Bitcoin Holds Ground At $65,700 Amid Unchanged Fed Rates, Anticipating September Moves

01 August 2024 - 5:00PM

NEWSBTC

In the wake of the highly anticipated address by Federal Reserve

Chair Jerome Powell, Bitcoin (BTC) maintained a steady course on

Wednesday as the Fed opted to keep interest rates unchanged at

5.25%-5.50%. Crypto Market Awaits Fed’s Next Move Powell,

speaking at a press conference in Washington DC, hinted at the

possibility of rate reductions in September, contingent upon the

economic performance in the weeks leading up to that month. “We’ve

made no decisions about future meetings and that includes the

September meeting,” Powell stated. “We’re getting closer to the

point at which we’ll reduce our policy rate, but we’re not quite at

that point yet.” Related Reading: This PEPE Holder Cohort Is The

Reason Price Is Struggling To Reclaim $0.00002 In response to the

Fed’s stance, crypto analysts weighed in on the implications for

the digital currency space, with Michael van de Poppe, founder of

MN Capital, expressing optimism over Powell’s “dovish outlook,”

suggesting that a September rate cut remains a strong

possibility. In his social media post, Van de Poppe expressed

confidence that this development bodes well for both Bitcoin and

altcoins, with an eye on the upcoming decision expected in

September. Similarly, another analyst, Daan Crypto Trades,

underscored Powell’s indication of a potential rate cut in

September, projecting a high likelihood of its realization unless

significant deviations occur following Consumer Price Index (CPI)

readings. With 48 days remaining until the September meeting,

Daan Crypto Trades proposed that market dynamics may revolve around

this impending decision, potentially giving rise to short-term

fluctuations after the initial rate adjustment in September.

Bitcoin To Hit $1 Million In 2028? In a recent social media post,

Timothy Peterson, a Bitcoin writer and researcher, unveiled a

significant prediction for the largest cryptocurrency on the market

that, if it holds true in time, could result in BTC’s price

reaching unprecedented highs. According to Peterson, the

Bitcoin price is directly and exponentially proportional to the

square root of the number of Halvings that the network has

undergone. In other words, the amount of new BTC introduced into

circulation is cut in half approximately every four years, a

process known as a Halving. “A combination of adoption curve math

and Metcalfe’s Law puts Bitcoin’s price well over $500,000 by the

next halving in 2028,” Peterson asserted. “This implies an

annualized rate of return of about 70%.” Related Reading: XRP

Analyst Thinks The Coin Is Ready To Skyrocket By 21,000% To Over

$150 Peterson’s prediction is particularly noteworthy given

Bitcoin’s current price of around $65,700, as if his prediction

proves accurate, it would represent a massive increase of over 670%

from current levels. Furthermore, the researcher suggests that

Bitcoin should be “sustainably above $1 million” about 450 days

after the next halving event in 2028, aligning with the observed

pattern of previous Halving cycles, where Bitcoin has tended to

experience a significant price surge in the years following each

reduction in new supply. Featured image from DALL-E, chart from

TradingView.com

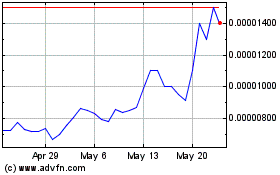

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

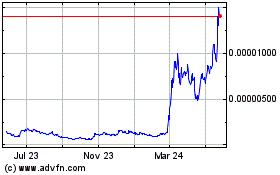

Pepe (COIN:PEPEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024