Acumen Announces Pricing of Upsized $130 Million Public Offering

19 July 2023 - 12:31PM

Acumen Pharmaceuticals, Inc. (“Acumen”) (NASDAQ: ABOS), a

clinical-stage biopharmaceutical company developing a novel

therapeutic that targets soluble amyloid beta oligomers (AβOs) for

the treatment of Alzheimer’s disease (AD), today announced the

pricing of an upsized underwritten public offering

of 16,774,193 shares of its common stock at a price to

the public of $7.75 per share. All of the shares are being offered

by Acumen. The gross proceeds from the offering, before deducting

underwriting discounts and commissions and other offering expenses

payable by Acumen, are expected to be approximately $130 million.

The offering is expected to close on July 21, 2023, subject to the

satisfaction of customary closing conditions. In addition, Acumen

has granted the underwriters a 30-day option to purchase up to an

additional 2,516,128 shares of its common stock at the public

offering price, less underwriting discounts and commissions.

BofA Securities, Citigroup and Stifel are acting

as bookrunners for the public offering. BTIG is acting as lead

manager for the offering.

The securities described above are being offered

by Acumen pursuant to its effective shelf registration statement on

Form S-3 declared effective by the Securities and Exchange

Commission (the “SEC”) on July 8, 2022. Before you invest, you

should read the prospectus in the registration statement and

related prospectus supplement for more complete information about

Acumen and this offering. An electronic copy of the preliminary

prospectus supplement and accompanying base prospectus relating to

the offering are available on the SEC website at www.sec.gov. An

electronic copy of the final prospectus supplement and accompanying

prospectus will be available on the SEC website at www.sec.gov or,

when available, may also be obtained by contacting BofA Securities,

NC1-022-02-25, 201 North Tryon Street, Charlotte, NC 28255-0001,

Attn: Prospectus Department, Email:

dg.prospectus_requests@bofa.com, by contacting Citigroup, c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717 (Tel: 800-831-9146), or by contacting Stifel, Nicolaus

& Company, Inc., Attention: Syndicate, One Montgomery Street,

Suite 3700, San Francisco, CA 94104, or by telephone at (415)

364-2720, or by email at syndprospectus@stifel.com.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification of these securities under the

securities laws of any such state or jurisdiction.

About Acumen Pharmaceuticals,

Inc.

Acumen, headquartered in Charlottesville, VA,

with clinical operations based in Carmel, IN, is a clinical-stage

biopharmaceutical company developing a novel therapeutic that

targets toxic soluble AβOs for the treatment of AD. Acumen’s

scientific founders pioneered research on AβOs, which a growing

body of evidence indicates are early and persistent triggers of AD

pathology. Acumen is currently focused on advancing its

investigational product candidate, ACU193, a humanized monoclonal

antibody that selectively targets toxic soluble AβOs.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. Words such as “expected”, “may”, “will,” and

similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

these identifying words. Forward-looking statements include

statements relating to Acumen’s expectations regarding the

completion and timing of the proposed public offering. These

statements are based upon the current beliefs and expectations of

Acumen management, and are subject to certain factors, risks and

uncertainties, including risks and uncertainties related to market

conditions and the satisfaction of customary closing conditions

related to the proposed public offering. Such risks may be

amplified by the impacts of geopolitical events and macroeconomic

conditions, such as rising inflation and interest rates, supply

disruptions and uncertainty of credit and financial markets. These

and other risks concerning Acumen’s programs are described in

additional detail in Acumen’s filings with the SEC, including in

Acumen’s most recent Annual Report on Form 10-K and in subsequent

filings with the SEC and the prospectus supplement related to the

proposed offering to be filed with the SEC. These forward-looking

statements speak only as of the date hereof, and Acumen expressly

disclaims any obligation to update or revise any forward-looking

statement, except as otherwise required by law, whether, as a

result of new information, future events or otherwise.

Investors: Alex

Braunabraun@acumenpharm.com

Media: Jessica LaubICR

WestwickeAcumenPR@westwicke.com

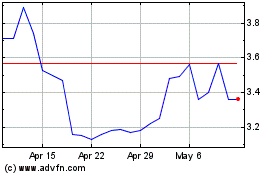

Acumen Pharmaceuticals (NASDAQ:ABOS)

Historical Stock Chart

From Feb 2025 to Mar 2025

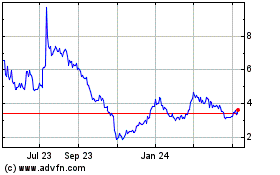

Acumen Pharmaceuticals (NASDAQ:ABOS)

Historical Stock Chart

From Mar 2024 to Mar 2025