false

0001541157

0001541157

2023-12-27

2023-12-27

0001541157

dei:AdrMember

2023-12-27

2023-12-27

0001541157

AKTX:OrdinarySharesParValue0.0001PerShareMember

2023-12-27

2023-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 27, 2023

AKARI THERAPEUTICS, PLC

(Exact Name of Registrant as Specified in Charter)

| England and Wales |

|

001-36288 |

|

98-1034922 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

22 Boston Wharf Road FL 7

Boston, MA 02210

(Address, including zip code, of Principal Executive

Offices)

Registrant’s telephone number, including

area code: (929) 274-7510

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class: |

|

Trading

Symbol(s) |

|

Name of each exchange on

which

registered |

| American Depository Shares each representing 2000 Ordinary Shares |

|

AKTX |

|

The Nasdaq Stock Market LLC |

| Ordinary Shares, par value $0.0001 per share* |

|

True |

|

The Nasdaq Stock Market LLC |

*Trading, but only in connection with the American

Depositary Shares.

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into a Material Definitive Agreement.

On December 27, 2023, Akari Therapeutics, Plc

(the “Company”) entered into a definitive agreement (the “Purchase Agreement”) with existing investors, the Company’s

Chairman Dr. Ray Prudo and Director Samir R. Patel, M.D., pursuant to which the Company agreed to sell and issue in a private placement

(the “Private Placement”) an aggregate of 947,868 unregistered American Depository Shares (“ADSs”), each representing

2,000 of the Company’s ordinary shares, at a purchase price of $2.11 per ADS. The Private Placement closed on December 29, 2023.

The Purchase Agreement also contains representations, warranties, indemnification and other provisions customary for transactions of this

nature.

The Company paid Paulson Investment Company, LLC

(the “Placement Agent”) a cash fee equal to 5% of the aggregate purchase price for the ADSs sold in the Private Placement

and a non-accountable expense allowance of $60,000.

Pursuant to the Purchase Agreement, the Company

has agreed to prepare and file a registration statement on Form S-3 with the Securities and Exchange Commission no later March 31, 2024

to register the resale of the ADSs purchased pursuant to the Purchase Agreement.

The securities issued to the purchasers under

the Purchase Agreement were offered in reliance on an exemption from registration provided by Section 4(a)(2) of the Securities Act of

1933, as amended (the “Securities Act”) and Rule 506 of Regulation D promulgated thereunder. The Company relied on this exemption

from registration based in part on representations made by the purchasers, including that each purchaser is an “accredited investor”,

as defined in Rule 501(a) promulgated under the Securities Act.

The offer and sale of the securities pursuant

to the Purchase Agreement have not been registered under the Securities Act or any state securities laws. The securities may not be offered

or sold in the United States absent registration or an applicable exemption from registration requirements. Neither this Current Report

on Form 8-K, nor the exhibits attached hereto, is an offer to sell or the solicitation of an offer to buy the securities described herein

or therein.

The foregoing summary of the terms of the Purchase

Agreement is subject to, and qualified in its entirety by such agreement which will be filed as an exhibit to the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 to be filed with the U.S. Securities and Exchange Commission..

Item 3.02 Unregistered Sales of Equity Securities.

The information under Item 1.01 of this Current Report on Form 8-K

regarding the unregistered securities described herein is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On

January 2, 2024, the Company issued a press release relating to the matters described

in Item 1.01 of this Current Report on Form 8-K. A copy of the press release is attached to this Current Report on Form 8-K

as Exhibit 99.1 and incorporated by reference in this Item 7.01. The information contained in this Item 7.01, including Exhibit 99.1,

is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference

into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general

incorporation language in such filing, except as shall be expressly incorporated by specific reference in such filing

Item 8.01. Other Events

Domestic Issuer Status

As of June 30, 2023, the last business day of

the second quarter of the Company, the Company determined that it no longer qualified as a foreign private issuer. As a result, effective

January 1, 2024, the Company is required to file periodic reports and registration statements on U.S. domestic issuer forms with the SEC,

which are more detailed and extensive in certain respects, and which must be filed more promptly, than the forms available to a foreign

private issuer. In addition, the Company is required to comply with U.S. proxy requirements and Regulation FD (Fair Disclosure) and the

Company’s officers, directors and principal shareholders are subject to the beneficial ownership reporting and short-swing profit

recovery requirements in Section 16 of the Securities Exchange Act of 1934, as amended. The Company is also no longer eligible to rely

upon exemptions from corporate governance requirements that are available to foreign private issuers or to benefit from other accommodations

for foreign private issuers under the rules of the SEC or the Nasdaq. The Company’s next Annual Report for the year ended December

31, 2023 will be filed as a domestic issuer on Form 10-K.

Disclosure Channels to Disseminate Information

Investors

and others should note that the Company may announce material information about its finances, product candidates, clinical trials and

other matters to its investors using its website (www.akaritx.com/), its Linkedin account (https://www.linkedin.com/company/akaritx/)

and its X (formerly Twitter) account (https://x. com/AkariTX) in addition to SEC filings, press releases, public conference calls

and webcasts. The Company uses these channels to communicate with the Company’s shareholders and the public about the Company and

other issues. It is possible that the information the Company posts on these channels could be deemed to be material information. Therefore,

the Company encourages investors, the media, and others interested in the Company to review the information it posts on the Company’s

website, LinkedIn account and X account in addition to following its press releases, SEC filings, public conference calls, and webcasts.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Akari Therapeutics, Plc |

| |

|

|

| Date: January 2, 2024 |

By: |

/s/ Rachelle Jacques |

| |

|

Rachelle Jacques |

| |

|

President and Chief Executive Officer |

Exhibit 99.1

Akari Therapeutics

Announces Existing Investors Support the Company

Through a $2 Million

Private Placement Financing

BOSTON and LONDON, January 2, 2024 (GLOBE

NEWSWIRE) -- Akari Therapeutics, Plc (Nasdaq: AKTX), a late-stage biotechnology company developing advanced therapies for autoimmune and

inflammatory diseases, today announced that it closed a private placement financing with existing investors, Akari Chairman Dr. Ray

Prudo and Director Samir R. Patel, M.D., on December 29, 2023, resulting in gross proceeds of approximately $2 million.

In connection with the financing, Akari issued

947,868 unregistered American Depository Shares (“ADSs”), each representing 2,000 of the company’s ordinary shares,

at a purchase price of $2.11 per ADS.

Paulson Investment Company, LLC acted as the

exclusive placement agent for this financing.

The ADSs described above were offered and

sold in a private placement under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Act”) and Regulation

D promulgated thereunder and have not been registered under the Act or state securities laws and may not be offered or sold in the United

States absent registration with the Securities and Exchange Commission or an applicable exemption from such registration requirements.

This press release shall not constitute an

offer to sell or the solicitation of an offer to buy any of the securities described herein. There shall not be any offer, solicitation

of an offer to buy, or sale of securities in any state or jurisdiction in which such an offering, solicitation, or sale would be unlawful

prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Akari Therapeutics

Akari Therapeutics, plc (Nasdaq: AKTX) is a biotechnology company developing

advanced therapies for autoimmune and inflammatory diseases. Akari’s lead asset, investigational nomacopan, is a bispecific recombinant

inhibitor of complement C5 activation and leukotriene B4 (LTB4) activity. Akari’s pipeline includes a Phase 3 clinical trial program

investigating nomacopan for severe pediatric hematopoietic stem cell transplant-related thrombotic microangiopathy (HSCT-TMA). Akari has

been granted Orphan Drug, Fast Track and Rare Pediatric Disease designations from the FDA for nomacopan for the treatment of pediatric

HSCT-TMA and orphan drug designation from the European Commission for treatment in hematopoietic stem cell transplantation. Akari’s

pipeline also includes a clinical program developing nomacopan for adult HSCT-TMA and pre-clinical research of long-acting PAS-nomacopan

in geographic atrophy (GA). For more information about Akari, please visit akaritx.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect

our current views about our plans, intentions, expectations, strategies, and prospects, which are based on the information currently available

to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies, and prospects as reflected

in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations,

or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking

statements and will be affected by a variety of risks and factors that are beyond our control. Such risks and uncertainties for our company

include, but are not limited to: needs for additional capital to fund our operations, our ability to continue as a going concern; uncertainties

of cash flows and inability to meet working capital needs; an inability or delay in obtaining required regulatory approvals for nomacopan

and any other product candidates, which may result in unexpected cost expenditures; our ability to obtain orphan drug designation in additional

indications; risks inherent in drug development in general; uncertainties in obtaining successful clinical results for nomacopan and any

other product candidates and unexpected costs that may result there; difficulties enrolling patients in our clinical trials; failure to

realize any value of nomacopan and any other product candidates developed and being developed in light of inherent risks and difficulties

involved in successfully bringing product candidates to market; inability to develop new product candidates and support existing product

candidates; the approval by the FDA and EMA and any other similar foreign regulatory authorities of other competing or superior products

brought to market; risks resulting from unforeseen side effects; risk that the market for nomacopan may not be as large as expected risks

associated with the impact of the COVID-19 pandemic; inability to obtain, maintain and enforce patents and other intellectual property

rights or the unexpected costs associated with such enforcement or litigation; inability to obtain and maintain commercial manufacturing

arrangements with third party manufacturers or establish commercial scale manufacturing capabilities; the inability to timely source adequate

supply of our active pharmaceutical ingredients from third party manufacturers on whom the company depends; unexpected cost increases

and pricing pressures and risks and other risk factors detailed in our public filings with the U.S. Securities and Exchange Commission,

including our most recently filed Annual Report on Form 20-F filed with the SEC. Except as otherwise noted, these forward-looking

statements speak only as of the date of this press release and we undertake no obligation to update or revise any of these statements

to reflect events or circumstances occurring after this press release. We caution investors not to place considerable reliance on the

forward-looking statements contained in this press release.

For more information

Investor Contact:

Mike Moyer

LifeSci Advisors

(617) 308-4306

mmoyer@lifesciadvisors.com

Media Contact:

Eliza Schleifstein

Schleifstein PR

(917) 763-8106

eliza@schleifsteinpr.com

v3.23.4

Cover

|

Dec. 27, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 27, 2023

|

| Entity File Number |

001-36288

|

| Entity Registrant Name |

AKARI THERAPEUTICS, PLC

|

| Entity Central Index Key |

0001541157

|

| Entity Tax Identification Number |

98-1034922

|

| Entity Incorporation, State or Country Code |

X0

|

| Entity Address, Address Line One |

22 Boston Wharf Road FL 7

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02210

|

| City Area Code |

929

|

| Local Phone Number |

274-7510

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| ADR [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American Depository Shares each representing 2000 Ordinary Shares

|

| Trading Symbol |

AKTX

|

| Security Exchange Name |

NASDAQ

|

| Ordinary Shares, par value $0.0001 per share [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.0001 per share*

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=dei_AdrMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AKTX_OrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

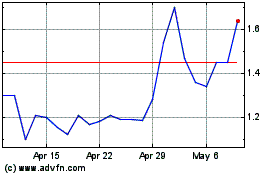

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024