Vale, Fortescue Plan Tie-Up on Iron Ore -- Update

08 March 2016 - 11:10AM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Brazil's Vale SA may buy shares in Fortescue Metals

Group Ltd. and invest in new or existing mines with the Australian

company, under a broad alliance that ties two of the world's

largest producers of iron ore.

After roughly a year of talks, the companies said they have

signed a pact that will open the door to Vale buying a minority

stake of up to 15% in Fortescue on market and will include

negotiations on new joint mining projects or investments by Vale in

Fortescue's existing pits in remote northwest Australia.

The companies said they will also look at setting up ventures to

blend the ore they each produce to sell to customers in China, the

world's biggest buyer of iron ore. Iron ore is the main ingredient

in steelmaking.

Vale said the tie-up is designed "to pursue long-term

opportunities to enhance competitiveness" of the companies

operations.

The iron-ore sector has been grappling with a sharp downturn in

iron-ore prices over the past few years, with a decade low below

US$40 a ton hit in December versus a high above US$190 a ton in

early 2011. Spot prices did spike on Monday, however, rising a

record 20% as confidence in China's economic outlook improved.

Vale and Fortescue are two of the world's largest iron-ore

exporters, along with Anglo-Australian miners BHP Billiton Ltd. and

Rio Tinto PLC.

Fortescue Chief Executive Nev Power on Tuesday denied the deal

was about wresting customers away from BHP and Rio, the most

profitable producers in the sector.

"This is about creating a long-term constructive relationship

between the two companies," said Mr. Power. "This is not any

strategy to try and exert control over the market."

He said the alliance would help Fortescue reduce its operating

costs and "provide value to Vale and allow them to start

diversifying their investments outside of Brazil."

Plans for Vale to buy up to a 15% stake in Fortescue, which has

a market value of roughly 9.59 billion Australian dollars (US$7.15

billion), has no time frame and isn't viewed as a precursor to a

full takeover, Mr. Power said.

The companies hope to start blending their ores within the next

six months, said Mr. Power, who estimated the pair could blend up

to 80 to 100 million metric tons of ore combined to sell to Chinese

steel mills. The timing for other proposed investments in mines or

new projects is uncertain, he said.

The agreement is a nonbinding memorandum of understanding that

still needs to be approved by both boards and regulators, the

companies said.

"The memorandum of understanding is one more important step

towards optimizing Vale's supply-chain, creating new platforms for

future mine development and offering a new world-class alternative

product to the Chinese steel industry," Peter Poppinga, Vale's

executive director for ferrous minerals, said in a statement. "We

are looking more than 10 years ahead."

Mr. Power, who said he couldn't recall which company initiated

the talks, said that details of the various components of the pact

are still being worked out.

The companies have held some early discussions with regulators

about their plans, he said. "We wanted to announce this to the

market to ensure there was full transparency," Mr. Power said on a

call with reporters.

Shares in Fortescue jumped by 24% on Monday, their biggest daily

rise since 2008, to a 16-month high.

Mr. Power said he didn't think news of the agreement had been

leaked, attributing the spike to a rally in iron-ore prices, which

surged roughly 20% on Monday.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

March 07, 2016 18:55 ET (23:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

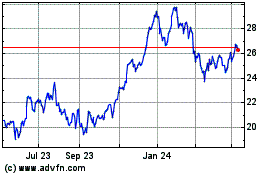

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024