Balance at 31

December 2014 6,651 25,192 1,075 204 (30,510) (211) 2,401

Consolidated Balance Sheet

at 31 December 2014

Note 2014 2013

GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 187 165

Goodwill 401 401

Development costs 1,103 640

Deferred tax assets 516 653

2,207 1,859

Current assets

Inventories 1,439 1,779

Trade and other receivables 2,982 983

Cash and cash equivalents

- escrow deposits 54 -

Cash and cash equivalents 1,434 1,440

5,909 4,202

Total assets 8,116 6,061

EQUITY AND LIABILITIES

Equity attributable to equity holders

of the parent

Share capital 6 6,651 6,645

Share premium 25,192 25,153

Equity reserve 204 206

Merger reserve 1,075 1,075

Currency translation reserve (211) (211)

Retained earnings deficit (30,510) (31,132)

Total equity 2,401 1,736

Non-current liabilities

Interest-bearing loans and

borrowings 5 1,524 1,518

Deferred tax liabilities 100 128

1,624 1,646

Current liabilities

Interest-bearing loans and - -

borrowings

Other trade and other payables 4,091 2,679

4,091 2,679

Total liabilities 5,715 4,325

Total equity and liabilities 8,116 6,061

Consolidated Statement of Cash Flows

for year ended 31 December 2014

Note 2014 2013

GBP000 GBP000

Cash flows from operating

activities

Profit/(loss) for the year 620 (2,293)

Adjustments for:

Depreciation 48 47

Amortisation of intangible

assets 198 261

Financial income 3 (3) (20)

Financial expense 3 152 1,078

Income tax credit - (95)

Exchange differences - (13)

Operating cash flows before

movement in working capital 1,015 (1,035)

Change in trade and other

receivables (2,035) 647

Change in inventories 340 (568)

Change in trade and other

payables 1,340 (267)

Cash generated from operations 660 (1,223)

Interest received 3 20

Interest paid (110) (60)

Tax received 208 -

Net cash from operating activities 761 (1,263)

Cash flows from investing

activities

Acquisition of property,

plant and equipment (70) (40)

Capitalised development expenditure (661) (371)

Cash deposits held in escrow (54) 77

Net cash outflow from investing

activities (785) (334)

Cash flows from financing

activities

Proceeds from exercise of

share options 6 18 -

Proceeds from share issue - 1,150

Expenses of share issue - (87)

Water Hall transaction 3 - (83)

Proceeds from sale of own

shares - 595

Repayment of bank borrowings - (42)

Net cash inflow from financing

activities 18 1,533

Net decrease in cash and

cash equivalents (6) (64)

Water Hall transaction: Settlement

of working capital facility 3 - 1,551

Total movement in cash and

cash equivalents in the year (6) 1,487

Cash and cash equivalents

at 1 January 1,440 (47)

Cash and cash equivalents

at 31 December 1,434 1,440

1 Basis of preparation and status of financial information

The financial information set out in this statement has been

prepared in accordance with the recognition and measurement

principles of International Financial Reporting Standards as

adopted by the EU ("adopted IFRSs"), IFRIC interpretations and the

Companies Act 2006 applicable to companies reporting under IFRS. It

does not include all the information required for full annual

accounts.

The financial information does not constitute the Company's

statutory accounts for the years ended 31 December 2014 or 31

December 2013 but is derived from those accounts. Statutory

accounts for 2013 have been delivered to the registrar of

companies, and those for 2014 will be delivered in due course. The

auditor has reported on those accounts; his reports were (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying his report and (iii) did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006.

2 Segmental information

The analysis by geographic segment below is presented in

accordance with IFRS 8 on the basis of those segments whose

operating results are regularly reviewed by the Board of Directors

(the Chief Operating Decision Maker as defined by IFRS 8) to make

strategic decisions, to monitor performance and to allocate

resources.

The directors consider the Group to have only one segment in

terms of products and services, being the development, supply and

maintenance of technologies used in advanced security, surveillance

and ruggedised electronic applications.

As the Board of Directors receives revenue, EBITDA and operating

profit/(loss) on the same basis as set out in the Consolidated

Income Statement no further reconciliation is considered to be

necessary.

As in 2013 the Group's operations continue to comprise one

segment.

Revenue by geographical destination can be analysed as

follows:

2014 2013

GBP000 GBP000

United Kingdom 10,773 5,482

Continental Europe 1,724 488

Rest of World 965 289

_____ _____

13,462 6,259

_____ _____

Included in the above amounts are revenues of GBP9,793,000

(2013: GBP862,000) in respect of construction contracts. The

balance comprises revenue from sales of goods and services.

3 Financial income and expense

2014 2013

GBP000 GBP000

Recognised in profit or loss

Interest on bank deposits 3 -

Net foreign exchange gain - 20

Financial expenses 3 20

GBP000 GBP000

Interest expense on financial liabilities

at amortised cost 150 100

Net foreign exchange loss 2 -

Water Hall transaction (see below) - 978

Financial expenses 152 1,078

On 29 August 2013 the Group completed a debt for equity swap

with Water Hall Group plc ('the Water Hall transaction'). Under the

terms of the arrangement, the Group issued equity share options,

and convertible loan notes with a combined fair value of

GBP2,975,000 to:

(i) settle its working capital facility of GBP1,551,000

(ii) purchase its own shares to the value of GBP592,000 and

(iii) acquire the remaining net assets of Water Hall Group plc

which comprised cash of GBP72,000 and net

liabilities of GBP68,000 relating to trade and other payables net of VAT receivables.

The loss on this transaction of GBP860,000 was included in total

exceptional finance costs for the year of GBP978,000; the balance

included transaction expenses of GBP118,000 (transaction expenses

totalled GBP155,000 of which GBP37,000 was allocated to merger

reserve). The net cash effect of the transaction was an outflow of

GBP83,000. In addition, the Group's overdraft of GBP1,551,000 was

settled. The debt for equity swap resulted in the Group obtaining

control of the Water Hall Group plc legal entity with the result

that, from 29 August 2013, Water Hall Group plc has been

consolidated into the accounts.

4 Taxation

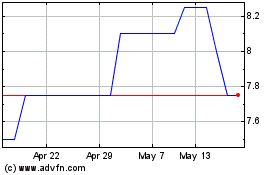

Petards (LSE:PEG)

Historical Stock Chart

From Jun 2024 to Jul 2024

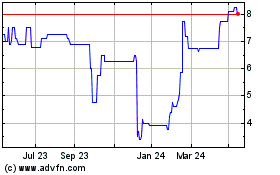

Petards (LSE:PEG)

Historical Stock Chart

From Jul 2023 to Jul 2024