Real Good Food PLC Overdraft Facility (1722O)

16 August 2017 - 9:21PM

UK Regulatory

TIDMRGD

RNS Number : 1722O

Real Good Food PLC

16 August 2017

For release: 16(th) August 2017

Real Good Food plc

(the "Company" or "Real Good Food")

Overdraft Facility

The Company announces that the Board has agreed a

'cash-collaterised' overdraft facility with Lloyds Bank. The recent

re-forecast exercise, announced on 1(st) August, identified a

short-term working capital requirement as the Company proceeds with

its major investment programmes at Renshaw and Haydens during the

autumn stock build. In addition, Downing LLP ("Downing") has

notified the Company that it has elected, at this time, not to

subscribe for the second tranche of the loan notes of GBP1.5m,

which it had an option to subscribe for, pursuant to its original

investment announced on 29 June 2017.

Sales within the Cake Decoration Division continue to show

strong year on year growth and the need to fund an autumn stock

build for a strongly seasonal business is part of the Company's

normal trading pattern. Accordingly, Lloyds Bank has agreed to

provide the Company with an overdraft facility of up to GBP2.0m

with two major shareholders (Napier Brown Holdings and Omnicane

Limited) each putting GBP1.0m into an account, as security (the

"Shareholder Loans").

The Shareholder Loans have an interest rate of 6.5% per annum,

which shall accrue daily and compound annually and shall be paid on

the date on which the Shareholder Loan is repaid or due to be

repaid. The Shareholders Loans are secured against the Company's

assets, subject to an inter-creditor agreement between each of

Downing, Lloyds Bank plc, Lloyds Bank Commercial Finance Limited,

Napier Brown Holdings Limited and Omnicane Limited. The Shareholder

Loans are repayable on the first anniversary of the Shareholder

Loan agreements, or on the provision of 6 months written notice by

the lenders. The Company can elect to repay the Shareholder Loans

early, at its own discretion, subject to written notice.

The Board considered other options that could be provided by

other debt providers, however it concluded that these could take a

number of weeks to arrange and that the Lloyds offer of a

cash-collaterised overdraft facility backed by the Shareholder

Loans was the most appropriate option available to meet the

Company's short term requirements at this time.

Christopher Thomas, Judith Mackenzie and Hugh Cawley, the

Independent Directors of the Company, having consulted with the

Company's Nominated Adviser, finnCap Ltd, consider the terms of the

Shareholder Loans to be fair and reasonable insofar as the

Company's shareholders are concerned.

-Ends-

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

ENQUIRIES:

Real Good Food plc

Chris Thomas, Executive Tel: 020 3857 3900

Director

Andrew Brown, Marketing

Director

finnCap Ltd (Nomad and

Broker)

Matt Goode Tel: 020 7220 0500

Carl Holmes

Daniel Stewart and Company

Plc (Joint Broker)

David Lawman Tel: 020 7776 6550

Belvedere Communications

(PR)

John West Tel: 020 3567 0510

Kim van Beeck

This information is provided by RNS

The company news service from the London Stock Exchange

END

ARIBBGDIRBBBGRL

(END) Dow Jones Newswires

August 16, 2017 07:21 ET (11:21 GMT)

Real Good Food (LSE:RGD)

Historical Stock Chart

From Mar 2024 to May 2024

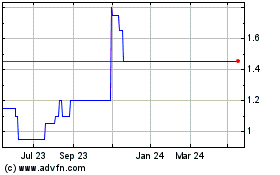

Real Good Food (LSE:RGD)

Historical Stock Chart

From May 2023 to May 2024