US Solar Fund PLC PAYMENT FRAUD UPDATE -- FURTHER RECOVERY OF $2.7m (8232D)

24 February 2020 - 6:00PM

UK Regulatory

TIDMUSF TIDMUSFP

RNS Number : 8232D

US Solar Fund PLC

24 February 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO OR WITHIN

THE UNITED STATES, AUSTRALIA, CANADA OR JAPAN, OR ANY OTHER

JURISDICTION WHERE, OR TO ANY OTHER PERSON TO WHOM, TO DO SO WOULD

BE UNLAWFUL. THE INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE

OR FORM PART OF ANY OFFER TO SELL OR ISSUE, OR ANY SOLICITATION OF

ANY OFFER TO PURCHASE, SUBSCRIBE FOR OR OTHERWISE ACQUIRE, ANY

INVESTMENTS IN ANY JURISDICTION.

24 February 2020

US SOLAR FUND PLC (USF, the "Company")

PAYMENT FRAUD UPDATE - FURTHER RECOVERY OF $2.7m

Further to the update on 21 February 2020, the Board of US Solar

Fund plc (LON: USF (USD)/USFP (GBP)) and New Energy Solar Manager

(the Investment Manager) have since been advised that the relevant

banks had successfully recovered a further $2.7m which has been

returned to USF-controlled accounts. Together with the $3.6m

recovery announced on 31 January 2020, total recovery stands at

$6.3m of the $6.9m transferred.

The Board does not expect the $0.6m not yet recovered to have

any impact on the next, or any subsequent, estimate of Net Asset

Value. Recovery and investigation activities involving all external

stakeholders are continuing, as is the previously announced review

of the Investment Manager's financial processes and controls.

Further updates will be announced in due course.

For further information, please contact:

US Solar Fund

Whitney V oûte +1 718 230 4329

Cenkos Securities plc

Will Rogers

Rob Naylor

Will Talkington +44 20 7397 8900

KL Communications +44 20 3995 6673

Charles Gorman

Charlotte Stickings

About US Solar Fund plc

US Solar Fund plc listed on the premium segment of the London

Stock Exchange in April 2019, following its successful US$200m IPO.

The Company's investment objective is to provide investors with

attractive and sustainable dividends with an element of capital

growth by investing in a diversified portfolio of solar power

assets in North America and other OECD countries in the

Americas.

The Company will acquire or construct, own and operate solar

power assets that are expected to have an asset life of at least 30

years and generate stable and uncorrelated cashflows by selling

electricity to creditworthy offtakers under long-term power

purchase agreements (or PPAs).

Further information on the Company can be found on its website

at http://www.ussolarfund.co.uk .

About the Investment Manager

USF is managed by New Energy Solar Manager (NESM). NESM also

manages New Energy Solar, an Australian Securities Exchange

(ASX)-listed fund which has committed over US$900m to US and

Australian solar plants since late 2015.

NESM is owned by Walsh & Company, the funds management

division of Evans Dixon, an ASX-listed company (ASX: ED1) with over

A$20 billion of funds under advice and management.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDBCGDDLDDDGGX

(END) Dow Jones Newswires

February 24, 2020 02:00 ET (07:00 GMT)

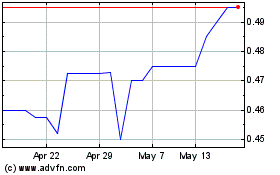

Us Solar (LSE:USF)

Historical Stock Chart

From Apr 2024 to May 2024

Us Solar (LSE:USF)

Historical Stock Chart

From May 2023 to May 2024