false

0001289340

0001289340

2024-05-11

2024-05-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT PURSUANT

TO SECTION

13 OR 15(D) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): May

11, 2024

STEREOTAXIS,

INC.

(Exact

Name of Registrant as Specified in Its Charter)

Delaware

(State

or Other Jurisdiction of Incorporation)

| 001-36159 |

|

94-3120386 |

| (Commission

File Number) |

|

(IRS

Employer Identification No.) |

710

North Tucker Boulevard, Suite

110, St.

Louis, Missouri |

|

63101 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(314)

678-6100

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities

registered pursuant to Section 12(b) of the Act: ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

STXS |

|

NYSE

American LLC |

Item 1.01. Entry into a Material Definitive Agreement

As previously announced, on May

11, 2024, Stereotaxis, Inc. (“Stereotaxis” or the “Company”) entered into a Share Purchase Agreement with APT

Holding Company, Inc., a Minnesota corporation (the “Seller”), to acquire (the “Acquisition”) all of the equity

interests of Access Point Technologies EP, Inc., a Minnesota corporation (“APT”). APT is a privately held company that designs,

manufactures, and commercializes a portfolio of differentiated high-quality diagnostic catheters used during cardiac ablation procedures

that are commercially available across key global geographies. The parties currently expect the Acquisition, which is subject to customary

closing conditions (summarized below), to close in the third quarter of 2024.

Pursuant

to the Share Purchase Agreement, Stereotaxis agreed to pay to Seller upfront consideration of Stereotaxis common stock subject to closing

conditions and a negative net working capital adjustment, as well as additional stock consideration pursuant to earnout provisions in

the Share Purchase Agreement. The Share Purchase Agreement specifies earnout performance targets during an earnout period ending at the

end of the calendar quarter following the fifth anniversary of the Acquisition closing date. The performance targets are based on achievement

of certain global and US revenue targets for APT Products as well as US and EU regulatory approvals of certain robotically-navigated catheters

that APT will develop. Stereotaxis is required to file a resale registration statement relating to the stock consideration and anticipates

it will cover approximately 6.1 million shares of common stock for

the estimated shares to be delivered as upfront consideration (estimated at approximately 25% of the estimated total shares in the resale

registration statement) and for potential milestone achievements (estimated at approximately 75% of the estimated total shares in the

resale registration statement) over the earnout period. The exact number of shares to be issued under the Share Purchase Agreement will

be calculated based on the average of the closing per share price of Stereotaxis common stock for each of the five trading days ending

on the second business day prior to the Acquisition closing date, and in the case of the revenue performance and regulatory milestones,

the extent to which milestones are achieved. Such contingent stock consideration, if earned, would be valued based on the value of Stereotaxis

common stock at the time(s) such commercial or regulatory milestones are achieved. The vesting of the right to receive the contingent

consideration would be accelerated in the event of a change of control of Stereotaxis, based on a probability-weighted average estimate

of the potential to achieve any remaining milestones, discounted to its net present value taking into account expected time when earnouts

related to the milestones would become payable through September 30, 2029.

The consummation of the Acquisition

is subject to certain customary closing conditions, including: (i) the approval of the Share Purchase Agreement by APT’s shareholders;

(ii) the absence of any law or judgment, order or decree enjoining, prohibiting or making illegal the consummation of the Acquisition;

(iii) the absence of a material adverse effect on APT; (iv) the representations and warranties of Seller, APT, Stereotaxis being true

and correct, subject to the materiality standards contained in the Share Purchase Agreement; (v) the Seller completing certain debt restructuring

such that APT will not have third-party loan indebtedness prior to the closing, and (vi) APT obtaining a lease extension on its principal

leased facilities in Minnesota on certain terms describe in the Share Purchase Agreement.

The Share Purchase Agreement

includes customary representations, warranties and covenants of Seller, APT and Stereotaxis for a transaction of this nature, including

covenants regarding the operation of APT’s business prior to the effective time of the Acquisition.

APT has agreed to customary

restrictions on its ability to solicit alternative acquisition proposals from third parties and engage in discussions or negotiations

with third parties regarding alternative acquisition proposals. The Share Purchase Agreement requires APT to pay Stereotaxis a termination

fee of $1.0 million in certain circumstances around a breach of such obligations and restrictions. The Share Purchase Agreement contains

certain termination rights for both the Stereotaxis and APT, including if the Acquisition is not consummated on or before an “end

date” of December 31, 2024.

Voting and Support

Agreement. Contemporaneously with the execution of the Share Purchase Agreement, Stereotaxis and certain shareholders of Seller who

collectively hold approximately 60% of the voting power of the Seller (the “APT Shareholders”) entered into a voting and support

agreement (the “Voting and Support Agreement”). Pursuant to the Voting and Support Agreement, the APT Shareholders have agreed

to, among other things, vote all of their shares in Seller that they own as of the record date for the Seller’s shareholder meeting

in favor of the adoption of the Merger Agreement.

The foregoing descriptions

of the Share Purchase Agreement and the Voting and Support Agreement do not purport to be complete and are qualified in its entirety by

reference to the full text of the Share Purchase Agreement and Voting and Support Agreement, respectively, copies of which will be filed

as exhibits to the Company’s Quarterly Report on Form 10-Q for the period ending June 30, 2024.

Item 3.02. Unregistered Sales of Equity

Securities

The information set forth above

in the first two paragraphs of Item 1.01 of this Report is incorporated by reference herein.

The issuance of shares

of Stereotaxis common stock in connection with the Acquisition will be made in accordance with the terms and subject to the conditions

set forth in the Share Purchase Agreement and in reliance on the private offering exemption of Section 4(a)(2) of the Securities Act of

1933, as amended, and/or the private offering safe harbor provision of Rule 506 of Regulation D promulgated thereunder. The issuance and

sale is not being conducted in connection with a public offering, and no public solicitation or advertisement will be made or relied upon

in connection with the issuance of the shares.

Item 5.07 Submission of Matters to a Vote of Security Holders

On May 15, 2024, the Company

held its Annual Meeting of Shareholders. A total of 82,128,762 shares of common stock were outstanding and entitled to vote, and the holders

of Series A Convertible Preferred Stock were entitled to an aggregate of 22,094,988 votes on an as-converted basis. At the Annual Meeting,

69,715,380 shares were represented, constituting a 67% quorum. Shareholders were asked to consider and act upon the following:

| |

(1) |

The election of one director as a Class II director to serve until the Company’s 2027 Annual Meeting; |

| |

|

|

| |

(2) |

A proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2024; |

| |

|

|

| |

(3) |

A proposal to

approve an amendment to the Stereotaxis, Inc. 2022 Stock Incentive Plan to increase the number of shares of common stock authorized for

issuance thereunder by 4,000,000 shares; and

|

| |

(4) |

A proposal to approve an amendment to the 2022 Employee Stock Purchase Plan to increase the number of shares of common stock authorized for issuance thereunder by 250,000 shares. |

Proposal 1, the election

of one director, was determined by a plurality of votes cast. The Board’s nominee for director was elected to serve until

the Company’s 2027 annual meeting, consistent with the proposal, or until his successor is elected and qualified, by the

votes set forth in the table below. Proposals 2, 3 and 4 each were determined by the vote of a majority of the outstanding shares entitled

to vote and present in person or represented by proxy at the meeting, and each proposal passed by the votes set forth in the applicable

table below.

| (1) |

Election of Directors: |

| Name of Nominee |

|

Votes For |

|

Votes

Withheld |

|

Broker

Non-Votes |

| David L. Fischel |

|

46,438,916 |

|

769,750 |

|

22,506,714 |

| (2) |

Proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2024: |

| Number of Votes For: | |

| 69,449,549 | |

| Number of Votes Against: | |

| 231,067 | |

| Number of Votes Abstain: | |

| 34,764 | |

| (3) |

Proposal to approve an amendment to the Stereotaxis, Inc. 2022 Stock Incentive Plan to increase the number of shares of common stock authorized for issuance thereunder by 4,000,000 shares: |

| Number of Votes For: | |

| 43,498,362 | |

| Number of Votes Against: | |

| 3,355,275 | |

| Number of Votes Abstain: | |

| 355,029 | |

| Number of Broker Non-Votes: | |

| 22,506,714 | |

| (4) |

Proposal to approve an amendment to the 2022 Employee Stock Purchase Plan to increase the number of shares of common stock authorized for issuance thereunder by 250,000 shares: |

| Number of Votes For: | |

| 45,897,897 | |

| Number of Votes Against: | |

| 962,071 | |

| Number of Votes Abstain: | |

| 348,698 | |

| Number of Broker Non-Votes: | |

| 22,506,714 | |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

STEREOTAXIS,

INC. |

| |

|

|

| Date:

May 16, 2024 |

By: |

/s/

Laura Spencer Garth |

| |

Name: |

Laura Spencer Garth |

| |

Title: |

Secretary |

v3.24.1.1.u2

Cover

|

May 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 11, 2024

|

| Entity File Number |

001-36159

|

| Entity Registrant Name |

STEREOTAXIS,

INC.

|

| Entity Central Index Key |

0001289340

|

| Entity Tax Identification Number |

94-3120386

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

710

North Tucker Boulevard

|

| Entity Address, Address Line Two |

Suite

110

|

| Entity Address, City or Town |

St.

Louis

|

| Entity Address, State or Province |

MO

|

| Entity Address, Postal Zip Code |

63101

|

| City Area Code |

(314)

|

| Local Phone Number |

678-6100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

STXS

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

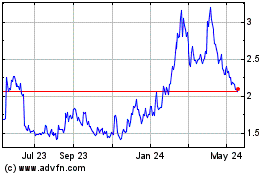

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Stereotaxis (AMEX:STXS)

Historical Stock Chart

From Mar 2024 to Mar 2025