Current Report Filing (8-k)

19 February 2022 - 1:55AM

Edgar (US Regulatory)

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

February 14, 2022

Date of Report (Date of earliest event reported)

A

SPAC I Acquisition Corp.

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands |

|

001- 41285 |

|

n/a |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

Level 39, Marina Bay Financial Centre

Tower 2

10 Marina Boulevard, Singapore 018983 |

|

n/a |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: +(65) 6818 5796

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share, with no par value, three-fourths of one redeemable warrant and one right to receive one-tenth of one Class A ordinary share |

|

ASCAU |

|

The Nasdaq Capital Market LLC |

| |

|

|

|

|

| Class A ordinary shares included as part of the units |

|

ASCA |

|

The Nasdaq Capital Market LLC |

| |

|

|

|

|

| Rights included as part of the units |

|

ASCAR |

|

The Nasdaq Capital Market LLC |

| |

|

|

|

|

| Warrants included as part of the units |

|

ASCAW |

|

The Nasdaq Capital Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On February 14, 2022, the

registration statement (File No. 333-258184) (the “Registration Statement”) relating to the initial public offering (“IPO”)

of A SPAC I Acquisition Corp. (the “Company”) was declared effective by the Securities and Exchange Commission. In connection

therewith, the Company entered into the following agreements previously filed as exhibits to the Registration Statement:

| |

● |

Underwriting Agreement, dated February 14, 2022, by and between the Company and Chardan Capital Markets, LLC (“Chardan”); |

| |

|

|

| |

● |

Amended and Restated Memorandum and Articles of Association |

| |

|

|

| |

● |

Rights Agreement, dated February 14, 2022, by and between the Company and Continental Stock Transfer & Trust Company; |

| |

|

|

| |

● |

Warrant Agreement, dated February 14, 2022, by and between the Company and Continental Stock Transfer & Trust Company; |

| |

|

|

| |

● |

Letter Agreement, dated February 14, 2022, by and between the Company’s officers, directors, shareholders and A SPAC (Holdings) Acquisition Corp.; |

| |

|

|

| |

● |

Investment Management Trust Agreement, dated February 14, 2022, by and between Continental Stock Transfer & Trust Company and the Company; |

| |

|

|

| |

● |

Registration Rights Agreement, dated February 14, 2022, by and among the Company and the initial shareholders of the Company; |

| |

|

|

| |

● |

Warrant Subscription Agreement, dated February 14, 2022, by and between the Company and A SPAC (Holdings) Acquisition Corp.; |

| |

|

|

| |

● |

Stock Escrow Agreement, dated February 14, 2022, by and between the Company and Continental Stock Transfer & Trust Company; and |

| |

|

|

| |

● |

Indemnity Agreement, dated February 14, 2022, by and between the Company’s officers, directors, shareholders and A SPAC (Holdings) Acquisition Corp. |

On February 17, 2022, the

Company consummated the IPO of 6,000,000 units (the “Units”). Each Unit consists of one Class A ordinary share (“Ordinary

Share”), three-fourths (3/4) of one redeemable warrant (“Warrant”), and one right (“Right”) to receive one-tenth

of one Ordinary Share upon the consummation of an initial business combination. The Units were sold at an offering price of $10.00 per

Unit, generating gross proceeds of $60,000,000. The Company granted the underwriters a 45-day option to purchase up to 900,000 additional

Units to cover over-allotments.

As of February 17, 2022, a

total of $60,600,000 of the net proceeds from the IPO and the Private Placement (as defined below) were deposited in a trust account established

for the benefit of the Company’s public shareholders. An audited balance sheet as of February 14, 2022 reflecting receipt of the

proceeds upon consummation of the IPO and the Private Placement will be filed within 4 business days of the consummation of the IPO.

Item 3.02. Unregistered Sales of Equity Securities.

Simultaneously with the closing

of the IPO, the Company consummated the private placement (“Private Placement”) with A SPAC (Holdings) Acquisition Corp.,

the Company’s sponsor, of 2,875,000 warrants (the “Private Warrants”) at a price of $1.00 per Private Warrant, generating

total proceeds of $2,875,000.

The Private Warrants are identical

to the public Warrants sold in the IPO, as set forth in the Underwriting Agreement, except as described in the Warrant Agreement. The

warrant agent will not register any transfer of Private Warrants, except for transfers (i) among the initial shareholders or to the initial

shareholder’s members or the Company’s officers, directors, consultants or their affiliates, (ii) to a holder’s shareholders

or members upon the holder’s liquidation, in each case if the holder is an entity, (iii) by bona fide gift to a member of the holder’s

immediate family or to a trust, the beneficiary of which is the holder or a member of the holder’s immediate family, in each case

for estate planning purposes, (iv) by virtue of the laws of descent and distribution upon death, (v) pursuant to a qualified domestic

relations order, (vi) to the Company for no value for cancellation in connection with the consummation of an initial business combination,

(vii) in the event of the Company’s liquidation prior to its consummation of an initial business combination or (viii) in the event

that, subsequent to the consummation of an initial business combination, the Company completes a liquidation, merger, share exchange,

reorganization or other similar transaction which results in all of the Company’s shareholders having the right to exchange their

Ordinary Shares for cash, securities or other property, in each case (except for clauses (vi), (vii) or (viii) or with the Company’s

prior written consent) on the condition that prior to such registration for transfer, the warrant agent shall be presented with written

documentation pursuant to which each transferee (each, a “Permitted Transferee”) or the trustee or legal guardian for such

Permitted Transferee agrees to be bound by the transfer restrictions contained in this Agreement and any other applicable agreement the

transferor is bound by.

The Private Warrants were

issued pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, as the transactions did not involve a public offering.

Item 9.01. Financial Statements and Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 1.1 |

|

Underwriting Agreement, dated February 14, 2022, by and between the Company and Chardan. |

| |

|

|

| 3.1 |

|

Amended and Restated Memorandum and Articles of Association. |

| |

|

|

| 4.1 |

|

Rights Agreement, dated February 14, 2022, by and between Continental Stock Transfer & Trust Company and the Company. |

| |

|

|

| 4.2 |

|

Warrant Agreement, dated February 14, 2022, by and between the Company and Continental Stock Transfer & Trust Company |

| |

|

|

| 10.1 |

|

Letter Agreement, dated February 14, 2022, by and between the Company’s officers, directors, shareholders and A SPAC (Holdings) Acquisition Corp. |

| |

|

|

| 10.2 |

|

Investment Management Trust Agreement, dated February 14, 2022, by and between Continental Stock Transfer & Trust Company and the Company. |

| |

|

|

| 10.3 |

|

Registration Rights Agreement, dated February 14, 2022, by and among the Company and the initial shareholders of the Company. |

| |

|

|

| 10.4 |

|

Warrant Subscription Agreement, dated February 14, 2022, by and between the Company and A SPAC (Holdings) Acquisition Corp. |

| |

|

|

| 10.5 |

|

Stock Escrow Agreement, dated February 14, 2022, by and between the Company and Continental Stock Transfer & Trust Company. |

| |

|

|

| 10.6 |

|

Indemnity Agreement, dated February 14, 2022, by and between the Company’s officers, directors, shareholders and A SPAC (Holdings) Acquisition Corp. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: February 18, 2022 |

|

| |

|

| A SPAC I ACQUISITION CORP. |

|

| |

|

| By: |

/s/Claudius Tsang |

|

| Name: Claudius Tsang |

|

| Title: Chief Executive Officer and Chief Financial Officer |

|

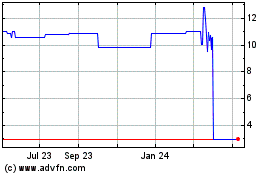

A SPAC I Acquisition (NASDAQ:ASCAU)

Historical Stock Chart

From Mar 2024 to Apr 2024

A SPAC I Acquisition (NASDAQ:ASCAU)

Historical Stock Chart

From Apr 2023 to Apr 2024