TIDMPHE

RNS Number : 4876L

Powerhouse Energy Group PLC

06 September 2023

6 September 2023

Powerhouse Energy Group plc

("Powerhouse", "PHE", the "Group" or the "Company")

Half Year Report

Powerhouse Energy Group plc (AIM: PHE), the UK technology

company pioneering integrated technology that converts

non-recyclable waste into low carbon energy , is pleased to

announce its unaudited half year report for the six months ended 30

June 2023.

Highlights

Management and Business Strategy

-- Appointment of new Non-Executive Chairman (Antony

Gardner-Hillman) and three Non-Executive Directors (David

Hitchcock, Tony Gale and Prof. Karol Kacprzak) with Paul Emmitt as

Acting Chief Executive Officer.

-- Acquisition of the remaining portion of Engsolve shares

(51.61%) to complete the 100% ownership of Engsolve and integration

into the Powerhouse Group.

-- Announced new Business Strategy in the Annual Report to

develop revenue streams through provision of engineering services

and being actively involved in developing capital projects using

project finance methodology.

Commercial Development

-- Framework Services Agreement signed with Petrofac for

provision of engineering services on request.

-- Completed acquisition of 100% of the shareholding in Protos

Waste to Hydrogen No1 Ltd, the special purpose vehicle for the

Waste to Hydrogen development at Protos. PHE is managing the

project and working with Petrofac to finalise details prior to

procurement of plant and equipment.

-- Established representation in Northern Ireland with view to

developing capital project in Ballymena.

-- Signed heads of agreement on a joint venture with Hydrogen

Utopia International plc (LON: HUI) at Longford, replacing project

at Lanespark, Tipperary.

-- Progressing prospects in south-east Asia and Australasia.

Technology and Innovation

-- Entered into lease and took possession of self-contained

building in Bridgend, Wales for establishment of the Powerhouse

Technology Centre, expected to open in Q1 2024.

-- Feedstock Testing Unit in manufacture by Mitchell Dryers to

be installed in the Powerhouse Technology Centre. Anticipated

operational by Q1 2024.

-- European patent on temperature control in kiln formally

allowed to go forward for registration.

-- Collaboration with University of Manchester on computerised

fluid dynamics and new methods of hydrogen separation from

syngas.

Financial Performance

-- Revenues for the half year of GBPnil (H1 2022: GBP353k).

-- Gross Profit for period GBPnil (H1 2022: GBP79.9k).

-- GBP4.90m cash at bank at 30 June 2023 (30 June 2022: GBP7.54m).

-- Placing to raise GBP1m before expenses on 21 August 2023,

supplementing the Group's resources.

The Group's revenues and gross profit for the half year ended 30

June 2023 decreased compared to the same period in 2022 due to the

Company changing strategy and acquiring Engsolve Ltd (Engineering

Services Supplier) and Protos Waste to Hydrogen No.1 Ltd (Waste to

Energy Project). These acquisitions formed part of the Company's

future strategy and changed the transactions between these

companies from third party supplies and third party sales to

intragroup transactions which were therefore eliminated from the

consolidation.

Statement from Tony Gardner-Hillman, Non-Executive Chairman of

Powerhouse Energy Group Plc

"PHE took a major step forward in 2023 with a new business

strategy and a new board to deliver it whose members have committed

to the Company and are expanding its activities to secure its

future. I welcome David Hitchcock, Tony Gale and Karol Kacprzak as

new board members and thank Paul Emmitt and Hugh McAlister for

their ongoing support. I also welcome the Engsolve team and look

forward to the positive contribution they will make to PHE. Keith

Riley has just announced his resignation from the board and as

Acting CEO. My thanks to Keith were set out in the Company's

announcement on that topic on 06 September 2023.

The profit and loss statement in this half year report does not,

in my view, reflect the true trading potential of the Company.

Following the acquisition of the Protos SPV, the revenues reported

last year in servicing the Protos project have now been

internalised, and so are reported as a cost. Meanwhile the

acquisition of Engsolve occurred late in the period, so minimal

benefit from Engsolve revenues is recognised in these accounts.

Good progress has been made on the development of the Powerhouse

Technology Centre. The board held its July board meeting there. The

building is now ready, and the Feedstock Testing Unit is well into

manufacture. I look forward to the Centre being operational early

next year and believe it will become a cornerstone in PHE's ability

to promote its technology and know-how. The Centre will also help

to support the Company's investments in capital projects, which are

now moving forward in Northern Ireland and the Republic of Ireland

as well as Protos. Considerable interest in PHE's offering is also

being expressed in south-east Asia and Australia.

There is much work to be done. We need to ensure the integration

of Engsolve, and PHE must grow its presence in the provision of

engineering services as well getting other commercial projects

underway. The changes implemented during the first half of this

year will enable this to happen. We look forward to updating

investors on our progress as we continue through the year."

For more information, contact:

Powerhouse Energy Group Plc

Antony Gardner-Hillman +44 (0) 7733 146326

WH Ireland Limited (Nominated Adviser)

James Joyce

James Bavister +44 (0) 207 220 1666

Turner Pope Investments (TPI) Ltd

(Joint Broker)

Andrew Thacker

James Pope +44 (0) 203 657 0050

Tavistock (Financial PR) powerhouse@tavistock.co.uk

Simon Hudson

Nick Elwes

Heather Armstrong

About Powerhouse Energy Group plc

Powerhouse Energy has developed a proprietary process technology

- DMG(R) - which can utilise waste plastic, end-of-life-tyres, and

other waste streams to convert them efficiently and economically

into syngas from which valuable products such as chemical

precursors, hydrogen, electricity, and other industrial products

may be derived. Powerhouse's technology is one of the world's first

proven, "distributable modular generation", energy from waste

processes.

Powerhouse's process produces low levels of safe residues and

requires a small operating footprint, making it suitable for

deployment at enterprise and community level.

Powerhouse is quoted on the London Stock Exchange's AIM Market

under the ticker: PHE and is incorporated in England and Wales.

For more information see www.powerhouseenergy.co.uk

Consolidated Statement of Comprehensive Income

(Unaudited) (Unaudited) (Audited)

Group Company Company

Six Months Six Months Year

Ended ended Ended

30 June 30 June 31 Dec

Note 2023 2022 2022

GBP GBP GBP

Revenue 1 - 352,713 380,277

Cost of sales - (272,808) (295,912)

Gross Profit - 79,905 84,365

----------- ----------- ------------

Engineering Project Costs (368,154) - -

Administrative expenses (979,432) (1,050,400) (2,258,177)

Acquisition costs (31,457) - -

Share of associate 67,302 49,694 60,326

Operating loss (pre-exceptional

items) (1,311,741) (920,801) (2,113,486)

=========== =========== ============

Exceptional Items:

Exclusivity Impairment - - (500,000)

Goodwill Impairment - - (40,660,000)

Fair Value Gain on Equity Investment 2 282,150 - -

Loan Reversal 3 453,017 - (2,159,274)

(Revenue)/Engineering Impairment - - (986,392)

Operating (Loss) (post exceptional

items) (576,574) (920,801) (46,419,152)

=========== =========== ============

Net finance revenues - 21,434 65,448

(Loss) before taxation (576,574) (899,367) (46,353,704)

Income tax credit/(charge) (9,273) 155,025

(Loss) after taxation (576,574) (908,640) (46,198,679)

----------- ----------- ------------

Total comprehensive (loss) (576,574) (908,640) (46,198,679)

=========== =========== ============

Total comprehensive (loss) attributable

to:

Owners of the Company (576,574) (908,640) (46,198,679)

Non-controlling interests - - -

----------- ----------- ------------

(Loss) per share from continuing

operations (pence) 6 (0.01) (0.02) (1.17)

The figures as presented are not strictly comparable with the

prior year period as the comparative figures are non-consolidated,

with the Group only coming into effect in 2023.

The notes numbered 1 to 9 are an integral part of the half year

financial information.

Statement of Consolidated Financial Position

(Unaudited) (Unaudited) (Unaudited) (Audited)

Group Company Company Company

As at As at As at As at

30 June 30 June 30 June 31 December

Note 2023 2023 2022 2022

GBP GBP GBP GBP

ASSETS

Non-current assets

Intangible fixed assets 5 3,155,337 2,503,585 43,654,220 2,502,073

Tangible fixed assets 456,672 444,978 23,901 5,795

Investments in subsidiary undertakings 1 827,838 1 1

Investments in associated undertakings - - 179,026 187,638

Total non-current assets 3,612,010 3,776,401 43,857,148 2,695,507

------------ ------------ ------------ ------------

Current Assets

Loans receivable - - 1,925,112 -

Trade and other receivables 250,620 100,128 1,441,287 403,247

VAT Recoverable 333,223 376,380 - -

Corporation tax - - - 166,318

Cash and cash equivalents 4,897,457 4,424,877 7,536,341 5,882,897

------------ ------------ ------------ ------------

Total current assets 5,481,300 4,901,385 10,902,740 6,452,462

============ ============ ============ ============

Total assets 9,093,310 8,677,786 54,759,888 9,147,969

LIABILITIES

Current liabilities

Creditors: amounts falling due

within one year (801,221) (1,120,864) (601,186) (279,306)

Total current liabilities (801,221) (1,120,864) (601,186) (279,306)

------------ ------------ ------------ ------------

Total assets less current liabilities 8,292,089 7,556,922 54,158,702 8,868,663

------------ ------------ ------------ ------------

Creditors: amounts falling due - - - -

after more than one year

Net assets 8,292,089 7,556,922 54,158,702 8,868,663

------------ ------------ ------------ ------------

EQUITY

Shares and stock 4 22,900,856 22,900,856 22,900,856 22,900,856

Share premium 61,291,710 61,291,710 61,291,710 61,291,710

Merger relief reserve - - 36,117,711 -

Accumulated deficit (75,900,477) (76,635,644) (66,151,575) (75,323,903)

Total surplus 8,292,089 7,556,922 54,158,702 8,868,663

------------ ------------ ------------ ------------

The figures as presented are not strictly comparable with the

prior year period as the comparative figures are non-consolidated,

with the Group only coming into effect in 2023.

The notes numbered 1 to 9 are an integral part of the half year

financial information.

Consolidated Statement of Cash Flows

(Unaudited) (Unaudited) (Audited)

Group Company Company

Six months Six months Year ended

Ended Ended 31

Note 30 June 30 June December

2023 2022 2022

GBP GBP GBP

Cash flows from operating activities

Operating (loss) (576,574) (920,801) (46,419,152)

Adjustments for:

* Share based payments - (18,629) (18,629)

* Amortisation 4,810 4,810 10,263

* Depreciation 2,633 11,021 27,970

* Goodwill impairment - - 41,160,000

* Loan Impairment 3 *(453,017) 2,077,600

* Share of associate (67,302) (49,694) (49,033)

* Fair Value Gain on Equity Investment (282,150) - -

* Loan Interest Charge 3 - - 81,674

* Other none cash movements (13,635) 3,006

Changes in working capital:

- Decrease/(Increase) in trade and

other receivables (14,278) (477,639) 560,401

* Increase/(decrease) in trade and other payables 521,915 50,007 (284,475)

* Tax credits received - 155,227 166,318

Net cash used in operations (877,598) (1,245,698) (2,684,057)

=========== =========== ============

Cash flows from investing activities

Dividends received from associate - 1,935 -

Cash for investment in Engsolve (572,896) - -

Cash acquired on acquisition 466,771

Loans advanced - (737,520) (927,600)

Purchase of intangible fixed assets - (104,532) (117,838)

Purchase of tangible fixed assets (1,512) (1,830) (673)

Net cash used in investing activities (107,637) (841,947) (1,046,111)

=========== =========== ============

Cash flows from financing activities

Proceeds from issue of shares - - -

Payments of principal under leases - (12,602) (23,455)

Net finance costs (205) (872) (940)

Net cash flows used in financing

activities (205) (13,474) (24,395)

=========== =========== ============

Net (decrease) in cash and cash equivalents (985,440) (2,101,119) (3,754,563)

Cash and cash equivalents at beginning

of period 5,882,897 9,637,460 9,637,460

Cash and cash equivalents at end

of period 4,897,457 7,536,341 5,882,897

----------- ----------- ------------

The figures as presented are not strictly comparable with the

prior year period as the comparative figures are non-consolidated,

with the Group only coming to effect in 2023.

The notes numbered 1 to 9 are an integral part of the half year

financial information.

Statement of Changes in Equity

Merger

Ordinary Deferred Share premium relief Accumulated

Share capital shares account reserve deficit Total

GBP GBP GBP GBP GBP GBP

Balance at 1 Jan 2022

(audited) 19,787,071 3,113,785 61,291,710 36,117,711 (65,224,306) 55,085,971

Transactions with equity

participants:

- Shares issued on -

exercise

options - - - - -

- Shares issued on -

exercise

warrants - - - - -

- Other share issues - - - - - -

Share based payment - - - - (18,629) (18,629)

Share issue -

costs - - - - -

Total

comprehensive

loss - - - - (908,640) (908,640)

Balance at 30 June 2022

(unaudited) 19,787,071 3,113,785 61,291,710 36,117,711 (66,151,575) 54,158,702

Transactions with equity

participants:

- Shares -

issued on

exercise

options - - - - -

Share based payment - - - - - -

Reserve transfer -

goodwill

impairment (36,117,711) 36,117,711 -

Total comprehensive loss - - - - (45,290,039) (45,290,039)

Balance at 31 Dec 2022

(audited) 19,787,071 3,113,785 61,291,710 - (75,323,903) 8,868,663

Share based payment - - - - - -

Total comprehensive (loss) - - - - (576,574) (576,574)

Balance at 30 June 2023

(unaudited) 19,787,071 3,113,785 61,291,710 - (75,900,477) 8,292,089

The following describes the nature and purpose of each reserve

within equity:

Deferred shares: Represents the combined total of all deferred

shares (0.5p, 4p and 4.5p).

Share premium: Amount subscribed for share capital in excess of

nominal value.

Merger relief reserve: Amount subscribed for share capital in

excess of nominal value where merger relief applies.

Accumulated deficit: Accumulated deficit represents the

cumulative losses of the Company and all other net gains and losses

and transactions with shareholders not recognised elsewhere.

The notes numbered 1 to 9 are an integral part of the half year

financial information.

Notes (forming part of the half year Group financial

information)

1. Summary of significant accounting policies

The following accounting policies have been applied consistently

in dealing with items which are considered material in relation to

the financial information.

1.1. Basis of preparation

This half year consolidated financial information is for the six

months ended 30 June 2023 and has been prepared in accordance with

International Accounting Standard 34 "Interim Financial

Statements". The accounting policies applied are consistent with

International Financial Reporting Standards ("IFRS") issued by the

International Accounting Standards Board (IASB) as adopted for use

in the United Kingdom and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS (except as

otherwise stated). The accounting policies and methods of

computation used in the half year financial information are

consistent with those of the previous financial year and

corresponding half year reporting period (save that, as mentioned

above, prior year comparative figures are non-consolidated, with

the Group only coming to effect in 2023) and with those expected to

be applied for the year ending 31 December 2023.

The Group d oes not consider any new and amended standards that

became applicable for the current reporting period to have any

impact on the Groups results.

The unaudited results for period ended 30 June 2023 do not

constitute statutory accounts within the meaning of Section 435 of

the Companies Act 2006. The comparative figures for the period

ended 31 December 2022 for the Company are extracted from the

audited financial statements which contained an unqualified audit

report and did not contain statements under Sections 498 to 502 of

the Companies Act 2006.

This half year financial statement will be, in accordance with

the AIM Rules for Companies, available shortly on the Company's

website.

As the Group did not come into existence until the current

period it should be noted that comparatives are for Company only.

Details on types of investment are in Note 1.4 below.

1.2. Going concern

The Directors have considered all available information about

future events when considering going concern. The Directors have

prepared and reviewed cash flow forecasts for 12 months following

the date of these Financial Statements. The projections show that

the Group will have sufficient funding to be able to continue as a

going concern on the basis of its cash balances as at 30 June

2023.

The half year financial statements do not include the

adjustments that would result if the Group were unable to continue

as a going concern.

1.3. Functional and presentational currency

This half year financial information is presented in GBP

sterling which is the Group's functional currency.

1.4. Fixed asset investments

Interests in subsidiaries, associates and jointly controlled

entities are initially measured at cost and subsequently measured

at cost less any accumulated impairment losses. The investments are

assessed for impairment at each reporting date and any impairment

losses or reversals of impairment losses are recognised immediately

in the profit and loss account.

A subsidiary is an entity controlled by the company. Control is

the power to govern the financial and operating policies of the

entity so as to obtain benefits from its activities.

An associate is an entity, being neither a subsidiary nor a

joint venture, in which the Company holds a long-term interest and

where the company has significant influence. The company considers

that it has significant influence where it has the power to

participate in the financial and operating decisions of the

associate.

Entities in which the Company has a long-term interest and

shares control under a contractual arrangement are classified as

jointly controlled entities.

1.5. Revenue

The Group provides engineering services for the application of

the DMG technology, the intellectual property that the Group owns.

Revenue from providing services is recognised in the accounting

period in which services are rendered. For fixed-price contracts,

revenue is recognised based on the actual service provided to the

end of the reporting period as a proportion of the total services

to be provided to the extent to which the customer receives the

benefits. This is determined based on the actual labour hours spent

relative to the total expected labour hours.

Where a contract includes multiple performance obligations as

specified by the work scope, the transaction price will be

allocated to each performance obligation based on the estimated

expected cost-plus margin.

Estimates of revenues, costs, or extent of progress toward

completion of services are revised if circumstances change. Any

resulting increases or decreases in estimated revenues or costs are

reflected in profit or loss in the period in which the

circumstances that give rise to the revision become known by

management.

In the case of fixed-price contracts, the customer pays the

fixed amount based on a payment schedule. If the services rendered

by the Group exceed the payment, a contract asset is recognised. If

the payments exceed the services rendered, a contact liability is

recognised.

If a contract includes an hourly fee, revenue is recognised in

the amount to which the Group has a right to invoice.

2. FAIR VALUE GAIN ON EQUITY INVESTMENT

On 12 August 2021, the Company acquired a 48.39% interest in

Engsolve Limited, an engineering consultancy company incorporated

and operating in England and Wales. On 21 June 2023, the Company

completed the acquisition of the balance of the issued share

capital of Engsolve (51.61%). The previous shareholding in Engsolve

(48.39%) was subsequently revalued leading to a fair value gain of

GBP282,150 on the original shareholding. Please refer to note 8

below.

3. impairment of INTER Company loans & transactions

Prior to December 2022 the Company entered into transactions

with Protos to provide funding via a loan facility with the balance

at 31 December of GBP2,159,274 and also made sales to Protos of

GBP986,392. It was determined by the Company on 31 December 2022

that these amounts were no longer recoverable and were therefore

written off within the Company. The write off of the loan

facilities has been recognised against capitalised development

expenditure in the sum of GBP2,692,649. The remaining GBP453,017

has been written off to the profit and loss account in the

consolidated financial statements. This write off was to reflect

the impairment of the transactions with the understanding of the

fact that the impairment maybe unwound should Protos achieve

sufficient results to be able to repay the loan and sales.

4. SHARE CAPITAL

0.5 p Ordinary 0.5p Deferred 4.5 p Deferred 4.0 p Deferred

shares shares shares shares

Balance at 1 January 2023 3,957,414,135 388,496,747 17,373,523 9,737,353

Shares issued - - - -

---------------- ---------------------- -------------- --------------

Balance at 30 June 2023 3,957,414,135 388,496,747 17,373,523 9,737,353

---------------- ---------------------- -------------- --------------

The deferred shares have no voting rights and do not carry any

entitlement to attend general meetings of the Company. They carry

only a right to participate in any return of capital once an amount

of GBP100 has been paid in respect of each ordinary share. The

Company is authorised at any time to effect a transfer of the

deferred shares without reference to the holders thereof and for no

consideration.

5. INTANgible Assets

Intangible assets in the period increased due to GBP651,752 of

goodwill being generated from the combination of the Group

including Protos and Engsolve. Please refer to note 8 below.

6. (Loss) per share

(Unaudited) (Unaudited) (Audited)

As at As at As at

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

Total comprehensive (loss) (576,574) (908,640) (46,198,679)

Weighted average number of

shares 3,957,414,135 3,957,414,135 3,957,414,135

Basic loss per share in pence (0.01) (0.02) (1.17)

Diluted loss per share in pence (0.01) (0.02) (1.17)

7. SHARE BASED PAYMENTS

The expense recognised for share-based payments during the year

is shown in the following table:

(Unaudited) (Unaudited) (Audited)

As at As at As at

30 June 30 June 31 December

2023 2022 2022

GBP GBP GBP

Share based payment charge/(credit)

recognised in Income Statement

Expense arising from equity-settled share-based

payment transactions:

- Share options for Directors and employees - (18,629) (18,629)

Total share-based payment in Income Statement - (18,629) (18,629)

Share based payment charge recognised

in Share Premium

- Warrants for third party services - - -

------------ ----------- ------------

Total share-based payment in Share Premium - - -

Account

Total share-based payment charges/(credits)

recognised - (18,629) (18,629)

Other share-based payment movements

Exercise of options by Directors and - - -

employees

Exercise of warrants for third party - - -

services

------------ ----------- ------------

Total share-based payment - (18,629) (18,629)

------------ ----------- ------------

The were no liabilities recognised in relation to share based

payment transactions.

8. acquisitions During THE REPORTING PERIOD

The Company announced on 28 April 2023 that it had acquired full

ownership of Protos Plastics to Hydrogen No.1 Ltd from Peel NRE Ltd

for a nominal payment of GBP1. Protos Plastics to Hydrogen No. 1

Limited is a special purpose vehicle and owner of the development

of the Protos plant, the first proposed commercial application of

the Company's DMG(TM) technology. The acquisition of Protos

generated goodwill of GBP64,326 and net liabilities of

GBP64,325.

Details of the transaction:

Non-Current Assets: Book Value Fair Value

Goodwill 64,326

Property Plant & Equipment 2,692,649

Current Assets:

Bank 5,787 5,787

Other Debtors - VAT 412,634 412,634

Current Liabilities:

Loans (3,145,666) 0

Creditors (29,729) (29,729)

Total Value of assets acquired (64,325) 453,018

Cash flows

Cash Consideration to old owners GBP1

On 12 August 2021, the Company acquired a 48.39% interest in

Engsolve Limited, an engineering consultancy company incorporated

and operating in the UK. On 21 June 2023, the Company completed the

acquisition of the entire outstanding share capital of Engsolve

(51.61%) for a cash consideration of GBP572,896. The previous

shareholding in Engsolve was subsequently revalued leading to a

fair value gain on the original shareholding of GBP282,150. On

acquisition the Company acquired net assets of GBP522,560. The

goodwill generated on acquisition amounted to GBP587,426. The

Company considers this as a strategic acquisition as it brings

engineering expertise in-house and enables the Company to generate

a regular income stream through the provision and development of

engineering services into the UK market.

The investment of GBP827,838 on the Company's stand-alone

Balance Sheet includes the cost of the original investment in

Engsolve of GBP99,990, share of profits to 30 June 2023 of

GBP156,887, less dividends of GBP1,935 plus the cash consideration

for the acquisition of the outstanding shares in Engsolve of

GBP572,896.

Details of the transaction:

Non-Current Assets: Book Value Fair Value

Goodwill 587,426

Property, Plant & Equipment 11,694 11,694

Current Assets:

Bank 466,793 466,793

Other Debtors 150,492 150,492

Current Liabilities:

Creditors (106,419) (106,419)

Total Value of assets acquired 522,560 1,109,986

Cash flows

Cash Consideration to old owners GBP572,896

9. EVENTS AFTER THE REPORTING PERIOD

On 21 August 2023, the Company raised GBP1 million, before

expenses, through a placing at a price of 0.5p per share ("Issue

Price") (the "Placing"). The Placing was arranged by the Company's

broker, Turner Pope Investments (TPI) Ltd ("TPI").

A total of 200,000,000 new Ordinary Shares of 0.5p each in the

capital of the Company ("Ordinary Shares") was placed by TPI at the

Issue Price with clients of TPI. TPI received 8,000,000 new

Ordinary Shares by way of remuneration, having elected to receive

Ordinary Shares at the Issue Price instead of cash in respect of

certain professional fees.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DXGDCDUGDGXU

(END) Dow Jones Newswires

September 06, 2023 02:05 ET (06:05 GMT)

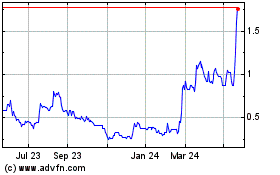

PowerHouse Energy (AQSE:PHE.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

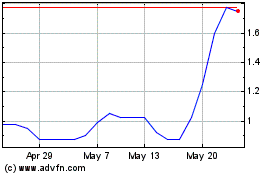

PowerHouse Energy (AQSE:PHE.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025