Uniswap Resurgence Incoming? Analyst Predicts 30% Surge For UNI Price

20 April 2024 - 6:49PM

NEWSBTC

Uniswap’s native token, UNI, has been struggling in terms of its

price action over the past few weeks. Although the general state of

the crypto market may be blamed for this gloomy price performance,

other factors, such as the Wells Notice from the US Securities and

Exchange Commission (SEC) to the Uniswap protocol, have also played

a role. However, the UNI price appears to be recovering well, as

the token has jumped by more than 2% in the past day. A popular

crypto pundit on X has predicted that a bullish rally might only

just be beginning for the DeFi coin, but the question is – how far

can Uniswap’s price go? Analyst Sets $10 Target For Uniswap Price

In a recent post on the X platform, prominent crypto analyst Ali

Martinez put forward an exciting bullish prediction for the price

of UNI. According to the expert, the cryptocurrency might be

getting ready for a run to the upside in the coming days. Related

Reading: Injective Votes On Major Upgrade To Make INJ Even More

Deflationary: Will Prices Recover? The rationale behind this

bullish prognosis for the Uniswap token is based on the TD (Tom

DeMark) Sequential Indicator. The Tom Demark Sequential is an

indicator in technical analysis used to identify the probable time

and points of trend exhaustion and price reversal. Uniswap's daily

price chart | Source: Ali_charts/X The TD Sequential indicator

consists of two stages, namely the “setup” and the “countdown”

phases. As shown in the chart above, UNI’s price just completed the

setup phase, which comprises nine consecutive candles that closed

lower than the candle four periods ago. The completion of this

phase usually signals a potential trend reversal for the token’s

price. The direction of the reversal depends on the type of candles

that formed the “setup” (I.e., red candles would suggest a bottom

for the asset, while green candles would imply a top). Martinez

noted in his post that the TD Sequential has flashed a buy alarm on

the UNI daily chart, and the token might be “gearing up for a 1 –

4-day rally. According to the analyst, the DeFi coin could jump as

high as $10, representing an over 31% surge from the current price

point. UNI Price Overview As of this writing, the price of UNI

stands at around $7.46, reflecting a 2% jump in the past 24 hours.

However, this latest price increase is not enough to bring the coin

to profit on the weekly timeframe. Related Reading: Shiba Inu Burn

Rate Sees 81% Daily Increase, But Why Is Participation Low?

According to CoinGecko’s data, Uniswap’s price is down by more than

4% in the past seven days. The cryptocurrency would look to regain

the $10 level, having lost it due to the news of the SEC’s looming

action. UNI price showing signs of recovery on the daily

timeframe | Source: UNIUSDT chart on TradingView Featured image

from Uniswap Labs, chart from TradingView

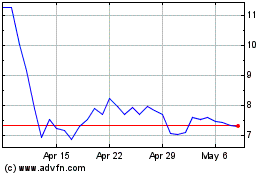

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Apr 2024 to May 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From May 2023 to May 2024