Amphastar Pharmaceuticals Shares Down 9% After Private Notes Offering

13 September 2023 - 2:10AM

Dow Jones News

By Chris Wack

Amphastar Pharmaceuticals shares declined 9% to $46.97 on

Tuesday after the company said it intends to offer $300 million of

convertible senior notes due 2029 in a private placement.

The stock hit a 52-week high of $67.66 on Aug. 9. The shares are

up 62% in the past 12 months.

The company also intends to grant the initial purchasers of the

notes an option to buy up to an additional $45 million in

notes.

The notes will be general senior unsecured obligations of

Amphastar and will accrue interest payable semi-annually in

arrears. The interest rate, initial conversion rate and other terms

will be determined when the offering prices.

Amphastar intends to use $200 million of proceeds from the

offering to repay borrowings under its term loan, and up to $50

million of its stock. The remainder of the proceeds will be used

for general corporate purposes.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

September 12, 2023 11:55 ET (15:55 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

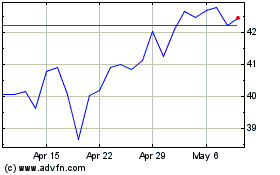

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From Apr 2024 to May 2024

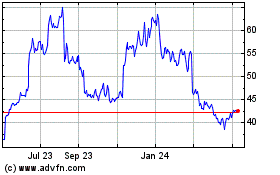

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From May 2023 to May 2024