UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 14)1

ALLIED GAMING & ENTERTAINMENT INC.

(Name

of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

019170109

(CUSIP Number)

Knighted Pastures,

LLC

1933 S. Broadway Suite 1146

Los Angeles, CA 90007

Attention: Roy Choi

(213) 222-8589

ANDREW

FREEDMAN

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300 |

Young

J. Kim

TroyGould

PC

1801 Century Park East, Suite 1600

Los Angeles, California 90067

(310) 553-4441 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

October 31, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Knighted Pastures, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

California |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,906,270 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,906,270 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,906,270 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

20.2%(1) |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

(1) Percentage calculated based on 44,106,014 shares of Common Stock

outstanding as of October 25, 2024, as reported in the Issuer’s preliminary proxy statement on Schedule 14A filed with the Securities

and Exchange Commission (“SEC”) on October 29, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Roy Choi |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

United States of America |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

0 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

11,986,423 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

0 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

11,986,423 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

11,986,423 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

27.2%(1) |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

(1) Percentage calculated based on 44,106,014 shares of Common

Stock outstanding as of October 25, 2024, as reported in the Issuer’s preliminary proxy statement on Schedule 14A filed with the

SEC on October 29, 2024.

AMENDMENT NO. 14 TO SCHEDULE 13D

Reference is hereby made to the statement on Schedule

13D filed with the Securities and Exchange Commission by the Reporting Persons with respect to the Common Stock of the Issuer on January

29, 2021, Amendment No. 1 thereto filed on December 13, 2021, Amendment No. 2 thereto filed on December 27, 2021, Amendment No. 3 thereto

filed on February 9, 2022, Amendment No. 4 thereto filed on September 9, 2023, Amendment No. 5 thereto filed on December 28, 2023, Amendment

No. 6 thereto filed on February 6, 2024, Amendment No. 7 thereto filed on March 7, 2024, Amendment No. 8 thereto filed on May 23, 2024,

Amendment No. 9 thereto filed on July 1, 2024, Amendment No. 10 thereto filed on July 11, 2024, Amendment No. 11 thereto filed on July

18, 2024, Amendment No. 12 thereto filed on October 1, 2024 and Amendment No. 13 thereto filed on October 25, 2024 (as amended, the “Schedule

13D”). Terms defined in the Schedule 13D are used herein as so defined.

| Item 4. | Purpose of Transaction. |

Item

4 is hereby amended to add the following:

On

October 31, 2024, the Reporting Persons delivered to the Issuer the Supplement to the Amended and Restated Notice of Nomination for Election

as Directors and Submission of Business Proposals at the 2024 Meeting of Stockholders of Issuer (“Supplemental No. 1”). Supplemental

No. 1 revised and supplemented certain proposals the Reporting Persons intend to submit to stockholders at the Issuer’s 2024 Annual

Meeting, which consisted of proposals to (i) remove for cause Yangyang Li, Yushi Guo and Yuanfei Qu from the Issuer’s board of directors

(the “Board”), (ii) to repeal any provision of the Issuer’s Amended and Restated Bylaws (the “Bylaws”) adopted

by the Board without stockholder approval subsequent to June 15, 2024, (iii) to amend Article III, Section 3.4 of the Bylaws to add that

meetings of the Board may be called by any two (2) directors, (iv) to amend Article III, Section 3.4 of the Bylaws to update the notice

procedures required to call a meeting of the Board such that the notice must include a description of the business to be transacted at

that meeting of the Board and to remove the ability for the meeting to be called without meeting certain minimum advance notice requirements,

(v) to amend Article III of the Bylaws to require supermajority approval of 80% of the directors serving on the Board to adopt certain

corporate actions specified therein, and (vi) to amend Article VIII, Section 8.7 of the Bylaws to require supermajority approval

of 80% of the directors serving on the Board to amend the Bylaws.

| Item 6. | Contracts, Arrangement, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 is hereby amended to

add the following:

On October 31, 2024, the Reporting

Persons and the individuals nominated by Knighted entered into a Group Agreement (the “Group Agreement”) pursuant to which,

among other things, the members of the group (the “Group”) agreed (i) to solicit proxies for the election of certain persons

nominated for election to the Board at the 2024 Annual Meeting, including the individuals nominated by Knighted, (ii) that the individuals

nominated by Knighted would not transact in the securities of the Issuer without the prior written consent of Knighted, and (iii) that

Knighted would bear all approved expenses incurred in connection with the Group’s activities. The foregoing description of the Group

Agreement is not complete and is qualified in its entirety by reference to the full text of the Group Agreement, which is attached hereto

as Exhibit 99.1 and is incorporated by reference herein.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended to add the following exhibit:

| 99.1 | Group Agreement, dated October 31, 2024. |

SIGNATURES

After reasonable inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: November 4, 2024 |

/s/ Roy Choi |

| |

Roy Choi |

| |

|

|

| Dated: November 4, 2024 |

Knighted Pastures, LLC |

| |

|

| |

/s/ Roy Choi |

| |

Name: |

Roy Choi |

| |

Title: |

Manager |

GROUP AGREEMENT

WHEREAS, certain of the

undersigned are stockholders, direct or beneficial, of Allied Gaming & Entertainment Inc., a Delaware corporation (the “Company”);

WHEREAS, Knighted

Pastures, LLC, a California limited liability company and Roy Choi (collectively, “Knighted”), Walter Ivey Delph III and Jennifer

van Dijk (collectively, the “Group”), wish to form a group for the purpose of seeking representation on the Board of

Directors of the Company (the “Board”) at the 2024 annual meeting of stockholders of the Company (including any other meeting

of stockholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof, the “Annual Meeting”)

and for the purpose of taking all other action necessary to achieve the foregoing.

NOW, IT IS AGREED, this

31st day of October, 2024 by the parties hereto:

1. In

the event that the Group becomes obligated to file a statement on Schedule 13D while this agreement (the “Agreement”) is in

effect, in accordance with Rule 13d-1(k)(1)(iii) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

each of the undersigned agrees to the joint filing on behalf of each of them of statements on Schedule 13D, and any amendments thereto,

with respect to the securities of the Company. Each member of the Group shall be responsible for the accuracy and completeness of his/her/its

own disclosure therein, and is not responsible for the accuracy and completeness of the information concerning the other members, unless

such member knows or has reason to know that such information is inaccurate.

2. So

long as this agreement is in effect, each of Walter Ivey Delph III and Jennifer van Dijk agrees

to provide Knighted advance written notice prior to effecting any purchase, sale, acquisition or disposal of any securities of the Company

in which he or she has, or would have, direct or indirect beneficial ownership so that Knighted has an opportunity to review the potential

implications of any such transaction in the securities of the Company and pre-clear any such potential transaction in the securities of

the Company by Walter Ivey Delph III and Jennifer van Dijk. Each of Walter

Ivey Delph III and Jennifer van Dijk agrees that he or she shall not undertake or effect any purchase, sale, acquisition or disposal

of any securities of the Company without the prior written consent of Knighted.

3. So

long as this Agreement is in effect, each of the undersigned shall provide written notice to Olshan Frome Wolosky LLP (“Olshan”)

of (i) any of their purchases or sales of securities of the Company; or (ii) any securities of the Company over which they acquire or

dispose of beneficial ownership. Notice shall be given no later than 24 hours after each such transaction.

4. Each

of the undersigned agrees to form the Group for the purpose of (i) soliciting proxies or written consents for the election of the persons

nominated by the Group to the Board at the Annual Meeting, (ii) taking such other actions as the parties deem advisable, and (iii) taking

all other action necessary or advisable to achieve the foregoing.

5. Knighted

shall have the right to pre-approve all expenses incurred in connection with the Group’s activities and agrees to pay directly all

such pre-approved expenses.

6. Each

of the undersigned agrees that any SEC filing, press release or stockholders communication proposed to be made or issued by the Group

or any member of the Group in connection with the Group’s activities set forth in Section 4 shall be first approved by Knighted,

or its representatives, which approval shall not be unreasonably withheld.

7. The

relationship of the parties hereto shall be limited to carrying on the business of the Group in accordance with the terms of this Agreement.

Such relationship shall be construed and deemed to be for the sole and limited purpose of carrying on such business as described herein.

Nothing herein shall be construed to authorize any party to act as an agent for any other party, or to create a joint venture or partnership,

or to constitute an indemnification. Subject to Section 2 hereof, nothing herein shall restrict any party’s right to purchase or

sell securities of the Company, as he/she/it deems appropriate, in his/her/its sole discretion, provided that all such sales are made

in compliance with all applicable securities laws.

8. This

Agreement may be executed in counterparts, each of which shall be deemed an original and all of which, taken together, shall constitute

but one and the same instrument, which may be sufficiently evidenced by one counterpart.

9. In

the event of any dispute arising out of the provisions of this Agreement or their investment in the Company, the parties hereto consent

and submit to the exclusive jurisdiction of the Federal and State Courts in the State of New York.

10. Any

party hereto may terminate his/her/its obligations under this Agreement on 24 hours’ written notice to all other parties, with a

copy by fax to Andrew Freedman at Olshan, Fax No. (212) 451-2222.

11. Each

party acknowledges that Olshan shall act as counsel for both the Group and Knighted and its affiliates relating to their investment in

the Company.

12. Each

of the undersigned parties hereby agrees that this Agreement shall be filed as an exhibit to a Schedule 13D pursuant to Rule 13d-1(k)(1)(iii)

under the Exchange Act.

IN WITNESS WHEREOF, the

parties hereto have caused this Agreement to be executed as of the day and year first above written.

| |

Knighted Pastures, LLC |

| |

|

| |

By: |

/s/ Roy Choi |

| |

|

Name: |

Roy Choi |

| |

|

Title: |

Manager |

| |

/s/ Walter Ivey Delph III |

| |

Walter Ivey Delph III |

| |

/s/ Jennifer Van Dijk |

| |

Jennifer van Dijk |

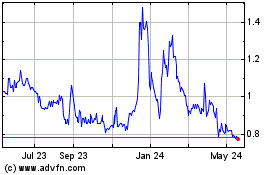

Allied Gaming and Entert... (NASDAQ:AGAE)

Historical Stock Chart

From Dec 2024 to Jan 2025

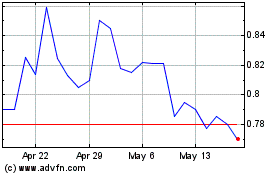

Allied Gaming and Entert... (NASDAQ:AGAE)

Historical Stock Chart

From Jan 2024 to Jan 2025