased to present the financial statements for Oracle

Power PLC ("Oracle" or the "Company") for the year ended 31

December 2022.

In December 2022, Andreas Migge, one of our non-executive

directors left the Company. It was then with sadness that we learnt

that he had died in February 2023. We would like to offer our

condolences to his friends and family.

The political tensions between the United States and China

slowed down some progress in the development of the mine and power

project at Block VI in the Thar desert. However, during the course

of the year the Company continued to advance its initiatives for

the development of Block VI. The Government of Pakistan established

demand for 1,320 MW of Thar coal-based power in 2027, allowing for

potential development of the project. Subsequently, post period we

signed an agreement for potential offtake for 1,320 MW of coal

generated power as well as another agreement with PowerChina to

develop, in parallel, a 1 GW solar farm at Thar.

During the year, we focused most of our attention on our Green

Hydrogen ("GH") project, which comprises the planned construction

of a 400MW plant producing 55,000 tonnes of green hydrogen per

annum backed by 1,200MW of hybrid solar/wind, green hydrogen/power

plants.

This project is being developed through Oracle Energy Limited.

This company is owned 70% by His Highness Sheikh Ahmed Dalmook Al

Maktoum through his wholly owned company Kaheel Energy FZE, and 30%

by Oracle Power Plc. Oracle will be primarily responsible for

putting the project together and Kaheel Energy will use its

position and influence to facilitate market access and

financing.

To that end, we have acquired a 7,000 acres site in the Thatta

district in Southeast Pakistan. This lease for this land has been

granted to us by the Government of Sindh and is for an initial

period of 30 years. This lease is now fully paid for and registered

to Oracle Energy Limited.

We have been issued with a Letter of Intent ("LOI") from the

Directorate of Alternative Energy of the Government of Sindh (the

"Directorate of Alternative Energy"), relating to the establishment

of a 1,200MW hybrid solar/wind, green hydrogen/power project. In

order to obtain formal approval of the LOI, we needed to provide a

$600,000 performance guarantee bond which has now been put in

place.

In addition to the above, we have an LOI from TUV SUD for the

certification of the hydrogen output. Thyssenkrupp Uhde is

undertaking the various feasibility studies, and post period land

and renewable power studies have also been commenced.

In terms of our funding position, we raised GBP1,200,000 before

expenses through two equity placings to finance the development of

the green hydrogen project.

The development of the green hydrogen project has advanced

rapidly and it should not be long before the project acheives

bankability and Oracle can benefit from potential transactions with

one or more energy or fuel companies.

With regard to Western Australia, we decided not to carry out

any more work on the Jundee East project as we did not manage to

find viable gold deposits. Post year end, we signed a "farm-in"

agreement for the Northern Zone with Riversgold Ltd, the details of

which can be found in our RNS dated 9 May 2023. We will retain a

minority interest and be carried for the next phase of its

development.

Operational highlights of 2022 are described in the Chief

Executive's Report.

The Pakistan Government remains supportive of both the

development of the Thar coal project and the GH project in Thatta.

The broad parameters of security remain as last year: there have

been no major incidents and, overall, order has been

maintained.

We are most grateful to the Pakistani Authorities, to the

Chinese Authorities and the Joint Cooperation Committee (JCC) of

CPEC for their support.

Above all, I wish to thank our shareholders for their continued

confidence, patience and support, enabling us to make progress on

our projects.

Mark Steed

Chairman

CHIEF EXECUTIVE'S REPORT

I am pleased to present a report on the Company's progress for

the year ended 31 December 2022.

This year has been one of very notable progress for the Company.

During the year, we focused on the development of the Company's

significant GH project in Pakistan and also continued to explore

our Western Australia assets and develop our Thar asset. I am happy

to say that we have made significant progress, and I provide an

overview below.

In Pakistan, we continued to actively pursue the development of

our Thar Block VI, for power as well as for CTG/L (coal to

gas/liquid). We maintained an active dialogue with the Power

Division, Ministry of Energy, throughout the year, to secure

permission for development of the Company's 1,320MW, coal to power

project under the China-Pakistan Economic Corridor ("CPEC"). In

September 2022, the Government of Pakistan published its annual

Indicative Generation Capacity Expansion Plan (the "IGCEP"), a

demand-supply policy guidance chart for Pakistan and the demand for

1,320 MW of local coal fired power was stated as required in 2027.

This inclusion which confirms demand for 1,320 MW coal-based power,

allows for potential development of the project, subject to

financing and off-take. In 2022 Q4, and subsequent to the

publication of the IGCEP, we initiated dialogue with off takers

other than the Government of Pakistan. We signed an MOU post

period, for an off-take with the largest private power utility,

along with the Government of Sindh as a facilitator and potential

investor, preparing a pathway for the development of this important

project.

Furthermore, following significant progress made in 2021 with

respect to CTG/L, the Company signed an MOU in January 2022, with

Sui Southern Gas Company Limited ("SSGC"), the public gas

distribution company, based on the understanding that a buy back

arrangement with SSGC would trigger required government policy

formulation, as well as provide necessary guarantees to lenders. I

can also confirm that generally, Oracle continued to receive

encouragement and support from the Government of Pakistan for

mobilisation of CTG/L development, given Pakistan's critical gas

crisis.

In Western Australia, Oracle continued to conduct active

exploration on both the tenements. We began an extensive drilling

programme at Jundee East ("JE") in February 2022 which concluded in

March 2022, covering 3830m in 54 holes. Subsequently complete

geochemical analysis for downhole data was done to confirm gold

mineralisation which was then followed by geochemical analysis of

surface data for lithium and rare earth elements. The results

obtained were not favourable and it was decided post period end not

to undertake further drilling at JE.

At the Company's Northern Zone ("NZ") project, 25 km from

Kalgoorlie, the results from the maiden drill programme targeting

felsic intrusives porphyry bodies which had concluded in September

2021, were received in January 2022. The results established a low

grade but potentially large mineralisation across the tenement. The

Company carried out further metallurgical tests to confirm gold

recovery rates. The results from these tests which were received in

June 2022, confirmed excellent gold recovery rate of up to 94.7%.

The Company proceeded to prepare a budget and plan for further

drilling, opting for a diamond drilling programme to establish a

JORC resource at NZ. In parallel the Company also started dialogue

with potential JV partners. A "farm-in" agreement for NZ with an

ASX listed company was entered into post period and work on NZ at

minimum cost for the Company is expected to commence post

period.

In 2022, the Company accelerated the development of its GH

project in the wind corridor in Thatta in Pakistan. The project was

launched in Q4 2021, and the Company has achieved major

developmental milestones in 2022, for the first GH project in

Pakistan and one of the largest in the region. The Company set up a

new company, Oracle Energy Limited, for the development of the GH

project in Pakistan in November 2021. In March 2022, the Company

signed a JV agreement between Oracle and Kaheel Energy, a company

owned by HH Sheikh Ahmed Dalmook Al Maktoum. The Company owns 30

percent of Oracle Energy with the balance owned by Kaheel Energy.

The Company has retained management and the project has made good

progress. In May 2022, a pre-feasibility study was completed by

Power China International for 400 MW of GH production and 1.2 GW of

hybrid power generation. Oracle Energy was issued an LOI from the

Government of Sindh for the production of 1.2 GW of hybrid

renewable power.

Subsequently, a lease for 7,000 acres (28.3 sq km) of land in

the Gharo-Keti Wind Corridor was awarded to Oracle Energy for the

project. In November 2022, Oracle Energy then commissioned

Thyssenkrupp to undertake the feasibility study for green hydrogen

and green ammonia, endorsing faith in the project by introducing

highly reputable stakeholders. Results from this study are expected

during the course of 2023. In parallel, Oracle Energy forged a

relationship with a highly credible certification company by

signing an LOI with TUV SUD for green hydrogen and green ammonia

certification, across the entire production value chain. Post

period end the project has continued to move quickly. Land studies

were commenced, and non-binding arrangements have been initiated

with potential off takers and investors.

In summary, the Company has strengthened its portfolio and

undertaken significant development on all its projects. We have

achieved exceptional milestones especially for the GH project and

concluded a joint development agreement for one of our gold assets.

We have also paved a way forward for potential development of our

Thar asset.

I remain grateful to all the relevant authorities in Pakistan

and Western Australia for supporting our initiatives. I am also

thankful to the authorities in China for continuing to support

projects in CPEC. I wish to also profoundly thank the Company's

team in the UK, Pakistan and Australia, for their work and

dedication. Above all I thank our shareholders for their continued

confidence, patience and support, enabling us to grow our company.

The Company remains committed to increasing shareholder value and

to becoming a company of recognizable size and repute.

Ms Naheed Memon,

Chief Executive Officer

CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE YEARED 31

DECEMBER 2022

2022 2021

Note GBP GBP

CONTINUING OPERATIONS

Administrative expenses (1,311,012) (881,973)

LOSS FROM OPERATIONS (1,311,012) (881,973)

Finance income 6 14,592 94

Amounts written off and p/l on disposals 6,762 -

LOSS BEFORE TAX (1,289,658) (881,879)

LOSS FOR THE YEAR (1,289,658) (881,879)

2022 2021

Pence Pence

Earnings per share attributable to the ordinary

equity holders of the parent

PROFIT OR LOSS

Basic 9 (0.04) (0.04)

Diluted 9 (0.04) (0.04)

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME FOR THE

YEARED 31 DECEMBER 2022

2022 2021

GBP GBP

Loss for the year (1,289,658) (881,879)

ITEMS THAT WILL OR MAY BE RECLASSIFIED TO PROFIT

OR LOSS:

Exchange gains arising on translation on foreign

operations (178,459) (130,361)

(178,459) (130,361)

OTHER COMPREHENSIVE INCOME FOR THE YEAR, NET

OF TAX (178,459) (130,361)

TOTAL COMPREHENSIVE INCOME (1,468,117) (1,012,240)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

Note GBP GBP

Assets

NON--CURRENT ASSETS

Property, plant and equipment 10 3,885 5,856

Intangible assets 11 5,023,296 5,403,066

Investments in equity--accounted associates 13 668,782 -

Loans and other financial assets 14 580,079 369,390

6,276,042 5,778,312

CURRENT ASSETS

Trade and other receivables 15 45,069 50,108

Cash and cash equivalents 25 150,905 872,000

195,974 922,108

TOTAL ASSETS 6,472,016 6,700,420

Liabilities

CURRENT LIABILITIES

Trade and other payables 18 203,034 170,321

203,034 170,321

TOTAL LIABILITIES 203,034 170,321

Net assets 6,268,982 6,530,099

ISSUED CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE

PARENT

Share capital 17 3,078,297 2,650,325

Share premium reserve 16 18,632,040 17,853,012

Foreign exchange reserve 17 (995,125) (816,666)

Share scheme reserve 17 58,179 66,733

Retained earnings 17 (14,504,409) (13,223,305)

TOTAL EQUITY 6,268,982 6,530,099

COMPANY STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

Note GBP GBP

Assets

NON--CURRENT ASSETS

Property, plant and equipment 10 274 479

Intangible assets 11 3,665,622 3,978,851

Investments in equity--accounted associates 13 668,782 -

Investments 13 2,898,531 3,703,047

Loans and other financial assets 14 2,605,218 1,985,987

9,838,427 9,668,364

CURRENT ASSETS

Trade and other receivables 15 40,731 230,070

Cash and cash equivalents 25 137,291 850,442

178,022 1,080,512

TOTAL ASSETS 10,016,449 10,748,876

Liabilities

NON--CURRENT LIABILITIES

CURRENT LIABILITIES

Trade and other liabilities 18 175,961 909,763

175,961 909,763

TOTAL LIABILITIES 175,961 909,763

Net assets 9,840,488 9,839,113

ISSUED CAPITAL AND RESERVES ATTRIBUTABLE TO OWNERS OF THE

PARENT

Share capital 17 3,078,297 2,650,325

Share premium reserve 18,632,040 17,853,012

Financial liabilities at FVTPL credit risk

reserve 58,179 66,733

Retained earnings (11,928,028) (10,730,957)

TOTAL EQUITY 9,840,488 9,839,113

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Total

attributable

to equity

Share scheme Foreign exchange Retained holders

Share capital Share premium reserve reserve earnings of parent Total equity

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2022 2,650,325 17,853,012 66,733 (816,666) (13,223,305) 6,530,099 6,530,099

Comprehensive

income for the

year

Loss for the

year - - - - (1,289,658) (1,289,658) (1,289,658)

Other

comprehensive

income - - - (178,459) - (178,459) (178,459)

Total

comprehensive

income for

the year - - - (178,459) (1,289,658) (1,468,117) (1,468,117)

Contributions

by and

distributions

to

owners

Issue of

share capital 427,972 779,028 - - - 1,207,000 1,207,000

Transfer

to/from

retained

earnings - - (8,554) - 8,554 - -

Total

contributions

by and

distributions

to owners 427,972 779,028 (8,554) - 8,554 1,207,000 1,207,000

At 31

December 2022 3,078,297 18,632,040 58,179 (995,125) (14,504,409) 6,268,982 6,268,982

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Total attributable

to equity

Foreign exchange holders

Share capital Share premium Share scheme reserve reserve Retained earnings of parent Total equity

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 2,146,862 16,908,975 180,229 (686,305) (12,454,922) 6,094,839 6,094,839

Comprehensive

income for the

year

Loss for the

year - - - - (881,879) (881,879) (881,879)

Other

comprehensive

income - - - (130,361) - (130,361) (130,361)

Total

comprehensive

income for

the year - - - (130,361) (881,879) (1,012,240) (1,012,240)

Contributions

by and

distributions

to

owners

Issue of

share capital 503,463 944,037 - - - 1,447,500 1,447,500

Transfer

to/from

retained

earnings - - (113,496) - 113,496 - -

Total

contributions

by and

distributions

to owners 503,463 944,037 (113,496) - 113,496 1,447,500 1,447,500

At 31

December 2021 2,650,325 17,853,012 66,733 (816,666) (13,223,305) 6,530,099 6,530,099

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Share scheme Retained

Share capital Share premium reserve earnings Total equity

GBP GBP GBP GBP GBP

At 1 January 2022 2,650,325 17,853,012 66,733 (10,730,957) 9,839,113

Comprehensive income for

the year

Loss for the year - - - (1,205,625) (1,205,625)

Total comprehensive

income

for the year - - - (1,205,625) (1,205,625)

Contributions by and

distributions

to owners

Issue of share capital 427,972 779,028 - - 1,207,000

Share warrants exercised - - (8,554) 8,554 -

Total contributions by

and distributions to

owners 427,972 779,028 (8,554) 8,554 1,207,000

At 31 December 2022 3,078,297 18,632,040 58,179 (11,928,028) 9,840,488

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2021

Share scheme Retained

Share capital Share premium reserve earnings Total equity

GBP GBP GBP GBP GBP

At 1 January

2021 2,146,862 16,908,975 180,229 (10,049,674) 9,186,392

Comprehensive

income for

the year

Loss for the

year - - - (794,779) (794,779)

Total

comprehensive

income

for the year - - - (794,779) (794,779)

Contributions

by and

distributions

to owners

Issue of

share capital 503,463 944,037 - - 1,447,500

Share

warrants

exercised - - (113,496) 113,496 -

Total

contributions

by

and

distributions

to owners 503,463 944,03 (113,496) 113,496 1,447,500

At 31

December 2021 2,650,325 17,853,012 66,733 (10,730,957) 9,839,113

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER

2022

2022 2021

Note GBP GBP

CASH FLOWS FROM OPERATING

ACTIVITIES

Loss for the year (1,289,658) (881,879)

ADJUSTMENTS FOR

Depreciation of property,

plant and equipment 10 205 1,942

Impairment losses on

intangible assets 11 579,728 -

Impairment loss recognised on

loans to associates 25,785 -

Finance income 6 (14,592) (94)

Gain on disposal of subsidiary

undertaking (6,762) -

Net foreign exchange

loss/(gain) 10,300 (7,206)

Income tax expense - 46

(694,994) (887,191)

MOVEMENTS IN WORKING CAPITAL:

Increase in trade and other

receivables (38,025) (45,174)

Increase/(decrease) in trade

and other payables 25,305 (110,943)

CASH GENERATED FROM

OPERATIONS (707,714) (1,043,308)

NET CASH USED IN OPERATING

ACTIVITIES (707,714) (1,043,308)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchase of Australia

exploration fixed assets 11 (238,245) (190,599)

Purchase of Pakistan project

fixed assets 11 (140,718) (94,317)

Payments for investments in

associates 13 (668,782) -

Issue of loans 6 (184,929) -

Interest received 6 14,592 94

NET CASH USED IN INVESTING

ACTIVITIES (1,218,082) (284,822)

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of ordinary shares 16 1,207,000 647,500

NET CASH FROM FINANCING ACTIVITIES 1,207,000 647,500

NET CASH DECREASE IN CASH AND CASH

EQUIVALENTS (718,796) (680,630)

Cash and cash equivalents at the

beginning

of year 872,000 1,554,424

Exchange loss on cash and cash

equivalents (2,299) (1,794)

CASH AND CASH EQUIVALENTS AT THE OF THE

YEAR 25 150,905 872,000

COMPANY STATEMENT OF CASH FLOWS FOR THE YEARED 31 DECEMBER

2022

2022 2021

Note GBP GBP

CASH FLOWS FROM OPERATING

ACTIVITIES

Loss for the year (1,205,625) (794,779)

ADJUSTMENTS FOR

Depreciation of property,

plant and equipment 10 205 205

Amortisation of intangible

fixed assets 11 313,229 -

Impairment loss recognised on

other receivables 301,462 20,070

Forgiveness of other loan (804,516) -

Finance income 6 (66,938) (17,058)

Loss on sale of discontinued

operations, net of tax 804,516 -

Net foreign exchange

loss/(gain) 47,944 (7,242)

(609,723) (798,804)

MOVEMENTS IN WORKING CAPITAL:

Increase in trade and other

receivables (665) (6,173)

Decrease in trade and other

payables (733,801) (162,136)

Decrease in loans to

subsidiaries 78,228 (365,704)

CASH GENERATED FROM

OPERATIONS (1,265,961) (1,332,817)

NET CASH USED IN OPERATING

ACTIVITIES (1,265,961) (1,332,817)

CASH FLOWS FROM INVESTING

ACTIVITIES

Payments for investments in

associates (668,782) -

Interest received 14,592 94

NET CASH (USED IN)/FROM

INVESTING ACTIVITIES (654,190) 94

CASH FLOWS FROM FINANCING

ACTIVITIES

Issue of ordinary shares 1,207,000 647,500

NET CASH FROM FINANCING

ACTIVITIES 1,207,000 647,500

NET CASH DECREASE IN CASH AND

CASH EQUIVALENTS (713,151) (685,223)

Cash and cash equivalents at

the beginning of year 850,442 1,535,665

CASH AND CASH EQUIVALENTS AT

THE OF THE YEAR 25 137,291 850,442

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEARED 31 DECEMBER 2022

1. STATUTORY INFORMATION

Oracle Power PLC is a public company, limited by shares and

registered and domiciled in England and Wales. It is the ultimate

holding company of the Oracle Power Plc Group. The Group is

primarily involved in an energy project, based on the exploration

and development of coal and building a mine--mouth power plant in

Pakistan. The Group also has two gold prospects in Western

Australia and a green hydrogen project in Pakistan. The

presentation currency of the financial statements is the Pound

Sterling (GBP). The Company's registered number and registered

office address can be found on the General Information page.

2. ACCOUNTING POLICIES

2.1 Going concern

During the year under review, the Group experienced net cash

outflows from operating activities which it financed from existing

cash resources held at the start of the year and cash received from

the issue of new equity share capital. The Directors have

considered the cash flow requirements of the Group over the next 12

months and believe that additional funding will be required to meet

the Group's cash requirements over that period. Post year end in

February 2023 and June 2023 the Company raised GBP500,000 and

GBP363,000 supporting that cash requirement. This additional cash

requirement creates a material uncertainty that may cast

significant doubt on the Company's ability to continue as a going

concern. However, the Directors expect to be able to meet the

funding requirements for the Group to continue as a going concern

for at least 12 months from the date of the approval of these

financial statements, and consequently, the Directors consider it

appropriate to adopt the going concern basis in the preparation of

the financial statements.

2.2 Compliance with accounting standards

These financial statements have been prepared in accordance with

UK adopted International Financial Reporting Standards and IFRIC

interpretations and with those parts of the Companies Act 2006

applicable to reporting groups under IFRS.

The financial statements have been prepared under the historical

cost convention.

2.3 Significant accounting judgements, estimates and assumptions

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that affect the

amounts reported for revenues and expenses during the year and the

amounts reported for assets and liabilities at the statement of

financial position date. However, the nature of estimation means

that the actual outcomes could differ from those estimates.

The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are the measurement of any impairment on intangible assets and the

estimation of share--based payment costs.

The principal risk and uncertainty of the intangible assets

(exploration assets) is that the Group may not reach financial

close - as disclosed in Note 11. The board have tested the

intangible assets for impairment. For this test, the board

considered market values of the assets (where applicable); results

from technical and feasibility studies and reports; and the

possibility of future project options available. Based on this, the

board have concluded that no impairment provision is required other

than for the Jundee East Tenement in Western Australia that has

been determined to be uneconomic to develop further.

The Group determines whether there is any impairment of

intangible assets on an annual basis.

At the balance sheet date, the intangible assets are carried

forward at their cost of GBP5,603,024 (2021: GBP5,403,066) less

impairment of GBP579,728.

2.4 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 31 December each year. Control is

achieved where the Company has the power to govern the financial

and operating policies of an investee entity so as to obtain

benefits from its activities.

Business acquisitions have been accounted for in accordance with

IFRS 3, 'Business Combinations'. Fair values are attributed to the

Group's share of net assets. Where the cost of acquisition exceeds

the fair values attributed to such assets, the difference is

treated as purchased goodwill and is capitalised.

2.5 Intangible assets

(i) Intangible fixed assets -- Australia exploration costs

Expenditure on the acquisition costs, exploration and evaluation

of interests in licences, including related finance and

administration costs, are capitalised. Such costs are carried

forward in the statement of financial position under intangible

assets and amortised over the minimum period of the expected

commercial production of gold in respect of each area of interest

where:

a) such costs are expected to be recouped through successful

development and exploration of the area of interest or

alternatively by its sale;

b) exploration activities have not yet reached a stage that

permits a reasonable assessment of the existence or otherwise of

economically recoverable reserves and active operations in relation

to the areas are continuing.

An annual impairment review is carried out by the Directors when

specific facts and circumstances indicate that an impairment test

is required, such as:

(1) the period for which the entity has the right to explore in

the specific area has expired during the period or will expire in

the near future, and is not expected to be renewed.

(2) substantive expenditure on further exploration for and

evaluation of mineral resources in the specific area is neither

budgeted nor planned.

(3) exploration for and evaluation of mineral resources in the

specific area have not led to the discovery of commercially viable

quantities of mineral resources and the entity has decided to

discontinue such

activities in the specific area.

(4) sufficient data exist to indicate that, although a

development in the specific area is likely to proceed, the carrying

amount of the exploration and evaluation asset is unlikely to be

recovered in full from successful development or by sale.

In any such case, or similar cases, the entity shall perform an

impairment test in accordance with IAS 36. Any impairment loss is

recognised as an expense in accordance with IAS 36

Australia exploration costs are carried at cost less any

provision for impairment.

(ii) Intangible fixed assets -- Pakistan project costs

Expenditure on the Pakistan project to achieve final project

approval prior to the start of mine operations including related

finance and administration costs are capitalised. Such costs are

carried forward in the statement of financial position under

intangible assets and amortised over the minimum period of the

expected commercial production of coal in respect of each area of

interest.

The Pakistan project costs are tested annually for impairment by

comparing the carrying amount to the recoverable amount Pakistan

project costs are carried at cost less any provision for

impairment.

2.6 Property, plant and equipment

Property, plant and equipment is stated at historical cost less

accumulated depreciation. Depreciation is provided at the following

annual rates in order to write off each asset over its estimated

useful life.

Fixtures and fittings -- 15% on reducing balance

Motor vehicles -- 20% on reducing balance

Computer equipment -- 30% on reducing balance

2.7 Investments

Investments in subsidiaries are stated at cost. The investments

are reviewed annually and any impairment is taken directly to the

statement of profit or loss. Investments in subsidiaries are fully

consolidated within the Group financial statements.

2.8 Investments in associates

An associate is an entity over which the Group has significant

influence. Significant influence is the power to participate in the

financial and operating policy decisions of the investee but is not

control or joint control over those policies.

The results and assets and liabilities of associates are

incorporated in these consolidated financial statements using the

equity method of accounting, except when the investment, or a

portion thereof, is classified as held for sale, in which case it

is accounted for in accordance with IFRS 5. Under the equity

method, an investment in an associate or a joint venture is

initially recognised in the consolidated statement of financial

position at cost and adjusted thereafter to recognise the Group's

share of the profit or loss and other comprehensive income of the

associate or joint venture. When the Group's share of losses of an

associate exceeds the Group's interest in that associate or joint

venture (which includes any long--term interests that, in

substance, form part of the Group's net investment in the

associate, the Group discontinues recognising its share of further

losses. Additional losses are recognised only to the extent that

the Group has incurred legal or constructive obligations or made

payments on behalf of the associate.

An investment in an associate is accounted for using the equity

method from the date on which the investee becomes an associate or

a joint venture. On acquisition of the investment in an associate ,

any excess of the cost of the investment over the Group's share of

the net fair value of the identifiable assets and liabilities of

the investee is recognised as goodwill, which is included within

the carrying amount of the investment. Any excess of the Group's

share of the net fair value of the identifiable assets and

liabilities over the cost of the investment, after reassessment, is

recognised immediately in profit or loss in the period in which the

investment is acquired.

The requirements of IAS 36 are applied to determine whether it

is necessary to recognise any impairment loss with respect to the

Group's investment in an associate or joint venture. When

necessary, the entire carrying amount of the investment (including

goodwill) is tested for impairment in accordance with IAS 36

Impairment of Assets as a single asset by comparing its recoverable

amount (higher of value in use and fair value less costs of

disposal) with its carrying amount. Any impairment loss recognised

forms part of the carrying amount of the investment. Any reversal

of that impairment loss is recognised in accordance with IAS 36 to

the extent that the recoverable amount of the investment

subsequently increases.

The Group discontinues the use of the equity method from the

date when the investment ceases to be an associate or joint

venture, or when the investment is classified as held for sale.

When the Group retains an interest in the former associate or joint

venture and the retained interest is a financial asset, the Group

measures the retained interest at fair value at that date and the

fair value is regarded as its fair value on initial recognition in

accordance with IFRS 9. The difference between the carrying amount

of the associate or joint venture at the date the equity method was

discontinued, and the fair value of any retained interest and any

proceeds from disposing of a part interest in the associate or

joint venture is included in the determination of the gain or loss

on disposal of the associate or joint venture. In addition, the

Group accounts for all amounts previously recognised in other

comprehensive income in relation to that associate or joint venture

on the same basis as would be required if that associate or joint

venture had directly disposed of the related assets or liabilities.

Therefore, if a gain or loss previously recognised in other

comprehensive income by that associate or joint venture would be

reclassified to profit or loss on the disposal of the related

assets or liabilities, the Group reclassified the gain or loss from

equity to profit or loss (as a reclassification adjustment) when

the equity method is discontinued.

The Group continues to use the equity method when an investment

in an associate becomes an investment in a joint venture or an

investment in a joint venture becomes an associate. There is no

remeasurement to fair value upon such changes in ownership

interests.

When the Group reduces its ownership interest in an associate or

a joint venture but the Group continues to use the equity method,

the Group reclassifies to profit or loss the proportion of the gain

or loss that had previously been recognised in the other

comprehensive income relating to that reduction in ownership

interest if that gain or loss would be reclassified to profit or

loss on the disposal of the related assets or liabilities.

When a group entity transacts with an associate or a joint

venture of the Group, profits and losses resulting from the

transactions with the associate or joint ventures are recognised in

the Group's consolidated financial statements only to the extent of

interests in the associate or joint venture that are not related to

the Group.

2.9 Leasing

All leases held are either short--term leases or are for low

value assets. The rentals paid are charged to the statement of

profit or loss on a straight-line basis over the period of the

lease.

2.10 Foreign currency

In preparing the financial statements of each individual group

entity, transactions in currencies other than the entity's

functional currency (foreign currencies) are recognised at the

rates of exchange prevailing at the dates of the transactions. At

the end of each reporting period, monetary items denominated in

foreign currencies are retranslated at the rates prevailing at that

date. Non--monetary items carried at fair value that are

denominated in foreign currencies are retranslated at the rates

prevailing at the date when the fair value was determined.

Non--monetary items that are measured in terms of historical cost

in a foreign currency are not retranslated.

Exchange differences on monetary items are recognised in profit

or loss in the period in which they arise except for exchange

differences on foreign currency borrowings relating to assets under

construction for future productive use, which are included in the

cost of those assets when they are regarded as an adjustment to

interest costs on those foreign currency borrowings;

For the purposes of presenting these consolidated financial

statements, the assets and liabilities of the Group's foreign

operations are translated into pounds using exchange rates

prevailing at the end of each reporting period. Income and expense

items are translated at the average exchange rates for the period,

unless exchange rates fluctuate significantly during that period,

in which case the exchange rates at the dates of the transactions

are used. Exchange differences arising, if any, are recognised in

other comprehensive income and accumulated in equity (and

attributed to non--controlling interests as appropriate).

On the disposal of a foreign operation (i.e. a disposal of the

Group's entire interest in a foreign operation, a disposal

involving loss of control over a subsidiary that includes a foreign

operation, or a partial disposal of an interest in a joint

arrangement or an associate that includes a foreign operation of

which the retained interest becomes a financial asset), all of the

exchange differences accumulated in equity in respect of that

operation attributable to the owners of the Company are

reclassified to profit or loss.

In addition, in relation to a partial disposal of a subsidiary

that includes a foreign operation that does not result in the Group

losing control over the subsidiary, the proportionate share of

accumulated exchange differences are re--attributed to

non--controlling interests and are not recognised in profit or

loss. For all other partial disposals (i.e. partial disposals of

associates or joint arrangements that do not result in the Group

losing significant influence or joint control), the proportionate

share of the accumulated exchange differences is reclassified to

profit or loss.

Goodwill and fair value adjustments to identifiable assets

acquired and liabilities assumed through acquisition of a foreign

operation are treated as assets and liabilities of the foreign

operation and translated at the rate of exchange prevailing at the

end of each reporting period. Exchange differences arising are

recognised in other comprehensive income.

2.11 Employee benefits

Retirement benefit costs and termination benefits

The group operates a defined contribution pension scheme.

Contributions payable to the group's pension scheme are charged to

the income statement in the period to which they relate.

2.12 Share--based payments

Share--based payment transactions of the Company

Where equity settled share warrants are awarded to employees,

the fair value of the warrants at the date of grant is charged to

the statement of profit or loss over the vesting period.

Non--market vesting conditions are taken into account by adjusting

the number of equity instruments expected to vest at each statement

of financial position date so that, ultimately, the cumulative

amount recognised over the vesting period is based on the number of

warrants that eventually vest. Market vesting conditions are

factored into the fair value of all warrants granted. As long as

all other vesting conditions are satisfied, a charge is made

irrespective of whether market vesting conditions are satisfied.

The cumulative expense is not adjusted for failure to achieve a

market vesting condition.

Where terms and conditions of warrants are modified before they

vest, the increase in the fair value of the warrants, measured

immediately before and after the modification, is also charged to

the statement of profit or loss over the remaining vesting

period.

Where equity instruments are granted to persons other than

employees, the statement of profit or loss is charged with the fair

value of goods and services received.

2.13 Financial instruments

Financial assets and financial liabilities are recognised in the

Group's statement of financial position when the Group becomes a

party to the contractual provisions of the instrument.

Financial assets and financial liabilities are initially

measured at fair value, except for trade receivables that do not

have a significant financing component which are measured at

transaction price. Transaction costs that are directly attributable

to the acquisition or issue of financial assets and financial

liabilities (other than financial assets and financial liabilities

at fair value through profit or loss) are added to or deducted from

the fair value of the financial assets or financial liabilities, as

appropriate, on initial recognition. Transaction costs directly

attributable to the acquisition of financial assets or financial

liabilities at fair value through profit or loss are recognised

immediately in profit or loss.

Financial Assets:

The Group classifies its financial assets other than investments

in subsidiaries and associates as financial assets at amortised

cost, at fair value through other comprehensive income (FVOCI) or

at fair value through profit or loss (FVTPL). The classification

depends on the purpose for which the financial assets were

acquired. Management determines the classification of its financial

assets at initial recognition.

A financial asset is measured at amortised cost if it is held

within a business model whose objective is to collect contractual

cash flows and its contractual terms give rise on specified dates

to cash flows that are solely payments of principal and interest on

the principal amount outstanding.

A financial asset is measured at FVOCI if it is held within a

business model whose objective is achieved by collecting

contractual cash flows and selling financial assets and its

contractual terms give rise on specified dates to cash flows that

are solely payments of principal and interest on the principal

amount outstanding.

A financial asset is measured at FVTPL if it is not measured at

amortised cost or at FVOCI.

All of the group financial assets are currently classified as at

amortised cost.

Financial assets at amortised cost are subsequently measured at

amortised cost using the effective interest method. The amortised

cost id reduced by impairment losses. They are included in current

assets, except for maturities greater than 12 months after the

balance sheet date. These are classified as non-current assets.

Trade receivables, with standard payment terms of between 30 to

65 days, are recognised and carried at the lower of their original

invoiced and recoverable amount.

A loss allowance is recognised on initial recognition of

financial assets held at amortised cost, based on expected credit

losses, and is re-measured annually with changes appearing in

profit or loss. Where there has been a significant increase in

credit risk of the financial instrument since initial recognition,

the loss allowance is measured based on lifetime expected losses.

In all other cases, the loss allowance is measured based on

12-month expected losses. For assets with a maturity of 12 months

or less, including trade receivables, the 12-month expected loss

allowance is equal to the lifetime expected loss allowance.

The Group's financial assets are disclosed in notes 14 and

15.

Financial Liabilities:

The Group classifies its financial liabilities as at amortised

cost or at FVTPL. A financial liability is measured at FVTPL if it

is classified as held for trading, it is a derivative or it is

designated as such on initial recognition, otherwise it is

classified as at amortised cost.

All of the group financial liabilities are currently classified

as at amortised cost.

Financial liabilities at amortised cost are subsequently

measured at amortised cost using the effective interest method.

They are classified as non-current when the payment falls due

greater than 12 months after the year end date.

2.14 Cash and cash equivalents

Cash and cash equivalents for the purpose of the cash flow

statement comprise cash and bank balances.

2.15 New Standards and Interpretations applied

There are no IFRSs or IFRIC interpretations that are effective

for the first time for the financial year beginning 1 January 2022

that would be expected to have a material impact on the Group.

New and revised standards not yet effective

Certain new accounting standards and interpretations have been

issued but have not been applied by the Group in preparing these

financial statements as they are not as yet effective. These

standards are not expected to have a material impact on the Group

in the current or future periods and on foreseeable future

transactions.

3. SEGMENT INFORMATION

Based on risks and returns, the Directors consider that the

primary business reporting format is by business segment which are

currently:

1) the principal activity of the Group which is an energy

project, based on the exploration and development of coal mining

and building a mine--mouth power plant in Pakistan ("Pakistan

Energy Project");

2) an investment in Western Australia for the exploration and

future extraction of gold ("Australia Gold Project"); and

3) a green hydrogen project in Pakistan ("Pakistan Green

Hydrogen Project").

The segments are not yet revenue generating and the primary

financial reporting metrics are the value of intangible assets

relating to the projects and total spend to date. The Pakistan

Green Hydrogen Project is carried out through the Company's

investment in associates which is not included in the analysis

below.

To--date the Group has raised a total GBP23.2m and spent

GBP18.0m on Thar Block VI and GBP0.5m on the Western Australia gold

project net of impairment of GBP0.6m.

The following is an analysis of the Group's results by

reportable segment in the year under review:

2022 2021

----------------------------- ---------------- ----------------

GBP GBP

----------------------------- ---------------- ----------------

Pakistan Energy Project (9,318) (5,277)

============================= ================ ================

Australia Gold Project (630,945) (78,168)

Total (640,263) (83,445)

============================= ================ ================

Central administration costs (670,749) (798,528)

============================= ================ ================

Finance income 14,592 94

============================= ================ ================

Other gains and losses 6,762 -

Profit before tax (1,289,658) (881,879)

============================= ================ ================

The accounting policies of the reportable segments are the same

as the Group's accounting policies described in note 2. Segment

profit represents the profit earned by each segment without

allocation of the share of profits of associates and joint

ventures, central administration costs including directors'

salaries, finance income, non--operating gains and losses in

respect of financial instruments and finance costs, and income tax

expense. This is the measure reported to the Group's Chief

Executive for the purpose of resource allocation and assessment of

segment performance.

Segment assets

2022 2021

-------------------------- -------------------- --------------------

GBP GBP

-------------------------- -------------------- --------------------

Pakistan Energy Project 4,529,390 4,593,369

========================== ==================== ====================

Australia Gold Project 493,906 809,697

Total segment assets 5,023,296 5,403,066

========================== ==================== ====================

Unallocated assets 3,885 5,856

Consolidated total assets 5,027,181 5,408,922

========================== ==================== ====================

For the purposes of monitoring segment performance and

allocating resources between segments the

Group's Chief Executive monitors the tangible, intangible and

financial assets attributable to each

segment. All assets are allocated to reportable segments with

the exception of investments in associates, and other financial

assets.

Other segment information

Additions

Depreciation & Amortisation to non--current*

------------------------ ------------------------ ---------------------- --------------- -----------------

assets*

------------------------ ------------------------ ---------------------- --------------- -----------------

2022 2021 2022 2021

------------------------ ------------------------ ---------------------- --------------- -----------------

GBP GBP GBP GBP

======================== ======================== ====================== =============== =================

Pakistan Energy Project 1,133 1,737 140,718 97,762

======================== ======================== ====================== =============== =================

Australia Gold Project - - 238,225 186,919

======================== ======================== ====================== =============== =================

1,133 1,737 378,943 284,681

======================== ======================== ====================== =============== =================

*The amounts exclude additions to financial instruments.

In addition to the depreciation and amortisation reported above,

impairment losses of GBP579,727 (2021: GBPnil) were recognised in

respect of non--current assets. These impairment losses were all

attributable to the Australia Gold Project.

25. NOTES SUPPORTING STATEMENT OF CASH FLOWS

Group

2022 2021

GBP GBP

Cash at bank available on demand 32,795 34,378

Short--term deposits 118,110 837,622

CASH AND CASH EQUIVALENTS IN THE STATEMENT OF

FINANCIAL POSITION 150,905 872,000

CASH AND CASH EQUIVALENTS IN THE STATEMENT OF

CASH FLOWS 150,905 872,000

Company

2022 2021

GBP GBP

Cash at bank available on demand 19,181 12,820

Short--term deposits 118,110 837,622

CASH AND CASH EQUIVALENTS IN THE STATEMENT OF FINANCIAL POSITION 137,291 850,442

CASH AND CASH EQUIVALENTS IN THE STATEMENT OF CASH FLOWS 137,291 850,442

26. RECONCILIATION OF CHANGES IN LIABILITIES ARISING FROM

FINANCING ACTIVITIES

Group

Trade and other

payables Borrowings Total

GBP GBP GBP

Balance at 1 January

2021 322,655 800,000 1,122,655

Cash flows (152,334) - (152,334)

Non--cash changes

Issue of share capital - (800,000) (800,000)

Balance at 31 December

2021 170,321 - 170,321

Cash flows 32,713 - 32,713

Balance at 31 December

2022 203,034 - 203,034

Company

Trade and other Amounts owed to

payables Borrowings group undertakings Total

GBP GBP GBP GBP

Balance at

1 January 2021 267,183 800,000 804,716 1,871,899

Cash flows (162,036) - (100) (162,136)

Non--cash changes

Issue of share

capital - (800,000) - (800,000)

Balance at

31 December

2021 105,147 - 804,616 909,763

Cash flows 70,814 - - 70,814

Forgiveness

of debt (804,616) (804,616)

Balance at

31 December

2022 175,961 - - 175,961

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKFBNDBKBAAB

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

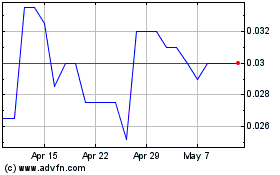

Oracle Power (LSE:ORCP)

Historical Stock Chart

From Apr 2024 to May 2024

Oracle Power (LSE:ORCP)

Historical Stock Chart

From May 2023 to May 2024