Discover Signs Agreement to Help Expand Acceptance of Sezzle’s Buy Now, Pay Later Feature

18 February 2021 - 11:00PM

Business Wire

Sezzle will now have the opportunity to work

with merchants that accept Discover

Discover, a digital banking and payments services company, and

Sezzle, Inc. (ASX:SZL), an installment payment platform, have

announced an agreement that will allow Sezzle to work with selected

merchants on the Discover Global Network in offering consumers

additional payment options.

This relationship is Discover Global Network’s latest

partnership in the buy now, pay later space and Sezzle’s latest

partnership with one of the four major card networks in the US

market. Select US merchants will be able to offer their customers

an interest-free buy now, pay later option through Sezzle’s

platform, with little to no upgrades to their existing payments

systems. These merchants will have the option to process buy now,

pay later transactions on the Discover Global Network.

“Our partnership with Discover will help to further accelerate

our business development efforts by connecting our team with

Discover and its established relationships,” said Paul Paradis, an

Executive Director and the President of Sezzle.

“Our merchant partners are always a top priority and we know

that providing them with additional payment options, such as a buy

now, pay later structure, can be beneficial, especially in the

current economic environment,” said Jason Hanson, senior vice

president of global business development and acceptance at

Discover. “We are able to leverage our unique technology

capabilities and vast network of merchant relationships to provide

Sezzle the ability to grow its business and provide new payment

opportunities.”

Discover Global Network has more than 48 million merchant

acceptance locations and two million ATM and cash access locations

around the world. Discover is accepted by 99% of places that take

credit cards in the United States.* The Discover Global Network

includes Discover Network, Diners Club International, PULSE and

more than 20 alliance partner networks across the globe. To learn

more about merchant solutions visit:

https://www.discoverglobalnetwork.com

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company issues the Discover card, America's cash rewards

pioneer, and offers private student loans, personal loans, home

loans, checking and savings accounts and certificates of deposit

through its banking business. It operates the Discover Global

Network comprised of Discover Network, with millions of merchant

and cash access locations; PULSE, one of the nation's leading

ATM/debit networks; and Diners Club International, a global

payments network with acceptance around the world. For more

information, visit www.discover.com/company.

About Sezzle, Inc.

Sezzle is a rapidly growing fintech company, on a mission to

financially empower the next generation. Sezzle’s payment platform

increases the purchasing power for more than 2.2 million active

consumers, by offering interest-free installment plans at online

stores and select in-store locations. Sezzle’s transparent,

inclusive, and seamless payment option allows consumers to take

control over the spending, be more responsible, and gain access to

financial freedom. When consumers apply, approval is instant, and

their credit scores are not impacted, unless the consumer elects to

opt in to credit reporting via a credit building feature called

Sezzle Up.

This increase in purchasing power for consumers leads to

increased sales and basket sizes for the more than 26,000 active

merchants that offer Sezzle.

For more information visit sezzle.com.

Sezzle’s CDIs are issued in reliance on the exemption from

registration contained in Regulation S of the US Securities Act of

1933 (Securities Act) for offers of securities which are made

outside the US. Accordingly, the CDIs, have not been, and will not

be, registered under the Securities Act or the laws of any state or

other jurisdiction in the US. As a result of relying on the

Regulation S exemption, the CDIs are ‘restricted securities’ under

Rule 144 of the Securities Act. This means that you are unable to

sell the CDIs into the US or to a US person who is not a QIB for

the foreseeable future except in very limited circumstances until

after the end of the restricted period, unless the re-sale of the

CDIs is registered under the Securities Act or an exemption is

available. To enforce the above transfer restrictions, all CDIs

issued bear a FOR Financial Product designation on the ASX. This

designation restricts any CDIs from being sold on ASX to US persons

excluding QIBs. However, you are still able to freely transfer your

CDIs on ASX to any person other than a US person who is not a QIB.

In addition, hedging transactions with regard to the CDIs may only

be conducted in accordance with the Securities Act.

If you are interested in learning more about Sezzle consumer

habits and buying patterns amid COVID-19, contact Sezzle media.

Merchants and retailers interested in learning more about Sezzle

can learn more here. Customers interested in signing up to use

Sezzle can learn more here.

*According to the Feb 2020 issue of the Nilson Report

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210218005111/en/

Media Contact Sarah Grage

Silberman Discover 224-405-6029 Sarahgragesilberman@discover.com

@Discover_News

Sezzle Media Contact: Erin Foran Tel: (651) 403-2184 Email:

erin.foran@sezzle.com

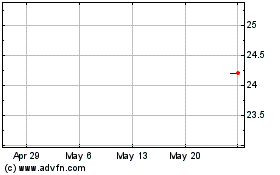

Sezzle (ASX:SZL)

Historical Stock Chart

From Feb 2025 to Mar 2025

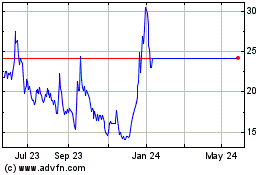

Sezzle (ASX:SZL)

Historical Stock Chart

From Mar 2024 to Mar 2025