0001379006

false

0001379006

2023-08-29

2023-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D)

OF

THE SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

August 29, 2023 |

| NANOVIRICIDES, INC. |

| (Exact Name of Registrant as Specified in Its Charter) |

| Delaware |

001-36081 |

76-0674577 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| |

|

|

1 Controls Drive,

Shelton, Connecticut |

06484 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| (203) 937-6137 |

| (Registrant's Telephone Number, Including Area Code) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

| Common Stock |

|

NNVC |

|

NYSE-American |

| Item 1.01. |

Entry into a Definitive Material Agreement. |

On August 29, 2023, NanoViricides, Inc. (the “Registrant”)

entered into a Deferred Expense Exchange Agreement (the “Agreement”) with TheraCour Pharma, Inc., a Connecticut corporation

(“TheraCour”) effective as of July 19, 2023. Dr. Anil Diwan, the Registrant’s founder, President and Chairman, owns

approximately 90% of TheraCour’s capital stock. Dr. Diwan recused himself from voting on any action of the Registrant’s Board

of Directors in connection with the Agreement and the Note (as that term is defined herein), and any discussions related thereto.

Pursuant to a Licensing Agreement dated September

7, 2021 (the “License Agreement”) between the Registrant and TheraCour, the Registrant is obligated to make certain milestone

payments to TheraCour upon achieving certain milestones. As the date of the Agreement, TheraCour achieved the milestone regarding the

“Initiation of Phase 1 Clinical Trials or Equivalent” by TheraCour within 3 months from Regulatory Approval. Upon achieving

this milestone, the Registrant was obligated to pay TheraCour a cash milestone payment in the amount of $1,500,000.

In lieu of this cash payment, TheraCour agreed

to accept a Convertible Promissory Note in the principal amount of $1,500,000 effective July 19, 2023 (the “Note”). The Note

accrues interest at the rate of twelve percent (12%) per annum and is due and payable on January 19, 2025. The Note is convertible, at

TheraCour’s option, into shares of the Company’s Series A Convertible Preferred Stock, par value $0.00001 (the “Series

A Shares”) at the conversion price specified in the terms and conditions contained within the Note. The Agreement and the

Note contain customary representations, warranties and covenants for similar agreements.

The foregoing

descriptions of the License Agreement, Deferred Expense Exchange Agreement, and Convertible Promissory Note are not complete and further

are qualified in their entirety by reference to the Licensing Agreement, the Agreement, and the Note which are filed as Exhibit 10.1,

Exhibit 10.2, and 10.3, respectively, to this Current Report on Form 8-K, which are incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of

a Registrant. |

The information contained above in Item 1.01 is

hereby incorporated by reference into this Item 2.03

| Item. 9.01. | Financial Statements and Exhibits. |

* Previously filed as Exhibit

10.1 to the Registrant’s Current Report on Form 8-K filed on September 15, 2021.

SIGNATURES

PURSUANT TO THE REQUIREMENTS OF THE SECURITIES

EXCHANGE ACT OF 1934, THE REGISTRANT HAS DULY CAUSED THIS REPORT TO BE SIGNED ON ITS BEHALF BY THE UNDERSIGNED THEREUNTO DULY AUTHORIZED.

| |

NANOVIRICIDES, INC. |

| |

|

| |

|

|

| Date: September 1, 2023 |

By: |

/s/ Meeta Vyas |

| |

|

Name: Meeta Vyas |

| |

|

Title: Chief Financial Officer |

EXHIBIT 10.2

DEFERRED

EXPENSE EXCHANGE AGREEMENT

This DEFERRED EXPENSE EXCHANGE

AGREEMENT (this “Exchange Agreement”), effective of July 19, 2023 (“Execution Date”), by and between NanoViricides,

Inc., a Nevada corporation (the “Company”) and TheraCour Pharma, Inc., a Connecticut corporation (“TheraCour”)

(collectively, the “Parties”).

WHEREAS, pursuant to

the Licensing Agreement dated September 7, 2021 between the Parties, the Company is required to pay TheraCour certain amounts as Milestone

payments for meeting certain thresholds (the “Milestone Payments”);

WHEREAS, as of the

date of this Agreement, the Company is indebted to TheraCour in the aggregate amount of $1,500,000 through and including July 19, 2023,

for achieving the Milestone regarding the Initiation of Phase 1 Clinical Trials or Equivalent by TheraCour within 3 months from Regulatory

Approval (the “Milestone 3 Payment”); and

WHEREAS, TheraCour

has proposed and the Company has agreed that TheraCour defer the Milestone Payment in in exchange the amount of $1,500,000 (the “Exchange”)

in exchange for a Convertible Promissory Note in the amount of $1,500,000 (the “Note”).

NOW THEREFORE, in consideration

of the premises and the mutual covenants and agreements of the Parties hereinafter set forth, the Parties hereto hereby agree as follows:

1. Exchange.

(a) TheraCour

agrees, subject to the conditions set forth herein, to exchange the Milestone 3 Payment for the Note, made by the Company in favor of

TheraCour.

(b) The

Parties shall use best efforts to consummate the transactions contemplated herein. Without limiting the generality of the foregoing, the

Parties: (i) shall make all filings and other submissions (if any) and give all notices (if any) required to be made and given by the

Parties; (ii) shall use best efforts to obtain any consent (if any) reasonably required to be obtained; and (iii) shall use best efforts

to satisfy any conditions precedent to the consummation of this Agreement and to effectuate the Exchange. The Company shall

pay any applicable fees and costs, including reasonable legal fees, associated with same.

(c) Upon

the issuance of the Note, to be held on the Execution Date, the amount the Company is indebted to TheraCour shall be reduced by the Exchange.

(d) The

Note shall be convertible into shares of the Company’s Series A Convertible Preferred Stock (the “Shares”) of the Company,

at the Conversion Price as defined in the terms and conditions contained within the Note therein.

(e) The

Company hereby agrees to defend and indemnify TheraCour and each of the officers or agents of TheraCour as of the date of this Agreement

against any loss, liability, claim, damage, or expense (including, but not limited to, any and all expense whatsoever reasonably incurred

in investigating, preparing, or defending against any litigation, commenced or threatened, or any claim whatsoever), to which it or they

may become subject arising out of or based on the transactions contemplated in this Agreement.

2. Representations

And Warranties Of The Company. The Company hereby represents and warrants to TheraCour as follows:

(a) The

Company has full legal power to execute and deliver this Agreement and to perform its obligations hereunder. All acts required to be taken

by the Company to enter into this Agreement and to carry out the transactions contemplated hereby have been properly taken, and this Agreement

constitutes a legal, valid and binding obligation of the Company, enforceable in accordance with its terms and does not conflict with,

result in a breach or violation of or constitute (or with notice of lapse of time or both constitute) a default under any instrument,

contract or other agreement to which the Company or its subsidiaries is a party.

(b) None

of the Company’s Certificate of Incorporation, as amended, or Bylaws, any agreement to which the Company is a party, or the laws

of Delaware, or New York, restrict the Company’s ability to enter into this Agreement or consummate the transactions contemplated

by this Agreement or would limit any of TheraCour’s rights following consummation of the transactions contemplated by this Agreement.

3. Representations,

Warranties And Covenants Of TheraCour. TheraCour represents, warrants and covenants to the Company as follows:

(a) TheraCour

has full legal power to execute and deliver this Agreement and to perform its obligations hereunder. All acts required to be taken by

TheraCour to enter into this Agreement and to carry out the transactions contemplated hereby have been properly taken; and this Agreement

constitutes a legal, valid and binding obligation of TheraCour enforceable in accordance with its terms.

(b) TheraCour

has such knowledge and experience in financial and business matters as to be capable of evaluating the merits and risks of an investment

in the Company’s securities and has obtained, in its judgment, sufficient information about the Company to evaluate the merits and

risks of an investment in the Company.

(c) TheraCour

is relying solely on the representations and warranties contained in Section 2 hereof, the information contained in the Company’s

filing with the Securities and Exchange Commission (“SEC”) and in certificates delivered hereunder in making its decision

to enter into this Agreement and consummate the transactions contemplated hereby and no oral representations or warranties of any kind

have been made by the Company or its officers, directors, employees or agents to TheraCour.

(d) TheraCour

represents, warrants and agrees that (i) any Shares of the Company it receives will be acquired for investment purposes only for their

own account or for the account of controlled affiliates, not as a nominee or agent, and not with a view to the resale or distribution

of any part thereof, and that they have no present intention of selling, granting any participation in or otherwise distributing the same,

(ii) it has not been formed for the specific purpose of acquiring the Shares, (iii) that it is financially sophisticated and is able to

fend for itself, can bear the economic risk of the investment, and has such knowledge and experience in financial or business matters

that it is capable of evaluating the merits and risks of the investment in the Shares, (iv) it is an “accredited investor”

or a “qualified institutional buyer” within the meaning of current SEC rules.

(e) TheraCour

understands that the Shares it may receive under the Note are “restricted securities” under U.S. federal securities laws inasmuch

as they will be acquired by it from the Company in a transaction not involving a public offering and that under such laws and applicable

regulations such Shares may be resold without registration only in certain limited circumstances. TheraCour further understands that the

Shares may not be sold, transferred, hypothecated or otherwise traded on or through the facilities of the any stock exchange unless there

is an effective registration statement covering the Shares or the Shares are being sold or transferred in reliance on an exemption, including

without limitation Regulation S.

(f) TheraCour

further understands that the Shares have significant restrictions in their conversion procedures and are not convertible into Common Stock

until and unless a “Change of Control” of the Company, as defined in the Certificate of Designation of Series A Convertible

Stock, as amended, and that there is currently no trading market for trading of the Shares.

4. Miscellaneous.

(a) Section

headings used in this Agreement are for convenience of reference only and shall not affect the construction of this Agreement.

(b) This

Agreement may be executed in any number of counterparts and by the different parties on separate counterparts and each such counterpart

shall be deemed to be an original, but all such counterparts shall together constitute but one and the same agreement.

(c) This

Agreement shall be a contract made under and governed by the laws of the State of New York.

(d) This

Agreement shall be binding upon the Company, TheraCour and their respective successors and assigns, and shall inure to the benefit of

the Company, TheraCour and their respective successors and permitted assigns.

(e) The

terms and provisions of this Agreement are intended solely for the benefit of each party hereto and their respective successors or permitted

assigns, and it is not the intention of the parties to confer third-party beneficiary rights upon any other person or entity.

(f) If

one or more provisions of this letter agreement are held to be unenforceable under applicable law, it shall be excluded from this letter

agreement and the balance of the letter agreement shall be interpreted as if it were so excluded and shall be enforceable in accordance

with its terms.

(g) This

Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute

one and the same instrument.

(h) All

amendments or modifications of this Agreement and all consents, waivers and notices delivered hereunder or in connection herewith shall

be in writing and executed by both parties hereto.

(i) This

Agreement constitutes the entire agreement among the parties with respect to the subject matter hereof and supersedes all prior agreements

and undertakings, both written and oral, among the parties with respect thereto.

(j) Each

of the Company and TheraCour hereby irrevocably waives all right to a trial by jury in any action, proceeding or counterclaim arising

out of or relating to this Agreement and the transactions contemplated hereby.

[REMAINDER OF THIS PAGE LEFT INTENTIONALLY

BLANK]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be executed by their duly authorized representatives or self as of the date first above written.

| |

NANOVIRICIDES, INC. |

| |

|

| |

|

| |

By: |

/s/ Meeta Vyas |

| |

|

Name: Meeta Vyas |

| |

|

Title: Chief Financial Officer |

| |

|

| |

|

| |

THERACOUR PHARMA, INC. |

| |

|

| |

|

| |

By: |

/s/ Anil Diwan |

| |

|

Name: Anil R. Diwan |

| |

|

Title: Chief Executive Officer |

EXHIBIT 10.3

THIS NOTE AND THE SECURITIES ISSUABLE UPON

ITS CONVERSION HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES

LAWS OF ANY STATE AND MAY NOT BE SOLD, TRANSFERRED, ASSIGNED OR OTHERWISE DISPOSED OF WITHOUT REGISTRATION UNDER THE SECURITIES ACT AND

ANY APPLICABLE STATE SECURITIES LAWS OR AN OPINION OF COUNSEL, REASONABLY SATISFACTORY TO THE COMPANY, THAT SUCH REGISTRATION IS NOT

REQUIRED.

NANOVIRICIDES, INC.

CONVERTIBLE PROMISSORY NOTE

| $1,500,000.00 | |

July 19, 2023 |

FOR VALUE RECEIVED, NanoViricides,

Inc., a Nevada corporation (the “Company”), hereby promises to pay to the order of TheraCour Pharma, Inc. or any subsequent

holder of this Note (collectively, the “Holder”), in exchange for the Milestone Payment due as of July 19, 2023 as

referenced fully in the “Deferred Expense Exchange Agreement of even date herewith, under the terms herein, unless and until converted,

the principal amount of One Million Five Hundred Thousand Dollars ($1,500,000) (the “Principal Amount”), plus interest

accrued thereon as herein provided with respect to the Principal Amount. Fixed annual interest shall accrue only on the unpaid Principal

Amount from the date of original issuance until paid or converted in accordance herewith, as applicable, at a rate equal to twelve percent

(12%) per annum. The unpaid Principal Amount, together with any then-unpaid accrued interest thereon, shall be due and payable or converted,

as the case may be, on January 19, 2025 (the “Maturity Date”) or (ii) when such amounts are made due and payable upon

or after the occurrence of an Event of Default in accordance with Section 1 hereof. All payments due on this Note shall be made

either (i) by the issuance of the applicable class of equity securities described in the Deferred Expense Exchange Agreement (the “Exchange

Agreement”) dated as of the date hereof between the Company and the Holder or (ii) in the event that the Holder is entitled or elects

to receive payment in cash for any payments due on this Note on the terms and conditions set forth herein and in the Exchange Agreement,

such payment shall be made via certified check or other immediately available funds. The Holder shall only be entitled to receive a cash

payment for a payment due on this Note (provided that the Note has not been converted pursuant to Section 3 of the Exchange Agreement)

(i) upon the demand of the Required Holders on or after the Maturity Date or (ii) upon the occurrence and continuance of Event of Default.

The Company may not repay this Note in cash without the approval of the Required Holders.

All capitalized terms not

defined herein shall have the meanings ascribed to them in the Defined Expense Exchange Agreement excluded as of even date herewith. The

Holder, by its acceptance hereof, agrees to be bound by the provisions of the Exchange Agreement. Subject to Section 8 hereof, any transfer

of this Note will be effected only by surrender of this Note to the Company and reissuance of a new note to the transferee for any unpaid

balance.

Interest shall be calculated

on the basis of actual number of days elapsed over a year of 365 days. Notwithstanding any other provision of this Note, the Holder will

not charge and the Company shall not be required to pay any interest or other fees or charges in excess of the maximum rates or amounts

permitted by applicable law and in the event any payments are made in excess of such maximum, such payments shall be credited to reduce

the Principal Amount. All payments received by the Holder hereunder will be applied first to reasonable costs of collection, if any, then

to interest and the balance to the Principal Amount.

(1) Events

of Default. An “Event of Default” will occur if any of the following occurs:

(a) the

Company fails to make any payment of the Principal Amount or interest when due hereunder within five (5) business days following written

demand therefor;

(b) the

Company materially breaches any representation or warranty contained in, or fails to comply in any material respect with, any of the terms

or covenants of the Exchange Agreement or this Note, and such breach or failure is not cured within thirty (30) days after the Required

Holders have given the Company written notice of such breach;

(c) involuntary

proceedings shall have been commenced against the Company (i) under federal bankruptcy law or under any applicable federal or state bankruptcy,

insolvency, or similar law, which seek the general adjustment of the Company’s debts, (ii) seeking the appointment of a receiver,

liquidator, assignee, custodian, trustee, sequestrator (or similar official) of the Company or for any material part of the Company’s

property, or (iii) seeking an order winding up or liquidating the assets of the Company are initiated and continue for a period of sixty

(60) days;

(d) (i)

a voluntary proceeding shall have been commenced under federal bankruptcy law, or any other applicable federal or state bankruptcy, insolvency,

or other similar law, (ii) the consent by the Company to the appointment of, or taking possession by, a receiver, liquidator, assignee,

trustee, custodian, sequestrator (or other similar official) of the Company or for any material part of the Company’s property,

(iii) the Company making any assignment for the benefit of creditors, or (iv) the taking of any formal action by the Company in furtherance

of any of the foregoing; or

(e) there

occurs a liquidation, dissolution or winding up of the Company.

(2) Remedies

on Default, Etc. Upon the occurrence and continuance of an Event of Default, at the option and upon the declaration of the Required

Holders the entire unpaid Principal Amount and accrued and unpaid interest on this Note and all other Notes shall, without presentment,

demand, protest or notice of any kind, all of which are hereby expressly waived, be forthwith due and payable (provided that if an Event

of Default specified in Sections 1(c) or 1(d) above occurs, this Note shall become immediately due and payable without any

declaration or other act on the part of the Holder) and the Holder may, among other things, proceed to protect and enforce its rights

hereunder by an action at law, suit in equity or other appropriate proceeding, whether for the specific performance of any agreement contained

herein or in the Exchange Agreement, or for an injunction against a violation of any of the terms hereof or thereof or in the exercise

of any power granted hereby or thereby or by law. No right conferred upon the Holder hereby or by the Exchange Agreement shall be exclusive

of any other right referred to herein or therein or now or hereafter available at law, in equity, by statute or otherwise.

(3) Conversion.

(a) Conversion Right.

The Holder shall have the right from time to time, following the date of this Note in respect of the remaining outstanding principal amount

of this Note to convert (a “Conversion”) all or any part of the outstanding and unpaid principal amount of this Note into

fully paid and non-assessable shares of the Company’s Series A Convertible Preferred Stock, par value $0.00001 per share (the “Series

A Stock”) as such Series A Stock exists on the Issue Date, or any shares of capital stock or other securities of the Borrower into

which such Series A Stock shall hereafter be changed or reclassified at a conversion price per share of which price is determined using

the Black-and Scholes or similar valuation of the share of Series A Stock as of the date when the Milestone Payment became due, namely,

July 19 2023, as determined by the Company’s Controller (subject to equitable adjustments for stock splits, stock dividends or rights

offerings by the Borrower relating to the Borrower’s securities or the securities of any subsidiary of the Borrower, combinations,

recapitalization, reclassifications, extraordinary distributions and similar events) (the “Conversion Price”). The number

of shares of Series A Stock to be issued upon each conversion of this Note shall be determined by dividing the Conversion Amount (as defined

below) by the Conversion Price as specified above in the notice of conversion, in the form attached hereto as Exhibit A (the “Notice

of Conversion”), delivered to the Borrower by the Holder in accordance with Section 3(b) below; provided that the Notice of Conversion

is submitted by facsimile or e-mail (or by other means resulting in, or reasonably expected to result in, notice) to the Borrower before

6:00 p.m., New York, New York time on such conversion date (the “Conversion Date”). The term “Conversion Amount”

means, with respect to any conversion of this Note, the sum of (1) the principal amount of this Note to be converted in such conversion

plus (2) at the Holder’s option, accrued and unpaid interest, if any, on such principal amount at the interest rates provided in

this Note to the Conversion Date, plus (3) at the Holder’s option, Default Interest, if any, on the amounts referred to in the immediately

preceding clauses (1) and/or (2).

(b) Method of Conversion.

(i) Mechanics

of Conversion. Subject to Section 3(a), this Note may be converted by the Holder in whole or in part at any time from time to time

after the Issue Date, by (A) submitting to the Company a Notice of Conversion (by facsimile, e-mail or other reasonable means of communication

dispatched on the Conversion Date prior to 6:00 p.m., New York, New York time) at the principal office of the Company.

(ii) Surrender

of Note Upon Conversion. Notwithstanding anything to the contrary set forth herein, upon conversion of this Note in accordance with

the terms hereof, the Holder shall not be required to physically surrender this Note to the Company unless the entire unpaid principal

amount of this Note is so converted. The Holder and the Company shall maintain records showing the principal amount so converted and the

dates of such conversions or shall use such other method, reasonably satisfactory to the Holder and the Borrower, so as not to require

physical surrender of this Note upon each such conversion. In the event of any dispute or discrepancy, such records of the Borrower shall,

prima facie, be controlling and determinative in the absence of manifest error. Notwithstanding the foregoing, if any portion of this

Note is converted as aforesaid, the Holder may not transfer this Note unless the Holder first physically surrenders this Note to the Company,

whereupon the Company will forthwith issue and deliver upon the order of the Holder a new Note of like tenor, registered as the Holder

(upon payment by the Holder of any applicable transfer taxes) may request, representing in the aggregate the remaining unpaid principal

amount of this Note. The Holder and any assignee, by acceptance of this Note, acknowledge and agree that, by reason of the provisions

of this paragraph, following conversion of a portion of this Note, the unpaid and unconverted principal amount of this Note represented

by this Note may be less than the amount stated on the face hereof.

(iii) Payment of Taxes. The Company shall not be required to pay any tax which may be payable in respect of any transfer involved in

the issue and delivery of shares of Series A Stock or other securities or property on conversion of this Note in a name other than that

of the Holder (or in street name), and the Company shall not be required to issue or deliver any such shares or other securities or property

unless and until the person or persons (other than the Holder or the custodian in whose street name such shares are to be held for the

Holder’s account) requesting the issuance thereof shall have paid to the Company the amount of any such tax or shall have established

to the satisfaction of the Company that such tax has been paid.

(iv) Delivery of Series A Preferred Stock Upon Conversion. Upon receipt by the Company from the Holder of a facsimile transmission or

e-mail (or other reasonable means of communication) of a Notice of Conversion meeting the requirements for conversion as provided in this

Section 3(b), the Company shall issue and deliver or cause to be issued and delivered to or upon the order of the Holder certificates

for the Series A Preferred Convertible Stock issuable upon such conversion within three (3) business days after such receipt (the “Deadline”).

(v) Obligation

of the Company to Deliver Series A Preferred Stock. Upon receipt by the Company of a Notice of Conversion, the Holder shall be deemed

to be the holder of record of the Common Stock issuable upon such conversion, the outstanding principal amount and the amount of accrued

and unpaid interest on this Note shall be reduced to reflect such conversion, and, unless the Company defaults on its obligations under

this Section 3, all rights with respect to the portion of this Note being so converted shall forthwith terminate except the right to receive

the Series A Stock or other securities, cash or other assets, as herein provided, on such conversion. If the Holder shall have given a

Notice of Conversion as provided herein, the Company’s obligation to issue and deliver the certificates for Series A Stock shall

be absolute and unconditional, irrespective of the absence of any action by the Holder to enforce the same, any waiver or consent with

respect to any provision thereof, the recovery of any judgment against any person or any action to enforce the same, any failure or delay

in the enforcement of any other obligation of the Company to the holder of record, or any setoff, counterclaim, recoupment, limitation

or termination, or any breach or alleged breach by the Holder of any obligation to the Company, and irrespective of any other circumstance

which might otherwise limit such obligation of the Company to the Holder in connection with such conversion. The Conversion Date specified

in the Notice of Conversion shall be the Conversion Date so long as the Notice of Conversion is received by the Company before 6:00 p.m.,

New York, New York time, on such date.

(4) Prepayment.

This Note may be prepaid, in whole or in part, by the Company, without the prior written consent of the Holders.

(5) Waivers,

Amendments by Holder. This Note and any provision hereof may be amended, waived or terminated only in accordance with the Exchange

Agreement.

(6) Notice.

Notices. All notices required to be given to any of the parties hereunder shall be in writing and shall be

deemed to have been sufficiently given for all purposes when presented personally to such party or sent by certified or registered mail,

return receipt requested, to such party at its address set forth below:

| The Holder: |

TheraCour Pharma, Inc

135 Wood Street Suite 200

West Haven, CT 06516 |

| |

|

| With a copy to : |

Anil R. Diwan

493 Glen Devon Road

West Haven, CT 06516 |

| |

|

| The Company: |

NanoViricides, Inc

1 Controls Drive

Shelton, CT 06484 |

| |

|

| With a copy to: |

Peter Campitiello, Esq.

McCarter& English, LLP

Two Tower Center Boulevard, 24th Floor

East Brunswick, NJ 08816 |

(7) Severability.

In the event any one or more of the provisions of this Note shall for any reason be held to be invalid, illegal or unenforceable, in whole

or in part or in any respect, or in the event that any one or more of the provisions of this Note operate or would prospectively operate

to invalidate this Note, then and in any such event, such provision(s) only shall be deemed null and void and shall not affect any other

provision of this Note and the remaining provisions of this Note shall remain operative and in full force and effect and in no way shall

be affected, prejudiced, or disturbed thereby.

(8) Transferability.

Before any proposed sale, pledge, or transfer of this Note (“Transfer”), unless there is in effect a registration statement

under the Securities Act covering the proposed Transfer, the Holder thereof shall give notice to the Company of such Holder’s intention

to effect such Transfer. Each such notice shall describe the manner and circumstances of the proposed Transfer in sufficient detail and,

if reasonably requested by the Company, shall be accompanied at such Holder’s expense by either (i) a written opinion of legal counsel

who shall, and whose legal opinion shall, be reasonably satisfactory to the Company, addressed to the Company, to the effect that the

proposed transaction may be effected without registration under the Securities Act; (ii) a “no action” letter from the U.S.

Securities and Exchange Commission (the “SEC”) to the effect that the proposed Transfer of this Note without registration

will not result in a recommendation by the staff of the SEC that action be taken with respect thereto; or (iii) any other evidence reasonably

satisfactory to counsel to the Company to the effect that the proposed Transfer of this Note may be effected without registration under

the Securities Act, whereupon the Holder of such Restricted Securities shall be entitled to Transfer the Note in accordance with the terms

of the notice given by the Holder to the Company. The Company agrees that no opinion shall be required with respect to a Transfer by a

Holder, without consideration, to any affiliate of such Holder; a Transfer by a Holder which is a partnership to a partner of such partnership

or a retired partner of such partnership or to the estate of any such partner or retired partner; or a Transfer by a Holder which is a

limited liability company to a member of such limited liability company or a retired member or to the estate of any such member or retired

member or a Transfer by a Holder which is a corporation to its stockholders, provided that the transferee in each case agrees in

writing to be subject to the terms of this Note and the Exchange Agreement (such transactions, a “Permitted Transfer”).

In the event of a Permitted Transfer, upon the receipt of the original executed copy of this Note from the Holder, the Company will promptly

issue a new Note in the name of the transferee at no charge, except for any applicable transfer taxes.

(9) Defenses.

The obligations of the Company under this Note shall not be subject to reduction, limitation, impairment, termination, defense, set-off,

counterclaim or recoupment for any reason.

(10) Attorneys’

and Collection Fees. Should the indebtedness evidenced by this Note or any part hereof be collected at law or in equity or in bankruptcy,

receivership or other court proceedings, or this Note be placed in the hands of attorneys for collection, the Company agrees to pay, in

addition to the Principal Amount and accrued interest due and payable hereon, all costs of collection, including, without limitation,

reasonable attorneys’ fees and expenses, incurred by the Holder in collecting such indebtedness or enforcing this Note.

(11) Waiver

of Presentment. The Company hereby waives presentment, demand for payment, notice of dishonor, notice of protest and all other notices

or demands in connection with the delivery, acceptance, performance or default of this Note.

(12) Governing

Law. This Note shall be governed by and construed and enforced in accordance with the laws of the State of New York, without regard

to conflict of law principles that would result in the application of any law other than the law of the State of New York.

(13) Security.

This Note shall be an unsecured obligation of the Company.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the Company

has caused this Convertible Promissory Note to be signed by its duly authorized officer.

| |

NANOVIRICIDES, INC. |

| |

|

| |

|

| |

By: |

/s/ Meeta Vyas |

| |

Name: Meeta Vyas |

| |

Title: Chief Financial Officer |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

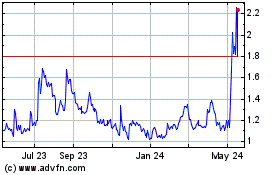

NanoViricides (AMEX:NNVC)

Historical Stock Chart

From Oct 2024 to Nov 2024

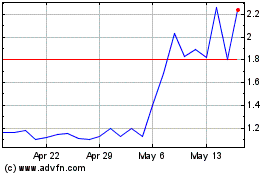

NanoViricides (AMEX:NNVC)

Historical Stock Chart

From Nov 2023 to Nov 2024