TIDMVEL

RNS Number : 1751H

Velocity Composites PLC

26 July 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the UK Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

26 July 2023

VELOCITY COMPOSITES PLC

("Velocity, the "Company" or the "Group")

Trading Update

Velocity Composites plc (AIM: VEL), the leading supplier of

composite material kits to aerospace and other high-performance

manufacturers, provides the following trading update.

As previously announced, Velocity is progressing the first

article inspection ("FAI") process and production ramp up of the

US$100 million, five-year Work Package Agreement ("the Agreement")

announced in December 2022. The development of the Company's

Advanced Manufacturing Facility in Alabama, US (the "Site")

continues with further manufacturing cells being installed, and

additional workers being recruited and trained.

The first two launch programmes for the Customer at the Site,

which account for 49% of expected revenues for the year ending 31

October 2024 ("FY2024"), have successfully completed the FAI

process. The first programme is at volume production and the

second, the largest, is expected to be up to the full rate of

production by August 2023, once the Customer has signed off on the

final FAI kits as they are built into finished parts.

Further to the announcement dated 18 April 2023, an updated FAI

timeline for the remaining programmes has now been agreed with the

Customer, with the FAI process for the third group of programmes

(12% of FY24 revenue) expected to commence in September 2023, the

fourth group (26% of FY24 revenue) in October 2023, and the fifth

group (8% of FY24 revenue) in March 2024.

The FAI process is extremely complicated and has required

extensive time and work on both sides. The Customer and Velocity

are in discussions for the five-year term of the Agreement

announced in December 2022, with the term initially expected to

commence in March 2023, to now start on 1 January 2024, when all

the critical kits have been outsourced. All other contractual

terms, including the full-term revenue under the Agreement of

US$100m, are expected to remain unchanged, at the underlying base

of US$20m per annum based on current programme production rates.

Using current exchange rates of GBP1:US$1.30, this is worth

approximately GBP15.4m of revenue to Velocity for each year of the

Agreement.

As a result of the updated FAI timeline, revenue that was

expected to be realised in the ramp up stage of production in the

US for the year ending 31 October 2023 ("FY2023") has been reduced

to GBP2.2m from GBP5.0m. However, any FY2023 revenue achieved under

the Agreement is in addition to the US$20m per annum for the

five-year period of the Agreement and therefore has no commercial

impact on the value of that contract long term. Once the programme

transfer from the Customer to Velocity is completed, revenues under

the Agreement will be more predictable, as they will follow the

platform run rates required by the Customer.

For FY2023, with the adjustment to FAI process sales estimates

and changes in exchange rates, the Group is now expecting to report

revenue of between GBP15m to GBP17m, and an EBITDA loss of between

GBP1.2m to GBP1.6m (subject to finalising the capitalisation of

certain costs in the US).

In FY2024, once the contract extension is in place, the

Agreement term is expected to commence at volume rates in January

2024, with a renewal due by the end of calendar year 2028, though

the contract can be subject to further annual extensions. As a

result, FY2024 revenue is expected to be between GBP30m and GBP36m,

and EBITDA profit of between GBP1.7m to GBP2.5m, including

additional investment to fund further growth opportunities as they

emerge.

The Board is pleased to announce that it is in advanced

discussions with a large, global Tier 1 composites manufacturer

with multiple sites in the US on another agreement. Further

announcements will be made, as appropriate.

In the UK, demand is growing. In FY2023, growth of at least 15%

is expected compared to FY2022. In FY2024, Velocity is planning for

extra work from a UK manufacturer seeking to expand its capacity to

meet growing demand. With expected UK growth and the start of the

full rate production under the Agreement in the US, the Company can

deliver profitability in FY2024.

To accommodate the planned growth in the US and the UK, the

Company is pleased to announce the appointment of Kevin Hickey as

Group Chief Operating Officer (a non-Board position). Kevin

previously worked at the Company between early 2017 and late 2020,

where he was responsible for the establishment, ramp up and ongoing

management of the Company's production facility in Fareham, UK.

Prior to this, Kevin held a range of senior operational management

roles both in the UK and internationally at GE Aviation and brings

a wealth of experience in the industry and the Company's processes

as Velocity's existing facilities grow, and new facilities are

established.

Andy Beaden, Chairman, Velocity, said :

"Velocity is focused on successfully completing the FAI with the

Customer, enabling it to achieve operational success in its

projects. Collaboration with the Customer has been close knit,

working together on what is one of the largest composite kit supply

FAI processes ever conducted in the industry.

The last year has been one of transition and investment. The

investments we have made will be repaid many times through the new

contracted business we have already won and the new business we can

now target. In the next financial year, we will see a

transformational upturn in annual revenue at Velocity. We have

built a significant asset in the US in terms of production

capability and engineering resource, which with organic growth in

the UK, will make the Company profitable.

We will continue to invest in skills and technical engineering

abilities to drive business development and project implementation.

The appointment of Kevin Hickey as COO will help the team in our

next exciting growth phase. We remain confident that more contracts

can be won as the use of composites grows as part of the next

generation of aircraft, and as other industries look to use

composites to deliver their net zero goals. We expect our

investment in people and technology to be fully rewarded in the

coming years as we expand at scale."

Enquiries:

Velocity Tel: +44 (0) 1282

577577

Andy Beaden, Chairman

Jon Bridges, Chief Executive Officer

Adam Holden, Chief Financial Officer

Cenkos (Nominated Adviser and Broker) Tel: +44 (0)20 7397

8900

Katy Birkin

Ben Jeynes

George Lawson

SEC Newgate (Financial Communications) Tel: +44 (0)7540

Robin Tozer 106 366

George Esmond Email: velocity@secnewgate.co.uk

Harry Handyside

About Velocity Composites

Based in Burnley, UK, Velocity Composites is the leading

supplier of composite material kits to aerospace and other

high-performance manufacturers, that reduce costs and improve

sustainability. Customers include Airbus, Boeing, and GKN.

By using Velocity's proprietary technology, manufacturers can

also free up internal resources to focus on their core business.

Velocity has significant potential for expansion, both in the UK

and abroad, including into new market areas, such as wind energy,

urban air mobility and electric vehicles, where the demand for

composites is expected to grow.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEDFUIEDSEEW

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

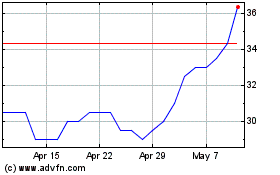

Velocity Composites (LSE:VEL)

Historical Stock Chart

From Apr 2024 to May 2024

Velocity Composites (LSE:VEL)

Historical Stock Chart

From May 2023 to May 2024