LONDON MARKETS: U.K. Stocks Rise As Disappointing Inflation Eases Pressure On BOE To Hike

19 April 2018 - 2:32AM

Dow Jones News

By Sara Sjolin, MarketWatch

Pound briefly drops below $1.42

U.K. stocks rose for a second straight day on Wednesday, moving

higher after a disappointing reading on Britain's inflation reduced

pressure on the Bank of England to raise interest rates next

month.

Miners were among biggest advancers as metals prices rallied on

concerns further sanctions against Russia could dent supply.

What are markets doing?

The FTSE 100 index climbed 1.3% to end at 7,317.34, logging its

highest close since early February, according to FactSet data.

The pound dropped to $1.4220, down from $1.4290 late Tuesday in

New York and falling from an intraday high of $1.4315. Sterling

briefly dipped below $1.42 during Wednesday's session to an

intraday low of $1.4173.

A weaker pound tends to prop up the British blue-chip index as

its multinational companies generate most of their sales in foreign

currencies.

What is driving the market?

The moves in both the pound and the FTSE came after data showed

U.K. inflation fell to 2.5% in March

(http://www.marketwatch.com/story/uk-inflation-cools-misses-forecasts-2018-04-18)

from 2.7% in February. Analysts had expected consumer prices to

have risen 2.7%.

The weaker reading is good news for households, but could give

BOE Gov. Mark Carney a headache ahead of next month's

policy-setting meeting. The market is still pricing in an

interest-rate rise, but the fall in inflation could make an

increase less of a done deal.

Sterling earlier this week jumped above $1.43 and reached its

highest level since the Brexit vote in June 2016 on rising

expectations the U.K. central bank will tighten policy. The pound,

however, already started to unravel on Tuesday after data showed

February wages including bonuses rose less than some had

expected.

The gains on the U.K. stock market on Wednesday were also

propelled by corporate news. Miners were among top performers,

after Rio Tinto PLC (RIO.LN) (RIO.LN) (RIO.LN) said quarterly

iron-ore exports from its Australian mines rose 5%. Shares of the

mining major ended up 5.4%, also boosted by gains in metals

prices.

What are strategists saying?

"The FTSE 100 has gone from the back of the pack to the market

leader, as a sharp deterioration in U.K. inflation has driven the

pound sharply lower," said Joshua Mahony, market analyst at IG, in

a note.

"The outperformance of the pound has certainly been one of the

main determinants of FTSE 100 underperformance among European

bourses, yet with GBPUSD falling almost 100 points in the wake of

today's inflation figures, we are finally seeing the FTSE benefit

from the pound's performance," he added.

Read:Embrace these 5 unloved investments, says Morningstar

(http://www.marketwatch.com/story/embrace-these-5-unloved-investments-says-morningstar-2018-04-18)

What stocks are in focus?

Among miners on the rise, shares of Glencore PLC (GLEN.LN) added

7.7%, Anglo American PLC (AAL.LN) climbed 6.2% and BHP Billiton PLC

(BLT.LN) (BHP.AU) (BHP.AU) put on 5.5%.

Mediclinic International PLC (MDC.LN) rallied 9.2% after the

health-care company said it expects full-year results marginally

ahead of expectations.

Oil companies were also rising, tracking a more-than 2% jump in

oil prices

(http://www.marketwatch.com/story/oil-prices-rise-on-optimism-ahead-of-us-supply-data-2018-04-18)

that came after a surprise decline in weekly U.S. crude supplies.

Shares of BP PLC (BP.LN) (BP.LN) climbed 2.6% and Royal Dutch Shell

PLC (RDSA.LN)(RDSA.LN) put on 2.4%.

Outside the FTSE 100, CYBG PLC (CYBG.LN) shares slid 5% after

the owner of Clydesdale and Yorkshire Bank said it expects to set

aside another GBP350 million

(http://www.marketwatch.com/story/cybg-to-raise-ppi-provision-capital-position-hit-2018-04-18)

($501 million) for legacy claims over mis-sold payment-protection

insurance. The increased provisions would bring its capital

position below its guidance range.

Intu Properties PLC (INTU.LN) gave up 4.1%, after Hammerson PLC

(HMSO.LN) said it's abandoning plans to buy

(http://www.marketwatch.com/story/hammerson-withdraws-intu-buy-recommendation-2018-04-18)

the shopping center owner in the face of a weak U.K. retail market.

Intu responded

(http://www.marketwatch.com/story/intu-reacts-to-hammerson-ditching-takeover-bid-2018-04-18)

by saying Hammerson's reasons for dropping the approach were

"unsatisfactory." Hammerson shares ended up 4.2%.

(END) Dow Jones Newswires

April 18, 2018 12:17 ET (16:17 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

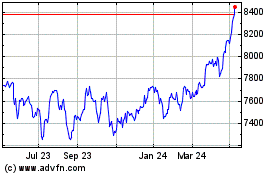

FTSE 100

Index Chart

From Apr 2024 to May 2024

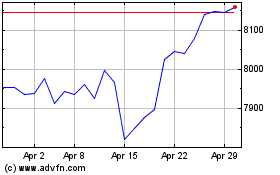

FTSE 100

Index Chart

From May 2023 to May 2024