Novacyt S.A. ("Novacyt", the "Company" or the "Group") Full Year 2022 Trading Update

26 January 2023 - 6:00PM

Business Wire

Full year revenue and EBITDA in line with

guidance

Remain focused on post-COVID-19 growth

strategy to become a leading global clinical diagnostics company in

infectious diseases

Regulatory News:

Novacyt (EURONEXT GROWTH: ALNOV; AIM: NCYT), an international

specialist in clinical diagnostics, announces an unaudited trading

update for the year ended 31 December 2022. Reported revenues and

EBITDA for the period are both expected to be in line with

guidance.

Financial highlights1

- Group revenue for FY2022 was £21.0m, in line with guidance,

compared to £92.6m1 for FY2021, due to the expected decline in

COVID-19 related sales.

- Revenue from COVID-19 products in 2022 totalled £14.7m (2021:

£84.0m1).

- Revenue for the non-COVID-19 portfolio in 2022 totalled £6.3m

(2021: £8.6m1). As previously announced, this decline was

predominantly driven by lower instrument sales compared to 2021

which benefited from COVID-19 demand.

- Group EBITDA loss in FY2022 is anticipated to be circa £13.5m

before exceptional items (2021: £3.1m1 profit) as a result of the

expected decline in revenue and in line with guidance.

- Cash position at 31 December 2022 was £87.0m (2021: £101.7m)

and the Company remains debt free.

1 In accordance with IFRS 5, the net result of the Lab21

Products business will be reported on a separate line “loss from

discontinued operations” in the consolidated income statement for

2021 and 2022.

Strategic progress

During 2022, the Company made good progress transitioning away

from COVID-19 revenue and beginning to deliver against its growth

strategy, as outlined at the full year 2021 results. This included

diversification of its diagnostic portfolio through internal

R&D, such as the enhancement of its integrated and scalable

molecular workflow capability and a focus on high growth target

infectious disease areas, as well as through strategic

partnerships, such as the distribution agreement signed with Clonit

srl, which provided Novacyt with immediate access to over 40 CE

marked assays. At the same time, the Company relaunched its

extensive research-use-only portfolio and has continued to be a

global first responder in infectious diseases.

In addition, following a strategic review of the business in

2022, the Company completed the closure of the Lab21 Healthcare and

Microgen Bioproducts businesses to focus on core capabilities and

operations. As a result, Novacyt remains well positioned for future

growth and to become a leading global clinical diagnostics company

focused on unmet needs in infectious diseases.

2023 outlook

The Company intends to announce its 2022 audited full year

results in the week commencing 24 April 2023 and will provide an

update on the full year 2023 outlook at this time.

The information contained within this Announcement is deemed by

the Company to constitute inside information as stipulated under

Article 7 of the Market Abuse Regulation (EU) No. 596/2014 (as

amended) as it forms part of the domestic law of the United Kingdom

by virtue of the European Union (Withdrawal) Act 2018 (as amended).

Upon the publication of this Announcement via the Regulatory

Information Service, this inside information is now considered to

be in the public domain.

About Novacyt Group

The Novacyt Group is an international diagnostics business

generating an increasing portfolio of in vitro and molecular

diagnostic tests. Its core strengths lie in diagnostics product

development, commercialisation, contract design and manufacturing.

The Company supplies an extensive range of high-quality assays and

reagents worldwide. The Group directly serves microbiology,

haematology and serology markets as do its global partners, which

include major corporates.

For more information, please refer to the website:

www.novacyt.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230125005827/en/

Novacyt SA James Wakefield, Non-Executive Chairman James

McCarthy, Acting Chief Executive Officer +44 (0)1276 600081 SP

Angel Corporate Finance LLP (Nominated Adviser and Broker)

Matthew Johnson / Charlie Bouverat (Corporate Finance) Vadim

Alexandre / Rob Rees (Corporate Broking) +44 (0)20 3470 0470

Numis (Joint Broker) James Black / Freddie Barnfield /

Duncan Monteith +44 (0)20 7260 1000 Allegra Finance (French

Listing Sponsor) Rémi Durgetto / Yannick Petit +33 (1) 42 22 10

10 r.durgetto@allegrafinance.com; y.petit@allegrafinance.com FTI

Consulting (International) Victoria Foster Mitchell / Alex Shaw

+44 (0)20 3727 1000 victoria.fostermitchell@fticonsulting.com /

Alex.Shaw@fticonsulting.com FTI Consulting (France) Arnaud

de Cheffontaines +33 (0)147 03 69 48

arnaud.decheffontaines@fticonsulting.com

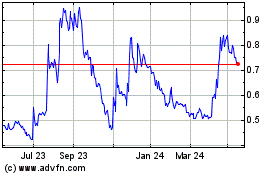

Novacyt (EU:ALNOV)

Historical Stock Chart

From Dec 2024 to Jan 2025

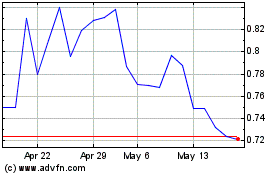

Novacyt (EU:ALNOV)

Historical Stock Chart

From Jan 2024 to Jan 2025