Eurocastle announces Realisation Plan to accelerate return of value

from its assets. Publication of Circular and Notice of General

Meeting to be held on 2 December 2019. Management Call to be held

on 19 November 2019.

Contact:Oak Fund Services (Guernsey) LimitedCompany

Administrator Attn: Mark WoodallTel: +44 1481

723450

Eurocastle announces Realisation Plan to

accelerate return of value from its assets

Publication of Circular and Notice of

General Meeting to be held on 2 December 2019

Management Call

to be held on 19 November 2019

Guernsey, 18 November 2019 – Eurocastle

Investment Limited (“Eurocastle” or the

“Company”) today announces that the Board of

Directors (the “Board”) has resolved to realise

the majority of the Company’s assets, being its shares in doValue

S.p.A. (“doValue Shares”) and interests in Italian

loan investments (the “NPL Portfolio”) in order to

accelerate the return of value to the Company’s shareholders by way

of a tender offer (the “Realisation Plan”).

Following completion of the Tender Offer and the NPL Sale as

described below, the Company is expected to have realised €281

million in aggregate, equal to more than 90% of the Company’s Q3

2019 net asset value (“NAV”)i.

As previously communicated, Eurocastle and the

Board have been focused on enhancing shareholder value and

maximizing distributions to shareholders. Through a number of

strategies, including the adoption of a distribution policy and a

series of accretive tender offers, the Company has distributed €544

million to shareholders over the past 6 years, with a remaining Q3

2019 NAV of approximately €308 millioni. In light of the discount

at which the Company continues to trade relative to its NAV, the

Board has determined that this is an appropriate time to set new

strategic priorities for the Company to realise the value of its

assets for shareholders.

Eurocastle has today published a circular to

shareholders (the “Circular”) containing details

of the Realisation Plan and the actions required to be taken by

shareholders to implement the Proposed NPL Sale and the Tender

Offer. The Circular contains notice of the general meeting of the

Company’s shareholders (the “General Meeting”) to

be held on 2 December 2019 to seek shareholder approval on two

resolutions. The first resolution (the “NPL Sale

Resolution”) will seek shareholder approval, as an

ordinary resolution, for a transaction pursuant to which the

Company would dispose of the NPL Portfolio for a purchase price of

€140.2 million to funds managed by an affiliate of FIG LLC, the

Company’s Investment Manager (the “NPL Sale”). The

second resolution will seek shareholder approval, as a special

resolution, for a tender offer whereby the Company will offer to

exchange Eurocastle shares for a combination of doValue Shares and

the distributable cash proceeds from the NPL Sale (the

“Tender Offer”). The General Meeting will be held

at Regency Court, Glategny Esplanade, St Peter Port, Guernsey GY1

1WW on 2 December 2019 at 3.00 p.m. (GMT).

Under the terms of the Tender Offer, the maximum

number of Ordinary Shares to be tendered is 34.6 million (the

“Maximum Number of Shares”). Assuming the Maximum

Number of Shares are tendered, tendering shareholders will receive

both approximately 0.4353 doValue Shares and €3.16 in cash in

exchange for each Eurocastle share validly tendered. This initial

ratio will be adjusted in the manner set out in the Circular if

fewer than the Maximum Number of Shares are validly tendered. The

Tender Offer will return 15.04 million doValue Shares and up to

€109.2 million in cash to shareholders.

The consideration per Ordinary Share, which is

equivalent to a value of €8.14, has been determined by the Board

based on its calculation of the Company’s currently distributable

NAV, which reflects: (i) the volume weighted average price of

doValue S.p.A. for the 5 days ended 15 November 2019ii (the

“VWAP”), being €11.44 per doValue Share; (ii) the

estimated net proceeds from the Proposed NPL Sale of €140.2

million; (iii) the carrying value of the remaining assets of the

Company as at 30 September 2019; and (iv) additional reserves

determined by the Board of Directors in order to take into account

future costs and potential liabilities.

The Board does not currently intend to make any

material new investments with the proceeds realised from the

Company’s existing holdings. With respect to the remaining assets,

which predominantly comprise Eurocastle’s investments in Italian

real estate funds, the Company plans to continue to hold and

realise these assets in accordance with existing business plans. It

will support these investments to the extent required to optimise

returns and distribute cash to shareholders when available. The

Company’s distribution policy, including the regular quarterly

dividend, will not apply with effect from Q3 2019. The Board

currently anticipates that the majority of the Company’s existing

assets will be realised by the end of 2023.

FIG LLC, the Company’s Investment Manager, has

also agreed to amend the calculation of its incentive fee to treat

the Company’s other remaining assets, which predominantly comprise

investments in Italian real estate funds, as fully realised at an

agreed value in 2019 and to better reflect the price per Ordinary

Share represented in the initial Exchange Ratio. These amendments

will reduce the fee payable by the Company to the Investment

Manager in the fourth quarter of 2019 by up to €2.4 million to

€19.7 million and no further fees will be due in relation to the

Company’s remaining investments. In return, the Investment Manager

will be entitled to earn back a portion of this discount if amounts

are released from certain reserves put in place by the Board to

fund future costs and potential liabilities.

EJF Debt Opportunities Master Fund, L.P., Asset

Value Investors, and EMS EC Investments LP, for themselves and

their affiliates, whose aggregate voting rights in the Company

represented approximately 62% of the total voting rights in the

Company as at 15 November 2019 (the “Major

Shareholders”), have provided the Company with letters

containing confirmations of their firm intentions to vote in favour

of the resolutions at the General Meeting and tender all of their

Ordinary Shares as part of the Tender Offer.

The Investment Manager, on behalf of itself, its

principals and managed funds, whose aggregate voting rights in the

Company represented approximately 14% of the total voting rights in

the Company as at 15 November 2019, has provided the Company with a

letter containing confirmations of (i) each of the Investment

Manager, its principals and managed funds’ firm intention to vote

in favour of the Tender Offer at the General Meeting and tender all

of their Ordinary Shares as part of the Tender Offer; and (ii) the

Investment Manager’s commitment not to vote on the NPL Sale

Resolution, and to take all reasonable steps to ensure that members

of its group and employees will not vote on the NPL Sale Resolution

to be proposed at the General Meeting.

In addition, the Major Shareholders and the

Investment Manager, on behalf of itself, its principals and managed

funds, have agreed to restrictions on their ability to dispose of

any doValue Shares acquired through the Tender Offer prior to

January 31, 2020 and such restrictions will then expire in stages

up to March 31, 2020. Please refer to the Circular for more details

of these restrictions. Certain other affiliates and employees of

the Investment Manager may participate in the Tender Offer on the

same terms as all other shareholders.

Shareholders should refer to the sections of the

Circular entitled “Action to be Taken in Relation to the Proposed

NPL Sale” and “Action to be Taken in Relation to the Tender Offer”

for action to be taken in respect of the Proposed NPL Sale and the

Tender Offer.

NPL Sale Details

The NPL Sale is conditional on approval

by Shareholders at the General Meeting

Since the establishment of the change in

strategy in 2013, Eurocastle has invested €289 million in 24

Italian loan pools. These investments have returned €237

million to date, helping to support the Company’s regular quarterly

dividend, and have a remaining value as at 30 September 2019 of

€149 million. The Board has been evaluating options of how to

accelerate the return of this remaining value to shareholders.

After carefully considering the possibility of running a marketed

process with third parties and the associated timing, cost and

execution risk in light of the complexity and size of the Company’s

portfolio, the Board approached the Investment Manager to gauge the

interest of any of its affiliated funds, certain of which already

held interests in the NPL Portfolio, to acquire these interests in

a single accelerated transaction.

The Company has now reached agreement to sell

the NPL Portfolio for a purchase price (after customary adjustments

for collections) of €140.2 million to funds managed by an affiliate

of its Investment Manager (the “NPL

Purchaser”). The purchase price represents a 5%

discount to the Q3 2019 NAV of the NPL Portfolio excluding certain

residual interests which the Company is required to retain due to

legal obligations and which the NPL Purchaser has committed to

acquire at the same 5% discount when such obligations no longer

apply. In addition, the NPL Purchaser will assume an obligation to

fund the €18.1 million deferred purchase price due to be paid by

the Company in July 2020 in relation to the FINO NPL investment.

Therefore, the Company anticipates receiving cash proceeds of

approximately €122.1 million upon completion of the Proposed NPL

Sale in December 2019.

It is intended that the distributable cash

proceeds realised by the Company from the Proposed NPL Sale

(representing the cash proceeds to be received by the Company in

December 2019 less transaction costs and certain additional amounts

to be retained by the Company to cover future costs and potential

liabilities) of €109.2 million will be returned to shareholders via

the cash component of the Tender Offer consideration.

As the NPL Sale is a related party transaction

between the Company and the NPL Purchaser, a committee comprising

the four members of the Board who are not affiliated with the

Investment Manager (the “Board Committee”)

obtained an independent valuation of the NPL Portfolio from Alantra

Corporate Portfolio Advisors, S.L. and are of the unanimous view

that the terms of the NPL Sale are fair and reasonable so far as

Eurocastle’s shareholders are concerned and that it has been

entered into on arms’ length terms.

In particular, the Board Committee believes that

the proposed sale to the NPL Purchaser represents an attractive

opportunity for shareholders as it provides transaction certainty,

speed of execution and a clean exit with no requirement to reserve

for tail liability risk at a limited discount to the investments’

carrying value, an outcome which the Board Committee believes would

not be achieved through a marketed process. Execution of the

Proposed NPL Sale will allow the Company to return the value of the

NPL Portfolio to Shareholders in a timely fashion, primarily via

the cash component of the Tender Offer consideration.

Tender Offer Details

The Tender Offer is conditional on both

the Tender Offer Resolution and the NPL Sale Resolution being

approved by Shareholders at the General Meeting

The Board is proposing to deliver both: (i) up

to 15.04 million doValue Shares currently held by the Company; and

(ii) up to €109.2 million in cash, through the acquisition of up to

34.6 million Eurocastle shares from tendering shareholders via an

off-market share buy-back process in exchange for the delivery of

cash and doValue Shares. Assuming the Maximum Number of Shares are

tendered, tendering shareholders will receive both approximately

0.4353 doValue Shares and €3.16 in cash in exchange for each

Eurocastle share validly tendered, representing a value per

Ordinary Share of €8.14.

The consideration per Ordinary Share has been

determined by the Board based on its calculation of the Company’s

currently distributable NAV, which reflects: (i) the VWAP of

doValue; (ii) the estimated net proceeds from the Proposed NPL

Sale; (iii) the NAV of the remaining assets of the Company as at 30

September 2019; and (iv) additional reserves determined by the

Board of Directors in order to take into account future costs and

potential liabilities.

Each tendering shareholder will be entitled to

have 94.91 per cent. of the Ordinary Shares registered in their

respective names on the Tender Offer record date, on 17 December

2019, accepted into the Tender Offer, rounded down to the nearest

whole number of Ordinary Shares. This is what is known as each

tendering shareholder’s “Basic Entitlement”. All

Ordinary Shares validly tendered by tendering shareholders up to

their respective Basic Entitlement will be accepted in full in

exchange for doValue Shares and cash. Shareholders may also be able

to participate in the Tender Offer in excess of their Basic

Entitlement to the extent that other tendering shareholders tender

less than their respective Basic Entitlements. For further details

see the Tender Offer Circular.

The Circular, which includes notice of the

General Meeting, has been posted on the Investor Relations section

of the Company’s website under the tab “Periodic Reports and

Shareholder Communications – Tender Offer” and has been mailed to

eligible shareholders on the register as at close of business on 15

November 2019.

EXPECTED TIMETABLE FOR

PROPOSED NPL SALE AND TENDER

OFFER

| |

|

2019 |

|

| Date of publication of

Circular and Tender Offer opens |

|

18 November |

|

| Latest time and date for

receipt of Forms of Proxy or CREST Proxy Instructions (as

applicable) to be provided in respect of the General

Meeting…………….………………………………. |

|

3.00 p.m. (GMT) on 28 November |

|

| General Meeting to

approve NPL Sale Resolution and Tender Offer

Resolution………......…………………...……… |

|

3.00 p.m. (GMT) on 2 December |

|

| Latest time and date

for receipt of Tender Forms in respect of the Tender

Offer………………………………………..…... |

|

6.00 p.m. (CET) on 17 December |

|

| Tender Offer Record Date and

Tender Offer Closing Date…..… |

|

6.00 p.m. (CET) on 17 December |

|

| Commencement of: (i) delivery

of doValue Shares via Monte Titoli to Admitted Institutions, CREST

Participants and holders of successfully tendered certificated

Ordinary Shares; (ii) settlement of Cash Component of Tender Offer

consideration; (iii) settlement of fractional entitlements and (iv)

despatch of balance share certificates for unsuccessful tenders of

Ordinary Shares (certificated holders only)

................................................ |

|

20 December |

|

The above times and/or dates may be

subject to change and, in the event of such change, the revised

times and/or dates will be notified to Shareholders by a press

release on the Company’s website, an announcement through a

Regulatory Information Service and via newswire in the United

States.

In addition, management will host a conference

call at 2:00 P.M. London time (9:00 A.M. New York time) on Tuesday,

19 November 2019. All interested parties are welcome to participate

on the live call. You can access the conference call by dialing

first +1-844-492-7988 (from within the U.S.) or +1-478-219-0293

(from outside of the U.S.) ten minutes prior to the scheduled start

of the call; please reference “Eurocastle Management Call or

conference ID number 2437329”

A webcast of the conference call will be

available to the public on a listen-only basis at

www.eurocastleinv.com. Please allow extra time prior to the call to

visit the site and download the necessary software required to

listen to the internet broadcast. A replay of the webcast will be

available for three months following the call.

For those who are not available to listen to the

live call, a replay will be available until 11:59 P.M. New York

time on Monday, 2 December 2019 by dialing +1-855-859-2056 (from

within the U.S.) or +1-404-537-3406 (from outside of the U.S.);

please reference access code “2437329”

ABOUT EUROCASTLE

Eurocastle Investment Limited is a publicly

traded closed-ended investment company focused on performing and

non-performing loans and other real estate related assets primarily

in Italy. The Company is Euro denominated and is listed on Euronext

Amsterdam under the symbol “ECT”. Eurocastle is managed by an

affiliate of Fortress Investment Group LLC, a leading global

investment manager. For more information regarding Eurocastle

Investment Limited and to be added to our email distribution list,

please visit www.eurocastleinv.com.

i The Company’s NAV as at 30 September 2019 net of additional

incentive fees which would be due to the Company’s Investment

Manager if all investments were realised at that date in line with

their Q3 2019 carrying value (as reported on the Company’s Q3 2019

Investor Factsheet).

ii as reported on Bloomberg screen “DOV IM Equity AQR”.

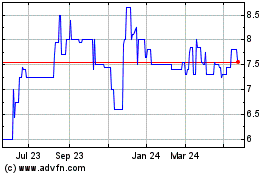

Eurocastle Investment (EU:ECT)

Historical Stock Chart

From Dec 2024 to Jan 2025

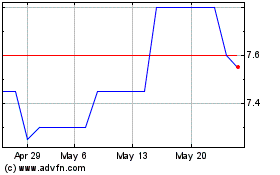

Eurocastle Investment (EU:ECT)

Historical Stock Chart

From Jan 2024 to Jan 2025