0001173313

false

0001173313

2023-11-15

2023-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 15, 2023

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On November 15, 2023, ABVC BioPharma, Inc. (the “Company”)

issued a press release announcing its financial results for the third quarter ended September 30, 2023, which were disclosed in the Quarterly

Report on Form 10-Q filed with the U.S. Securities and Exchange Commission on November 15, 2023. A copy of the press release is furnished

as Exhibit 99.1 to this Current Report on Form 8-K.

The information reported under this Item 2.02 of Form 8-K, including

Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be

expressly set forth by specific reference in such filing.

Item 9.01 Financial Statement and Exhibits

(d) Exhibits

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| November 15, 2023 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

2

Exhibit 99.1

ABVC BioPharma Reports Third Quarter 2023 Financial

and Operational Results

FREMONT, CA, November 15, 2023 -- ABVC BioPharma, Inc. (Nasdaq: ABVC),

a biotechnology company specializing in botanically based solutions that seeks to deliver high efficacy and low toxicity to improve health

outcomes, today announced its financial and operating results for the third quarter of 2023. These results, including the financial statements

included herein, can be found in the Company’s Quarterly Report on Form 10-Q that was filed earlier today with the Securities and

Exchange Commission

Third

Quarter 2023 Financial Results

All comparisons are made on a year-over-year basis.

Shareholders’ Equity

On February 23, 2023, the Company entered into a securities purchase agreement with Lind Global Fund II, LP (“Lind”), pursuant

to which the Company issued Lind a secured, convertible note in the principal amount of $3,704,167, for a purchase price of $3,175,000,

that is convertible into shares of the Company’s common stock at an initial conversion price of $1.05 per share, subject to adjustment.

The Company also issued Lind a common stock purchase warrant to purchase up to 5,291,667 shares of the Company’s common stock at

an initial exercise price of $1.05 per share, subject to adjustment. During the period ended September 30, 2023, the Company has been

repaying Lind with securities for 614,912 shares, totaling $1,814,800. During July 2023, the warrant exercise price was reset to $3.5

in accordance to the issuance of common stock in relation to securities purchase agreement on July 2023. As of September 30, 2023, the

warrant has not yet been exercised.

On July 27, 2023, the Company entered into that certain securities purchase agreement. relating to

the offer and sale of 300,000 shares of common stock, par value $0.001 per share and 200,000 pre-funded warrants, at an exercise price

of $0.001 per share, in a registered direct offering. Pursuant to the Purchase Agreement, the Company agreed to sell the Shares and/or

Pre-funded Warrants at a per share purchase price of $3.50, for gross proceeds of $1,750,000, before deducting any estimated offering

expenses. On August 1, 2023, the pre-funded warrants were exercised.

On August 14, 2023, the Company entered into a cooperation agreement

with Zhonghui. Pursuant thereto, the Company acquired 20% of the ownership of a property and the parcel of the land owned by Zhonghui

in Leshan, Sichuan, China. During the third quarter of 2023, the Company issued to Zhonghui, an aggregate of 370,000 shares of the Company’s

common stock, at a per share price of $20.

The above-mentioned equity is before the reverse stock split in 2023.

As of September 30, 2023, the Company achieved

a total shareholders’ equity of $9.10M and therefore believes it has regained the compliance with NASDAQ’s shareholders’

equity requirement.

| |

● |

Revenues. We generated $15,884 and $42,269 in revenues for the three months ended September 30, 2023 and 2022, respectively. The decrease in revenues was due to completion of ongoing projects and awaiting new drug approval. |

| |

● |

Operating Expenses. Operating Expenses decreased by $1,606,226 or 43%, to $2,141,143 for the three months ended September 30, 2023 from $3,747,369 for the three months ended September 30, 2022. Such decrease in operating expenses was mainly attributable to the decrease in selling, general and administrative expenses and research and development expenses, since research and development projects have been dormant while the Company awaits results for further development, while being offset by the increase in stock-based compensation. |

| |

● |

Other Income (expense). Other expense was $1,214,206 for the three months ended September 30, 2023, compared to other expense of $56,461 for the three months ended September 30, 2022. The change was principally caused by the increase in interest expense and the loss on foreign exchange changes, while being offset by the increase in interest income for the three months ended September 30, 2023, and decrease in other expenses for the three months ended September 30, 2022. |

| |

● |

Net Loss. The net loss was $3,368,080 for the three months ended September 30, 2023 compared to $3,776,524 for the three months ended September 30, 2022, representing a decrease of $408,444, or 11%. |

| |

● |

Cash and Cash Equivalents. The Company considers highly liquid investments with maturities of three months or less, when purchased, to be cash equivalents. As of September 30, 2023 and December 31, 2022, the Company’s cash and cash equivalents amounted $500,069 and $85,265, respectively. |

Recent Operational

Highlights

Neurology

The MDD Phase

II trials for ABV-1504 were completed successfully with good tolerance to the drug, and no serious adverse effects were reported. The

product is ready for an End-of-Phase 2 meeting with the FDA to finalize the protocol for Phase III trials. At the same time, we commenced

the ADHD Phase IIb trials at the University of California, San Francisco (UCSF) and another five sites in Taiwan. The trials are heading

for the interim report, which we expect to complete by the end of 2023. ABV-1601 for MDD in cancer patients has completed Phase I study

preparation, including the Site Initiation Visit (SIV).

On July 31,

2023, ABVC signed a legally binding term sheet with a Chinese pharmaceutical company, Xinnovation Therapeutics Co., Ltd, for the exclusive

licensing of ABV-1504 for Major Depressive Disorder (MDD) and ABV-1505 for Attention-Deficit/Hyperactivity Disorder in mainland China.

Under this agreement, Xinnovation will hold exclusive rights to develop, manufacture, market, and distribute our innovative drugs for

MDD and ADHD in the Chinese market and shall bear the costs for clinical trials and product registration in China. We are negotiating

definitive agreements with Xinnovation and are excited that the licensing deal carries a possible aggregate income of $20 million for

ABVC if all expected sales are made.

In November 2023, each of ABVC and one of its subsidiaries, BioLite,

Inc. (“BioLite”) entered into a multi-year, global licensing agreement with AIBL for the Company and BioLites’s CNS

drugs with the indications of MDD (Major Depressive Disorder) and ADHD (Attention Deficit Hyperactivity Disorder) (the “Licensed

Products”). The potential license will cover the Licensed Products’ clinical trial, registration, manufacturing, supply, and

distribution rights. The Licensed Products for MDD and ADHD, owned by ABVC and BioLite, were valued at $667M by a third-party evaluation.

The parties are determined to collaborate on the global development of the Licensed Products. The parties are also working to strengthen

new drug development and business collaboration, including technology, interoperability, and standards development. As per each of the

respective agreements, each of ABVC and BioLite shall receive 23 million shares of AIBL stock at $10 per share, and if certain milestones

are met, $3,500,000 and royalties equaling 5% of net sales, up to $100 million.

Ophthalmology

Vitargus®,

a vitreous substitute, is a groundbreaking, advanced-staged R&D product that we believe will be the first biodegradable hydrogel

used in retinal detachment surgery. Vitargus® has completed the feasibility study in Australia and was approved by the

Australian Therapeutic Goods Administration (TGA) to initiate the next trial phase in two participating sites. This is vital to obtaining

final regulatory approval for Vitargus® in Australia.

The Science

Park Administration in Taiwan approved ABVC’s plan to set up a pilot Good Manufacturing Practice (GMP) facility to produce Vitargus®

and to pursue the process development work for manufacturing optimization. We are undertaking this project, proposed by ABVC’s Taiwan

affiliate and co-development partner, BioFirst Corporation, to upgrade the Vitargus® manufacturing processes so it can

ultimately handle the global market supply. ABVC and BioFirst Corporation expect to complete the facility’s construction in Hsinchu Biomedical

Science Park, Taiwan, in 2024.

Oncology/Hematology

The United States

Food & Drug Administration (US FDA) approved the Investigational New Drug (IND) application for the proposed clinical investigation

of BLEX 404, the primary active ingredient in ABV-1519, for advanced inoperable or metastatic EGFR-mutated non-small cell lung cancer.

This treatment is being co-developed by BioKey, Inc. (“BioKey”) and by the Rgene Corporation, Taiwan. The study is under review

at the Taiwan FDA for approval. This is the fourth IND approved by the US FDA for BLEX 404. The previous three INDs are for the combination

therapies of triple-negative breast cancer, myelodysplastic syndromes (MDS), and pancreatic cancer.

CDMO

BioKey, a wholly-owned subsidiary of the Company

based in Fremont, California, produces dietary supplements derived from the maitake mushroom in tablet and liquid forms. BioKey has entered

the second year of the distribution agreement with Define Biotech Co. Ltd. BioKey is currently set to produce an additional $1 million

worth of products for the global market. We continue to work on distribution for the US and Canadian markets with Shogun Maitake.

On the regulatory services front for our clients,

we received two ANDA approvals from the US FDA. We have a three-year contract, worth up to $3 million,

for clinical development services between BioKey and Rgene Corporation. With this base, we are actively developing BioKey as a contract

research, development, and manufacturing organization (CRDMO) to become a one-stop solution for pharmaceutical services. We also established

BioKey (Cayman), Inc. to attract strategic investors to aid BioKey in getting listed on the Taiwan Stock Exchange.

Strategic Investments

ABVC entered a cooperation agreement with Zhonghui

United Technology (Zhonghui) Group Co., Ltd. and its affiliated enterprises that contemplates a joint development of a large-scale

health and wellness base in Chengdu, China. The anticipated partnership aims to establish an integrated platform to facilitate collaborations

between researchers and industry leaders. ABVC issued 370,000 shares of common stock to Zhonghui at $20 per share in consideration for

a 20% ownership of certain property owned by Zhonghui, estimated at $37 million by a third-party valuation company, and another piece

of land Zhonghui currently owns in that same area. The parties are waiting for final asset ownership certification over these properties

from the Chinese government, but based on the cooperation agreement, Zhongui does maintain the right to replace these properties with

suitable replacements, acceptable to ABVC.

On July 27,

2023, we entered a definitive securities purchase agreement with a single institutional investor to purchase $1.75 million worth of our

common stock and pre-funded warrants in a registered direct offering. Under the terms of the securities purchase agreement, the Company

sold 300,000 shares of common stock and 200,000 pre-funded warrants. The purchase price per share of common stock is $3.50, and the purchase

price for the pre-funded warrants is identical to the purchase price for a share of common stock, less the exercise price of $0.01 per

share.

Nasdaq

Compliance

The Company has regained compliance with Nasdaq

Marketplace Rules relating to maintaining a minimum $1.00 bid price and believes it regained compliance with the $2.5 million minimum

shareholders equity requirements, as explained above.

As per Nasdaq Marketplace Rules, the Company had

to present evidence on closing bid price of at least $1.00 per share for ten consecutive trading days, which it completed on August 08,

2023.

“We are delighted with our remarkable accomplishments

and meaningful progress in 2023, and look forward to upcoming reports to end 2023 on a positive note,” said Uttam Patil, Ph.D., Chief

Executive Officer of ABVC BioPharma. “I am pleased with ABV-1505 (ADHD) Phase II, part II study making substantial progress at five

Taiwan study sites and UCSF and expecting to be completed in 2023, Phase I studies of ABV-1601 for treating depression in cancer patients

being initiated at CSMC in the US, and the progress of End-of-Phase II meeting preparation for ABV-1504 (MDD) with Dr. Maurizio Fava and

Dr. Thomas Laughren of Clinical Trials Network and Institute, (CTNI). In addition, ABV-1701 Vitargus®, a

hydrogel we developed to make retina reattachment surgery more comfortable and successful for patients, has shown advantages over existing

devices available to surgeons in a Phase I clinical study completed in Australia in 2018, indicating a promising outcome from the Phase

II trials. We remain excited about our ongoing research initiatives and look forward to expanding our product pipeline.”

About ABVC BioPharma

ABVC BioPharma is a

clinical-stage biopharmaceutical company with an active pipeline of six drugs and one medical device (ABV-1701/Vitargus®) under development.

For its drug products, the Company utilizes in-licensed technology from its network of world-renowned research institutions to conduct

proof-of-concept trials through Phase II of clinical development. The Company’s network of research institutions includes Stanford

University, University of California at San Francisco, and Cedars-Sinai Medical Center. For Vitargus®, the Company intends

to conduct global clinical trials through Phase III.

Forward-Looking Statements

Clinical trials are in

early stages, and there is no guarantee that any specific outcome will be achieved. This press release contains “forward-looking

statements.” Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,” “believes,”

“hopes,” “potential,” or similar words. Forward-looking statements are not guarantees of future performance, are based

on certain assumptions, and are subject to various known and unknown risks and uncertainties, many of which are beyond the Company’s control,

and cannot be predicted or quantified, and, consequently, actual results may differ materially from those expressed or implied by such

forward-looking statements. None of the outcomes expressed herein are guaranteed. Such risks and uncertainties include, without limitation,

risks and uncertainties associated with (i) our inability to manufacture our product candidates on a commercial scale on our own, or in

collaboration with third parties; (ii) difficulties in obtaining financing on commercially reasonable terms; (iii) changes in the size

and nature of our competition; (iv) loss of one or more key executives or scientists; and (v) difficulties in securing regulatory approval

to proceed to the next level of the clinical trials or to market our product candidates. More detailed information about the Company and

the risk factors that may affect the realization of forward-looking statements is set forth in the Company’s filings with the Securities

and Exchange Commission (SEC), including the Company’s Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. Investors are

urged to read these documents free of charge on the SEC’s website at http://www.sec.gov. The Company assumes no obligation to publicly

update or revise its forward-looking statements as a result of new information, future events or otherwise.

This press release does

not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of that state or jurisdiction.

Contact

Leeds Chow, CFO

Email: leedschow@ambrivis.com

ABVC BIOPHARMA, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | |

September 30,

2023 | | |

December 31,

2022 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| Current Assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 500,069 | | |

$ | 85,265 | |

| Restricted cash | |

| 620,868 | | |

| 1,306,463 | |

| Accounts receivable, net | |

| 1,530 | | |

| 98,325 | |

| Accounts receivable – related parties, net | |

| 624,373 | | |

| 757,343 | |

| Due from related party – current | |

| 535,046 | | |

| 513,819 | |

| Short-term Investment | |

| 68,521 | | |

| 75,797 | |

| Prepaid expenses and other current assets | |

| 143,127 | | |

| 150,235 | |

| Total Current Assets | |

| 2,493,534 | | |

| 2,987,247 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 7,953,936 | | |

| 573,978 | |

| Operating lease right-of-use assets | |

| 899,817 | | |

| 1,161,141 | |

| Long-term investments | |

| 2,677,395 | | |

| 842,070 | |

| Deferred tax assets | |

| 34,256 | | |

| 117,110 | |

| Prepaid expenses – non-current | |

| 128,898 | | |

| 135,135 | |

| Security deposits | |

| 44,259 | | |

| 58,838 | |

| Prepayment for long-term investments | |

| 1,429,016 | | |

| 2,838,578 | |

| Due from related parties – non-current | |

| 930,396 | | |

| 865,477 | |

| Total Assets | |

$ | 16,591,507 | | |

$ | 9,579,574 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Short-term bank loans | |

$ | 852,500 | | |

$ | 1,893,750 | |

| Accrued expenses and other current liabilities | |

| 3,558,213 | | |

| 2,909,587 | |

| Contract liabilities | |

| 79,501 | | |

| 10,985 | |

| Operating lease liabilities – current portion | |

| 392,666 | | |

| 369,314 | |

| Due to related parties | |

| 480,196 | | |

| 359,992 | |

| Total Current Liabilities | |

| 5,363,076 | | |

| 5,543,628 | |

| | |

| | | |

| | |

| Tenant security deposit | |

| 5,680 | | |

| 7,980 | |

| Operating lease liability – non-current portion | |

| 507,151 | | |

| 791,827 | |

| Convertible notes payable – third parties | |

| 1,654,404 | | |

| - | |

| Total Liabilities | |

| 7,529,911 | | |

| 6,343,435 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Preferred stock, $0.001 par value, 20,000,000 authorized, nil shares issued and outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value, 10,000,000 authorized, 4,823,043 and 3,286,190 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively(1) | |

| 4,823 | | |

| 3,286 | |

| Additional paid-in capital | |

| 80,662,290 | | |

| 67,937,050 | |

| Stock subscription receivable | |

| (677,220 | ) | |

| (1,354,440 | ) |

| Accumulated deficit | |

| (62,309,161 | ) | |

| (54,904,439 | ) |

| Accumulated other comprehensive income | |

| 519,123 | | |

| 517,128 | |

| Treasury stock | |

| (9,100,000 | ) | |

| (9,100,000 | ) |

| Total Stockholders’ Equity | |

| 9,099,855 | | |

| 3,098,585 | |

| Noncontrolling interest | |

| (38,259 | ) | |

| 137,554 | |

| Total Equity | |

| 9,061,596 | | |

| 3,236,139 | |

| | |

| | | |

| | |

| Total Liabilities and Equity | |

$ | 16,591,507 | | |

$ | 9,579,574 | |

| (1) |

Prior period results have been adjusted to reflect the 1-for-10 reverse stock split effected on July 25, 2023. |

ABVC BIOPHARMA, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

LOSS

(UNAUDITED)

| | |

Three months Ended

September 30, | | |

Nine months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 15,884 | | |

$ | 42,269 | | |

$ | 150,265 | | |

$ | 380,789 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues | |

| 29,614 | | |

| 10,741 | | |

| 162,831 | | |

| 21,004 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross (loss) profit | |

| (13,730 | ) | |

| 31,528 | | |

| (12,566 | ) | |

| 359,785 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 1,182,093 | | |

| 3,216,146 | | |

| 3,841,633 | | |

| 6,000,055 | |

| Research and development expenses | |

| 141,310 | | |

| 305,483 | | |

| 990,731 | | |

| 1,197,669 | |

| Stock-based compensation | |

| 817,740 | | |

| 225,740 | | |

| 1,409,969 | | |

| 5,143,483 | |

| Total operating expenses | |

| 2,141,143 | | |

| 3,747,369 | | |

| 6,242,333 | | |

| 12,341,207 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (2,154,873 | ) | |

| (3,715,841 | ) | |

| (6,254,899 | ) | |

| (11,981,422 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 40,246 | | |

| 48,164 | | |

| 147,998 | | |

| 127,354 | |

| Interest expense | |

| (1,218,624 | ) | |

| (126,536 | ) | |

| (1,390,039 | ) | |

| (159,507 | ) |

| Operating sublease income | |

| (3,000 | ) | |

| 21,597 | | |

| 53,900 | | |

| 78,523 | |

| Gain/Loss on foreign exchange changes | |

| (25,059 | ) | |

| (177 | ) | |

| (55,625 | ) | |

| 17,865 | |

| Other (expense) income | |

| (7,769 | ) | |

| 491 | | |

| (1,174 | ) | |

| (59,381 | ) |

| Total other (expense) income | |

| (1,214,206 | ) | |

| (56,461 | ) | |

| (1,244,940 | ) | |

| 4,854 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax | |

| (3,369,079 | ) | |

| (3,772,302 | ) | |

| (7,499,839 | ) | |

| (11,976,568 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for (benefit from) income tax | |

| (999 | ) | |

| 4,222 | | |

| 80,696 | | |

| (165,096 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (3,368,080 | ) | |

| (3,776,524 | ) | |

| (7,580,535 | ) | |

| (11,811,472 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributable to noncontrolling interests | |

| (50,564 | ) | |

| (71,660 | ) | |

| (175,813 | ) | |

| (252,171 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss attributed to ABVC and subsidiaries | |

| (3,317,516 | ) | |

| (3,704,864 | ) | |

| (7,404,722 | ) | |

| (11,559,301 | ) |

| Foreign currency translation adjustment | |

| (15,082 | ) | |

| (190,019 | ) | |

| 1,995 | | |

| (426,579 | ) |

| Comprehensive loss | |

$ | (3,332,598 | ) | |

$ | (3,894,883 | ) | |

$ | (7,402,727 | ) | |

$ | (11,985,880 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | (0.82 | ) | |

$ | (1.14 | ) | |

$ | (2.08 | ) | |

$ | (3.71 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in computing net loss per share of common stock(1): | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

| 4,055,345 | | |

| 3,257,912 | | |

| 3,555,474 | | |

| 3,119,795 | |

| (1) |

Prior period results have been adjusted to reflect the 1-for-10 reverse stock split effected on July 25, 2023. |

ABVC BIOPHARMA, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Nine months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | |

| |

| Net loss | |

$ | (7,580,535 | ) | |

$ | (11,811,472 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation | |

| 20,949 | | |

| 17,364 | |

| Stock-based compensation for non-employees | |

| 1,409,969 | | |

| 5,143,483 | |

| Provision for doubtful accounts | |

| 38,500 | | |

| 521,955 | |

| Other non-cash expenses | |

| 1,422,362 | | |

| 30,564 | |

| Deferred tax expense | |

| (35,719 | ) | |

| (31,247 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Decrease (increase) in accounts receivable | |

| 191,265 | | |

| (31,909 | ) |

| Decrease (increase) in prepaid expenses and security deposits | |

| 27,924 | | |

| 243,065 | |

| Decrease (increase) in tenant security deposit | |

| (2,300 | ) | |

| - | |

| Decrease (increase) in due from related parties | |

| 189,755 | | |

| (983,707 | ) |

| Decrease in inventory | |

| - | | |

| 5,486 | |

| Increase (decrease) in accrued expenses and other current liabilities | |

| 648,626 | | |

| (99,306 | ) |

| Increase (decrease) in contract liabilities | |

| 68,516 | | |

| - | |

| Increase (decrease) in due to related parties | |

| (155,697 | ) | |

| 58,402 | |

| Net cash used in operating activities | |

| (3,756,385 | ) | |

| (6,937,322 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of equipment | |

| (21,201 | ) | |

| (119,603 | ) |

| Increase in prepayment for long-term investments | |

| (493,158 | ) | |

| (1,518,793 | ) |

| Net cash used in investing activities | |

| (514,359 | ) | |

| (1,638,396 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Issuance of common stock | |

| 1,050,000 | | |

| 3,917,425 | |

| Proceeds from issuance of warrant | |

| 2,429,028 | | |

| - | |

| Proceeds from convertible notes payable – third parties | |

| 1,352,512 | | |

| - | |

| Proceeds from short-term loan | |

| - | | |

| 350,000 | |

| Repayment of short-term bank loans | |

| (1,000,000 | ) | |

| - | |

| Net cash provided by financing activities | |

| 3,831,540 | | |

| 4,267,425 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | |

| 168,413 | | |

| (286,775 | ) |

| | |

| | | |

| | |

| Net decrease in cash and cash equivalents and restricted cash | |

| (270,791 | ) | |

| (4,595,068 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents and restricted cash | |

| | | |

| | |

| Beginning | |

| 1,391,728 | | |

| 6,565,215 | |

| Ending | |

$ | 1,120,937 | | |

$ | 1,970,147 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flows | |

| | | |

| | |

| Cash paid during the year for: | |

| | | |

| | |

| Interest expense paid | |

$ | 27,525 | | |

$ | 161,741 | |

| Income taxes paid | |

$ | - | | |

$ | 1,600 | |

8

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

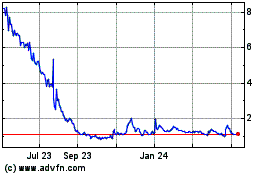

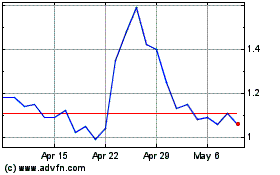

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From Apr 2024 to May 2024

ABVC BioPharma (NASDAQ:ABVC)

Historical Stock Chart

From May 2023 to May 2024