European Regulators Weigh State Aid for Troubled Banks

28 September 2016 - 9:30PM

Dow Jones News

LONDON—European regulators are open to using public funds to

help clean up toxic assets weighing on bank balance sheets and

hampering lending in the bloc's struggling economy.

"I think the authorities should consider whether, if the process

is not going fast enough, whether state aid could be part of the

ingredients to accelerate this process," Andrea Enria, chairman of

the European Banking Authority, said Wednesday at a Wall Street

Journal Financial Regulation Pro event here.

Mr. Enria's comments came as investor worries are mounting about

the health of leading banks in Italy and Germany in particular,

prompting speculation about whether government assistance might

play a role, despite strict postcrisis continental rules intending

to limit bailouts. Shares in Deutsche Bank AG have plunged over

fears that a threatened American fine in a mortgage-securities

probe could strain its capital levels, while Italy's Banca Monte

dei Paschi di Siena SpA is struggling to complete a private

recapitalization plan.

European law "does not exclude the possibility of state aid,"

said Mr. Enria, whose agency monitors the health of European banks.

"First of all," he stressed, "it says that before getting to state

aid you need to have private investors of course paying their fair

share of the price." But, he added, "there are conditions to have

state aid, and there are also situations in which state aid can be

say used in case of systemic events. There are rules to do that and

I think that these rules should be applied."

European policy is now structured to favor investor "bail-ins"

as opposed to taxpayer "bailouts"—that is, to force investors to

absorb losses before turning to public funds.

But the politics of "bail-in" have proved complicated,

particularly in Italy, where household investors own a large

portion of banking debt, having been sold the instruments with the

promise that they were virtually as safe as deposits.

"Bail-in is a very intrusive tool—it's a mighty weapon," said

Joanne Kellerman, a member of the Single Resolution Board, the

newly created agency in charge of writing resolution plans and

winding down a bank in case it is failing or likely to fail.

Ms. Kellermann, who was on the panel with Mr. Enria, added that

"if there are issues with a large number of bail-in able securities

being held by private investors, that is something to be addressed,

especially if those securities were sold under a false pretense"—as

some in Italy have alleged.

She didn't specify how she thought those issues should be

addressed.

(END) Dow Jones Newswires

September 28, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

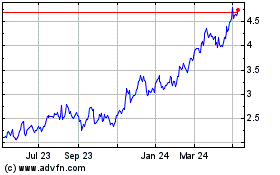

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Mar 2024 to May 2024

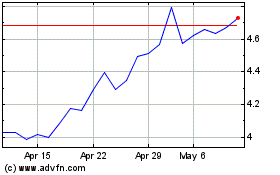

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From May 2023 to May 2024