Rio Tinto First-Half Earnings, Dividend Fall on Weaker Commodity Prices -- Update

26 July 2023 - 8:11PM

Dow Jones News

By Rhiannon Hoyle

Mining giant Rio Tinto reported a 43% drop in first-half net

profit and pared its payout to shareholders, reflecting a fall in

commodity prices as China's economic recovery faltered.

The world's second-biggest miner by market value on Wednesday

said it made a net profit of $5.12 billion in the six months

through June, down from $8.94 billion a year earlier.

Underlying earnings totaled $5.72 billion, compared with $8.66

billion in the first half of 2022, as prices of aluminum, copper

and, most importantly, iron ore--which accounts for the majority of

Rio Tinto's profits--declined.

It is the company's lowest first-half underlying earnings since

2020, after which commodity prices surged on government stimulus

programs in response to the Covid-19 pandemic. Analysts had

expected first-half underlying earnings of roughly $5.85 billion,

according to 11 forecasts compiled by Visible Alpha.

Directors of Rio Tinto declared an interim dividend of $1.77 a

share, which the miner said was equal to 50% of underlying

earnings, in line with its policy and typical midyear payouts in

recent years. A year ago, Rio Tinto paid out $2.67 a share, also

50% of underlying earnings.

A postpandemic surge in Chinese metals demand predicted by some

miners and traders hasn't materialized, as consumers refrain from

spending and exports slump.

An ongoing downturn in the country's property sector, a big

buyer of industrial metals, has weighed on the economy, which

barely grew in the second quarter from the first quarter. Earlier

this week, one of China's top decision-making bodies signaled plans

to boost the ailing sector, helping to drive up prices of metals

and stocks of miners, including Rio Tinto.

"We are of course deeply engrained in the Chinese economy, it's

our biggest market," said Jakob Stausholm, the miner's chief

executive.

He said he is cautiously optimistic about the outlook for

China's economy. "For sure they have some challenges, but in the

past they have had that and they have managed that well," he told

reporters.

The Anglo-Australian miner makes most of its money from the vast

iron-ore mining operations it runs in remote northwest Australia.

As steel's main ingredient, iron ore is one of the world's

most-traded commodities, and Rio Tinto is the top producer

alongside Brazil's Vale.

While shipments from those Australian operations were 7% higher

in the first half versus a year earlier, the average price Rio

Tinto was paid for that iron ore was 11% lower year over year.

In addition to China's sluggish economic growth, global exports

of iron ore have been strong, with shipments from dominant global

suppliers Australia and Brazil recently estimated to be at or close

to all-time highs, Rio Tinto said last week.

Weaker aluminum prices outweighed Rio Tinto's increased output

of that commodity, too. While the company produced 9% more aluminum

during the period year over year, it was paid 25% less per metric

ton.

"That was the absolute major factor that drove our Ebitda down

period on period," Chief Financial Officer Peter Cunningham said of

the impact of commodity prices on earnings.

Rio Tinto is increasing spending on deals and projects to grow

its production, especially of commodities needed for an energy

transition including a rapid take-up of electric vehicles. That

includes an expansion of copper-mining operations in the U.S. and

in Mongolia, where it says its Oyu Tolgoi business is set to become

the world's fourth-largest copper mine by 2030.

"Rio Tinto has not grown a lot over a decade but actually, this

first half, you really see evidence of profitable growth,"

Stausholm said.

The miner on Wednesday said a test plant at its Rincon lithium

project in Argentina will cost more than previously anticipated,

raising its capital estimate to $335 million from $140 million

previously.

"We were pretty clear when we took over Rincon that we wanted to

go fast," said Stausholm. "We jumped a few steps on its way and

probably didn't do enough engineering," but the miner has also

learned lessons it can use on the full-scale development, he

said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

July 26, 2023 05:56 ET (09:56 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

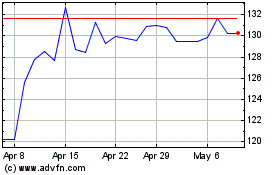

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

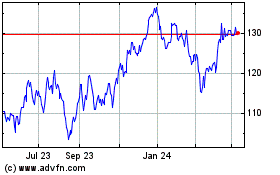

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024