Yen Falls Following PM Shigeru Ishiba Comments

03 October 2024 - 11:43AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Thursday, after Japan's newly appointed prime

minister said that the nation is not prepared for additional rate

hikes, following a meeting with the central bank governor.

Traders reacted to Japan's newly appointed Economy Minister's

comments that the central bank should be careful about raising

rates again as it takes time to completely exit deflation.

According to reports, the Japan's Prime Minister Ishiba stated,

"I do not believe that we are in an environment that would require

us to raise interest rates further,"

Meanwhile, traders remain cautious amid the escalating tensions

in the Middle East following Iran's ballistic missile attack

against Israel.

In economic news, the services sector in Japan continued to

expand in September, albeit at a slower pace, the latest survey

from Jibun Bank revealed on Thursday with a services PMI score of

53.1. That's down from 53.7 in August, although it remains above

the boom-or-bust line of 50 that separates expansion from

contraction. The data also said the composite PMI slipped to 52.0

in September from 52.9 in August.

Since the beginning of this week, the safe-haven yen has been

losing ground to its main competitors.

In the Asian trading now, the yen fell to 6-day lows of 162.49

against the euro and 195.18 against the pound, from yesterday's

closing quotes of 161.77 and 194.31, respectively. If the yen

extends its downtrend, it is likely to find support around 168.00

against the euro and 200.00 against the pound.

The yen edged down to more than a 2-month low of 173.00 against

the Swiss franc, from Wednesday's closing value of 172.33. On the

downside, 176.00 is seen as the next support level for the yen.

Against the U.S., Australia, the New Zealand and the Canadian

dollars, the yen slid to nearly a 1-1/2-month low of 147.24, more

than a 2-month low of 101.28, a 6-day low of 91.93 and a 1-month

low of 108.97 from yesterday's closing quotes of 146.46, 100.82,

91.71 and 108.46, respectively. The next possible downside targets

for the yen is seen around 151.00 against the greenback, 104.00

against the aussie, 91.71 against the kiwi and 110.00 against the

loonie.

Looking ahead, Switzerland CPI data for September is due to be

released in the pre-European session at 2:30 am ET.

In the European session, PMI reports from various European

economies and U.K. for September and Eurozone PPI data for August

are slated for release.

In the New York session, U.S. weekly jobless claims, Canada and

U.S. PMI reports for September, U.S. factory orders for August are

set to be released.

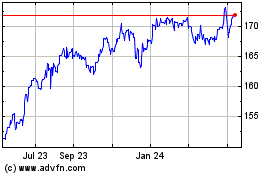

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Oct 2024 to Nov 2024

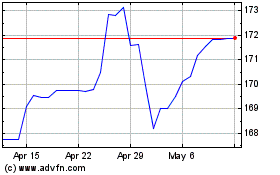

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Nov 2023 to Nov 2024