2nd UPDATE: National Australia Bank Revives AXA Asia Pacific Bid

09 August 2010 - 8:29PM

Dow Jones News

National Australia Bank Ltd. (NAB.AU) revived its A$13.3 billion

bid for wealth manager AXA Asia Pacific Holdings Ltd. (AXA.AU)

Monday with undertakings to on-sell the target's innovative retail

investment platform North, prompting Australia's competition

regulator to re-open its investigation of the deal.

The complex plan by Australia's fourth largest bank by market

capitalization to sell North to wealth management rival IOOF

Holdings Ltd. (IFL.AU), and provide support to the fledgling

product for at least three more years, will now be scrutinised by

the Australian Competition and Consumer Commission to see if it

overcomes the regulator's objections.

The ACCC on April 19 rejected NAB's plan to buy the

majority-owned unit of French insurer AXA SA (AXAHY), arguing the

biggest deal in Australia's financial services history would crimp

competition in the market for supply of retail investment

platforms, internet portals that link retail investors with the

wide range of investment products that fund management companies

provide.

"The ACCC now seeks views from market participants to assist its

consideration of the undertakings and of IOOF as a proposed

purchaser, and to determine whether the proposed divestiture would

be likely to alleviate the ACCC's competition concerns," the

regulator said in a statement.

The news raised hopes NAB's stalled deal, which has the support

of both AXA APH's independent directors and AXA SA, might go ahead.

Both AXA APH and IOOF shares rose, outperforming NAB whose gains

were limited by concerns it would be paying too much, or perhaps

conceding too much, in pursuing the deal. AXA APH closed up 28

cents, or 5.4%, at A$5.49 while IOOF finished 27 cents, or 4.1%,

firmer at A$6.85. NAB ended up 2 cents, or 0.1%, at A$25.05.

NAB said the sale of North to IOOF and a range of undertakings

relating to the continued supply of customers, funding for planned

software and product enhancements and non-compete clauses running

for three years were designed to address the ACCC concerns.

"NAB has listened to the ACCC's concerns and taken them into

account in developing the divestment proposal," said NAB's head of

its wealth management operations, Steve Tucker, in a statement.

"IOOF is a substantial and experienced platform operator and NAB

believes that it will be a capable manager of the North investment

platform business."

The undertakings, conditional on the AXA APH takeover deal

proceeding, include an arrangement to ensure IOOF access to the

"Bluedoor" software from U.S. software developer DST Systems Inc.

(DST) that underpins the platform. They also include an arrangement

to fund existing planned enhancements to the software to support an

expanded range of functions. These functions include the provision

of model portfolios, term deposits and a direct equities

capability.

IOOF will also exclusively provide platform administration

services to AXA APH for the North products for at least three years

after the planned enhancements to the platform, which currently

holds around A$1.4 billion in funds under administration.

IOOF didn't disclose the purchase price for North, but said the

financial effect of the deal is "not material," and is expected to

be immediately accretive to its per share earnings.

The ACCC said it has commenced market consultation on the

undertakings by NAB and will take public submissions until Aug. 23

ahead of an expected decision on Sept. 9.

AXA APH said that as a result of the ACCC's statement it had

agreed with NAB to extend the deadline for the deal to close of

business on Sept. 9.

Under NAB's proposal, 55% owner AXA SA would retain the Asian

assets of AXA APH, while minority shareholders would be given the

choice between A$6.43, or 0.1745 NAB share and A$1.59 for each of

their shares in the target.

The developments continued to sideline wealth management and

life insurance firm AMP Ltd. (AMP.AU) who's November cash and scrip

offer of 0.6896 of its own shares and A$1.92 for each AXA APH share

was trumped by NAB. Its shares were 11 cents or 2% firmer at

A$5.53.

-By Bill Lindsay, Dow Jones Newswires; 61-2-8272-4694;

bill.lindsay@dowjones.com

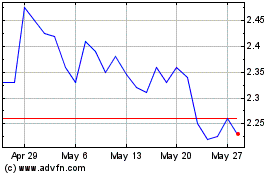

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Feb 2024 to Feb 2025