Aspira Women’s Health Reports Third Quarter 2021 Financial Results

11 November 2021 - 12:00AM

Aspira Women’s Health Inc. (“Aspira”) (Nasdaq: AWH), a

bio-analytical based women’s health company focused on gynecologic

disease, today reported its financial results for the third quarter

ended September 30, 2021.

“We are very pleased with the growth in positive

medical policy coverage with the addition of AIM Specialty

Health’s Clinical Appropriateness Guidelines and Medicaid coverage

and credentialing for OVA1. In addition, in spite of renewed

COVID-19 restrictions we were able to grow in specific markets,”

indicated Valerie Palmieri, Aspira’s Chief Executive Officer. “We

are also making positive progress on our product collaboration with

the Dana Farber Cancer Institute with the successful completion of

the Phase 1 of our proof of concept study relating to our

OvaInherit trial. We had continued positive dialogue with the Food

and Drug Administration regarding our planned EndoCheck product and

expect resolution on our optimal regulatory path forward for

Endocheck by the end of the year.”

Recent Corporate Highlights

- Coverage for OVA1®

Increased to over 194 Million Covered LivesWe increased

covered lives during the third quarter to a total of over 194

million. This is an 8% increase from our base of approximately 179

million covered lives as of April 1, 2021. The Company’s OVA1 test,

a pelvic mass risk assessment for ovarian cancer, has been

determined to be medically necessary according to AIM Specialty

Health’s Clinical Appropriateness Guidelines in addition to the

eviCore Guidelines. Our market access strategy made significant

progress with reaching over 194 million covered lives, and we

believe inclusion in the AIM and eviCore guidelines provides us

with further validation and credibility in our discussions with

ALL health plans.

- Medicaid

CoverageWe are now credentialed in the top 5 states by

Medicaid population for OVA1, including California, New York,

Texas, Florida, and Pennsylvania, bringing the total credentialed

national Medicaid population to nearly 61 million Medicaid lives,

which represents approximately 77% of the U.S. Medicaid

population.

- Collaboration with Harvard

Dana Farber Cancer Institute miRNA Technology Passes Phase 1 Proof

of ConceptWe have completed with the teams at Dana Farber

Cancer Institute, Brigham and Women’s Hospital and Medical

University of Lodz the Phase 1 of the Proof of Concept evaluation.

The evaluation surpassed all required metrics and based on the

outcome of the evaluation, the Aspira Innovation team along with

the collaborators from the institutions have begun implementing

Phase 2. With the first critical stage gate passed, we are

proceeding to evaluate the combined potential impact of our protein

biomarker algorithms and the miRNA technology in the development of

a combined technology and platform which we

believe may set the foundation for a high risk ovarian

cancer screening application, which is branded as our OvaInherit

trial.

-

Publication in Third Quarter Demonstrates OVA1 Superiority

Versus CA125, the Most Common Ovarian Cancer Risk Assessment Used

TodayIn a special ovarian cancer edition, Diagnostics,

published a paper entitled “Salvaging Detection of Early-Stage

Ovarian Malignancies When CA125 Is Not Informative.” In a

retrospective study of 2,305 patients, OVA1 detected over 50% of

ovarian malignancies in premenopausal women of all cancer

stages, that CA125 would have missed. OVA1 also correctly

identified 63% of early-stage cancers missed by CA125. This paper

further validates and supports the superior early-stage risk

detection of ovarian cancer of OVA1 versus CA125 in a large

population.

- OvaSight

Development ProgressWe have determined that we will

be branding the OvaSight test as OvaWatch which we

believe is more descriptive of the utility of the

test. The test was developed through a rigorous

scientific and clinical-based process based on data from

our New York State laboratory developed tests (LDT) and from

our FDA regulatory process in 3,000 patients. We will be performing

additional scientific and market review with the intent to

refine the intended use for OvaWatch.

Financial Highlights

- Quarter over Quarter

Results – Third Quarter of 2021 versus Third Quarter of

2020:

- Total product and genetics revenue

increased 34% to $1,663,000 up from $1,239,000

- Total product and genetics volumes

increased 20% to 4,386 units up from 3,660 units

- Quarter over Quarter Results

– Third Quarter 2021 versus Second Quarter 2021:

- Total product and genetics revenue

decreased 7% to $1,663,000 down from $1,797,000 in the second

quarter of this year.

- Total product and genetics volumes

decreased 7% to 4,386 units down from 4,708 units in the second

quarter of this year.

Highlights of Third Quarter 2021 vs.

Third Quarter 2020:

- Product revenue was $1,614,000 for

the three months ended September 30, 2021, compared to $1,217,000

for the same period in 2020, an increase of 33%.

- The number of OVA1plus tests

performed increased 19% to 4,281 OVA1plus tests during the three

months ended September 30, 2021, compared to 3,596 OVA1plus tests

for the same period in 2020.

- The revenue per OVA1plus test

performed increased to approximately $377 compared to $338 for the

same period in 2020, an increase of 11%. This increase was

primarily driven by an increase in payments by contracted payers

and improved collections.

- Gross profit margin for OVA1plus

was 57% in the third quarter compared to 45% in the third quarter

of 2020. The year on year increase was driven by volume

improvement.

- Research and development expenses

for the three months ended September 30, 2021 increased by

$923,000, or 155%, compared to the same period in 2020. This

increase was primarily due to clinical utility and product

development costs related to OVASight, as well as investments in

bioinformatics, investments in Aspira Synergy and consulting

expenses associated with EndoCheck regulatory clearance.

- Sales and marketing expenses for

the three months ended September 30, 2021 increased by

$2,931,000, or 136%, compared to the same period in 2020. This

increase was primarily due to increased personnel, consulting and

recruiting costs.

- General and administrative expenses

for the three months ended September 30, 2021 increased by

$1,873,000 or 95%, compared to the same period in 2020. This

increase was primarily due to an increase in stock compensation

expenses, headcount, and personnel expenses.

- We ended the third quarter with

approximately $44.9 million in unrestricted cash. Cash used in

operations in the third quarter of 2021 was $7.9 million compared

to $3.1 million in the third quarter of 2020. This increase was

across all elements of operating expenses but primarily employment

costs and travel and entertainment as commercial travel in the

prior year was depressed due to COVID-19 pandemic related travel

restrictions.

Highlights of Third Quarter 2021 vs.

Second Quarter 2021:

- Product revenue was $1,614,000 for

the three months ended September 30, 2021, compared to $1,718,000

for the second quarter of 2021, a decrease of 6%.

- The number of OVA1plus tests

performed decreased 6% to 4,281 OVA1plus tests during the three

months ended September 30, 2021, compared to 4,553 OVA1plus tests

for the second quarter of 2021.

- The revenue per OVA1plus test

performed remained flat at approximately $377 compared to the

second quarter of 2021.

- Gross profit margin for OVA1plus

was 57% in the third quarter compared to 52% in the second quarter

of 2021.

- Research and development expenses

for the three months ended September 30, 2021 increased by

$47,000, or 3%, compared to the second quarter of 2021.

- Sales and marketing expenses for

the three months ended September 30, 2021 increased by

$1,065,000, or 27%, compared to the second quarter of 2021. The

increase was primarily driven by increases in personnel costs and

investments in marketing.

- General and administrative expenses

for the three months ended September 30, 2021 increased by

$560,000, or 17%, compared to the second quarter of

2021.

- We ended the third quarter with

approximately $44.9 million in unrestricted cash. Cash used in

operations in the third quarter of 2021 was $7.9 million compared

to $6.5 million in the second quarter of 2021. The increase was

primarily driven by new hires, consultants, marketing and

promotional activities as well as research and development spending

focused on EndoCheck.

Conference Call and Webcast

Aspira will host a call today at 8:30 a.m.

Eastern Time to discuss results followed by a question-and-answer

period.

|

Domestic: |

877-407-4018 |

|

International: |

201-689-8471 |

|

Conference ID: |

13724440 |

|

Webcast: |

https://78449.themediaframe.com/dataconf/productusers/vvdb/mediaframe/47156/indexl.html |

|

|

|

About Aspira Women’s Health

Inc.Aspira Women’s Health Inc. (formerly known as

Vermillion, Inc., Nasdaq: VRML) is transforming women’s health with

the discovery, development, and commercialization of innovative

testing options and bio-analytical solutions that help physicians

assess risk, optimize patient management, and improve gynecologic

health outcomes for women. Aspira Women’s Health is

particularly focused on closing the ethnic disparity gap in ovarian

cancer risk assessment and developing solutions for pelvic diseases

such as pelvic mass risk assessment and endometriosis.

OVA1plus™ combines our FDA-cleared products, OVA1® and OVERA®,

to detect risk of ovarian malignancy in women with adnexal masses.

Aspira GenetiX™ testing offers both targeted and more

comprehensive genetic testing options with a gynecologic

focus. With over 10 years of expertise in ovarian cancer risk

assessment, Aspira Women’s Health is working to deliver a portfolio

of pelvic mass products over a patient’s lifetime with our

cutting-edge research. The next generation of products in

development are OVASight™, which we are rebranding as OvaWatch™,

and EndoCheck™. Visit our website for more information at

www.aspirawh.com.

Forward-Looking StatementsThis

press release contains forward-looking statements, as defined in

the Private Securities Litigation Reform Act of 1995, including

statements regarding expectations with respect to studies relating

to OvaInherit and plans with respect to OvaSight/OvaWatch,

including its rebranding, scientific and market review and launch

dates. Forward-looking statements involve a number of risks and

uncertainties. Words such as “may,” “expects,” “intends,”

“anticipates,” “believes,” “estimates,” “plans,” “seeks,” “could,”

“should,” “continue,” “will,” “potential,” “projects” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements speak only as of the date of this

press release and are subject to a number of risks, uncertainties

and assumptions, including those described in the section entitled

“Risk Factors” in Aspira’s Annual Report on Form 10-K for the year

ended December 31, 2020, as supplemented by the section entitled

“Risk Factors” in Aspira’s Quarterly Report on Form 10-Q for the

quarter ended June 30, 2021. The events and circumstances reflected

in Aspira’s forward-looking statements may not be achieved or occur

and actual results could differ materially from those projected in

the forward-looking statements. Aspira expressly disclaims any

obligation to update, amend or clarify any forward-looking

statements whether as a result of new information, future events or

otherwise, except as required by law.

Investor Relations

Contact:Ashley R. RobinsonLifeSci Advisors, LLCTel:

617-535-7742

|

|

|

Aspira Women’s Health Inc. |

|

Condensed Consolidated Balance Sheets |

|

(Amounts in Thousands, Except Share and Par Value Amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

September 30,2021 |

|

December 31,2020 |

|

Assets |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

44,870 |

|

|

$ |

16,631 |

|

|

Restricted cash |

|

|

250 |

|

|

|

- |

|

|

Accounts receivable |

|

|

1,103 |

|

|

|

865 |

|

|

Prepaid expenses and other current assets |

|

|

828 |

|

|

|

1,077 |

|

|

Inventories |

|

|

137 |

|

|

|

30 |

|

|

Total current assets |

|

|

47,188 |

|

|

|

18,603 |

|

|

Property and equipment, net |

|

|

498 |

|

|

|

583 |

|

|

Right-of-use assets |

|

|

361 |

|

|

|

406 |

|

|

Other assets |

|

|

- |

|

|

|

13 |

|

|

Total assets |

|

$ |

48,047 |

|

|

$ |

19,605 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,155 |

|

|

$ |

1,103 |

|

|

Accrued liabilities |

|

|

4,998 |

|

|

|

3,618 |

|

|

Current portion of long-term debt |

|

|

200 |

|

|

|

645 |

|

|

Short-term debt |

|

|

- |

|

|

|

611 |

|

|

Lease liability |

|

|

56 |

|

|

|

23 |

|

|

Total current liabilities |

|

|

6,409 |

|

|

|

6,000 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

Long-term debt |

|

|

2,768 |

|

|

|

3,477 |

|

|

Lease liability |

|

|

366 |

|

|

|

409 |

|

|

Total liabilities |

|

|

9,543 |

|

|

|

9,886 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Common stock, par value $0.001 per share, 150,000,000 shares

authorized at September 30, 2021 and December 31, 2020;

112,100,049 and 104,619,876 shares issued and outstanding at

September 30, 2021 and December 31, 2020, respectively |

|

|

112 |

|

|

|

105 |

|

|

Additional paid-in capital |

|

|

501,159 |

|

|

|

449,680 |

|

|

Accumulated deficit |

|

|

(462,767 |

) |

|

|

(440,066 |

) |

|

Total stockholders’ equity |

|

|

38,504 |

|

|

|

9,719 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

48,047 |

|

|

$ |

19,605 |

|

|

Aspira Women’s Health Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(Amounts in Thousands, Except Share and Per Share Amounts) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

$ |

1,614 |

|

|

$ |

1,217 |

|

|

$ |

4,748 |

|

|

$ |

3,128 |

|

|

Genetics |

|

|

49 |

|

|

|

22 |

|

|

|

208 |

|

|

|

64 |

|

|

Service |

|

|

3 |

|

|

|

- |

|

|

|

5 |

|

|

|

13 |

|

|

Total revenue |

|

|

1,666 |

|

|

|

1,239 |

|

|

|

4,961 |

|

|

|

3,205 |

|

|

Cost of revenue(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Product |

|

|

694 |

|

|

|

670 |

|

|

|

2,167 |

|

|

|

1,793 |

|

|

Genetics |

|

|

223 |

|

|

|

133 |

|

|

|

746 |

|

|

|

394 |

|

|

Service |

|

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

13 |

|

|

Total cost of revenue |

|

|

917 |

|

|

|

807 |

|

|

|

2,913 |

|

|

|

2,200 |

|

|

Gross profit |

|

|

749 |

|

|

|

432 |

|

|

|

2,048 |

|

|

|

1,005 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development(2) |

|

|

1,518 |

|

|

|

595 |

|

|

|

3,861 |

|

|

|

1,370 |

|

|

Sales and marketing(3) |

|

|

5,083 |

|

|

|

2,152 |

|

|

|

12,209 |

|

|

|

6,000 |

|

|

General and administrative(4) |

|

|

3,839 |

|

|

|

1,966 |

|

|

|

9,627 |

|

|

|

5,542 |

|

|

Total operating expenses |

|

|

10,440 |

|

|

|

4,713 |

|

|

|

25,697 |

|

|

|

12,912 |

|

|

Loss from operations |

|

|

(9,691 |

) |

|

|

(4,281 |

) |

|

|

(23,649 |

) |

|

|

(11,907 |

) |

|

Interest income (expense), net |

|

|

(14 |

) |

|

|

5 |

|

|

|

(35 |

) |

|

|

14 |

|

|

Other income (expense), net |

|

|

(2 |

) |

|

|

(11 |

) |

|

|

983 |

|

|

|

69 |

|

|

Net loss |

|

$ |

(9,707 |

) |

|

$ |

(4,287 |

) |

|

$ |

(22,701 |

) |

|

$ |

(11,824 |

) |

|

Net loss per share - basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.12 |

) |

|

Weighted average common shares used to compute basic and diluted

net loss per common share |

|

|

112,077,133 |

|

|

|

103,200,612 |

|

|

|

110,904,824 |

|

|

|

99,555,194 |

|

|

Non-cash stock-based compensation expense included in cost of

revenue and operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Cost of revenue |

|

$ |

50 |

|

|

$ |

20 |

|

|

$ |

137 |

|

|

$ |

73 |

|

|

(2) Research and development |

|

|

115 |

|

|

|

16 |

|

|

|

235 |

|

|

|

17 |

|

|

(3) Sales and marketing |

|

|

367 |

|

|

|

31 |

|

|

|

843 |

|

|

|

116 |

|

|

(4) General and administrative |

|

|

646 |

|

|

|

343 |

|

|

|

1,734 |

|

|

|

915 |

|

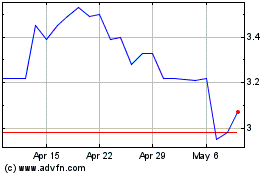

Aspira Womans Health (NASDAQ:AWH)

Historical Stock Chart

From Mar 2024 to Apr 2024

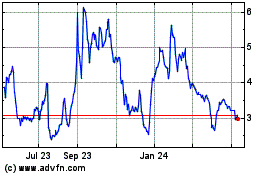

Aspira Womans Health (NASDAQ:AWH)

Historical Stock Chart

From Apr 2023 to Apr 2024