BlackRock Throg Tst Management fee and change in investment restrictions

24 July 2017 - 4:00PM

UK Regulatory

TIDMTHRG

BLACKROCK THROGMORTON TRUST PLC

(LEI: 5493003B7ETS1JEDPF59)

Management fee arrangements and change in investment restrictions

The Board of BlackRock Throgmorton Trust plc (the "Company") is pleased to

announce a change in the management fees payable to BlackRock Fund Managers

Limited ("the Manager").

* The base management fee will be reduced from 0.70 per cent. to 0.35 per

cent. of gross assets per annum. (Management fees will be calculated on the

month end gross assets of the Company, including the economic exposure of

the total long and short Contracts for Difference (CFDs) and index futures

less current liabilities). The new base management fee will be effective

from 1 August 2017.

* The performance fee will be increased from 10 per cent. to 15 per cent. of

Net Asset Value (NAV) total return outperformance of the benchmark measured

over a two year rolling basis and will be applied on the average gross

assets over two years.

* The previous cap on the performance fee of 1 per cent. of average gross

assets over a one year period has been replaced with a cap of 0.9% of

average gross assets over a two year period.The new performance fee will be

effective 1 December 2017 to coincide with the start of the new financial

year of the Company. These arrangements will be reflected in the Investment

Management Agreement between the Company and the Manager as a cap of 1.25%

of average gross assets over a two year period which will apply on the

total base and performance fee payable from 1 December 2017.

The Company also announces a non-material change to its investment policy.

Effective immediately, the Company will increase the restriction on its maximum

exposure to equities or collective investment vehicles traded on the AIM market

of the London Stock Exchange from 25 per cent. to 35 per cent. of the Company's

gross assets at the time of acquisition of investments. The Board will continue

to review whether the investment policy restrictions remain appropriate,

including investigating the potential benefits of increasing the AIM exposure

further and ensuring the benchmark is suitably aligned to the underlying

investments.

The Company remains a focused small/mid cap fund with the ability to mitigate

risk and improve performance by using CFDs and index futures to adjust both

market exposure and generate additional returns.

For the purposes of the Listing Rules, the Manager is a related party of the

Company and the amendments as set out above fall within Listing Rule 11.1.10 R,

thus not requiring a shareholder vote.

For further information, please contact:

Simon White, Managing Director, Investment Companies, BlackRock Investment

Management (UK) Limited

Tel: 020 7743 5284

Press enquiries:

Lucy Horne, Lansons Communications - Tel: 020 7294 3689

E-mail: lucyh@lansons.com

24 July 2017

END

END

(END) Dow Jones Newswires

July 24, 2017 02:00 ET (06:00 GMT)

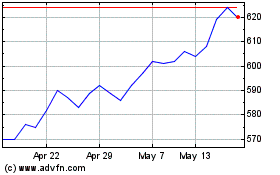

Blackrock Throgmorton (LSE:THRG)

Historical Stock Chart

From Apr 2024 to May 2024

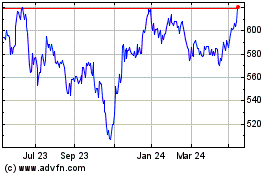

Blackrock Throgmorton (LSE:THRG)

Historical Stock Chart

From May 2023 to May 2024