Why Bitcoin Could Rise To $53K, Here Are The Risks Bulls Must Overcome

17 September 2021 - 5:03AM

NEWSBTC

Bitcoin is moving sideways in lower timeframes as the crypto

markets continue to run without a clear direction. The first

cryptocurrency by market cap trades at $47,837 with a 1.2% loss in

the daily chart. BTC’s price has been moving in a tight range

during the week, unable to break above $48,500. Data from Santiment

suggest an increase in the amount of BTC’s supply exchanging hands

since the beginning of September. This suggests that investors

could be taking more profits as Bitcoin tries to take previous

highs contributing to the bears’ attempts to take over the market.

As seen below, the BTC Token Circulation metric can be used to find

a correlation between the price action and the amount of supply

exchanging moving on the network. The firm said: Bitcoin now sits

at $48.1k following a volatile couple of weeks to open September.

Notably, the amount of unique tokens moving on the $BTC network,

known as token circulation, is up big. Wednesday saw 187.91 unique

coins moved, the most since July 29. For Analyst Justin Bennet,

BTC’s price broke its upward trend during last week’s selloff. In

that sense, the analyst found similarities between this event with

May’s price action, when Bitcoin experience the first of several

capitulation events. Related Reading | Bitcoin Suffers As Mid

Caps Cryptos Establish Market Dominance With Wide Margin The

$48,000 to $50,000 region is critical for the bulls, if BTC’s price

managed to take over the latter, Bennet expects a resume of the

bullish momentum. Otherwise, Bitcoin is at risk of returning to the

$40,000 lows. The analyst said: Until then (BTC back to $50,000),

I’ll continue to believe that this week is a corrective move before

the next selloff toward $40,000. It’s the same pattern as late

April and early May. A Turbulent Week For Bitcoin And The Crypto

Market In addition to the increase in profit-taking by investors,

the current week has seen some hurdles in prominent crypto projects

and crypto-based companies. In addition to the threat of legal

action from the Securities and Exchange Commission (SEC) to

Coinbase, Tether had to clarified rumors about the assets backing

USDT. Related Reading | Bitcoin Price “Pitchfork Channel” Could

Pin-Point The Last Dip Ever On the other hand, a report by QCP

Capital records a “quiet week” in the derivatives sectors. As seen

below, funding rates for perpetual swaps have been returning to

neutral levels after going negative on September 7th. With that in

mind, QCP expects the current period of consolidation to continue

into the $53,000 range for Bitcoin, at least in the short term.

Related Reading | New To Bitcoin? Learn To Trade Crypto With

The NewsBTC Trading Course By the end of September, BTC’s price

could increase its levels of volatility due to the “massive

end-month expiry” in BTC options, as seen below. In addition to

that, QCP Capital believes Q4, 2021, could bring more macro

uncertainty into the market.

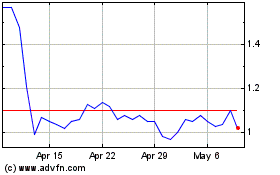

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Perpetual (COIN:PERPUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Perpetual (Cryptocurrency): 0 recent articles

More Perpetual News Articles