TIDMYCA

RNS Number : 6277R

Yellow Cake PLC

08 November 2021

8 November 2021

Yellow Cake plc ("Yellow Cake" or the "Company")

QUARTERLY OPERATING UPDATE

Yellow Cake, a specialist company operating in the uranium

sector with a view to holding physical uranium for the long term,

is pleased to report its performance for the quarter ended 30

September 2021 (the "Quarter").

Highlights

-- Following the completion of an oversubscribed share placing

and retail offer in June 2021, raising gross proceeds of

approximately GBP62.5 million (US$86.9 million), the Company:

o Purchased and took delivery of 550,000 lb of additional U(3)

O(8) in the spot market during the Quarter at an average price of

US$32.35/lb for a total consideration of US$17.8 million, bringing

the Company's holdings to 13.86 million lb of U(3) O(8) as at 30

September 2021; and

o Signed an agreement with JSC National Atomic Company

Kazatomprom ("Kazatomprom") on 26 August 2021 to purchase a further

2.0 million lb of U(3) O(8) at a price of US$32.23/lb for a total

consideration of US$64.5 million for agreed delivery between

October and December 2021. The completion of this transaction will

increase Yellow Cake's current holdings of 13.86 million lb of U(3)

O(8) to 15.86 million lb of U(3) O(8) .

-- Increase in value of U(3) O(8) held by Yellow Cake by 39%

over the Quarter from US$427.1 million(1) as at 30 June 2021 to

US$595.8 million(2) as at 30 September 2021.

-- Increase in value of U(3) O(8) held by Yellow Cake by 76% to

US$595.8 million (2) as at 30 September 2021, relative to the

average acquisition cost of US$337.8 million (US$24.38/lb)

(assuming a first in first out methodology).

-- Estimated net asset value on 30 September 2021 was GBP3.26

per share(3) or US$675.2 million, comprising 13.86 million lb of

U(3) O(8) valued at a spot price of US$43.00/lb(4), a uranium

derivative liability of US$6.5 million, and cash and other current

assets and liabilities of US$85.9 million as at 30 September

2021.

-- Subsequent to the end of the Quarter, the Company

successfully completed an oversubscribed share placing on 29

October 2021, raising gross proceeds of approximately GBP109

million (US$150 million) (the "October Placing").

-- The Company intends to use the proceeds of the October

Placing to fund purchases of physical uranium of approximately 3.0

million lb of U(3) O(8) , expected to bring Yellow Cake's holdings

of U(3) O(8) to 18.80 million lb on completion and comprising:

o 2.0 million lb of U(3) O(8) from Curzon Uranium Limited

("Curzon"), at a price of US$46.32/lb with agreed delivery to take

place before the end of November 2021; and

o 950,000 lb of U(3) O(8) from Kazatomprom, pursuant to

Kazatomprom's offer of 26 October 2021, at a price of US$47.58/lb,

with delivery expected to take place by June 2022.

-- Estimated proforma net asset value on 5 November 2021 was

GBP3.39 per share(5) or US$840.8 million(5), assuming 18.80 million

lb of U(3) O(8) valued at a spot price of US$43.50/lb(7), a uranium

derivative liability of US$6.5 million and cash and other current

assets and liabilities of US$85.9 million as at 30 September 2021,

plus net proceeds from the October Placing of US$145.7 million less

an estimated US$202.3 million applied to uranium purchases.

-- Under an existing arrangement (as previously disclosed in the

Company's admission document and the 2021 annual report),

Kazatomprom has an option to repurchase, 25% of the initial

purchase volume which the Company purchased from Kazatomprom in

July 2018 under the Framework Agreement, at the uranium spot price

less an aggregate discount of US$6.5 million (the "Repurchase

Option"). The Company has a corresponding buyback option to

purchase from Kazatomprom, at the prevailing spot price, all or a

portion of the volume repurchased by Kazatomprom under the

Repurchase Option (the "Buyback Option"). Following the conditions

being met for Kazatomprom to exercise its Repurchase Option, the

parties have entered into discussions regarding arrangements for

the exercise of the Repurchase Option and the Buyback Option. These

discussions are ongoing and are subject to agreement. It is

expected that the net impact of these transactions will be a net

pay-out by the Company to Kazatomprom of US$6.5 million. Further

details on these arrangements can be found in footnote 24 to the

Net Asset Value Update in this announcement.

Andre Liebenberg, CEO of Yellow Cake, said:

" 2021 continues to be a year of considerable growth for Yellow

Cake, with momentum continuing throughout the third quarter.

We successfully raised GBP62.5 million in June to increase our

uranium holdings by 20%. After the period end, we have extended

that strategy, raising a further GBP109 million, and agreeing to

purchase an additional 3 million pounds of uranium from Curzon and

Kazatomprom, bringing our total holdings to nearly 19 million

pounds once these transactions and deliveries are complete, more

than double our holdings since the start of the year. Our net asset

value is now over $800 million, compared to $200 million when we

first floated three years ago.

Our conviction in the case for holding uranium and the longer

term price outlook remains very strong, driven by the combination

of supply demand characteristics and the growing appreciation of

the role of nuclear in our clean energy future. On the demand side,

for the first time since 2011, the IAEA forecasts a potential

increase in nuclear power capacity during the coming decades, with

nuclear generation capacity set to more than double by 2050 in a

high case scenario. Yet supply side constraints remains deep

rooted, with the World Nuclear Association's "Nuclear Fuel Report"

noting the sharp drop in world uranium production and the need for

considerable investment in new production.

COP26 has clearly highlighted not just the need, but the global

will to address the challenge of climate change and nuclear energy

has a vital role to play. We continue to believe our investment

case is strong"

Uranium M arket Developments and Outlook

Uranium Market Developments

Subsequent to relatively subdued spot market activity during the

month of July (5.6 million lb) and early August in 2021, the

near-term market increased during the latter half of August 2021

with the UxC spot U(3) O(8) price reaching US$33.75/lb at month end

(30 August 2021)(8), a 4.5% rise from the previous month's spot

price of US$32.30/lb.

Following the establishment of an initial US$300 million

"At-The-Market" (ATM) funding facility, implementation of the

newly-formed Sprott Physical Uranium Trust ("SPUT") resulted in

August 2021 spot market volumes totalling 13.0 million lb U(3) O(8)

(9), more than double the July 2021 aggregate of 5.6 million

lb.

On 13 September 2021, SPUT announced a US$1 billion upsizing of

the ATM to allow the trust to issue new units and accumulate

physical uranium(10). Further near-term purchases drove the

September 2021 spot market volume to 18.0 million lb, with the high

level of market activity being reflected in the intra-month (16-17

September 2021) price peak of US$50.50/lb U(3) O(8) before

declining to US$43.00/lb by the end of September 2021(11), a

percentage increase of over 27% for the month.

Prices in the forward market as reported by UxC remained

relatively stable through July and August 2021, having ended in

June 2021 at Long-Term - US$32.00/lb, 3-year forward - US$34.00/lb,

and 5-year forward - US$38.00/lb with slight increases by the end

of August 2021 (US$33.50/lb, US$35.75/lb and US$39.50/lb

respectively). However, the unprecedented rise in the spot market

price beginning in August 2021 led to upward price pressure in the

forward market, resulting in end of September 2021 forward prices

reaching US$40.00/lb, US$43.00/lb and US$47.00/lb respectively. UxC

reported that as of the end of September 2021 "more than" 52.6

million lb had been contracted in the term market thus far in

2021(12).

The World Nuclear Association annual report, "World Nuclear

Performance Report," published in September 2021 reflected the

decrease in nuclear generated electricity during the pandemic year

of 2020. Global nuclear generation was down by almost 4% with the

average capacity factor declining to 80.3% from the 2019 level of

83.1%. A total of six nuclear reactors (5,165 Gwe) were permanently

shut-down during 2020 for a variety of reasons including for policy

reasons (Fessenhein 1 & 2 in France) and due to market

conditions (Duane Arnold), but five new reactors (5,521 Gwe)

entered commercial operations including units in China (2

reactors), Russia, Belarus and the United Arab Emirates(13).

The Illinois General Assembly passed clean energy legislation

(13 September 2021) which provides for the preservation of the

Byron and Dresden NPPs(14). Subsequent to the enactment of the

legislation, Exelon announced capital investment programs totalling

US$300 million in support of the commercial reactors and hiring to

fill 650 vacant positions(15).

The International Atomic Energy Agency (IAEA) distributed its

annual outlook for nuclear power and, for the first time since the

Fukushima Daiichi accident (March 2011), forecasts a potential

increase in nuclear power capacity during the coming decades. In

the High Case scenario, the IAEA now anticipates world nuclear

generating capacity to double to 792 Gwe by 2050 from 393 Gwe in

2020, representing a more than 10% increase from the 2020 forecast.

The IAEA Low Case scenario indicate that world nuclear capacity by

2050 would remain essentially the same as the current

capacity(16).

On 29 September 2021, the ruling Liberal Democratic Party of

Japan selected former foreign minister, Fumio Kishida, as the new

head of the party and Japan's Prime Minister. Mr Kishida has voiced

his support for the restart of Japan's idled commercial nuclear

reactor fleet and the assessment of new nuclear technology, such as

mall Modular Reactors for future incorporation in the Japanese

electric generating system(17). The new Prime Minister addressed

the Japanese Parliament on 11 October 2021 and reiterated his

support for nuclear power stating that restarting nuclear power

plants mothballed since the 2011 Fukushima accident was "vital"

(18).

On 8 September 2021, the World Nuclear Association released the

latest edition of its biennial nuclear fuel cycle assessment and

forecast, "The Nuclear Fuel Report" (World Nuclear Association

press release, 8 September 2021). The industry trade association

noted that "world uranium production dropped considerably from

63,207 tonnes of uranium (tU) in 2016 to 47,731 tU in 2020.

Unfavourable market conditions, compounded by the Covid-19

pandemic, led to a sharp decrease in investment in the development

of new and existing mines." Looking to the future uranium needs of

the anticipated increase in commercial nuclear power, the report

states "intense development of new projects will be needed in the

current decade to avoid potential supply disruptions." Furthermore,

"there will have to be a doubling in the development pipeline for

new projects by 2040. There are more than adequate project

extensions, uranium resources and other projects in the pipeline to

accomplish this need, but it is essential for the market to send

the signals needed to launch the development of these projects (19)

."

In a recent report issued by the United Nations Economic

Commission for Europe ("Technology Brief - Nuclear Power")(20), the

UNECE concluded that "Nuclear power is an important source of

low-carbon electricity and heat that contributes to attain carbon

neutrality. They have played a major role in avoiding carbon

dioxide (CO(2) ) emissions to date. Decarbonising energy is a

significant undertaking that requires the use of all available

low-carbon technologies. Analyses indicate that the world's climate

objectives will not be met if nuclear technologies are excluded"

(emphasis added).

The New Nuclear Watch Institute (NNWI) released its study (28

July 2021) entitled "Energy Security in the Age of Net-Zero

Ambitions and the System Value of Nuclear Power." The

European-based think tank concluded that establishing and

preserving a diversified, low-carbon generation mix during the

transition to a decarbonised energy system is crucial, and that

nuclear technology is necessary to back up variable renewables

without increasing exposure to the risks of price volatility and

supply insecurity of an imported transitional fuel (i.e. natural

gas).

Kazatomprom reported that Q2 2021 production (100% basis)

totalled 14.4 million lbs as compared to 13.6 million lb

year-on-year. Uranium output reached 27.2 million lb for the first

six months of the year, virtually equivalent to the same period in

2020 (27.1 million lb). Current 2021 guidance foresees total

production in the range of 58.5 - 59.3 million lb U(3) O(8) which

would be substantially above the 2020 output of 50.6 million lb. In

its announcement of 2 July 2021, Kazatomprom advised that uranium

production during 2023 would remain at the planned 2022 level of

22,500-23,000 tU (58.5-59.8 million lb), which is approximately 20%

below the expected production rate under the Subsoil Use Contracts

(27,500-28,00 tU; 71.5-72.8 million lb). Full implementation of the

production restraint plan would remove 5000 tU (13.0 million lb)

from the previously anticipated global primary supply in 2023.

In its 28 July 2021 Second Quarter Result Conference Call,

Cameco reported that Cigar Lake production could be as much as 12.0

million lb in 2021 (subject to any further disruptions due to

Covid-19 or forest fires in the area) with Cameco receiving "up to

6.0 million lb". Regarding 2021 market purchases, the company is

forecasting 11 - 13 million lb which includes volumes which have

already been delivered, those that are already under contract for

2021 delivery, pounds purchased from its equity position (40%) in

JV Inkai (Kazakhstan) as well as "purchase of excess inventory from

NUKEM" (it should be noted that during 2021 Cameco is entitled to

purchase as much as 5.3 million lb from JV Inkai, representing

59.4% of the 2021 planned production of 9.0 million lb). Regarding

the term market, the company reported an additional 7.0 million lb

having been added to their contract portfolio supplementing the 9.0

million lb secured earlier in the year bringing the aggregate of

new term contracts executed since 2019 to "over 60 million

pounds".

On 2 July, the Euratom Supply Agency (ESA) released its "Annual

Report - 2020" (21) which documents nuclear fuel activities by the

commercial nuclear power industry within the European Union and the

United Kingdom. Gross uranium requirements totalled 41.1 million lb

in 2020, with the utilities purchasing 32.7 million lb (97% under

multi-year/term uranium agreements). The five principal uranium

suppliers to the European Union included Niger, Russia, Kazakhstan,

Canada and Australia which, in the aggregate, provided 91.3% of the

total uranium acquired during the year. Uranium inventories fell

slightly from the 2019 level to 110.2 million lb, down considerably

from the 2016 inventory level of 133.9 million lb. Forward uranium

coverage ranges from 116% in 2024 declining to 57% by 2029 (Euratom

Supply Agency, "Annual Report 2020," 2 July 2021).

Market Outlook

Looking forward, in Yellow Cake's opinion, the spot uranium

price will remain highly volatile for the foreseeable future. The

18 October 2021 announcement by Kazatomprom that the world's

largest uranium producer will be participating in a newly-formed

physical uranium fund, ANU Energy OEIC Ltd., initially funded at

US$50 million with the expectation of raising a further US$500

million in capital to acquire physical uranium from the market is

expected to add increased price pressure.

UxC's most recent market outlook published 18 October 2021

concluded that "although there is no imminent shortage of uranium

expected in the near-term, the clear limitation of expected primary

production over the next few years relative to declining

inventories and other secondary supplies will undoubtedly

contribute to sustained high prices in the months ahead."(22)

Net Asset Value

Yellow Cake's estimated net asset value on 30 September 2021 was

GBP3.26 per share or US$675.2 million, consisting of 13.86 million

lb of U(3) O(8) , valued at a spot price of US$43.00/ lb(23), a

uranium derivative liability of US$6.5 million(24), and cash and

other current assets and liabilities of US$85.9 million(25)(.)

Yellow Cake Estimated Net Asset Value as at 30 September

2021

-----------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (A) lb 13,855,601

U(3) O(8) fair value per pound

(23) (B) US$/lb 43.00

(A) x (B)

U(3) O(8) fair value = (C) US$ m 595.8

------------

Uranium derivative liability

(24) (D) US$ m (6.5)

Cash and other net current

assets/(liabilities) (25) (E) US$ m 85.9

(C) + (D)

Net asset value in US$ m + (E) = (F) US$ m 675.2

------------

Exchange Rate (26) (G) US$/GBP 1.3484

(F) / (G)

Net asset value in GBP m = (H) GBP m 500.7

Number of shares in issue

less shares held in treasury

(27) (I) 153,671,232

Net asset value per share (H) / (I) GBP/share 3.26

Yellow Cake's estimated proforma net asset value on 5 November

2021 was GBP3.39 per share(28) or US$840.8 million, assuming 18.80

million lb of U(3) O(8) valued at a spot price of US$43.50/lb(29),

a uranium derivative liability of US$6.5 million and cash and other

current assets and liabilities of US$85.9 million as at 30

September 2021, plus net proceeds from the October Placing of

US$145.7 million less an estimated US$137.8 million of the proceeds

from the October Placing applied to uranium purchases.

At market close on that date, the Company's share price was

GBP3.56 per share, which represents a 5% premium to the above

estimated proforma net asset value per share.

Yellow Cake Estimated Proforma Net Asset Value as at 5 November

2021

-----------------------------------------------------------------------------

Units

Investment in Uranium

Uranium oxide in concentrates

("U(3) O(8) ") (30) (A) lb 18,805,601

U(3) O(8) fair value per pound

(29) (B) US$/lb 43.50

(A) x (B)

U(3) O(8) fair value = (C) US$ m 818.0

------------

Uranium derivative liability

(24) (D) US$ m (6.5)

Cash and other net current

assets/(liabilities) (31) (E) US$ m 29.3

(C) + (D)

Net asset value in US$ m + (E) = (F) US$ m 840.8

------------

Exchange Rate (31) (G) US$/GBP 1.3490

(F) / (G)

Net asset value in GBP m = (H) GBP m 623.3

Number of shares in issue

less shares held in treasury

(33) (I) 183,671,232

Net asset value per share (H) / (I) GBP/share 3.39

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) no 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018.

ENQUIRIES:

Yellow Cake plc

Andre Liebenberg, CEO Carole Whittall, CFO

Tel: +44 (0) 153 488 5200

Nominated Adviser and Joint Broker: Canaccord Genuity Limited

Henry Fitzgerald-O'Connor James Asensio

Georgina McCooke

Tel: +44 (0) 207 523 8000

Joint Broker: Berenberg

Matthew Armitt Jennifer Wyllie

Varun Talwar Detlir Elezi

Tel: +44 (0) 203 207 7800

Financial Adviser: Bacchus Capital Advisers

Peter Bacchus Richard Allan

Tel: +44 (0) 203 848 1640

Investor Relations: Powerscourt

Peter Ogden Linda Gu

Tel: +44 (0) 7793 858 211

ABOUT YELLOW CAKE

Yellow Cake is a London-quoted company, headquartered in Jersey,

which offers exposure to the uranium spot price. This is achieved

through its strategy of buying and holding physical triuranium

octoxide ("U(3) O(8) "). It may also seek to add value through the

acquisition of uranium royalties and streams or other uranium

related activities. Yellow Cake seeks to generate returns for

shareholders through the appreciation of the value of its holding

of U(3) O(8) and its other uranium related activities in a rising

uranium price environment. The business is differentiated from its

peers by its ten-year Framework Agreement for the supply of U(3)

O(8) with Kazatomprom, the world's largest uranium producer. Yellow

Cake currently holds 13.86 million pounds of U(3) O(8) , all of

which is held in storage in Canada and France.

FORWARD LOOKING STATEMENTS

Certain statements contained herein are forward looking

statements and are based on current expectations, estimates and

projections about the potential returns of the Company and the

industry and markets in which the Company will operate, the

Directors' beliefs and assumptions made by the Directors. Words

such as "expects", "anticipates", "should", "intends", "plans",

"believes", "seeks", "estimates", "projects", "pipeline", "aims",

"may", "targets", "would", "could" and variations of such words and

similar expressions are intended to identify such forward looking

statements and expectations. These statements are not guarantees of

future performance or the ability to identify and consummate

investments and involve certain risks, uncertainties and

assumptions that are difficult to predict, qualify or quantify.

Therefore, actual outcomes and results may differ materially from

what is expressed in such forward looking statements or

expectations. Among the factors that could cause actual results to

differ materially are: uranium price volatility, difficulty in

sourcing opportunities to buy or sell U(3) O(8) , foreign exchange

rates, changes in political and economic conditions, competition

from other energy sources, nuclear accident, loss of key personnel

or termination of the services agreement with 308 Services Limited,

changes in the legal or regulatory environment, insolvency of

counterparties to the Company's material contracts or breach of

such material contracts by such counterparties. These

forward-looking statements speak only as at the date of this

announcement. The Company expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any forward

looking statements contained herein to reflect any change in the

Company's expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

(1) Based on the month end spot price of US$32.10/ lb published

by UxC, LLC on 28 June 2021 and 13,305,601 lb U O held by the

company as at 30 June 2021 .

(2) Based on the daily spot price of US$43.00/ lb published by

UxC, LLC on 30 September 2021 and 13,855,601 lb U O held by the

company as at 30 September 2021 .

(3) Estimated net asset value per share on 30 September 2021 is

calculated assuming 157 ,740,730 ordinary shares in issue less

4,069,498 shares held in treasury, the Bank of England's daily USD/

GBP exchange rate of 1.3484 on 30 September 2021 and the daily spot

price published by UxC, LLC on 30 September 2021.

(4) Daily spot price published by UxC, LLC on 30 September 2021.

(5) Estimated net asset value per share on 5 November 2021 is

calculated assuming 187 ,740,730 ordinary shares in issue less

4,069,498 shares held in treasury, a US$/GBP exchange rate of

1.3490 and the daily spot price published by UxC, LLC on 5 November

2021.

(6) Yellow Cake's estimated pro-forma net asset value on 5

November 2021 was US$840.8 million, consisting of 13,855,601 lb of

U(3) O(8) held at that date, plus a purchase commitment of 2.0

million lb of U(3) O(8) from Kazatomprom for delivery between

October and December 2021, plus a purchase commitment of 2.0

million lb of U(3) O(8) from Curzon for delivery in November 2021,

plus 0.95 million lb of U(3) O(8) to be purchased from Kazatomprom,

subject to contract, for delivery in June 2022, valued at the daily

spot price of US$43.50/ lb published by UxC, LLC on 5 November

2021, a derivative liability of US$6.5 million and cash and other

current assets and liabilities of US$85.9 million as at 30

September 2021, plus net proceeds from the October Placing of

US$145.7 less a cash consideration of US$64.5 million to be paid to

Kazatomprom in respect of 2 million lb of U(3) O(8) to be delivered

in 2021, less a cash consideration of US$92.6 million to be paid to

Curzon in respect of 2 million lb of U(3) O(8) to be delivered in

2021, less a cash consideration of US$45.2 million to be paid to

Kazatomprom (subject to contract) in respect of 0.95 million lb of

U(3) O(8) to be delivered in 2022.

(7) Daily spot price published by UxC, LLC on 5 November 2021.

(8) UxC Weekly, Vol. 35 No. 34, 30 August 2021.

(9) UxC Weekly, 6 September 2021.

(10) Sprott press release: SPROTT PHYSICAL URANIUM TRUST

ANNOUNCES FILING OF AMED AND RESTATED BASE SHELF PROSPECTUS, 10

September 2021.

(11) UxC Weekly, Vol. 35 No. 39, 27 September 2021.

(12) UxC Weekly, Vol. 35 No. 40, 4 October 2021.

(13) World Nuclear Association, "World Nuclear Performance Report 2021," September 2021.

(14) Exelon press release, "Passage of Illinois Energy

Legislation Preserves Nuclear Plants and Strengthens State's Clean

Energy Leadership,"13 September 2021.

(15) Exelon Press Release, "Illinois Clean energy Legislation

Spurs Exelon Generation to Fill 650 Jobs, Invest $300 Million in

Capital Projects," 29 September 2021.

(16) IAEA press release, "IAEA Increases Projections for Nuclear

Power Use in 2050," 16 September 2021.

(17) Argus Media article, "Japan's Potential New Premier

Supports Nuclear Power, 29 September 2021.

(18) The Straits Times, "Japan's new PM Kishida defends

pro-nuclear stance in parliamentary debate," 11 October 2021.

(19) World Nuclear Association, "The Nuclear Fuel Report - 2021 Edition," 8 September 2021.

(20) https://unece.org/sites/default/files/2021-08/Nuclear%20power%20brief_EN_0.pdf .

(22) Ux Weekly, "Third Quarter Spot Uranium Market Update," 18 October 2021

(23) Daily spot price published by UxC, LLC on 30 September 2021.

(24) Yellow Cake purchased of 8,091,385 lb of U(3) O(8) from

Kazatomprom at IPO on 5 July 2018 for a cash consideration of

US$170,000,000 under the Framework Agreement (the "Initial

Purchase"). As part of the Initial Purchase, the Company benefited

from a purchase price which was 2.5% below the spot price,

resulting in the Company receiving an aggregate discount of

approximately US$ 4.3 million. In exchange for this discount, the

Company provided to Kazatomprom an option to repurchase up to 25%

of the Initial Purchase volume of 8,091,385 lb U(3) O(8) at the

prevailing uranium spot price less an aggregate discount of

approximately US$6.5 million (the "Repurchase Option"). The

Repurchase Option could only be exercised if the U(3) O(8) spot

price exceeded US$37.50 /lb for a period of 14 consecutive days

(the "Pricing Condition"), starting three years from 5 July 2018

and expiring on 30 June 2027 and was exerciseable within 60 days of

the Pricing Condition being met. The Company had a corresponding

option (the "Buyback Option") to purchase from Kazatomprom all or a

portion of the volume repurchased by Kazatomprom under the

Repurchase Option at the prevailing spot price. The Pricing

Condition was met on 17 September 2021 and the parties are in

discussion regarding arrangements for the exercise of the

Repurchase Option and the Buyback Option. It is expected that,

subject to final agreement, Yellow Cake and Kazatomprom will agree

that Kazatomprom will exercise its Repurchase Option at a price of

US$43.25/lb less an aggregate discount of US$6.5 million, after

which Yellow Cake will exercise its Buyback Option for the same

quantity at a price of US$43.25/lb, resulting in a net pay-out to

Kazatomprom of US$6.5 million.

(25) Cash and cash equivalents and other net current assets and

liabilities as at 30 September 2021.

(26) Bank of England's daily USD/ GBP exchange rate of 1.3484 on 30 September 2021.

(27) Net asset value per share on 30 September 2021 is

calculated assuming 157,740,730 ordinary shares in issue less

4,069,498 shares held in treasury. The shares held in treasury take

into account the treasury shares used for the settlement of the

option exercise announced by the Company on 26 July 2021.

(28) Estimated net asset value per share on 5 November 2021 is

calculated assuming 187 ,740,730 ordinary shares in issue less

4,069,498 shares held in treasury, a USD/ GBP exchange rate of

1.3490 and the daily spot price published by UxC, LLC on 5 November

2021.

(29) Daily spot price published by UxC, LLC on 5 November 2021.

(30) Comprises 13,855,601 lb of U(3) O(8) held 5 November 2021,

plus a purchase commitment of 2.0 million lb of U(3) O(8) from

Kazatomprom for delivery between October and December 2021, plus a

purchase commitment of 2.0 million lb of U(3) O(8) from Curzon for

delivery in November 2021, plus 0.95 million lb of U(3) O(8) to be

purchased from Kazatomprom, subject to contract, for delivery in

June 2022.

(31) Includes cash and other current assets and liabilities of

US$85.9 million as at 30 September 2021, plus net proceeds from the

October Placing of US$145.7 million less a cash consideration of

US$64.5 million to be paid to Kazatomprom in respect of 2 million

lb of U(3) O(8) to be delivered in 2021, less a cash consideration

of US$92.6 million to be paid to Curzon in respect of 2 million lb

of U(3) O(8) to be delivered in 2021, less a cash consideration of

US$45.2 million to be paid to Kazatomprom (subject to contract) in

respect of 0.95million lb of U(3) O(8) to be delivered in 2022.

(32) Bank of England's daily USD/ GBP exchange rate of 1.3484 on 30 September 2021.

(33) Net asset value per share on 30 September 2021 is

calculated assuming 157,740,730 ordinary shares in issue less

4,069,498 shares held in treasury.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUWVNRANUARRA

(END) Dow Jones Newswires

November 08, 2021 02:00 ET (07:00 GMT)

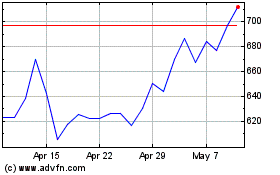

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yellow Cake (LSE:YCA)

Historical Stock Chart

From Apr 2023 to Apr 2024