TIDMRBGP

RNS Number : 1080X

RBG Holdings PLC

18 December 2023

18 December 2023

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as retained as part of UK

law by virtue of the European Union (Withdrawal) Act 2018 (as

amended). Upon the publication of this announcement, this inside

information is now considered to be in the public domain.

RBG Holdings plc

("RBG", the "Group", or the "Company")

Trading Update

RBG Holdings plc (AIM: RBGP), the legal and professional

services group, today publishes a trading update for the twelve

months ending 31 December 2023 ("FY 2023").

2023 has been a pivotal year for the Group. The new leadership

team has taken action to reduce the Group's risk profile and

refocus on its core business activities where the Board believes it

can best maximise profits. These key actions include:

Reduce Risk

-- the disposal of LionFish

-- scaling back from unfunded Alternative Billing Arrangements

("ABAs") and no longer carrying investments in ABAs as assets on

the balance sheet

Increase Stability

-- appointment of a new Chief Financial Officer, Kevin McNair

-- renewing banking facilities totalling GBP24.5m at interest

rates deemed favourable by the Board

Focus on Growth

-- the recruitment of seven new partners who have already

started to gain traction in their specific markets and are

generating new revenue streams

Prudent Financial Management

-- suspension of the dividend policy

-- a full root and branch review of all aspects of the

accounting treatments of work in progress and debtors

-- an increase in bad debt provisions

Operational Management

-- implementation of new ERP management information system

-- instruction of two agents on the Group's leasehold properties

to consolidate its property portfolio

Trading

Legal Services

In its results for the six months ended 30 June 2023, the

Company announced that Legal Services performed broadly in line

with the Board's expectations during H1 2023, despite the

challenging economic conditions.

The second half of the financial year has historically been the

stronger of the two halves, however activity levels during H2 2023

have been at similar levels to H1 2023 and there has not been the

increase in revenue and profitability seen in previous years and

that the Board had anticipated. In particular, Memery Crystal, has

been impacted by the lack of activity in both Commercial Real

Estate and Equity Capital Markets with transactions that were

forecast in Q4 2023 either being delayed into 2024 or cancelled

altogether.

Corporate Finance Advisory

The Group's specialist sell-side corporate finance advisory

business, Convex Capital, continues to have a strong pipeline of 18

deals. A number are in advanced stages of negotiations and had been

forecast to complete in Q4, but transactions are taking

significantly longer to complete in 2023 as a consequence of the

current economic environment and weakness in the M&A market.

Convex Capital completed three transactions this year delivering

total fee income of GBP2.19m versus a previous Board expectation of

GBP4.5m. Until recently, the Board had confidence over its

expectation but it has now become clear that no more transactions

will complete this side of the financial year end. The pipeline is

positioned to deliver the delayed transactions in 2024.

Financial Performance

LionFish & ABA costs

-- Lionfish: the disposal resulted in a reported loss on

disposal of GBP0.7m; an adverse cost ruling regarding a case prior

to the disposal has subsequently incurred a settlement of GBP0.4m

net of insurance.

-- The change in accounting policy set out in the RNS of 27 July

2023 has resulted in disbursements of GBP0.72m being expensed

during the period; these were incurred in respect of the final

remaining large ABA - any successful outcome will be returned to

the Group as revenue.

Debtors & Work in Progress:

-- As part of the recent re-financing exercise undertaken during

the second half of 2023 and concluded in December, management

undertook a comprehensive review of the historic debtor book and

the historic work in progress being carried on the balance sheet.

Some was very historic in nature and the decision has been taken to

write off GBP1.8m of debtors and work in progress. As this will be

a change in accounting policies, it will require a restatement of

the 2022 accounts.

Legal & Professional fees:

-- Costs relating to employment cases under the previous

leadership team have been incurred (principally in the second half)

totalling GBP1.9m.

-- In addition, a further c. GBP0.2m was incurred during H2 in the run-down of another ABA.

As a result of the various factors set out above, the Board now

expects that revenue for FY 2023 will be slightly lower than market

expectations at approximately GBP42m and adjusted EBITDA is

expected to be approximately GBP4m(1) . The table below sets out

comparable figures for FY 2022 and FY 2023. These figures do not

include the impact of LionFish, a discontinued business, in either

period.

Revenue ( GBPm

) H2 2023 H2 2022 FY 2023 FY 2022

Legal services 19.4 23.8 39.7 44.5

Convex 1.5 1.1 2.2 5.3

-------- -------- -------- --------

Total 20.9 24.9 41.9 49.8

Adjusted EBITDA

( GBPm ) 1.6 8.8 c. 4.0 15.8

The Company recently announced that it had renewed and extended

its existing borrowing facilities with its current lender, HSBC,

under which the debt headroom was raised to GBP24.5m. The Company

had a pre-IFRS 16 net debt position of GBP22.1m as at 15 December

2023. Under the Board's base case scenario which includes improved

working capital management , the Company has sufficient cash

headroom over the next 12 month period.

Commenting on the Trading Update and Outlook for FY 2023,

Marianne Ismail, Non-Executive Chair of RBG Holdings plc, said:

"The Board recognises that FY 2023 has been a year of

significant transition and a disappointing one for shareholders.

Nonetheless, the Board is confident that the business is moving

into FY 2024 on a significantly stronger footing than at the start

of this year.

"I would like to thank the new management team for the bold

decisions taken in tackling historical issues that have drained the

business of management time, profit and working capital during

2023.

"The Group now has noticeably improved operating processes that

will begin feeding through in terms of improved margins in 2024.

Our new agreement with HSBC gives the team operational headroom to

deleverage the business while it brings performance back up to

acceptable levels.

"There are early signs of recovery in some of the key areas of

legal services that were badly impacted in 2023 but we will be

presenting a more conservative budget for 2024, with revenue and

profit expected to be slightly higher than 2023, that is designed

to demonstrate both clarity and profitability to investors and

other key stakeholders.

"Continuing to improve the Group's operational efficiency,

expand margins and generate cash are the key priorities for the

Board and management team going forward. We will continue to review

our costs in light of our revenues and the market conditions."

The person responsible for the release of this announcement is

Kevin McNair, Chief Financial Officer.

(1) Adjusted for GBP11.4m of litigation write offs, GBP1.4m of

legal and professional fees, GBP2.8m of Lionfish costs and GBP0.9m

of other non-underlying costs

Enquiries:

RBG Holdings plc Via SEC Newgate

Jon Divers, Chief Executive Officer

Kevin McNair, Chief Financial Officer

Tel: +44 (0)20 7496 3000

Singer Capital Markets (Nomad and Broker)

Rick Thompson / Alex Bond / James Fischer (Corporate

Finance)

Tom Salvesen (Corporate Broking)

SEC Newgate (for media/analyst enquiries) Tel: +44 ( 0)7970 664807

Tali Robinson / Robin Tozer rbg@secnewgate.co.uk

About RBG Holdings plc

-- Further information about RBG Holdings plc is available at: www.rbgholdings.co.uk

-- Further information about Rosenblatt (founded in 1989) is available at: www.rosenblatt.co.uk

-- Further information about Memery Crystal (founded in 1979) is

available at: www.memerycrystal.com

-- Further information about Convex Capital (founded in 2010) is

available at: www.convexcap.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTTRBTTMTIBTMJ

(END) Dow Jones Newswires

December 18, 2023 02:00 ET (07:00 GMT)

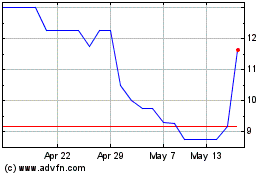

Rbg (LSE:RBGP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rbg (LSE:RBGP)

Historical Stock Chart

From Jan 2024 to Jan 2025