UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

JULIUS D. RUDOLPH

BRANDON L. SIMMONS

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC together with the other participants named herein (collectively, “Driver”), intends to file a preliminary proxy statement

and accompanying WHITE universal proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of

its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania

corporation (the “Company”).

On January 20, 2023, Driver

sent the following letter to the Company’s Chief Executive Officer, Jeffrey Stopko:

January 20, 2023

Jeffrey Stopko

Chief Executive Officer

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Via Email and FedEx

Mr. Stopko,

By letter dated December 20, 2022 (the “December 20

Letter”; a copy of which is transmitted herewith), Allan Dennison, chairman of the board (the (“Board”) of

AmeriServ Financial, Inc. (the “Corporation” or “ASRV”) made reference to “unique economic

realities” affecting ASRV. Driver Opportunity Partners I LP (together with its general partner, Driver Management Company LLC,

“Driver”) is the record owner of 1,000 shares of the common stock (the “Common Stock”), par value

$0.01, of the Corporation. Driver is the beneficial owner of 1,477,919 shares of the Common Stock and one of, if not the, largest holders

of shares of the Corporation. Based on the undersigned’s review of reports filed by the Corporation with the Securities and Exchange

Commission pursuant to the Securities Exchange Act of 1934, Driver can find no description of any “unique economic realities”

affecting ASRV, let alone any explanation of how such “unique economic realities” might impact the Corporation’s

business, results of operations or financial condition.

Pursuant to 15 Pa. C.S. § 1508(b), Driver is hereby exercising

its right to inspect certain books and records and demands to inspect (and make copies or extracts therefrom) the following (collectively,

the “Books and Records”) documents:

| 1. | All documents describing, listing, detailing, or summarizing the facts and circumstances constituting the “unique economic

realities” facing, impacting, or otherwise affecting the Corporation referenced in the December 20 Letter (such facts and circumstances,

the “Unique Economic Realities”); |

| 2. | All documents quantifying, analyzing or referencing the impact of the Unique Economic Realities on the Corporation’s past, current

and prospective business, financial condition, and/or results, including, to the extent that such impact is negative, how such negative

impact might be mitigated or any steps taken in an effort to mitigate any such impact; |

| 3. | Any documents relating to any public disclosure of the Unique Economic Realities, including, without limitation, any documents regarding

whether and to what extent disclosure of the Unique Economic Realities may be required pursuant to the Securities Act of 1933 (and the

rules and regulations promulgated thereunder), the Securities Exchange Act of 1934 (and the rules and regulations promulgated thereunder)(the

“Securities Exchange Act”), or any Nasdaq listing rule, as well as any documents reflecting any discussion, analysis

or consideration regarding whether such disclosure should be made; and |

| 4. | All documents relating to any communication concerning of the Unique Economic Realities with any current or former holder of shares

of the Common Stock. |

* * *

Under Pennsylvania law, Driver has the right to make its own

inspection of the Books and Records for any proper purpose, including to make its own determination as to whether the Corporation is being

properly managed.1 Broadly speaking, there are two purposes

of this investigation.

The first purpose is to determine the nature and extent of the

Unique Economic Realities and, in light thereof, determine whether the Corporation is being properly managed. As an experienced bank investor,

Driver has yet to come across a bank or bank holding company that claimed to be subject to any “unique economic realities”

and it does not appear that the Corporation has undertaken to provide any public disclosure regarding the Unique Economic Realities. Since,

by the Corporation’s own admission, the Unique Economic Realities are “unique” operating within those Unique

Economic Realities must pose a “unique” challenge to proper management. In order to assess whether the Corporation

is being properly managed in light of the Unique Economic Realities, Driver first needs to understand the nature and extent of the Unique

Economic Realities.

The second purpose is to assess whether, by failing to insist

on adequate public disclosure of the Unique Economic Realities, the Board has exposed the Corporation to potential liability under the

federal securities laws, including without limitation, section 10(b) of the Securities and Exchange Act. Since, again, in the Corporation’s

own words, the Unique Economic Realities are “unique” and therefore not common to other similarly situation corporations,

it follows that the nature of the Unique Economic Realities, as well as their past, current and prospective impact on the Corporation’s

business and financial condition and results, would be information that would be material to any past, current or prospective holder of

shares of the Common Stock. Driver believes that proper management includes, at a minimum, not creating legal liability for failing to

disclose material information known to the Board.

Pursuant to 15 Pa. C.S. § 1508(c), the Corporation has

five business days from recepit of this demand to reply substantively to this demand. Please advise the undersigned as promptly as practicable

when and where the books and records covered by this demand will be made available to Driver. To the extent the Corporation wishes to

provide Driver with copies of the books and records covered by this demand, Driver will bear the reasonable out of pocket costs incurred

by the Corporation in copying and delivering those books and records to Driver. If the Corporation contends this demand is incomplete

or deficient in any respect, please notify the undersigned immediately in writing setting forth the facts that the Corporation contends

support its position and specifying any additional information believed to be required. In the absence of such prompt notice, Driver will

assume that this demand complies in all respects with the requirements of 15 Pa. C.S. § 1508(b).

| |

Driver Opportunity Partners I LP |

| |

|

| |

By: |

Driver Management Company, its general partner |

| |

|

|

| |

By: |

/s/ J. Abbott R. Cooper |

| |

|

Name: |

J. Abbott R. Cooper |

| |

|

Title: |

Managing Member |

I verify that the statements made in this demand are true and

correct. I understand that any false statements made herein are subject to the penalties of 18 Pa. C.S. § 4904.

| Date: January 20, 2023 |

Signed: J. Abbott R. Cooper |

1 See, Zerbey v. J.H. Zerbey Newspapers, Inc., 560 A.2d 191, 198 (Pa. Super. Ct. 1989)(holding that wanting to determine whether a corporation “is being properly managed in a general sense” constitutes a proper purpose under 15 Pa. C.S. § 1508).

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver Management”),

together with the other participants named herein (collectively, “Driver”), intends to file a preliminary proxy statement

and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

for the election of its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial,

Inc., a Pennsylvania corporation (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY

MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated

to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper, Julius D. Rudolph and

Brandon L. Simmons.

As of the date hereof, the participants

in the proxy solicitation beneficially own in the aggregate 1,477,919 shares of Common Stock, par value $0.01 per share, of the Company

(the “Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 201,000 shares of Common Stock,

including 1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity and investment manager to

certain separately managed accounts (the “SMAs”), may be deemed to beneficially own the (i) 201,000 shares of Common Stock

directly beneficially owned by Driver Opportunity and (ii) 1,276,919 shares of Common Stock held in the SMAs. Mr. Cooper, as the managing

member of Driver Management, may be deemed to beneficially own the (i) 201,000 shares of Common Stock directly beneficially owned by

Driver Opportunity and (ii) 1,276,919 shares of Common Stock held in the SMAs. Neither of Messrs. Rudolph or Simmons beneficially own

any securities of the Company.

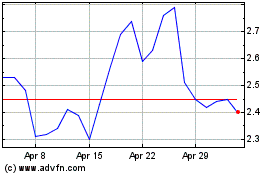

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

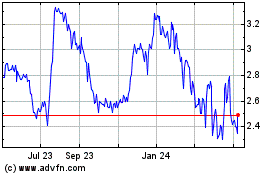

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024