Australia Stocks May Recover After Near-15% Decline Last Year

03 January 2012 - 6:09PM

Dow Jones News

Australian shares sank more than European stocks last year, but

investors say they could be headed for a revival as interest rate

cuts get consumers spending and a global economic recovery

intensifies.

The benchmark S&P/ASX 200 completed the first consecutive

annual decline in its 20-year history in 2011 as domestic and

global headwinds shattered local investor confidence. Its near-15%

slump to end the year at 4056.6 was greater than the 11% fall in

the Stoxx Europe 600 Index, which was weighed down by that region's

sovereign debt crisis. In the U.S., the S&P 500 was virtually

unchanged.

"Australian stocks are looking very cheap right now," said Shane

Oliver, head of investment strategy at AMP Capital Investors, who

helps manage close to US$100 billion from Sydney. "The market

should recover next year as it becomes clear the global economy

isn't going into free fall, and as rate cuts in Australia reach a

critical mass."

In addition to Europe's problems, Australian investors' faith in

a global recovery was hurt by patchy U.S. economic data, several

natural disasters, and tighter monetary policy in China, the

destination for much of Australia's raw-materials exports.

At home, manufacturers were hit by a surging Australian dollar,

while retailers and banks struggled as the country's interest

rates, still among the highest in the developed world, crimped

consumer spending.

In August, the S&P/ASX 200 entered what some investors call

a bear market after Standard & Poor's cut the U.S. credit

rating. That news rocked markets globally, although U.S. shares

have held up on optimism an economic recovery there is intact.

While Australian shares may struggle early in 2012 as some of

last year's issues continue to play out, the market should recover

in the latter half as a global recovery is confirmed, investors

say.

There are already signs growth is picking up--a survey Tuesday

showed Australian manufacturing expanding for the first time in six

months, while earlier German and Chinese factory output reports

beat economists' estimates.

On the Sydney bourse, BHP Billiton Ltd. (BHP) and Rio Tinto PLC

(RIO) tumbled 24% and 29% in 2011, respectively, on concerns

commodities demand will wane as austerity programs leave European

nations cash-strapped. The mining giants also suffered from

speculation China's anti-inflation policies may lead to a hard

landing for its economy.

Australia's central bank in December cut interest rates for the

second straight month citing concern over the fall-out from

Europe's crisis, although worry about a Chinese slowdown

lessened.

Australian manufacturers suffered last year as the dollar

hovered near parity with the U.S. currency after a near-40% gain

since 2008. BlueScope Steel Ltd. (BSL.AU) dropped 79%, while

Cochlear Ltd. (COH.AU), which sells hearing implants overseas, lost

almost a quarter of its value.

Companies with a heavy U.S. presence--including James Hardie

Industries SE (JHX.AU) and Brambles Ltd. (BXB.AU)--were among the

few to climb as that nation's economic prospects looked like

improving in the June-December period.

While the order of declines was less than in the resources

sector, financial shares--including Westpac Banking Corp. (WBC.AU)

and National Australia Bank Ltd. (NAB.AU)--retreated as the

nation's high interest rates encouraged people to save.

That had a knock-on effect on retailers such as JB Hi-Fi Ltd.

(JBH.AU) and Billabong International Ltd. (BBG.AU)--both of which

issued profit warnings recently. JB Hi-Fi lost 37% of its value in

2011, while Billabong shed close to 78%.

"Rather than progressive improvements in economic conditions, as

most anticipated, we saw an intensification of the economic

headwinds in 2011," says Angus Gluskie, managing director of White

Funds Management in Sydney.

Still, last year's drop pales in comparison with the S&P/ASX

200 index's 41% decline in 2008 in the midst of the credit crisis.

The benchmark gauge recovered 31% in 2009 as governments pumped

money to stimulate their economies.

-By Shani Raja, Dow Jones Newswires; +61-2-82724683; shani.raja@dowjones.com

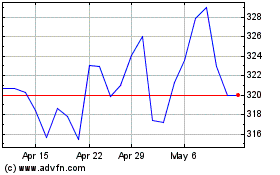

Cochlear (ASX:COH)

Historical Stock Chart

From Apr 2024 to May 2024

Cochlear (ASX:COH)

Historical Stock Chart

From May 2023 to May 2024