TIDMSYS

RNS Number : 6737U

SysGroup PLC

27 November 2023

27 November 2023

SysGroup plc

("SysGroup" or the "Company" or the "Group")

Half year results for the six months ended 30 September 2023

SysGroup plc (AIM:SYS), the end-to-end data solution provider ,

is pleased to announce its unaudited half year results for the six

months ended 30 September 2023 ("H1 FY24" or the "Period").

Financial highlights

-- Revenue decrease of 3% to GBP10.96m (H1 FY23: GBP11.32m)

-- Managed IT Services revenue growth of 8% representing 84% of total revenue (H1 FY23: 75%)

-- Adjusted EBITDA(1) of GBP1.57m (H1 FY23: GBP1.68m)

-- Adjusted profit before tax(2) of GBP0.99m (H1 FY23: GBP1.10m)

-- Statutory loss before tax of GBP1.09m (H1 FY23: loss before tax of GBP0.19m)

-- Adjusted basic EPS(3) of 1.7p (H1 FY23: 2.0p)

-- Basic EPS of (1.5)p (H1 FY23: (0.2)p)

-- Adjusted cashflow from operations of GBP1.24m (H1 FY23: GBP2.01m)

-- Net debt (4) of GBP3.43m at 30 September 2023 (30 September 2022: GBP1.92m)

Operational highlights

-- A new strategy to provide end-to-end solutions focused on

Artificial Intelligence ("AI") and Machine Learning ("ML") with an

associated investment in a team of ML engineers from AWS, JP

Morgan, Validus and McLaren

-- Refreshed the SysCloud infrastructure with the latest

hardware and upgraded our internal security architecture with

industry leading cloud-based security platform

-- Strengthened the senior management team with individuals with

invaluable experience and expertise from industry leading

companies

-- Heejae Chae appointed as Executive Chair and Paul Edwards as new Non-Executive Director

Heejae Chae, Executive Chair, commented:

"Our strategy aims to position SysGroup as the go-to end-to-end

data solution provider for small and medium sized businesses

("SMB") embarking on their AI/ML journey. AI's prominence is

undeniable with daily media coverage and increasing demand for AI

strategies at the board level of every company. We recognise a

significant market gap: while many SMBs are eager to adopt AI/ML,

they often lack a clear strategy or implementation path. There is a

great demand for a partner to support their development of an AI/ML

strategy and transition from the current platform.

We have made significant investments in both technology and

people. We have recruited a team of ML engineers from industry

leaders such as AWS, JP Morgan, Validus and McLaren. We have

significantly strengthened the senior management team to help take

us on this journey, bringing together the right skillsets and

mindsets. Throughout the organisation, we are reinforcing a culture

of customer focus and outstanding service underpinned by

innovation, entrepreneurialism and high performance. Whilst we are

at the early stage of our journey, I am excited at the potential of

what we are building at SysGroup combined with the considerable

unexploited market opportunity that lays ahead of us.

Finally, the core business, which has more than 80% recurring

revenues provides a very solid base from which we can expand,

giving us very good revenue certainty and visibility, albeit that

in the short term we may see our overall bottom line performance

impacted marginally, reflecting the investment we are making in the

Company to drive revenue growth in future financial years."

Notes

1. Adjusted EBITDA is earnings before interest, taxation,

depreciation, amortisation of intangible assets, exceptional items

and share based payments.

2. Adjusted profit before tax is profit before tax after adding

back amortisation of intangible assets, exceptional items and share

based payments.

3. Adjusted basic EPS is profit after tax after adding back

amortisation of intangible assets, exceptional items, share based

payments and associated tax, divided by the number of shares in

issue.

4. Net debt represents cash balances less bank loans and lease

liabilities, and excludes contingent consideration.

For further information please

contact:

Tel: 0151 559

SysGroup Plc 1777

Heejae Chae, Executive Chair

Martin Audcent, Chief Financial

Officer

Zeus Capital (Nominated Adviser Tel: 0161 831

and Broker) 1512

Jordan Warburton

Nick Cowles

Nick Searle

About us

SysGroup plc is a managed service provider of end-to-end data

solutions enabling us to take our customers on their AI data

journey. The Group offers an integrated set of modern technologies

that collectively meets our customers end-to-end data needs

including connectivity, cloud hosting, delivery, analytics and

governance of customer data, as well as a security layer for users

and applications.

The Group has offices in Bristol, Edinburgh, Liverpool, London,

Manchester and Newport.

For more information, visit http://www.sysgroup.com

Overview & Strategy

During the Period, SysGroup maintained a stable revenue of

GBP10.96m. This consistency reflects growth in Truststream, our

CyberSecurity acquisition in April 2022, counterbalancing a

decrease in traditional SysGroup revenues. Notably, managed IT

services now constitutes 84% of our revenues, an increase from 75%

last year, bolstering our financial stability and visibility. In

the Period we delivered Adjusted EBITDA of GBP1.57m, maintaining a

margin comparable to last year.

The Group's gross cash balance was GBP1.99m at the end of the

Period (H1 FY23: GBP4.22m) following payments to satisfy the

Truststream year one earn-out and settle the contractual terms of

the previous CEO's departure including the acquisition of 2,076,394

ordinary shares of 1 pence each ("Ordinary Shares"), now held in

Treasury. Excluding these one-off payments, the cash conversion was

79%. The net debt (4) at the end of the Period was GBP3.43m (H1

FY23: GBP1.92m), which excludes contingent consideration payable

within one year of GBP1.84m (H1 FY23: GBP2.93m).

Since my appointment as Executive Chair in June, I have engaged

with various stakeholders including customers, employees, partners

and competitors. These interactions have provided valuable insights

into both industry trends and company-specific challenges. SysGroup

is well positioned to participate in the burgeoning field of AI/ML,

a technology set to redefine our era. AI's prominence is

undeniable, with daily media coverage and increasing demand for AI

strategies at the board level of every company. The reality is that

AI is here to stay and will be a powerful tool for those that

embrace it.

Factors driving the AI/ML adoption include:

-- The growing availability of data, crucial for training AI/ML

algorithms. As the amount of data that companies collect continues

to grow, so does the potential for AI and ML to deliver value;

-- Decreasing costs of computing power, making AI/ML algorithms

more accessible across various company sizes and budgets; and

-- The increasing sophistication and user-friendliness of AI/ML tools and technologies

Our strategy is to position SysGroup as the go-to end-to-end

data solution provider for SMBs embarking on their AI/ML journey.

It is clear from our conversations with our customers we recognise

a significant market gap: while many SMBs are eager to adopt AI/ML,

they often lack a clear strategy or implementation path. There is a

great demand for a partner to support their development of an AI/ML

strategy and transition from their current platforms. Many

providers claim to be AI/ML experts but lack the capability to

provide an end-to-end solution. Traditionally, most IT providers

specialise in specific technology stacks. AI/ML strategy requires a

holistic approach where the outcome is delivered from both software

and hardware solutions. Over 80% of all AI projects fail because

they have not taken a holistic approach, for example, by not

defining the correct business case or not employing appropriate

data architecture framed by the right technology infrastructure.

Whilst gaps still exist in our offerings, we believe that we have

the framework to build our strategy, underpinned by the

relationship with our customers.

Our Technology Services strategy is to build a modern unified

data solution platform that is simple for SysGroup to sell and

support and is simple for our customers to consume and benefit

from. This will comprise of an integrated set of technologies that

collectively meets our customers end-to-end data needs. It will

allow for connectivity, storage, preparation, delivery, analytics

and governance of customer data, as well as a security layer for

users and applications.

Operations

We have made substantial investments both in our IT

infrastructure and people during the Period. These include

upgrading SysCloud infrastructure with the latest hardware and

enhancing our internal security architecture with a leading

cloud-based security platform. We have completed the refurbishment

of our offices to provide a positive and productive working

environment as we moved to more flexible working.

We have recruited a team of ML engineers with turnkey experience

to deliver AI solutions from design to delivery at an annual cost

of GBP0.5m. They bring considerable combined experience in a

nascent field of technology having worked at industry leaders such

as AWS, JP Morgan, McLaren and Validus. To support the end-to-end

strategy, we have segmented our technology into five key areas: (i)

data analytics and ML; (ii) data storage and management; (iii) data

connectivity; (iv) data engineering; and (v) cybersecurity. We will

invest to enhance the existing competencies organically as well as

through acquisitions to fill the gaps in our technology

offerings.

Board and Management Changes

We have taken steps to ensure robust corporate governance,

reviewing the Board and committees' Terms of Reference and

establishing a new Nomination Committee to ensure that the

composition and succession of the Board is reviewed and reflects a

balance of skills, knowledge and experience which is appropriate

for the Company. Wendy Baker has been appointed as Company

Secretary and General Counsel, providing oversight and guidance on

governance. Wendy was previously at Scapa Group plc, Promethean

World plc and Volex Group plc.

Paul Edwards joined as a Non-Executive Director on 26 September

2023 to balance the independence in the Board. Paul brings

extensive PLC experience as the CFO of Tatton Asset Management plc

and previously Scapa Group plc and NCC Group plc.

We have also upgraded the senior management team with the

appointments of people with relevant experience from leading

companies in the sector:

-- Heinrich Koorts joined us as Chief Revenue Officer from

Softcat plc where he spent the past ten years in London and

Bristol;

-- Paul Sullivan has been appointed as Chief Technology Officer.

Paul was the founder of Truststream which SysGroup acquired in

April 2022;

-- Ross Humphrey has recently joined as the Chief AI Officer to

lead our AI/ML initiative. Ross has over a decade of experience in

machine learning as one of the UK's early adopters during his

tenure at JP Morgan and Validus; and

-- Charles Vivian has joined as Director of Business Development

to support our M&A strategy as acquisitions will be part of our

growth plan. Charles was previously at MXC Capital, Marwyn Capital

and Freshfields Bruckhaus Deringer.

These individuals bring invaluable experience and expertise,

positioning SysGroup for future success.

Results and Trading

The Group has delivered revenue of GBP10.96m (H1 FY23:

GBP11.32m) and Adjusted EBITDA of GBP1.57m (H1 FY23: GBP1.68m) in

H1 FY24. Managed IT services revenue increased to GBP9.22m (H1

FY23: GBP8.54m), a growth of 8% on the comparative period, whilst

Value Added Resale ("VAR") revenue was GBP1.74m (H1 FY23:

GBP2.78m), a decrease of 37%. The driver of the Managed IT services

growth has been in IT security where this year we have seen more

customers take up contracted managed service support in addition to

the provision of security licences. In cases where managed services

and licences are sold together the revenue is recognised as Managed

IT services uniformly across the contract term. This also explains

the reason for the reduction in VAR revenue since fewer "licence

only" contracts are being sold. The revenue mix in H1 FY24 is 84%

Managed IT services and 16% VAR sales (H1 FY23: 75%:25%) and this

is expected to remain similar in H2 FY24.

Gross profit was GBP5.47m with a gross margin of 49.9% (H1 FY23:

GBP5.61m and 49.6% respectively). Whilst the revenue mix has moved

to higher margin Managed IT Services, the IT security sales which

led the contracted income growth are lower margin than core managed

services business. The gross margin has also been impacted by

supplier cost increases which have been prevalent in the UK economy

over the last twelve months.

Adjusted operating expenses of GBP3.90m were broadly flat with

the same period last year (H1 FY23: GBP3.94m). We expect overheads

to increase in H2 FY24 from our investments in the Senior

Leadership Team and AI/Machine Learning team.

The consolidated income statement includes GBP1.05m of

exceptional costs which are for the settlement of the former CEO's

contractual terms, payments of supplier charges which are disputed

and remain subject to ongoing action, and restructuring activity

with the Senior Leadership Team.

Finance costs of GBP0.29m have increased compared to the same

period last year (H1 FY23: GBP0.24m). Finance costs include

GBP0.21m of bank loan interest, which has increased due to the

increase in the Bank of England's base rate, and GBP0.06m of

non-cash finance charges relating to the unwinding of discount on

contingent consideration and amortisation of the loan arrangement

fee.

The Group delivered an adjusted profit before tax of GBP0.99m

(H1 FY23: GBP1.10m) and a statutory loss before tax of GBP1.09m (H1

FY23: loss before tax GBP0.19m). The statutory loss before tax

results from having GBP1.05m of exceptional costs (H1 FY23:

GBP0.34m) in the Period and from an increase in share based

payments.

The taxation credit of GBP0.34m (H1 FY23: credit of GBP0.08m)

represents the movement on deferred tax in the Period with no

corporation tax charge arising on the Group's trading position in

H1 FY24. The corporation tax rate increased on 1 April 2023 from

19% to 25%.

Adjusted basic earnings per share for H1 FY24 was 1.7p (H1 FY23:

2.0p) and basic loss per share was (1.5p) (H1 FY23: loss per share

(0.2p)).

Cashflow & Net Debt

The Group had a gross cash balance of GBP1.99m at 30 September

2023 (H1 FY23: GBP4.22m) and net debt of GBP3.43m (H1 FY23:

GBP1.92m). Cash balances were utilised in H1 FY24 for the

Truststream year one earn-out (GBP0.88m), the acquisition of

2,076,394 Ordinary Shares into Treasury (GBP0.76m), and to settle

the former CEO's contractual terms (GBP0.66m). Cashflow from

operations was GBP0.23m (H1 FY23: GBP1.67m) and included GBP1.00m

of exceptional cash costs. Cash conversion of 79% was broadly in

line with the target range and compares to 120% in H1 FY23 which as

explained at the time was due to a number of VAR deals where

customer payments had been received in advance. Capex expenditure

in H1 includes the refurbishment of the Bristol office which was

completed in July and development costs for the implementation of a

new financial accounts system.

The Truststream year 1 earn-out was finalised in H1 FY24 and in

accordance with the share purchase agreement 75% of the year 1

consideration was paid to the vendors. Accordingly, GBP0.89m was

paid in cash consideration and GBP0.29m is deferred for payment to

H1 FY25. The contingent consideration liability held in the

Consolidated Statement of Financial Position is GBP1.84m which

compares to GBP2.94m as at 31 March 2023 and 30 September 2022. The

liability is held at the maximum consideration payment value under

the terms of the earn-out agreement and this will be re-assessed

for fair value at the 31 March 2024 year end.

Share Options

In April 2023, under the 2020 LTIP Scheme and in respect of

performance for the FY23 financial year , a grant of 362,709

performance shares was made to Adam Binks, Chief Executive Officer,

and 204,024 performance shares to Martin Audcent, Chief Financial

Officer. In May 2023, in respect of Mr Binks' departure, the Board

agreed that the unvested options held by Mr Binks would vest with

immediate effect with restrictions waived. Mr Binks exercised his

share options, totalling 2,076,394 Ordinary Shares and the Company

acquired them at a price of GBP0.375 per Ordinary Share. The

Company holds these Ordinary Shares in Treasury to satisfy the

exercise of future share options under SysGroup's share incentive

schemes.

CONSOLIDATED CONDENSED STATEMENT OF COMPREHENSIVE INCOME

SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

six months six months year

to to to

30-Sep-23 30-Sep-22 31-Mar-23

Notes GBP'000 GBP'000 GBP'000

Revenue 2 10,963 11,321 21,648

Cost of sales (5,497) (5,708) (10,552)

Gross profit 2 5,466 5,613 11,096

----------------------------------------- ------ ------------ ------------ ----------

Operating expenses before depreciation,

amortisation, exceptional items

and share based payments (3,897) (3,935) (7,768)

----------------------------------------- ------ ------------ ------------ ----------

Adjusted EBITDA 1,569 1,678 3,328

----------------------------------------- ------ ------------ ------------ ----------

Depreciation (297) (330) (625)

Amortisation of intangible assets (866) (866) (1,739)

Exceptional items 4 (1,052) (337) (408)

Share based payments (156) (96) (178)

Administrative expenses (6,268) (5,564) (10,718)

----------------------------------------- ------ ------------ ------------ ----------

Operating (loss)/profit (802) 49 378

Finance costs 5 (287) (243) (483)

----------------------------------------- ------ ------------ ------------ ----------

Loss before taxation (1,089) (194) (105)

Taxation 343 77 98

Total comprehensive loss attributable

to the equity holders of the

company (746) (117) (7)

----------------------------------------- ------ ------------ ------------ ----------

Basic loss per share (pence) 3 (1.5)p (0.2)p 0.0p

Diluted loss per share (pence) 3 (1.5)p (0.2)p 0.0p

----------------------------------------- ------ ------------ ------------ ----------

All the results arise from continuing operations.

CONSOLIDATED CONDENSED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

Unaudited Unaudited Audited

30-Sep-23 30-Sep-22 31-Mar-23

Notes GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Goodwill 7 21,666 21,894 21,666

Intangible assets 7 5,536 7,005 6,295

Plant, property and equipment 2,013 2,139 1,966

------------------------------- ------ ---------- ---------- ----------

29,215 31,038 29,927

Current assets

Trade and other receivables 8 5,609 4,090 5,007

Cash and cash equivalents 1,986 4,216 4,186

------------------------------- ------ ---------- ---------- ----------

7,595 8,306 9,193

Total Assets 36,810 39,344 39,120

------------------------------- ------ ---------- ---------- ----------

Equity and Liabilities

Equity attributable to the equity shareholders of the

parent

Called up share capital 12 515 494 494

Share premium 9,080 9,080 9,080

Treasury reserve (984) (201) (201)

Other reserve 3,293 3,123 3,205

Retained earnings 8,173 8,741 8,851

------------------------------- ------ ---------- ---------- ----------

20,077 21,237 21,429

Non-current liabilities

Lease liabilities 520 685 621

Contract liabilities 174 486 383

Contingent consideration 11 - 1,060 1,875

Provisions 148 175 191

Deferred taxation 1,106 1,642 1,434

Bank loan 10 4,720 5,187 4,705

6,668 9,235 9,209

------------------------------- ------ ---------- ---------- ----------

Current liabilities

Trade and other payables 9 4,576 3,844 3,861

Lease liabilities 176 268 182

Contract liabilities 3,475 2,885 3,633

Contingent consideration 11 1,838 1,875 806

10,065 8,872 8,482

------------------------------- ------ ---------- ---------- ----------

Total Equity and Liabilities 36,810 39,344 39,120

------------------------------- ------ ---------- ---------- ----------

CONSOLIDATED CONDENSED STATEMENT OF CHANGES IN EQUITY

SIX MONTHSED 30 SEPTEMBER 2023

Attributable to equity holders of the parent

Share Share Treasury Other Translation Retained Total

capital premium reserve reserve reserve earnings

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 April 2022 494 9,080 (201) 3,027 4 8,854 21,258

Loss and total comprehensive

e xpense for the

period - - - - - (117) (117)

Reclass of translation

reserve - - - - (4) 4 -

Share options charge - - - 96 - - 96

------------------------------ --------- --------- --------- --------- ------------ ---------- --------

At 30 September

2022 (unaudited) 494 9,080 (201) 3,123 - 8,741 21,237

Profit and total

comprehensive income

for the period - - - - - 110 110

Share options charge - - - 82 - - 82

------------------------------ --------- --------- --------- --------- ------------ ---------- --------

At 31 March 2023 494 9,080 (201) 3,205 - 8,851 21,429

Loss and total comprehensive

e xpense for the

period - - - - - (746) (746)

Purchase of own

shares into Treasury - - (783) - - - (783)

Issue of share capital 21 - - - - - 21

Share options charge - - - 156 - - 156

Reserves transfer

on forfeiture of

share options - - - (68) - 68 -

------------------------------

At 30 September

2023 (unaudited) 515 9,080 (984) 3,293 - 8,173 20,077

------------------------------ --------- --------- --------- --------- ------------ ---------- --------

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

---------------------- --------------------------------------------------------

Share Premium Reserve Amount subscribed for share capital in excess

of nominal values.

Treasury reserve Company owned shares held for the purpose of settling

the exercise of employee share options.

Other Reserve Amount reserved for share-based payments to be

released over the life of the instruments and

the equity element of convertible loans

Translation Reserve Amount represents differences in relations to

the consolidation of subsidiary companies accounting

for currencies other than the Group's functional

currency.

Retained earnings All other net gains and losses and transactions

with owners (e.g. dividends) not recognised elsewhere.

---------------------- --------------------------------------------------------

CONSOLIDATED CONDENSED STATEMENT OF CASHFLOWS

SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

six months six months year

to to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Cashflows used in operating

activities

Loss after tax (746) (117) (7)

Adjustments for:

Depreciation and amortisation 1,163 1,196 2,364

Finance costs 287 243 483

Share based payments 156 96 178

Taxation credit (343) (77) (98)

---------------------------------------------- ------------ ------------ -----------

Operating cashflows before movement

in working capital 517 1,341 2,920

---------------------------------------------- ------------ ------------ -----------

(Increase)/decrease in trade

and other receivables (713) 68 (737)

Increase in trade and other payables 430 260 837

Cashflow from operations 234 1,669 3,020

---------------------------------------------- ------------ ------------ -----------

Taxation paid (64) (128) (303)

Net cash from operating activities 170 1,541 2,717

---------------------------------------------- ------------ ------------ -----------

Cashflows from investing activities

Payments to acquire property, plant

& equipment (180) (105) (252)

Payments to acquire intangible

assets (139) - (163)

Acquisition of subsidiary companies

net of cash acquired - (5,390) (5,389)

Net cash used in investing activities (319) (5,495) (5,804)

---------------------------------------------- ------------ ------------ -----------

Cashflows from financing activities

Payment of contingent consideration (886) - -

on acquisitions

RCF drawdown - 4,500 4,500

Payment of bank loan arrangement fee - (127) (127)

Repayment of bank loan - (82) (582)

Repurchase of shares into treasury (783) - -

Proceeds for issue of share capital 21 - -

Capital/principal paid on lease liabilities (171) (102) (303)

Interest paid on loan facility (217) (138) (316)

Interest paid on lease liabilities (15) (14) (32)

Net cash used in financing activities (2,051) 4,037 3,140

---------------------------------------------- ------------ ------------ -----------

Net (decrease)/increase in cash and

cash equivalents (2,200) 83 53

---------------------------------------------- ------------ ------------ -----------

Cash and cash equivalents at the beginning

of the period /year 4,186 4,133 4,133

Cash and cash equivalents at the

end of the period/year 1,986 4,216 4,186

---------------------------------------------- ------------ ------------ -----------

NOTES TO THE CONSOLIDATED CONDENSED FINANCIAL STATEMENTS

SIX MONTHSED 30 SEPTEMBER 2023

1. ACCOUNTING POLICIES

The accounting policies used in the preparation of the unaudited

consolidated condensed financial information for the six months

ended 30 September 2023 are prepared in accordance with UK adopted

International Financial Reporting Standards ("IFRS") and are

consistent with those that will be adopted in the annual statutory

financial statements for the year ended 31 March 2024.

While the financial information included has been prepared in

accordance with the recognition and measurement criteria, in

accordance with UK adopted International Financial Reporting

Standards, these consolidated condensed financial statements do not

contain sufficient information to comply with IFRSs.

The financial information for the six-month period ended 30

September 2023 and 30 September 2022 does not constitute statutory

accounts within the meaning of Section 434(3) of the Companies Act

2006 and is unaudited but has been reviewed by our auditors in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board. The comparative

financial information for the year ended 31 March 2023 included

within this report does not constitute the full statutory accounts

for that period. The statutory Annual Report and Financial

Statements for 2023 have been filed with the Registrar of

Companies. The Independent Auditor's Report on that Annual Report

and Financial Statements for 2023 was unqualified, did not draw

attention to any matters by way of emphasis, and did not contain a

statement under 498(2) or 498(3) of the Companies Act 2006.

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Group's

strategies and the potential for those strategies to succeed. The

Interim Report should not be relied on by any other party or for

any other purpose.

This unaudited interim financial information has been prepared

in accordance with the requirement of the AIM Rules for Companies

and in accordance with this basis of preparation.

Exceptional items

The Group presents as exceptional items on the face of the

Statement of Comprehensive Income those material items of income

and expense which the Directors consider, because of their size or

nature and expected non-recurrence, merit separate presentation to

facilitate financial comparison with prior periods and to assess

trends in financial performance. Exceptional items are included in

Administration expenses in the Consolidated Statement of

Comprehensive Income but excluded from Adjusted EBITDA (Note 6) as

management believe they should be considered separately to gain an

understanding of the underlying profitability of the trading

businesses.

Going concern

The Directors have prepared the financial statements on a going

concern basis which assumes that the Group and the Company will

continue to meet liabilities as they fall due.

The Group has an operating model with a high level of resilience

with 84% of revenue deriving from contracted managed IT services

which are business critical supplies to customers. The Group has a

gross cash balance of GBP1.99m and a net debt position of GBP3.43m

(excluding contingent consideration of GBP1.84m) at 30 September

2023. The Group has undrawn RCF facilities available of GBP3.2m

which can be used for working capital and acquisitions, and an

unutilised overdraft facility of GBP0.5m. The Group is forecasting

to generate healthy operational cashflows and achieve the bank loan

covenants for the full period of the forecast to March 2025.

The Directors have reviewed the Group's financial forecasts and

taken into account the current UK economic outlook. The projected

trading forecasts and resultant cashflows, together with the

confirmed loan and overdraft facilities, taking account of

reasonably possible changes in trading performance, show that the

Group can continue to operate within the current facilities

available to it.

The Directors therefore have a reasonable expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future and they continue to adopt the going

concern basis of accounting in preparing the financial

statements.

2. SEGMENTAL REPORTING

The chief operating decision maker for the Group is the Board of

Directors and the Group reports in two segments:

-- Managed IT Services - this segment provides all forms of

managed services to customers and includes professional

services.

-- Value Added Resale (VAR) - this segment is for sales of IT

hardware and licences procured from supplier partners.

The monthly management accounts reported to the Board of

Directors are reviewed at a consolidated level and the Board review

the results of the operating segments at a revenue and gross profit

level since the Group's management and operational structure

operate as unified Group functions. In this respect, assets and

liabilities are also not reviewed on a segmental basis. All assets

are located in the UK. All segments are continuing operations and

there are no transactions between segments, and all revenue is

earned from external customers. The business segments' gross profit

is reconciled to profit before taxation as per the consolidated

income statement. The Group's overheads are managed centrally by

the Board and consequently there is no reconciliation to profit

before tax at a segmental level.

Unaudited Unaudited Audited

six months six months year to

to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

--------------------- ------------ ------------ ----------

Revenue

Managed IT Services 9,223 8,543 17,441

Value Added Resale 1,740 2,778 4,207

10,963 11,321 21,648

--------------------- ------------ ------------ ----------

Gross Profit

Managed IT Services 5,167 5,157 10,349

Value Added Resale 299 456 747

5,466 5,613 11,096

--------------------- ------------ ------------ ----------

3. EARNINGS PER SHARE

Unaudited Unaudited Audited

six months six months year to

to to

30-Sep-23 30-Sep-22 31-Mar-23

Loss for the financial period attributable (GBP746,336) (GBP117,000) (GBP7,000)

to shareholders

Adjusted profit for the financial GBP809,553 GBP974,000 GBP1,917,000

period

Weighted number of equity shares in

issue* 48,912,025 48,859,690 48,859,690

Weighted number of equity shares for

diluted calculation* 50,935,963 52,189,652 52,274,633

Adjusted basic earnings per share

(pence) 1.7p 2.0p 3.9p

Basic loss per share (pence) (1.5p) (0.2p) 0.0p

Diluted loss per share (pence) (1.5p) (0.2p) 0.0p

-------------------------------------------- ------------- --------------- ------------------

*The weighted number of equity shares in

issue and for diluted calculation excludes

the Treasury shares held by the Company

Unaudited Unaudited Audited

six months six months year to

to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Loss after tax used for basic earnings

per share (746) (117) (7)

Amortisation of intangible assets 866 866 1,739

Exceptional items 1,052 337 408

Share based payments 156 96 178

Tax adjustments (519) (208) (401)

-------------------------------------------- ------------- --------------- ------------------

Adjusted profit used for Adjusted

earnings per share 809 974 1,917

-------------------------------------------- ------------- --------------- ------------------

The tax adjustments relate to current and deferred tax on the

amortisation of intangible assets, exceptional items and share

based payments.

4. EXCEPTIONAL ITEMS

Unaudited Unaudited Audited

six months six months year

to to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

------------------------------- ------------ ------------ ----------

Integration and restructuring

costs 832 113 189

Supplier charges in dispute 220 - -

Acquisition costs - 224 219

1,052 337 408

------------------------------- ------------ ------------ ----------

The integration and restructuring costs relate to the settlement

of the former CEO's contractual terms and costs associated with the

restructuring of the Senior Leadership Team. The supplier charges

in dispute are subject to ongoing action for which the company is

pursuing recovery. In the prior periods, the acquisition and

integration costs relate to two acquisitions in April 2022,

Truststream Security Solutions Limited and Independent Network

Services Limited (trading as "Orchard IT").

5. FINANCE COSTS

Unaudited Unaudited Audited

six months six months year

to to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ ----------

Interest payable on lease liabilities 15 26 32

Interest payable on bank loan 212 120 307

Arrangement fee amortisation

on bank loan 17 18 29

Unwinding of discount on contingent

consideration 43 79 105

Other interest - - 10

287 243 483

--------------------------------------- ------------ ------------ ----------

6. ALTERNATIVE PERFORMANCE MEASURES

Unaudited Unaudited Audited

Reconciliation of operating six months six months year to

profit to adjusted EBITDA to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Operating (loss)/profit (802) 49 378

Depreciation 297 330 625

Amortisation of intangible assets 866 866 1,739

EBITDA 361 1,245 2,742

----------------------------------- ------------ ------------ ----------------

Exceptional items 1,052 337 408

Share based payments 156 96 178

Adjusted EBITDA 1,569 1,678 3,328

----------------------------------- ------------ ------------ ----------------

Reconciliation of loss before Unaudited Unaudited Audited

tax to adjusted profit before six months six months year to

tax to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Loss before tax (1,089) (194) (105)

Amortisation of intangible assets 866 866 1,739

Exceptional items 1,052 337 408

Share based payments 156 96 178

----------------------------------- ------------ ------------ ----------------

Adjusted profit before tax 985 1,105 2,220

----------------------------------- ------------ ------------ ----------------

Cash conversion Unaudited Unaudited Audited

six months six months year to

to to

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Cashflow from operations 234 1,669 3,020

Adjustments:

Acquisitions, integration and

restructuring cashflows 1,005 337 408

Adjusted cashflow from operations 1,239 2,006 3,428

----------------------------------- ------------ ------------ -------------

Adjusted EBITDA 1,569 1,678 3,328

----------------------------------- ------------ ------------ -------------

Cash conversion 79% 120% 103%

----------------------------------- ------------ ------------ -------------

Net debt Unaudited Unaudited Audited

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Cash balances 1,986 4,216 4,186

Bank loans - non-current (4,720) (5,187) (4,705)

Net debt before lease liabilities (2,734) (971) (519)

Lease liabilities - property (696) (953) (803)

Net debt (3,430) (1,924) (1,322)

Contingent consideration (1,838) (2,935) (2,681)

Net debt including contingent

consideration (5,268) (4,859) (4,003)

----------------------------------- ---------- ---------- ---------------

7. INTANGIBLE ASSETS

Software Customer

Systems development licences relationships Goodwill Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------------------- ---------- --------------- --------- --------

Cost

At 1 April 2022 1,073 205 9,156 15,554 25,988

Additions 163 - 3,553 6,112 9,828

Disposals (225) (205) - - (430)

At 31 March 2023

(audited) 1,011 - 12,709 21,666 35,386

---------------------- -------------------- ---------- --------------- --------- --------

At 1 April 2023 1,011 - 12,709 21,666 35,386

Additions 107 - - - 107

---------------------- -------------------- ---------- --------------- --------- --------

At 30 September 2023

(unaudited) 1,118 - 12,709 21,666 35,493

---------------------- -------------------- ---------- --------------- --------- --------

Accumulated amortisation

At 1 April 2022 404 205 5,507 - 6,116

Charge for the year 177 - 1,562 - 1,739

Disposals (225) (205) - - (430)

At 31 March 2023

(audited) 356 - 7,069 - 7,425

---------------------- -------------------- ---------- --------------- --------- --------

At 1 April 2023 356 - 7,069 - 7,425

Charge for the year 110 - 756 - 866

---------------------- -------------------- ---------- --------------- --------- --------

At 30 September 2023

(unaudited) 466 - 7,825 - 8,291

---------------------- -------------------- ---------- --------------- --------- --------

Net book value

At 31 March 2023

(audited) 655 - 5,640 21,666 27,961

At 30 September 2023

(unaudited) 652 - 4,884 21,666 27,202

---------------------- -------------------- ---------- --------------- --------- --------

8. TRADE AND OTHER RECEIVABLES

Unaudited Unaudited Audited

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Trade receivables 2,067 1,723 1,706

Other receivables 3,542 2,367 3,301

-------------------- ---------- ---------- ----------------

5,609 4,090 5,007

------------------- ---------- ---------- ----------------

9. TRADE AND OTHER PAYABLES

Unaudited Unaudited Audited

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Trade payables 2,304 1,399 1,813

Corporation tax 360 427 438

Other taxes and social

security 615 836 622

Accruals 1,297 1,182 988

------------------------- ---------- ---------- ----------------

4,576 3,844 3,861

------------------------ ---------- ---------- ----------------

10. BANK LOAN

Unaudited Unaudited Audited

30-Sep-23 30-Sep-22 31-Mar-23

GBP'000 GBP'000 GBP'000

Bank loan net of arrangement

fee 4,720 5,187 4,705

4,720 5,187 4,705

------------------------------ ---------- ---------- ----------------

The Group has an GBP8.0m revolving credit facility with

Santander of which GBP4.83m is drawn down at 30 September 2023. The

banking facility has a term of five years to April 2027, an

interest rate of Base Rate +3.25% margin on drawn funds and

covenants that are tested quarterly relating to total net debt to

adjusted EBITDA leverage and minimum liquidity.

11. CONTINGENT CONSIDERATION

The Group acquired Truststream Security Solutions Limited in

April 2022 and the agreement included a two year earn-out mechanism

with contingent consideration payable up to GBP3.08m following the

first and second anniversaries of the transaction. The earn-out is

subject to the achievement of certain maintainable EBITDA

performance targets in the first and second 12-month periods

following the completion of the acquisition

The Year 1 earn-out period was completed in April 2023 and a

payment of GBP1.18m was due to the Sellers based on the

Maintainable EBITDA achieved. In accordance with the SPA, 75% of

this amount, GBP0.89m, was paid in August 2023 and GBP0.29m is

deferred to be paid with the Year 2 payment in H1 FY25.

The contingent consideration liability of GBP1.84m has been

assessed at its discounted fair value at 30 September 2023, and

includes the GBP0.29m payment deferred from Year 1. The liability

assumes that Truststream achieves its full Maintainable EBITDA

target in Year 2.

Unaudited Audited

Contingent consideration 30-Sep-23 31-Mar-23

Amounts due within one year GBP'000 GBP'000

------------------------------------- ---------- ----------

Contingent consideration 1,869 806

-------------------------------------- ---------- ----------

Discounted value (31) -

------------------------------------- ---------- ----------

1,838 806

------------------------------------- ---------- ----------

Amounts due after one year

Contingent consideration - 1,949

Discounted value - (74)

====================================== ========== ==========

- 1,875

===================================== ========== ==========

Discounted contingent consideration 1,838 2,681

-------------------------------------- ---------- ----------

12. SHARE CAPITAL

Equity share capital Number GBP'000

=================================== =========== ========

Allotted, called up and fully

paid

At 1 April 2022 49,419,690 494

----------------------------------- ----------- --------

At 31 March 2023 49,419,690 494

----------------------------------- ----------- --------

Issue of share capital - exercise

of share options 2,076,394 21

At 30 September 2023 51,496,084 515

----------------------------------- ----------- --------

In May 2023, the Company issued 2,076,394 shares to the CEO,

Adam Binks, on the exercise of share options under the 2020 LTIP

Scheme. These shares were subsequently repurchased by the Company

into Treasury reserves.

13. AVAILABILITY OF INTERIM REPORT

Copies of this report are available on the Company's website at

http://www.sysgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPGRGGUPWPGQ

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

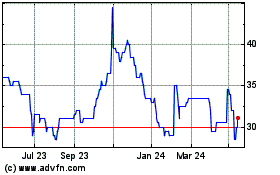

Sysgroup (LSE:SYS)

Historical Stock Chart

From Mar 2024 to Apr 2024

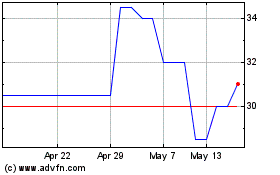

Sysgroup (LSE:SYS)

Historical Stock Chart

From Apr 2023 to Apr 2024