0000805928false00008059282023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

AXOGEN, INC.

(Exact Name of Registrant as Specified in Charter)

Minnesota

(State or Other Jurisdiction of

Incorporation or Organization)

001-36046

(Commission File Number)

41-1301878

(I.R.S. Employer Identification No.)

13631 Progress Boulevard, Suite 400 Alachua, Florida

(Address of principal executive offices)

(386) 462-6800

(Registrant's telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, $0.01 par value | AXGN | The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 7, 2023, Axogen, Inc. (the “Company”) issued a press release announcing its three and nine months ended September 30, 2023 financial results. A copy of the press release is furnished as Exhibit 99.1.

The information furnished pursuant to Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of such section, nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933, as amended (the “Securities Act”), or under the Exchange Act, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

Item 7.01 Regulation FD Disclosure

On November 7, 2023, the Company also posted an updated corporate presentation to its website at https://ir.axogeninc.com/news-events. The Company may use the investor presentation from time to time in conversation with analysts, investors, and others. A copy of the investor update is furnished as Exhibit 99.2.

The information in the Item 7.01, including Exhibit 99.2, is being furnished and shall not be deemed to be "filed" for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference into any filing under the Securities Act or Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| AXOGEN, INC. |

| |

| Dated: November 7, 2023 | By: | /s/ Marc Began |

| | Marc Began |

| | Executive Vice President, General Counsel and Chief Compliance Officer |

Axogen, Inc Reports 2023 Third Quarter Financial Results

ALACHUA and TAMPA, FL – November 7, 2023 – Axogen, Inc. (NASDAQ: AXGN), a global leader in developing and marketing innovative surgical solutions for peripheral nerve injuries, today reported financial results and business highlights for the third quarter ended September 30, 2023.

Third Quarter Financial Results

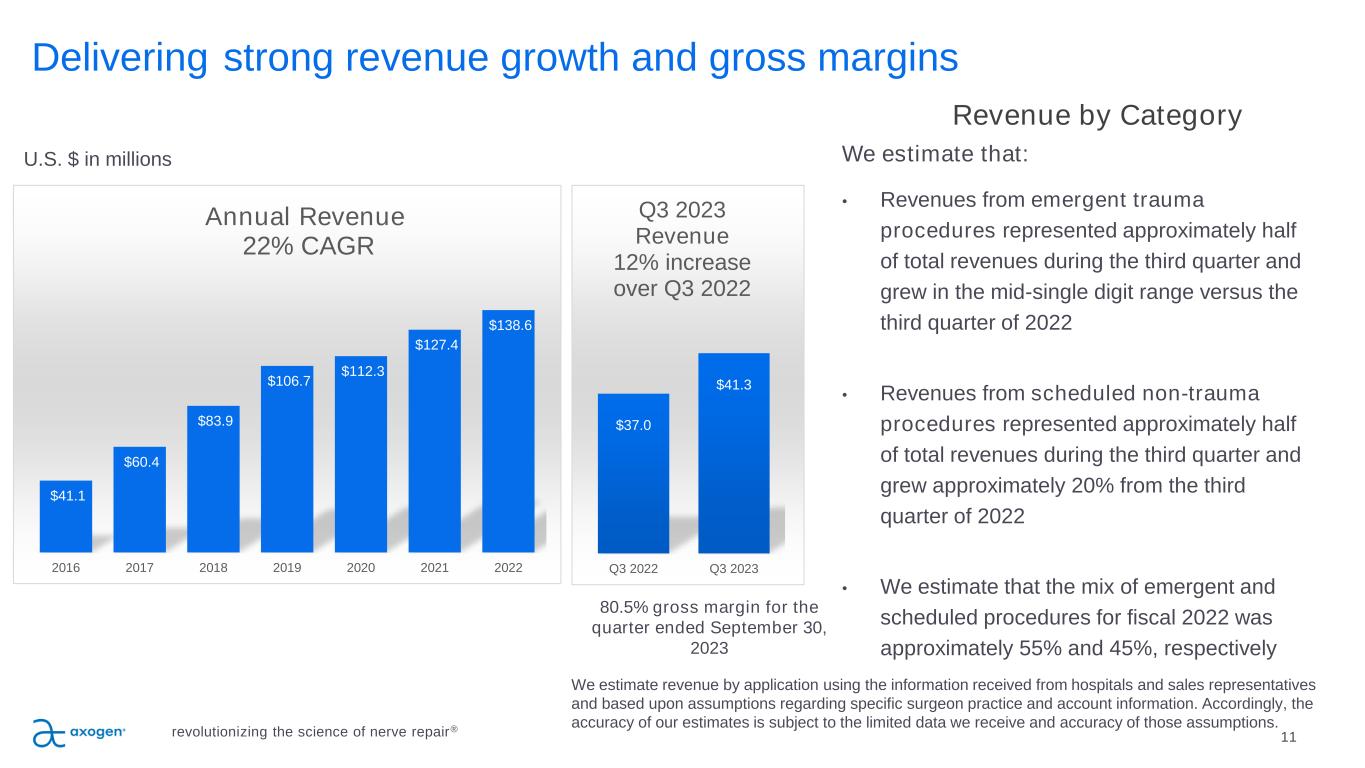

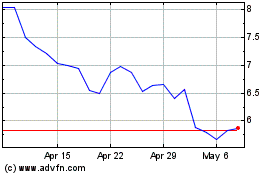

•Revenue was $41.3 million during the third quarter, an increase of approximately 12% over the third quarter of 2022.

•The Company estimates that revenues from emergent trauma procedures represented approximately half of total revenues during the third quarter and grew in the mid-single digit range versus the third quarter of 2022.

•The Company estimates that revenues from scheduled non-trauma procedures represented approximately half of total revenues during the third quarter and grew approximately 20% from the third quarter of 2022.

•Gross margin was 80.5% for the quarter, compared to 83.3% in the third quarter of 2022.

•Net loss of $4.1 million, or $0.10 per share, compared to net loss of $4.3 million, or $0.10 per share in the third quarter of 2022.

•Adjusted net income of $0.7 million or $0.01 per share, compared to adjusted net loss of $0.4 million, or $0.01 per share, in the third quarter of 2022.

•Adjusted EBITDA of $2.4 million, compared to adjusted EBITDA of $0.4 million in the third quarter of 2022.

•The balance of all cash and cash equivalents and investments on September 30, 2023, was $38.6 million, compared to $40.8 million on June 30, 2023. The net change of $2.2 million includes interest and other charges capitalized into the Company's new processing facility.

“We are pleased with our performance in the quarter, which includes improvement in our emergent trauma category as well as continued strength in scheduled procedures. This performance was driven by stabilization in the hospital operating environment, and improved commercial execution,” stated Karen Zaderej, Axogen's Chairman, CEO, and President. “We remain focused on executing our strategic initiatives anchored in the strength of our clinical data, innovation, market development, and commercial execution to continue to drive surgeon adoption and growth.”

Operational and Business Highlights

•In August, the Company began processing tissue in the new, state-of-the-art APC facility, which provides for up to 3 times current capacity and was designed for long-term growth and expansion.

•The Company is continuing to expand its offering in the nerve protection market with the national launch of Axoguard HA+ Nerve Protector™ in August, and expects to launch Avive+ Soft Tissue Matrix™ in Q1 2024.

•The Company continues to anticipate a Pre-BLA meeting with the FDA in early first quarter 2024 where it will request utilization of a rolling submission process for the Biologics License Application (BLA) for Avance® nerve graft which would begin later in the first quarter. The Company anticipates completing the submission in the second quarter of 2024 and believes this process will support BLA approval in the first half of 2025.

•The Company has exceeded its initial goal of training 20 additional surgical teams on techniques in implant-based Resensation® and now expects to have more than 30 teams trained by the end of this year.

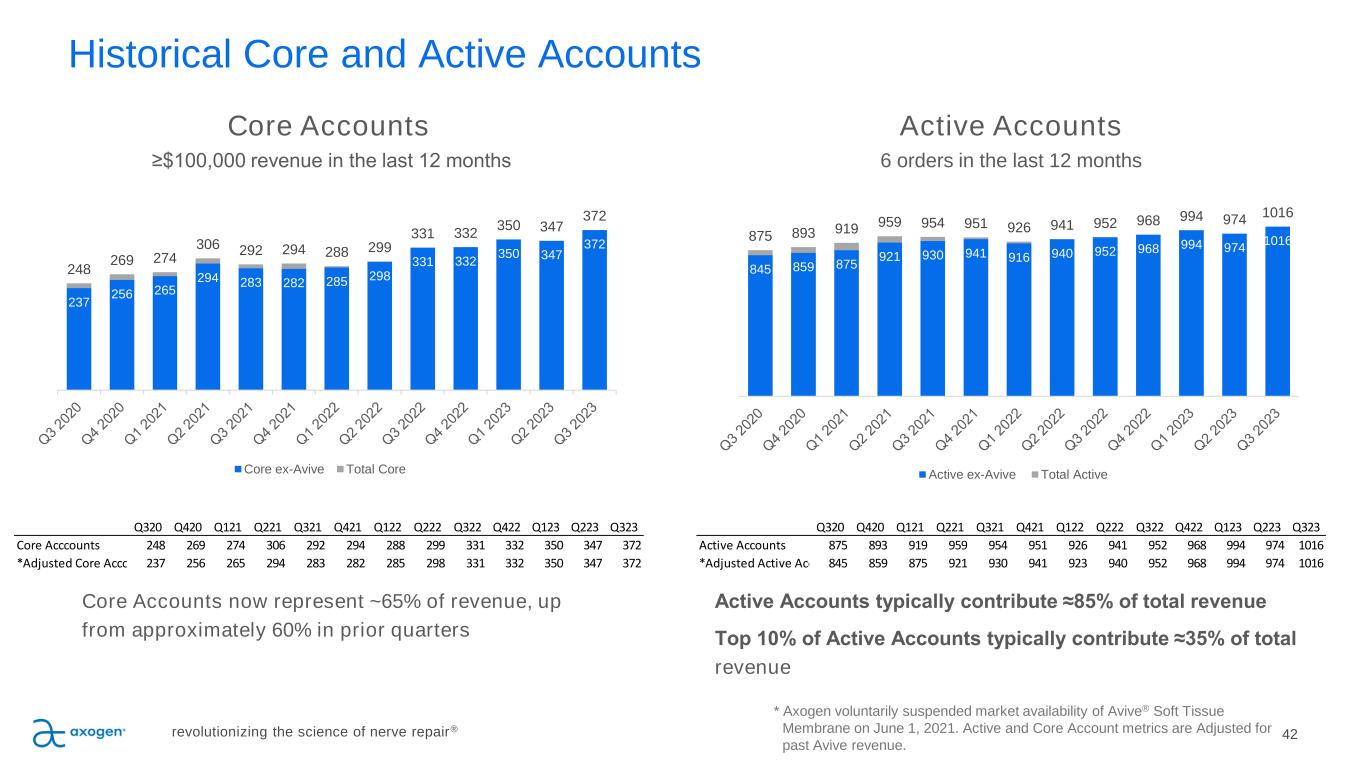

•Core Accounts totaled 372, an increase of 12% over prior-year level of 331, and an increase of 7% sequentially. Revenue from Core Accounts now represent approximately 65% of revenue, up from approximately 60% in prior quarters.

•Active Accounts totaled 1016, an increase of 7% over prior-year level of 952, and an increase of 4% sequentially.

•Ended the quarter with over 200 peer-reviewed clinical publications featuring Axogen’s nerve repair product portfolio.

•Ended the quarter with 116 direct sales representatives compared to 115 on June 30, 2023, and 111 a year ago.

2023 Financial Guidance

Management is maintaining full-year 2023 revenue guidance in the range of $154 million to $159 million, which represents annual growth of 11% - 15%. The Company anticipates that gross margin will be reduced with the continued transition to the new processing facility in the fourth quarter and continues to expect that gross margin for the full year 2023 will be approximately 80%.

Axoguard HA+ Nerve Protector Launch

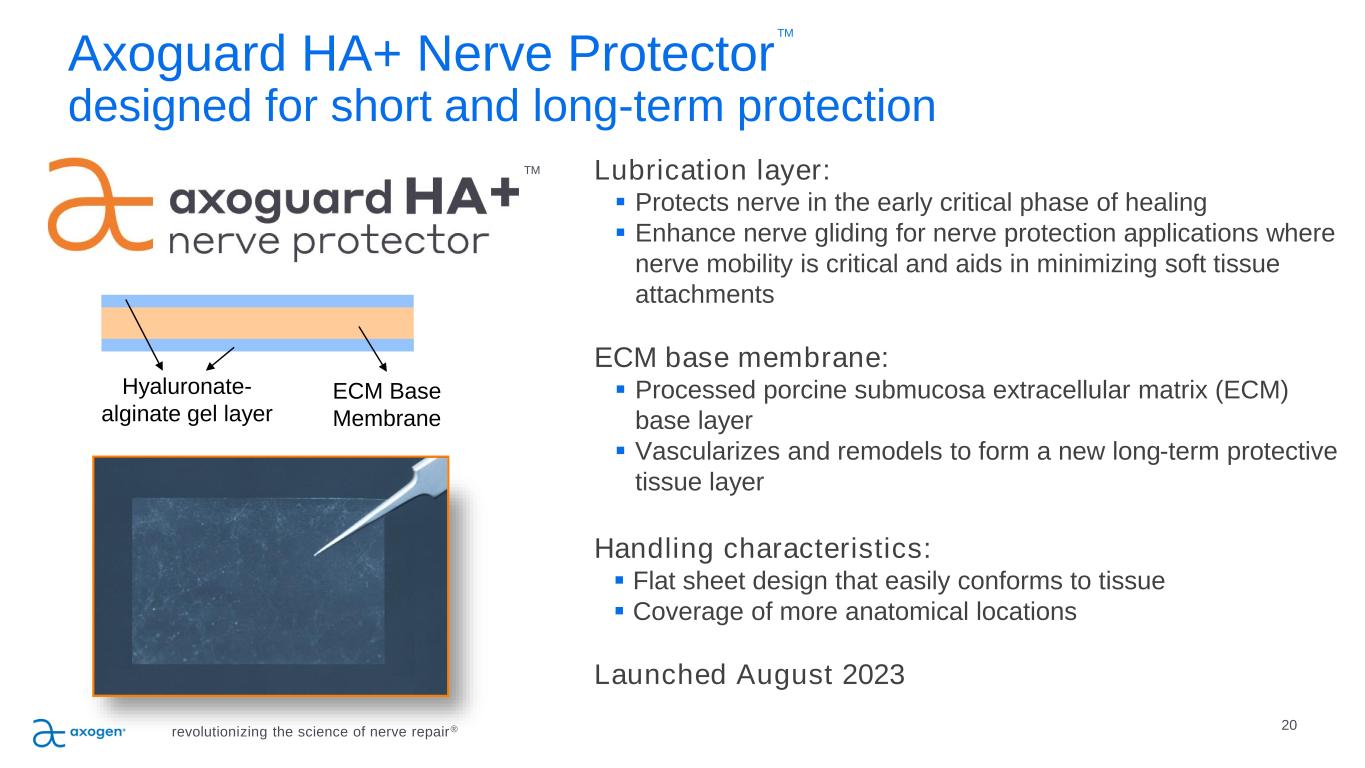

In August 2023, the Company completed the full market release of Axoguard HA+ Nerve Protector™, an extension of its nerve protection platform. Axoguard HA+ Nerve Protector is a proprietary nerve protection device designed to provide short- and long-term protection for peripheral nerve injuries. The device is comprised of a processed porcine submucosa extracellular matrix (ECM) base layer with a hyaluronate-alginate gel coating. The gel layer facilitates enhanced nerve gliding to aid in minimizing soft tissue attachments, while the base layer is remodeled into a long-term protective tissue layer. It is available in a variety of sizes to meet patients' and surgeons’ needs.

Conference Call

The Company will host a conference call and webcast for the investment community today at 8:00 a.m.ET. Investors interested in participating in the conference call by phone may do so by dialing toll free at (877) 407-0993 or using the direct dial-in number at (201) 689-8795. Those interested in listening to the conference call live via the Internet may do so by visiting the Investors page of the Company's website at www.axogeninc.com and clicking on the webcast link.

Following the conference call, a replay will be available in the Investors section of the Company's website at www.axogeninc.com under Investors.

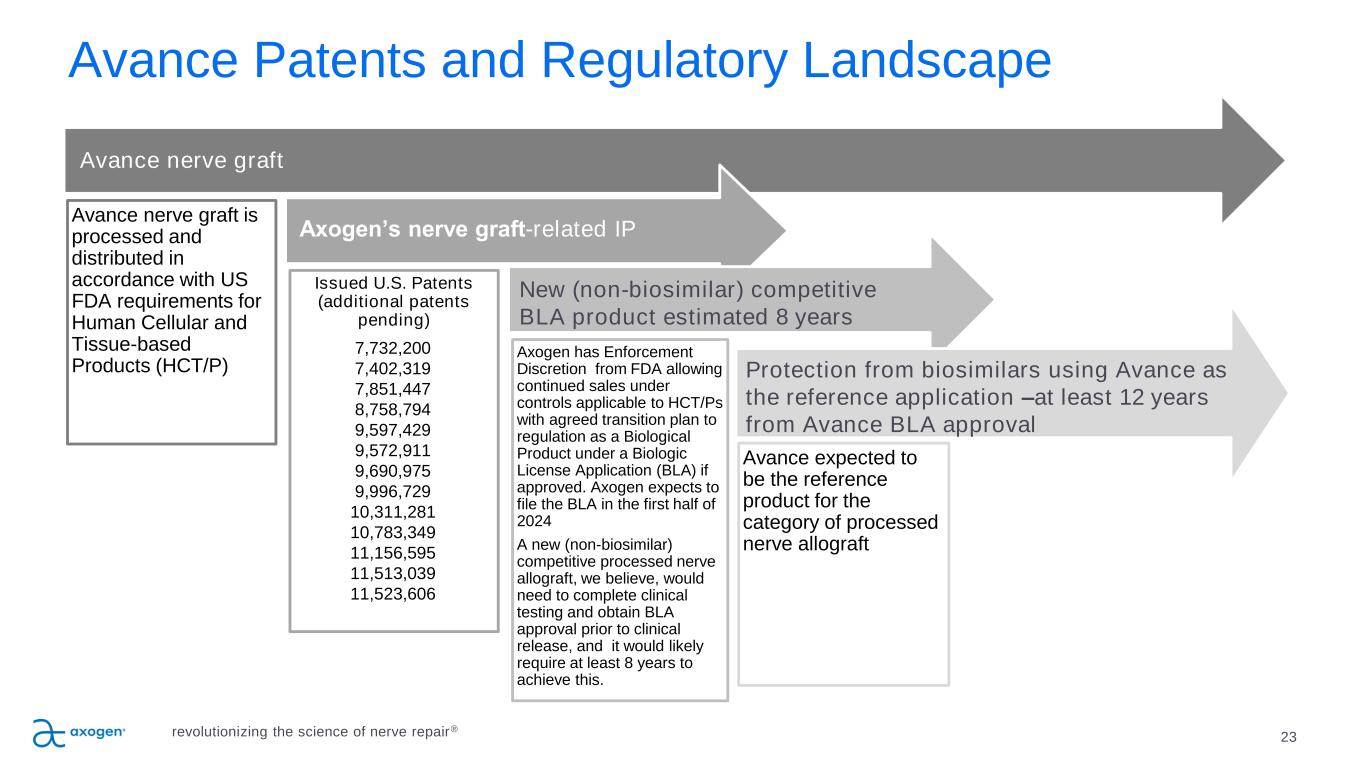

About Avance Nerve Graft

Avance nerve graft is a biologically active off-the-shelf processed human nerve allograft for bridging severed peripheral nerves without the comorbidities associated with a second surgical site. Avance provides structural guidance for regenerating axons, and revascularizes and remodels into the patient’s own tissue. It is available in a variety of lengths and diameters.

A 2010 written agreement between the FDA and Axogen allows the company to continue marketing Avance as a section 361 Human Cells, Tissues and Cellular and Tissue Based Product (HCT/P) while taking the necessary steps to file a Biologics License Application (BLA) under section 351.

In 2018 the FDA granted a Regenerative Medicine Advance Therapy (RMAT) designation for Avance nerve graft. A regenerative medicine therapy is eligible for the designation if it is intended to treat, modify, reverse, or cure a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that the product has the potential to address unmet medical needs for such a disease or condition. The RMAT designation provides access to a streamlined approval process for regenerative medicine technologies and ensures continued informal meetings with the FDA in support of the BLA for Avance nerve graft.

About Axogen

Axogen (AXGN) is the leading Company focused specifically on the science, development, and commercialization of technologies for peripheral nerve regeneration and repair. Axogen employees are passionate about helping to restore peripheral nerve function and quality of life to patients with physical damage or transection to peripheral nerves by providing innovative, clinically proven, and economically effective repair solutions for surgeons and health care providers. Peripheral nerves provide the pathways for both motor and sensory signals throughout the body. Every day, people suffer traumatic injuries or undergo surgical procedures that impact the function of their peripheral nerves. Physical damage to a peripheral nerve, or the inability to properly reconnect peripheral nerves, can result in the loss of muscle or organ function, the loss of sensory feeling, or the initiation of pain.

Axogen's platform for peripheral nerve repair features a comprehensive portfolio of products that are used across two primary application categories: scheduled, non-trauma procedures and emergent trauma procedures. Scheduled procedures are generally characterized as those where a patient is seeking relief from conditions caused by a nerve defect or surgical procedure. These procedures include providing sensation for women seeking breast reconstruction following a mastectomy, nerve reconstruction following the surgical removal of painful neuromas, oral and maxillofacial procedures, and nerve decompression. Emergent procedures are generally characterized as procedures resulting from injuries that initially present in an ER. These procedures are typically referred to and completed by a specialist either immediately or within a few days following the initial injury.

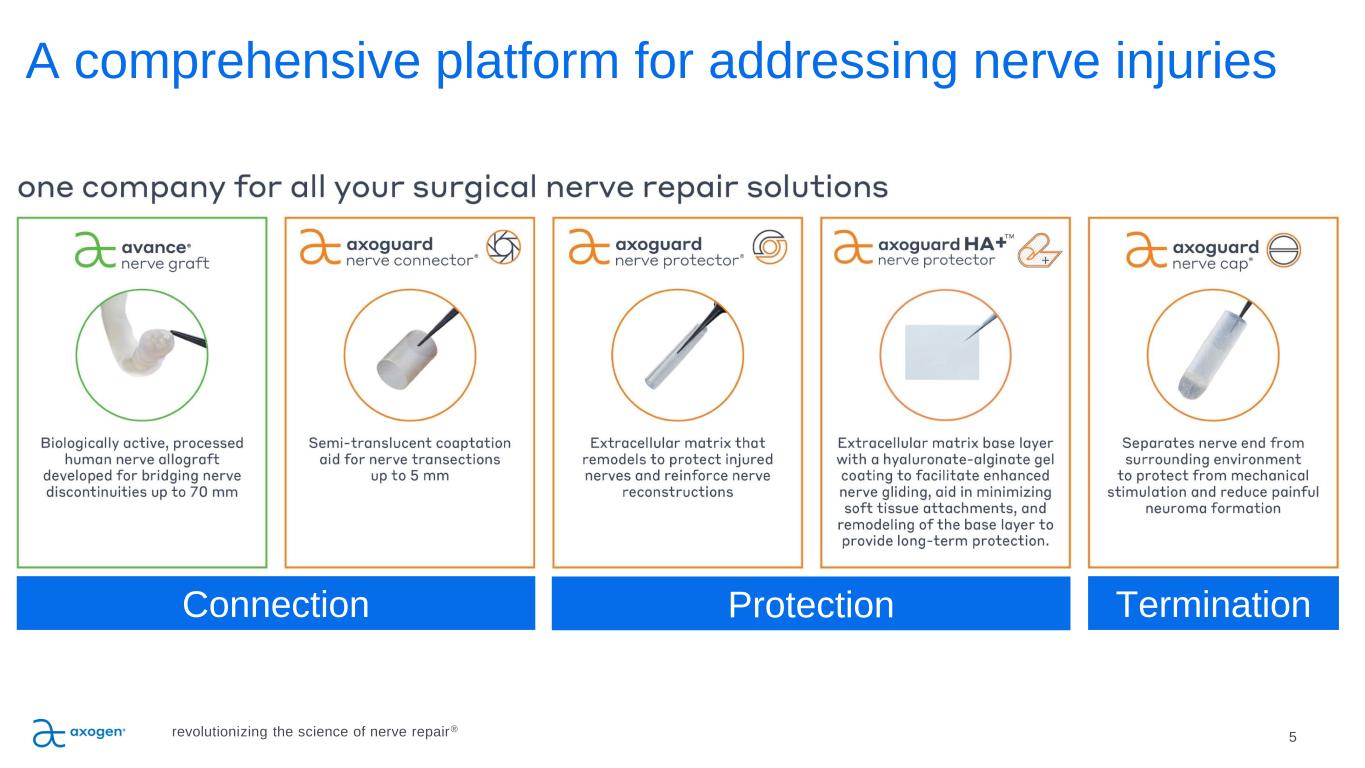

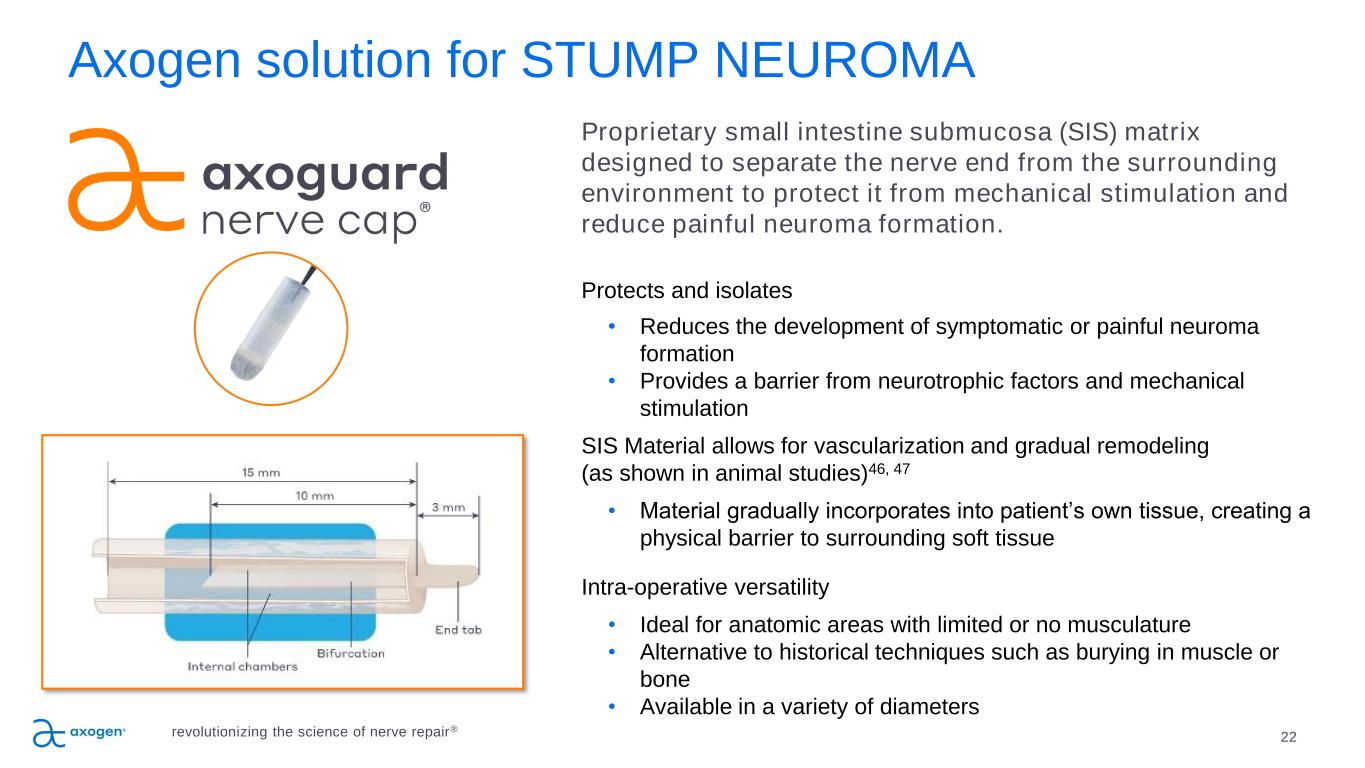

Axogen’s product portfolio includes Avance® nerve graft, a biologically active off-the-shelf processed human nerve allograft for bridging severed peripheral nerves without the comorbidities associated with a second surgical site; Axoguard Nerve Connector®, a porcine submucosa ECM coaptation aid for tensionless repair of severed peripheral nerves; Axoguard Nerve Protector®, a porcine submucosa ECM product used to wrap and protect damaged peripheral nerves and reinforce the nerve reconstruction while preventing soft tissue attachments; Axoguard HA+ Nerve Protector™, a porcine submucosa ECM base layer coated with a proprietary hyaluronate-alginate gel, a next-generation technology designed to provide short- and long-term protection for peripheral nerve injuries; and Axoguard Nerve Cap®, a porcine submucosa ECM product used to protect a peripheral nerve end and separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma. The Axogen portfolio of products is available in the United States, Canada, Germany, the United Kingdom, Spain, South Korea, and several other countries.

Cautionary Statements Concerning Forward-Looking Statements

This press release contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include statement on benefits and market opportunities, our ability to submit the BLA on a rolling basis, timing of the submission and approval of the BLA, development and market launch timetable for Avive+, as well as statements under the subheading "2023 Financial Guidance." Actual results or events could differ materially from those described in any forward-looking statements as a result of various factors, including, without limitation, statements related to the continued impact of COVID-19, global supply chain issues, record inflation, hospital staffing issues, product development, product potential, expected clinical enrollment timing and outcomes, regulatory process and approvals, APC transition timing and expense, financial performance, sales growth, surgeon and product adoption, market awareness of our products, data validation, our visibility at and sponsorship of conferences and educational events, global business disruption caused by Russia’s invasion of Ukraine and related sanctions, as well as those risk factors described under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the most recently ended fiscal year and Part II, Item 1A., “Risk Factors,” for our Quarterly Report on Form 10-Q for the most recently ended fiscal quarter. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements.

About Non-GAAP Financial Measures

To supplement our consolidated financial statements, we use the non-GAAP financial measures of EBITDA, which measures earnings before interest, income taxes, and depreciation and amortization, and Adjusted EBITDA which further excludes non-cash stock compensation expense and litigation and related expenses. We also use the non-GAAP financial measures of Adjusted Net Loss and Adjusted Net Loss Per Common Share - basic and diluted which excludes non-cash stock compensation expense and litigation and related expenses from Net Loss and Net Loss Per Common Share - basic and diluted, respectively. These non-GAAP measures are not based on any comprehensive set of accounting rules or principles and should not be considered a substitute for, or superior to, financial

measures calculated in accordance with GAAP, and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures should be read in conjunction with our financial statements prepared in accordance with GAAP. The reconciliations of the non-GAAP measures to the most directly comparable financial measures calculated and presented in accordance with GAAP should be carefully evaluated.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. We believe these non-GAAP financial measures are useful to investors because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the performance of our business, the Company’s cash available for operations, and the Company’s ability to meet future capital expenditure and working capital requirements.

| | |

Contact: Axogen, Inc. InvestorRelations@axogeninc.com |

Axogen, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 31,094 | | | $ | 15,284 | |

| Restricted cash | 6,002 | | | 6,251 | |

| Investments | 1,494 | | | 33,505 | |

Accounts receivable, net of allowance for doubtful accounts of $319 and $650 , respectively | 23,263 | | | 22,186 | |

| Inventory | 23,019 | | | 18,905 | |

| Prepaid expenses and other | 2,567 | | | 1,944 | |

| Total current assets | 87,439 | | | 98,075 | |

| Property and equipment, net | 89,030 | | | 79,294 | |

| Operating lease right-of-use assets | 13,873 | | | 14,369 | |

| | | |

| Intangible assets, net | 4,288 | | | 3,649 | |

| | | |

| Total assets | $ | 194,630 | | | $ | 195,387 | |

| | | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities: | | | |

| Accounts payable and accrued expenses | $ | 25,550 | | | $ | 22,443 | |

| Current maturities of long-term lease obligations | 1,096 | | | 1,310 | |

| Total current liabilities | 26,646 | | | 23,753 | |

| | | |

| Long-term debt, net of debt discount and financing fees | 46,378 | | | 45,712 | |

| Long-term lease obligations | 19,927 | | | 20,405 | |

| Debt derivative liabilities | 3,869 | | | 4,518 | |

| | | |

| Total liabilities | 96,820 | | | 94,388 | |

| | | |

| Commitments and contingencies - see Note 12 | | | |

| | | |

| Shareholders’ equity: | | | |

Common stock, $0.01 par value per share; 100,000,000 shares authorized; 43,039,399 and 42,445,517 shares issued and outstanding | 430 | | | 424 | |

| Additional paid-in capital | 374,783 | | | 360,155 | |

| Accumulated deficit | (277,403) | | | (259,580) | |

| Total shareholders’ equity | 97,810 | | | 100,999 | |

| Total liabilities and shareholders’ equity | $ | 194,630 | | | $ | 195,387 | |

Axogen, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30,

2023 | | September 30,

2022 | | September 30,

2023 | | September 30,

2022 |

| | | | | | | | |

| Revenues | | $ | 41,271 | | | $ | 36,959 | | | $ | 116,090 | | | $ | 102,420 | |

| Cost of goods sold | | 8,043 | | | 6,176 | | | 21,980 | | | 18,006 | |

| Gross profit | | 33,228 | | | 30,783 | | | 94,110 | | | 84,414 | |

| Costs and expenses: | | | | | | | | |

| Sales and marketing | | 21,429 | | | 19,792 | | | 63,885 | | | 60,349 | |

| Research and development | | 6,989 | | | 7,050 | | | 21,032 | | | 20,347 | |

| General and administrative | | 8,835 | | | 8,796 | | | 27,461 | | | 27,817 | |

| Total costs and expenses | | 37,253 | | | 35,638 | | | 112,378 | | | 108,513 | |

| Loss from operations | | (4,025) | | | (4,855) | | | $ | (18,268) | | | (24,099) | |

| Other income (expense): | | | | | | | | |

| Investment income (loss) | | 367 | | | 186 | | | 1,151 | | | 172 | |

| Interest expense | | (827) | | | (61) | | | (992) | | | (664) | |

| Change in fair value of derivatives | | 402 | | | 469 | | | 649 | | | 1,155 | |

| Other expense | | (6) | | | (57) | | | (363) | | | (97) | |

| Total other (expense) income, net | | (64) | | | 537 | | | 445 | | | 566 | |

| Net loss | | $ | (4,089) | | | $ | (4,318) | | | $ | (17,823) | | | $ | (23,533) | |

| | | | | | | | |

| Weighted average common shares outstanding — basic and diluted | | 43,022,328 | | | 42,220,519 | | | 42,821,284 | | | 42,008,013 | |

| Loss per common share — basic and diluted | | $ | (0.10) | | | $ | (0.10) | | | $ | (0.42) | | | $ | (0.56) | |

Axogen, Inc.

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

(unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| | | | | | | | |

| Net loss | | $ | (4,089) | | | $ | (4,318) | | | $ | (17,823) | | | $ | (23,533) | |

| Depreciation and amortization expense | | 1,224 | | | 830 | | | 2,874 | | | 2,380 | |

| Investment income | | (367) | | | (186) | | | (1,151) | | | (172) | |

| Income tax expense | | 12 | | | 31 | | | 331 | | | 64 | |

| Interest expense | | 827 | | | 61 | | | 992 | | | 664 | |

| EBITDA - non GAAP | | $ | (2,393) | | | $ | (3,582) | | | $ | (14,777) | | | $ | (20,597) | |

| | | | | | | | |

| Non cash stock-based compensation expense | | $ | 4,747 | | | $ | 3,849 | | | $ | 13,091 | | | $ | 11,437 | |

| Litigation and related costs | | — | | | 101 | | | — | | | 584 | |

| Adjusted EBITDA (loss) - non GAAP | | $ | 2,354 | | | $ | 368 | | | $ | (1,686) | | | $ | (8,576) | |

| | | | | | | | |

| Net loss | | $ | (4,089) | | | $ | (4,318) | | | $ | (17,823) | | | $ | (23,533) | |

| Non cash stock-based compensation expense | | 4,747 | | | 3,849 | | | 13,091 | | | 11,437 | |

| Litigation and related costs | | — | | | 101 | | | — | | | 584 | |

| Adjusted net income (loss) - non GAAP | | $ | 658 | | | $ | (368) | | | $ | (4,732) | | | $ | (11,512) | |

| | | | | | | | |

| Weighted average common shares outstanding — basic and diluted | | 43,022,328 | | | 42,220,519 | | | 42,821,284 | | | 42,008,013 | |

| | | | | | | | |

| Loss per common share — basic and diluted | | $ | (0.10) | | | $ | (0.10) | | | $ | (0.42) | | | $ | (0.56) | |

| Non cash stock-based compensation expense | | $ | 0.11 | | | $ | 0.09 | | | $ | 0.31 | | | $ | 0.27 | |

| Litigation and related costs | | $ | — | | | $ | — | | | $ | — | | | $ | 0.01 | |

| Adjusted net income (loss) per common share — basic and diluted - non GAAP | | $ | 0.01 | | | $ | (0.01) | | | $ | (0.11) | | | $ | (0.28) | |

Axogen, Inc.

Condensed Consolidated Statements of Changes in Shareholders’ Equity

(unaudited)

(In thousands, except share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-in

Capital | | Accumulated

Deficit | | Total Shareholders'

Equity | |

| Shares | | Amount | | | | |

| Three Months Ended September 30, 2023 | | | | | | | | | | |

| Balance at June 30, 2023 | 42,979,541 | | | $ | 430 | | | $ | 370,036 | | | $ | (273,314) | | | 97,152 | | |

| Net loss | — | | | — | | | — | | | (4,089) | | | (4,089) | | |

| Stock-based compensation | — | | | — | | | 4,747 | | | — | | | 4,747 | | |

| Issuance of restricted and performance stock units | 59,858 | | | — | | | — | | | — | | | — | | |

| Exercise of stock options and employee stock purchase plan | — | | | — | | | — | | | — | | | — | | |

| Balance at September 30, 2023 | 43,039,399 | | | $ | 430 | | | $ | 374,783 | | | $ | (277,403) | | | 97,810 | | |

| | | | | | | | | | |

| Nine Months Ended September 30, 2023 | | | | | | | | | | |

| Balance at December 31, 2022 | 42,445,517 | | $ | 424 | | | $ | 360,155 | | | $ | (259,580) | | | $ | 100,999 | | |

| Net loss | — | | | — | | | — | | | (17,823) | | | (17,823) | | |

| Stock-based compensation | — | | | — | | | 13,091 | | | — | | | 13,091 | | |

| Issuance of restricted and performance stock units | 356,236 | | 4 | | | (4) | | | — | | | — | | |

| | | | | | | | | | |

| Exercise of stock options and employee stock purchase plan | 237,646 | | 2 | | | 1,541 | | | — | | | 1,543 | | |

| Balance at September 30, 2023 | 43,039,399 | | | $ | 430 | | | 374,783 | | | $ | (277,403) | | | $ | 97,810 | | |

| | | | | | | | | | |

| Three Months Ended September 30, 2022 | | | | | | | | | | |

| Balance at June 30, 2022 | 42,134,504 | | | $ | 420 | | | $ | 351,117 | | | $ | (249,847) | | | 101,690 | | |

| Net loss | — | | | — | | | — | | | (4,318) | | | (4,318) | | |

| Stock-based compensation | — | | | — | | | 3,849 | | | — | | | 3,849 | | |

| Issuance of restricted and performance stock units | 55,934 | | | 1 | | | (1) | | | — | | | — | | |

| Exercise of stock options and employee stock purchase plan | 81,785 | | | 2 | | | 222 | | | — | | | 224 | | |

| Balance at September 30, 2022 | 42,272,223 | | | $ | 423 | | | $ | 355,187 | | | $ | (254,165) | | | $ | 101,445 | | |

| | | | | | | | | | |

| Nine Months Ended September 30, 2022 | | | | | | | | | | |

| Balance at December 31, 2021 | 41,736,950 | | | $ | 417 | | | $ | 342,765 | | | $ | (230,632) | | | $ | 112,550 | | |

| Net loss | — | | | — | | | — | | | (23,533) | | | (23,533) | | |

| Stock-based compensation | — | | | — | | | 11,437 | | | — | | | 11,437 | | |

| Issuance of restricted and performance stock units | 315,275 | | | 3 | | | (3) | | | — | | | — | | |

| Exercise of stock options and employee stock purchase plan | 219,998 | | | 3 | | | 988 | | | — | | | 991 | | |

| Balance at September 30, 2022 | 42,272,223 | | | $ | 423 | | | $ | 355,187 | | | $ | (254,165) | | | $ | 101,445 | | |

| | | | | | | | | | |

Axogen, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

(InThousands) | | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2023 | | September 30, 2022 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (17,823) | | | $ | (23,533) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation | 2,660 | | | 2,182 | |

| Amortization of right-of-use assets | 826 | | | 1,303 | |

| Amortization of intangible assets | 214 | | | 198 | |

| Amortization of debt discount and deferred financing fees | 666 | | | 667 | |

| Provision for bad debt | (311) | | | 566 | |

| Provision for inventory write-down | 1,841 | | | 1,381 | |

| Change in fair value of derivatives | (649) | | | (1,155) | |

| Change in investment gains or losses | (660) | | | 44 | |

| Stock-based compensation | 13,091 | | | 11,437 | |

| Change in operating assets and liabilities: | | | |

| Accounts receivable | (766) | | | (3,695) | |

| Inventory | (5,955) | | | (3,804) | |

| Prepaid expenses and other | (623) | | | (828) | |

| Accounts payable and accrued expenses | 3,012 | | | (870) | |

| Operating lease obligations | (1,012) | | | (1,320) | |

| Cash paid for interest portion of finance leases | (2) | | | (1) | |

| Contract and other liabilities | (14) | | | — | |

| Net cash used in operating activities | (5,505) | | | (17,428) | |

| | | |

| Cash flows from investing activities: | | | |

| Purchase of property and equipment | (12,409) | | | (13,456) | |

| | | |

| Purchase of investments | (10,203) | | | (24,607) | |

| Proceeds from sale of investments | 42,874 | | | 37,100 | |

| Cash payments for intangible assets | (732) | | | (1,028) | |

| Net cash from (used in) investing activities | 19,530 | | | (1,991) | |

| | | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash paid for debt portion of finance leases | (7) | | | (9) | |

| Proceeds from exercise of stock options and ESPP stock purchases | 1,543 | | | 990 | |

| Net cash provided by financing activities | 1,536 | | | 981 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 15,561 | | | (18,438) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 21,535 | | | 39,007 | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 37,096 | | | $ | 20,569 | |

| | | |

| Supplemental disclosures of cash flow activity: | | | |

| Cash paid for interest, net of capitalized interest | $ | 325 | | | $ | — | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Acquisition of fixed assets in accounts payable and accrued expenses | $ | 853 | | | $ | 2,090 | |

| Obtaining of property and equipment in exchange for a lease liability | $ | — | | | $ | 22 | |

| Obtaining a right-of-use asset in exchange for a lease liability | $ | 366 | | | $ | 920 | |

| | | |

| Acquisition of intangible assets in accounts payable and accrued expenses | $ | 420 | | | $ | 177 | |

November 7, 2023 nasdaq: axgn Corporate presentation

2 This presentation contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995. These statements are based on management's current expectations or predictions of future conditions, events, or results based on various assumptions and management's estimates of trends and economic factors in the markets in which we are active, as well as our business plans. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “continue,” “may,” “should,” “will,” “goals,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Forward-looking statements include (1) the TAM for the targeted nerve markets, (2) 2023 financial guidance, including revenue range and gross margins, (3) growth drivers for the business, (4) expectation that RECONSM study topline results will support our BLA filing in the first half of 2024, (5) timing of filing of the BLA and our ability to utilize a rolling submission, (6) timing of transition of the APC facility and APC future capacity, and (7) opportunities in the peripheral nerve repair market. Actual results or events could differ materially from those described in any forward-looking statements as a result of various factors, including, without limitation, statements related to the continued impact of COVID-19, global supply chain issues, record inflation, hospital staffing issues, product development, product potential, expected clinical enrollment timing and outcomes, regulatory process and approvals, APC renovation timing and expense, financial performance, sales growth, surgeon and product adoption, market awareness of our products, data validation, our visibility at and sponsorship of conferences and educational events, global business disruption caused by Russia’s invasion of Ukraine and related sanctions, as well as those risk factors described under Part I, Item 1A., “Risk Factors,” of our Annual Report on Form 10-K for the most recently ended fiscal year and Part II, Item 1A., “Risk Factors,” for our Quarterly Report on Form 10-Q for the most recently ended fiscal quarter. Forward-looking statements are not a guarantee of future performance, and actual results may differ materially from those projected. The forward-looking statements are representative only as of the date they are made and, except as required by applicable law, we assume no responsibility to publicly update or revise any forward-looking statements. Safe harbor statement revolutionizing the science of nerve repair®

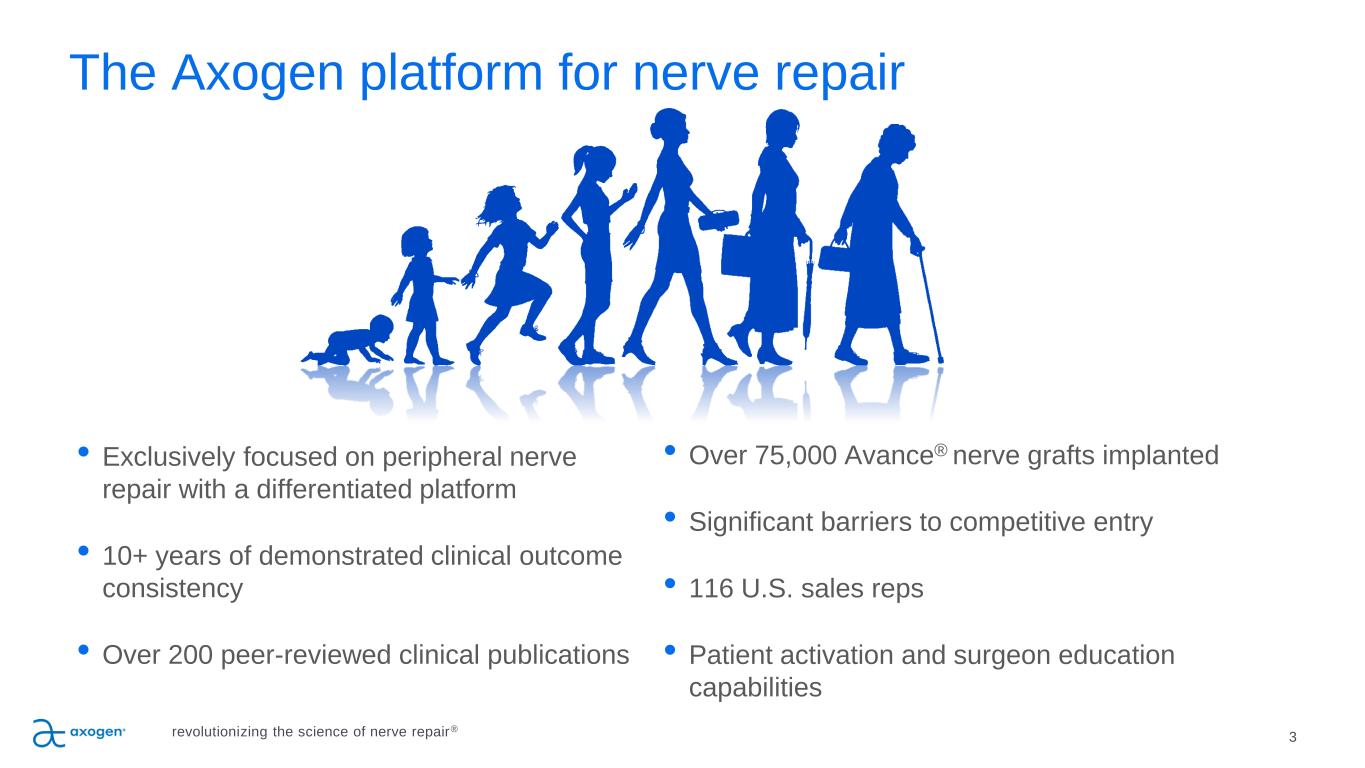

3 The Axogen platform for nerve repair revolutionizing the science of nerve repair® • Exclusively focused on peripheral nerve repair with a differentiated platform • 10+ years of demonstrated clinical outcome consistency • Over 200 peer-reviewed clinical publications • Over 75,000 Avance® nerve grafts implanted • Significant barriers to competitive entry • 116 U.S. sales reps • Patient activation and surgeon education capabilities

4 The function of nerves and injury types Nerves are like wires • Transfer signals across a network • If cut, data cannot be transferred • If crushed, short circuits and data corruption may occur The peripheral nervous system is a vast network from every organ to and from the brain • Sensory • Motor • Mixed Nerves can be injured in three ways: 1. Transection Traumatic nerve injuries e.g., motor vehicle accidents, power tool accidents, battlefield injuries, gunshot wounds, surgical injuries, neuroma-in- continuity 2. Compression Carpal, cubital, tarsal tunnel revisions, blunt trauma, previous surgeries 3. Stump Neuroma Amputations, mastectomies, previous surgeries revolutionizing the science of nerve repair®

5 A comprehensive platform for addressing nerve injuries revolutionizing the science of nerve repair® TerminationProtectionConnection

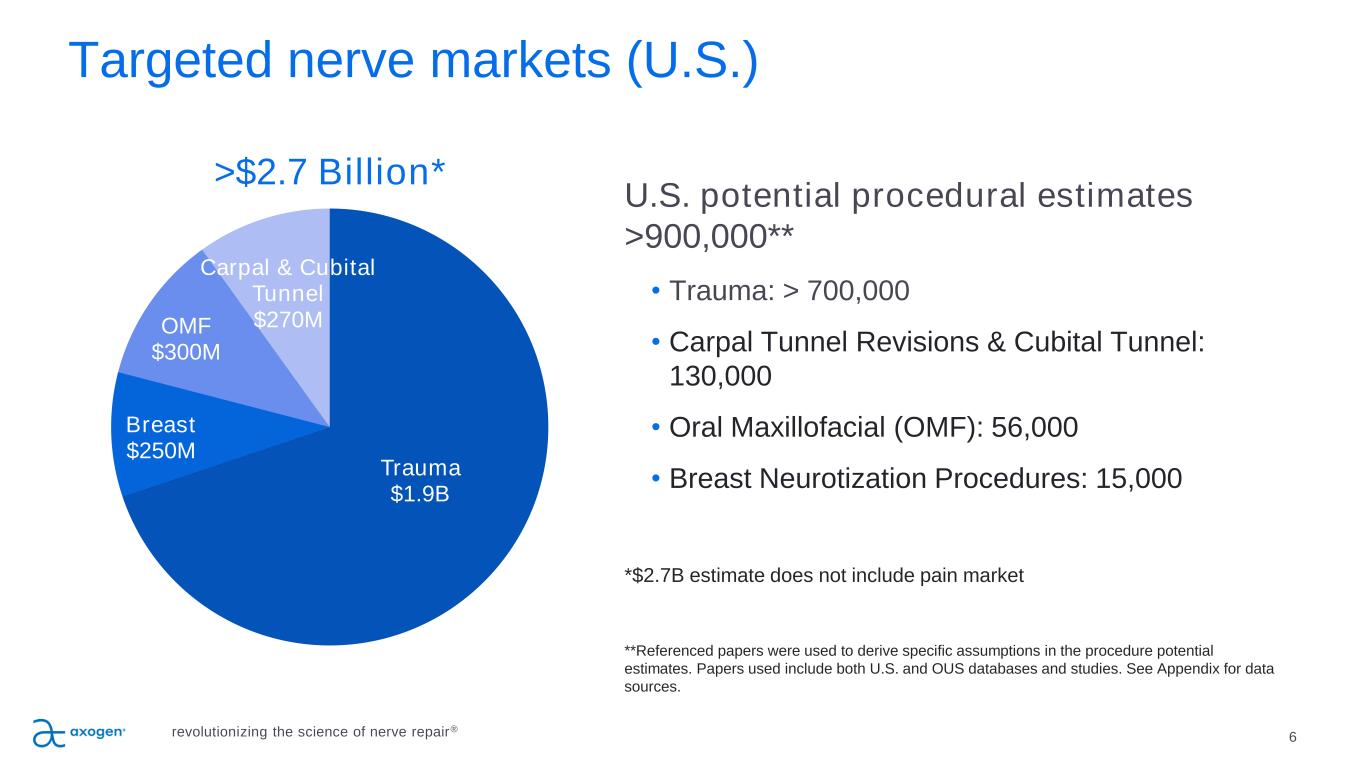

Targeted nerve markets (U.S.) 6 Trauma $1.9B Breast $250M OMF $300M Carpal & Cubital Tunnel $270M U.S. potential procedural estimates >900,000** • Trauma: > 700,000 • Carpal Tunnel Revisions & Cubital Tunnel: 130,000 • Oral Maxillofacial (OMF): 56,000 • Breast Neurotization Procedures: 15,000 *$2.7B estimate does not include pain market **Referenced papers were used to derive specific assumptions in the procedure potential estimates. Papers used include both U.S. and OUS databases and studies. See Appendix for data sources. >$2.7 Billion* revolutionizing the science of nerve repair®

7 P IL L A R 5 Opportunities in nerve repair P IL L A R 4 P IL L A R 3 Pain Iatrogenic injuries, post-traumatic, migraine, TKA and TKH pain, amputations, symptomatic neuromas, and nerve compressions Core business anchored in Trauma and Upper Extremity, and expanded to Breast, OMF and Pain. Further Market Expansion in Corneal Neurotization and Podiatry. revolutionizing the science of nerve repair® Breast Neurotization Autologous Flap Reconstruction; Breast Implant Reconstruction Urology Prostatectomy OMF Mandible Tumor Reconstruction; Iatrogenic Nerve Injuries, Extremities (Trauma and Compression) Acute trauma, revision carpal tunnel and cubital tunnel Head & Neck OB/GYN General Surgery Cardio Thoracic Orthopedic Podiatry Vascular Corneal Neurotization

Applications for our products include two primary categories 8 Emergent Trauma Procedure Examples Transected sensory nerves Transected mixed/motor nerves Non-transected nerve injury Scheduled Procedure Examples Breast reconstruction Mandibular reconstruction Neuroma repair Cubital and carpal tunnel revisions revolutionizing the science of nerve repair®

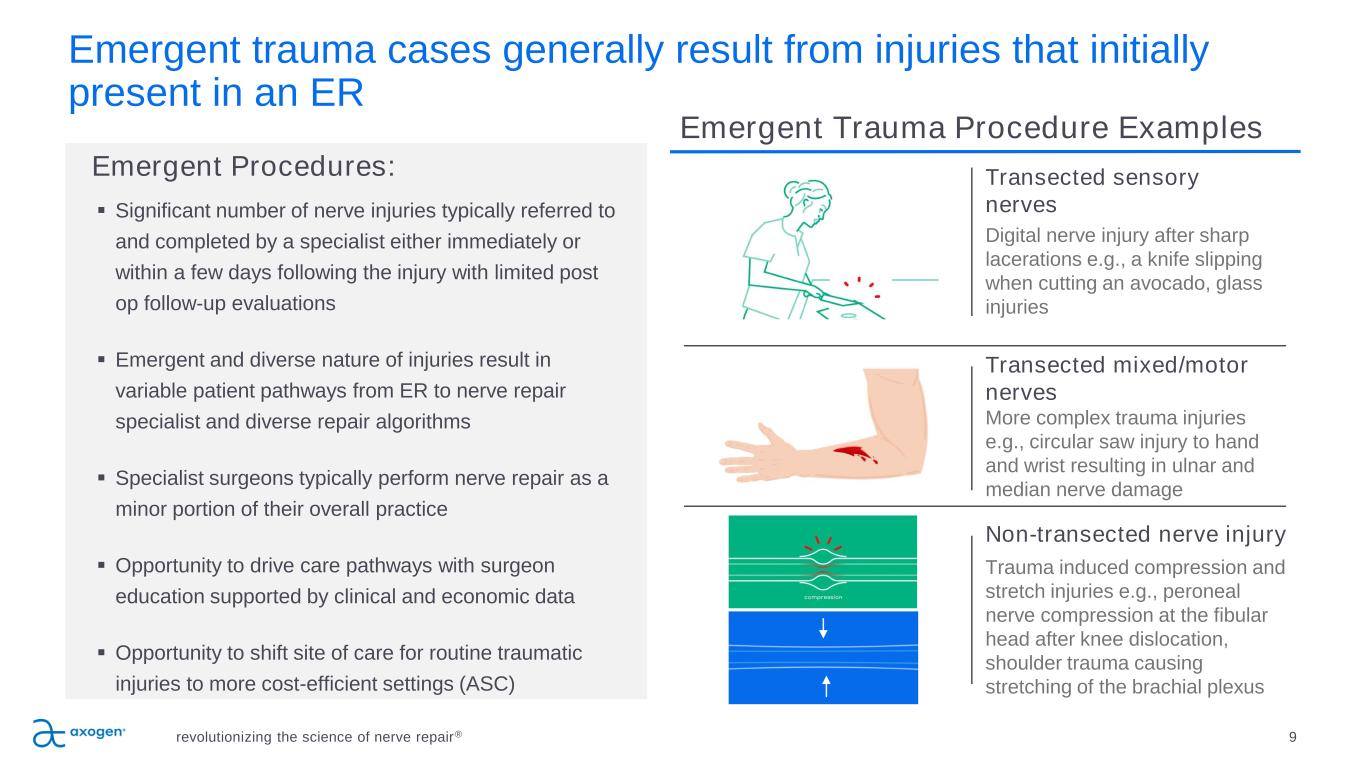

Emergent trauma cases generally result from injuries that initially present in an ER revolutionizing the science of nerve repair® 9 ▪ Significant number of nerve injuries typically referred to and completed by a specialist either immediately or within a few days following the injury with limited post op follow-up evaluations ▪ Emergent and diverse nature of injuries result in variable patient pathways from ER to nerve repair specialist and diverse repair algorithms ▪ Specialist surgeons typically perform nerve repair as a minor portion of their overall practice ▪ Opportunity to drive care pathways with surgeon education supported by clinical and economic data ▪ Opportunity to shift site of care for routine traumatic injuries to more cost-efficient settings (ASC) Emergent Procedures: Emergent Trauma Procedure Examples Transected sensory nerves Transected mixed/motor nerves Non-transected nerve injury Digital nerve injury after sharp lacerations e.g., a knife slipping when cutting an avocado, glass injuries More complex trauma injuries e.g., circular saw injury to hand and wrist resulting in ulnar and median nerve damage Trauma induced compression and stretch injuries e.g., peroneal nerve compression at the fibular head after knee dislocation, shoulder trauma causing stretching of the brachial plexus

Scheduled procedures involve a patient seeking relief of a condition caused by a nerve defect or surgical procedure revolutionizing the science of nerve repair® 10 ▪ Patients seeking a scheduled procedure weeks or months in advance allows patients to advocate for solutions that may improve quality of life outcomes ▪ Procedures lend themselves to standardized surgical techniques and more consistent repair algorithms, and extended follow-up evaluations ▪ Completed in specialist centers on regular intervals, typically in existing core accounts ▪ Concentrated group of surgeon specialists allow for more focused surgeon training and adoption ▪ Typically involve a higher value of Axogen products per procedure Scheduled Procedures: Scheduled Procedure Examples Breast reconstruction Mandibular reconstruction Neuroma repair Cubital and carpal tunnel revisions Neurotization of the breast and/or nipple areolar complex may be possible in many delayed or immediate breast reconstruction settings. Reconstruction of the inferior alveolar nerve with ablation of the mandible Symptomatic neuroma resection with nerve reconstruction

11 Delivering strong revenue growth and gross margins Revenue by Category 80.5% gross margin for the quarter ended September 30, 2023 U.S. $ in millions revolutionizing the science of nerve repair® $41.1 $60.4 $83.9 $106.7 $112.3 $127.4 $138.6 2016 2017 2018 2019 2020 2021 2022 Annual Revenue 22% CAGR We estimate that: • Revenues from emergent trauma procedures represented approximately half of total revenues during the third quarter and grew in the mid-single digit range versus the third quarter of 2022 • Revenues from scheduled non-trauma procedures represented approximately half of total revenues during the third quarter and grew approximately 20% from the third quarter of 2022 • We estimate that the mix of emergent and scheduled procedures for fiscal 2022 was approximately 55% and 45%, respectively We estimate revenue by application using the information received from hospitals and sales representatives and based upon assumptions regarding specific surgeon practice and account information. Accordingly, the accuracy of our estimates is subject to the limited data we receive and accuracy of those assumptions. $37.0 $41.3 Q3 2022 Q3 2023 Q3 2023 Revenue 12% increase over Q3 2022

2023 Annual Financial Guidance 12 • Full-year 2023 revenue is expected to be between $154 million and $159 million revolutionizing the science of nerve repair® • Gross margin will be reduced with the continued transition to the new processing facility in the fourth quarter • Expect full year gross margins will be approximately 80% The company anticipates: • Represents ~11% to 15% growth over 2022 • Began processing tissue in the new facility in August 2023

Growth Drivers revolutionizing the science of nerve repair® 13 • Recent clinical data published within the past year will support increased adoption particularly with middle adopters – RECONSM – Meta Analysis of clinical outcomes and Medicare Economic Data – Premier Economic Data • Innovation – New product launches in nerve protection: Axoguard HA+ Nerve Protector™ launched in August, Avive+ Soft Tissue Matrix™ launch anticipated in Q1 2024 – Resensation® for breast neurotization expansion into implant-based reconstructions • Patient activation programs for breast neurotization, surgical treatment of pain, and OMF • Improved emergent procedure logistics and economics in more cost-efficient settings (ASCs) • Surgeon training across our applications

14 Axogen Processing Center (APC) • Began processing tissue in the new facility in August 2023 • Supports BLA requirements for Avance nerve graft • Provides 3x current capacity, designed for long-term growth and expansion revolutionizing the science of nerve repair®

Product Portfolio revolutionizing the science of nerve repair® 15

Traditional TRANSECTION repair options are suboptimal 16 SUTURE Direct suture repair of no-gap injuries • Common repair method • May result in tension to the repair leading to ischemia • Concentrates sutures at the coaptation site AUTOGRAFT Traditional method despite several disadvantages • Secondary surgery • Loss of function and sensation at harvest site • 27% complication rate including infection, wound healing and chronic pain 19 • Limited availability of graft length and diameter SYNTHETIC CONDUITS Convenient off the shelf option; limited efficacy & use • Provides only gross direction for regrowth • Limited to small gaps • 34%-57% failure rate >5mm gaps20, 21 • Semi-rigid and opaque material limits use and visualization • Repair reliant on fibrin clot formation revolutionizing the science of nerve repair®

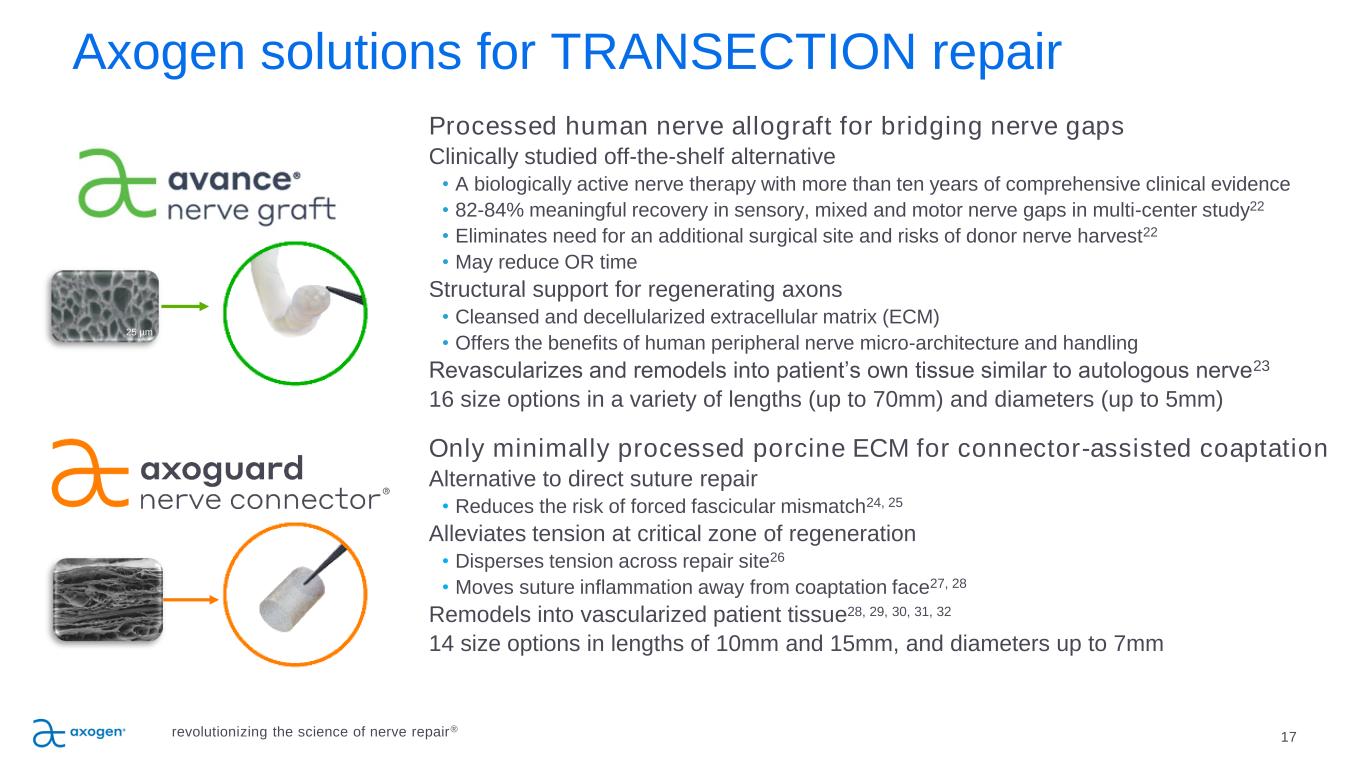

17 25 µm Processed human nerve allograft for bridging nerve gaps Clinically studied off-the-shelf alternative • A biologically active nerve therapy with more than ten years of comprehensive clinical evidence • 82-84% meaningful recovery in sensory, mixed and motor nerve gaps in multi-center study22 • Eliminates need for an additional surgical site and risks of donor nerve harvest22 • May reduce OR time Structural support for regenerating axons • Cleansed and decellularized extracellular matrix (ECM) • Offers the benefits of human peripheral nerve micro-architecture and handling Revascularizes and remodels into patient’s own tissue similar to autologous nerve23 16 size options in a variety of lengths (up to 70mm) and diameters (up to 5mm) Only minimally processed porcine ECM for connector-assisted coaptation Alternative to direct suture repair • Reduces the risk of forced fascicular mismatch24, 25 Alleviates tension at critical zone of regeneration • Disperses tension across repair site26 • Moves suture inflammation away from coaptation face27, 28 Remodels into vascularized patient tissue28, 29, 30, 31, 32 14 size options in lengths of 10mm and 15mm, and diameters up to 7mm Axogen solutions for TRANSECTION repair revolutionizing the science of nerve repair®

Traditional COMPRESSION repair options are suboptimal 18 VEIN WRAPPING Autologous vein • Barrier to attachment to surrounding tissue • Requires extra time and skill to perform spiral wrapping technique • Second surgery site HYPOTHENAR FAT PAD Autologous vascularized flap • Barrier to attachment to surrounding tissue • Only wraps part of the nerve circumference • Increases procedure time COLLAGEN WRAPS Off-the-shelf • Semi-rigid material limits use • Degrades over time and does not provide a lasting barrier to soft tissue attachment revolutionizing the science of nerve repair®

19 Axogen solution for COMPRESSION repair Minimally processed porcine extracellular matrix for wrapping and protecting injured peripheral nerve Protects repair site from surrounding tissue • Processing results in an implant that works with the body’s natural healing process33 • Minimizes soft tissue attachments34 Allows nerve gliding • Minimizes risk of entrapment34 • Creates a barrier between repair and surrounding tissue bed34 • ECM revascularizes and remodels into patient’s own tissue29,35 revolutionizing the science of nerve repair®

Axoguard HA+ Nerve Protector designed for short and long-term protection Lubrication layer: ▪ Protects nerve in the early critical phase of healing ▪ Enhance nerve gliding for nerve protection applications where nerve mobility is critical and aids in minimizing soft tissue attachments ECM base membrane: ▪ Processed porcine submucosa extracellular matrix (ECM) base layer ▪ Vascularizes and remodels to form a new long-term protective tissue layer Handling characteristics: ▪ Flat sheet design that easily conforms to tissue ▪ Coverage of more anatomical locations Launched August 2023 Hyaluronate- alginate gel layer ECM Base Membrane 20 revolutionizing the science of nerve repair® TM TM

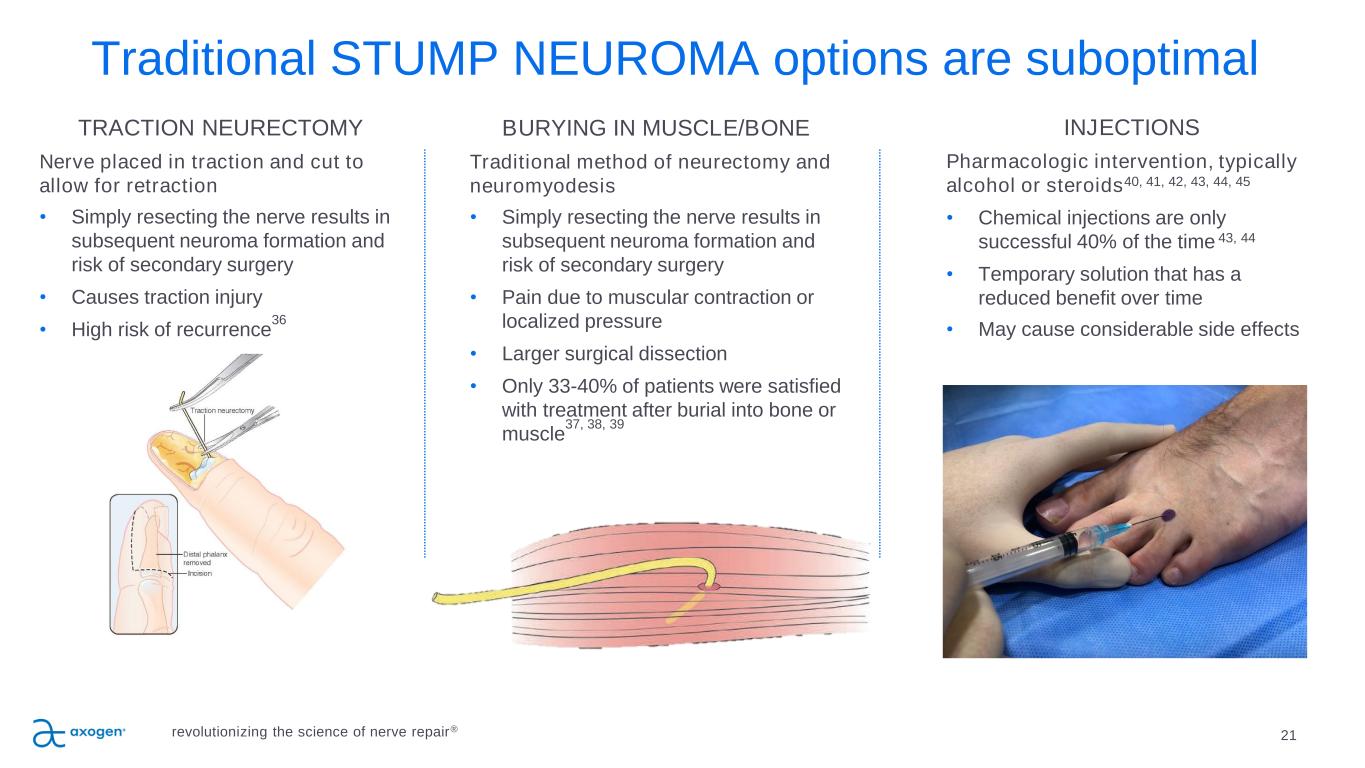

Traditional STUMP NEUROMA options are suboptimal 21 TRACTION NEURECTOMY Nerve placed in traction and cut to allow for retraction • Simply resecting the nerve results in subsequent neuroma formation and risk of secondary surgery • Causes traction injury • High risk of recurrence 36 BURYING IN MUSCLE/BONE Traditional method of neurectomy and neuromyodesis • Simply resecting the nerve results in subsequent neuroma formation and risk of secondary surgery • Pain due to muscular contraction or localized pressure • Larger surgical dissection • Only 33-40% of patients were satisfied with treatment after burial into bone or muscle 37, 38, 39 INJECTIONS Pharmacologic intervention, typically alcohol or steroids40, 41, 42, 43, 44, 45 • Chemical injections are only successful 40% of the time 43, 44 • Temporary solution that has a reduced benefit over time • May cause considerable side effects revolutionizing the science of nerve repair®

22 Axogen solution for STUMP NEUROMA Proprietary small intestine submucosa (SIS) matrix designed to separate the nerve end from the surrounding environment to protect it from mechanical stimulation and reduce painful neuroma formation. Protects and isolates • Reduces the development of symptomatic or painful neuroma formation • Provides a barrier from neurotrophic factors and mechanical stimulation SIS Material allows for vascularization and gradual remodeling (as shown in animal studies)46, 47 • Material gradually incorporates into patient’s own tissue, creating a physical barrier to surrounding soft tissue Intra-operative versatility • Ideal for anatomic areas with limited or no musculature • Alternative to historical techniques such as burying in muscle or bone • Available in a variety of diameters revolutionizing the science of nerve repair®

23 Avance Patents and Regulatory Landscape Avance nerve graft is processed and distributed in accordance with US FDA requirements for Human Cellular and Tissue-based Products (HCT/P) Issued U.S. Patents (additional patents pending) Axogen has Enforcement Discretion from FDA allowing continued sales under controls applicable to HCT/Ps with agreed transition plan to regulation as a Biological Product under a Biologic License Application (BLA) if approved. Axogen expects to file the BLA in the first half of 2024 A new (non-biosimilar) competitive processed nerve allograft, we believe, would need to complete clinical testing and obtain BLA approval prior to clinical release, and it would likely require at least 8 years to achieve this. Avance expected to be the reference product for the category of processed nerve allograft Avance nerve graft Axogen’s nerve graft-related IP New (non-biosimilar) competitive BLA product estimated 8 years Protection from biosimilars using Avance as the reference application –at least 12 years from Avance BLA approval 7,732,200 7,402,319 7,851,447 8,758,794 9,597,429 9,572,911 9,690,975 9,996,729 10,311,281 10,783,349 11,156,595 11,513,039 11,523,606 revolutionizing the science of nerve repair®

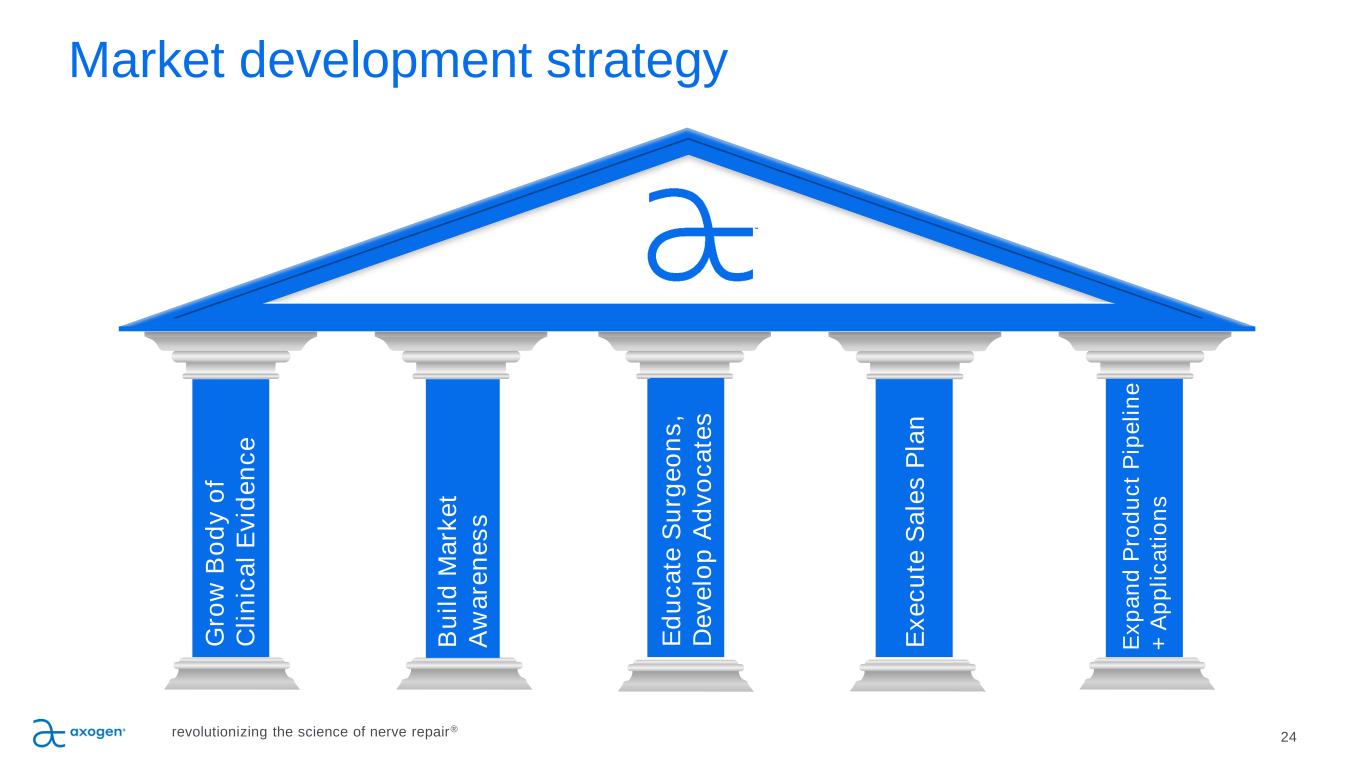

24 Market development strategy B u il d M a rk e t A w a re n e s s G ro w B o d y o f C li n ic a l E v id e n c e E x e c u te S a le s P la n E x p a n d P ro d u c t P ip e li n e + A p p li c a ti o n s revolutionizing the science of nerve repair® E d u c a te S u rg e o n s , D e v e lo p A d v o c a te s

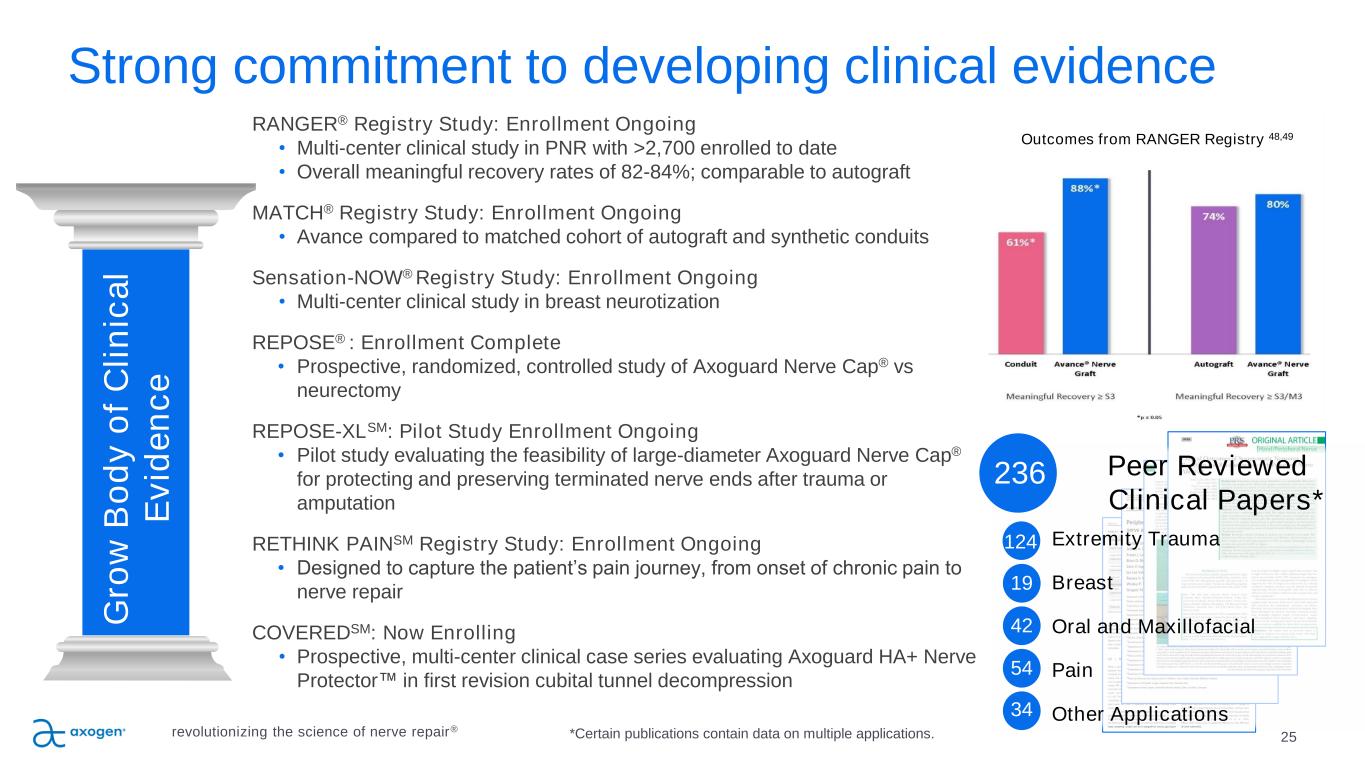

Outcomes from RANGER Registry 48,49 25 P IL L A R 3 Strong commitment to developing clinical evidence RANGER® Registry Study: Enrollment Ongoing • Multi-center clinical study in PNR with >2,700 enrolled to date • Overall meaningful recovery rates of 82-84%; comparable to autograft MATCH® Registry Study: Enrollment Ongoing • Avance compared to matched cohort of autograft and synthetic conduits Sensation-NOW® Registry Study: Enrollment Ongoing • Multi-center clinical study in breast neurotization REPOSE® : Enrollment Complete • Prospective, randomized, controlled study of Axoguard Nerve Cap® vs neurectomy REPOSE-XLSM: Pilot Study Enrollment Ongoing • Pilot study evaluating the feasibility of large-diameter Axoguard Nerve Cap® for protecting and preserving terminated nerve ends after trauma or amputation RETHINK PAINSM Registry Study: Enrollment Ongoing • Designed to capture the patient’s pain journey, from onset of chronic pain to nerve repair COVEREDSM: Now Enrolling • Prospective, multi-center clinical case series evaluating Axoguard HA+ Nerve Protector™ in first revision cubital tunnel decompression G ro w B o d y o f C li n ic a l E v id e n c e Peer Reviewed Clinical Papers* Extremity Trauma Breast Oral and Maxillofacial Pain Other Applications 124 19 42 54 34 236 *Certain publications contain data on multiple applications.revolutionizing the science of nerve repair®

RECON : A Multicenter, Prospective, Randomized, Subject & Evaluator Blinded Comparative Study of Nerve Cuffs & Avance Nerve Graft Evaluating Recovery Outcomes for the Repair of Nerve Discontinuities 26 Safety & efficacy non- inferiority comparison of Avance vs conduit Evaluated upper extremity digital nerve repair for nerve gaps 5-25mm 220 subjects from up to 25 U.S. centers stratified into gap lengths with two-thirds in the 5-14mm group and one- third in the 15-25mm group revolutionizing the science of nerve repair® SM

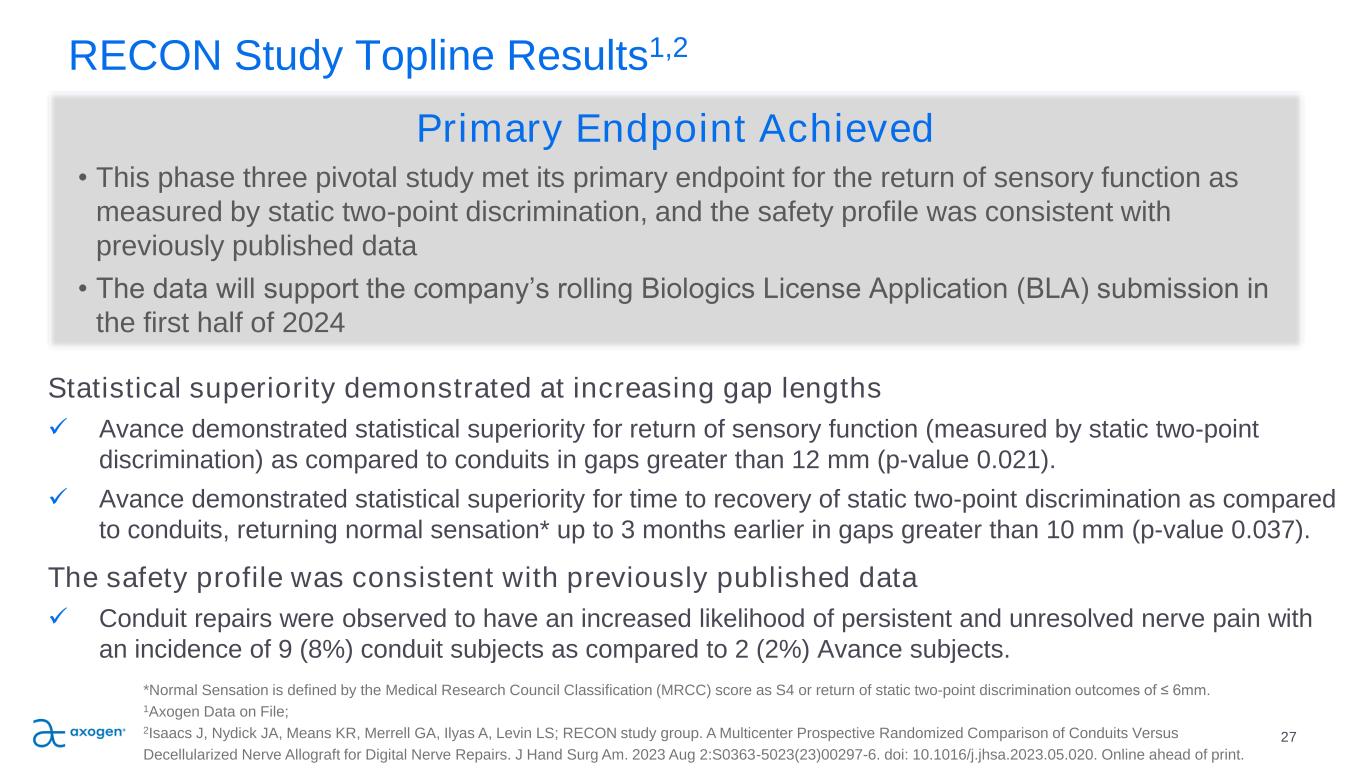

revolutionizing the science of nerve repair® RECON Study Topline Results1,2 27 Statistical superiority demonstrated at increasing gap lengths ✓ Avance demonstrated statistical superiority for return of sensory function (measured by static two-point discrimination) as compared to conduits in gaps greater than 12 mm (p-value 0.021). ✓ Avance demonstrated statistical superiority for time to recovery of static two-point discrimination as compared to conduits, returning normal sensation* up to 3 months earlier in gaps greater than 10 mm (p-value 0.037). The safety profile was consistent with previously published data ✓ Conduit repairs were observed to have an increased likelihood of persistent and unresolved nerve pain with an incidence of 9 (8%) conduit subjects as compared to 2 (2%) Avance subjects. *Normal Sensation is defined by the Medical Research Council Classification (MRCC) score as S4 or return of static two-point discrimination outcomes of ≤ 6mm. 1Axogen Data on File; 2Isaacs J, Nydick JA, Means KR, M rell GA, Ilyas A, Levin LS; RECON study group. A Multicenter Prospective Randomized Comparison of Conduits Versus Decellularized Nerve Allograft for Digital Nerve Repairs. J Hand Surg Am. 2023 Aug 2:S0363-5023(23)00297-6. doi: 10.1016/j.jhsa.2023.05.020. Online ahead of print. Primary Endpoint Achieved • This phase three pivotal study met its primary endpoint for the return of sensory function as measured by static two-point discrimination, and the safety profile was consistent with previously published data • The data will support the company’s rolling Biologics License Application (BLA) submission in the first half of 2024

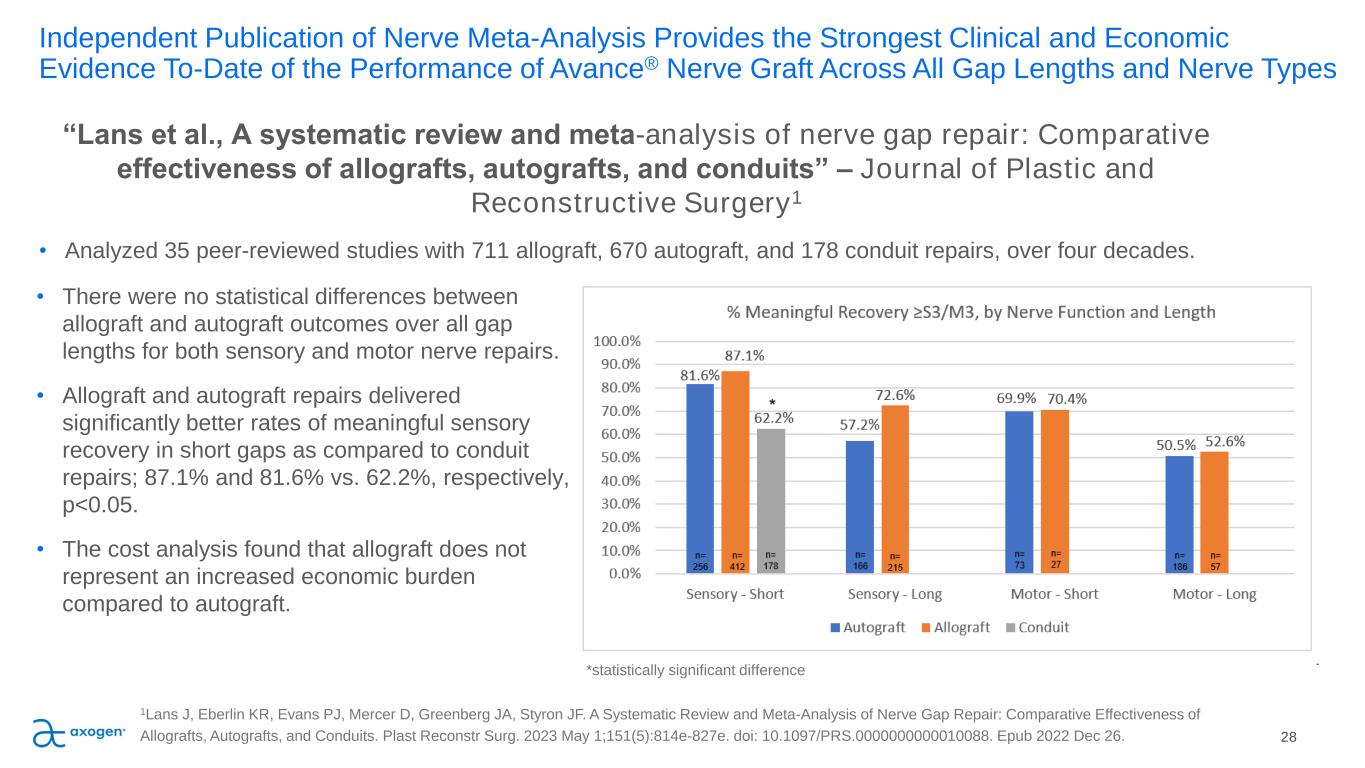

Independent Publication of Nerve Meta-Analysis Provides the Strongest Clinical and Economic Evidence To-Date of the Performance of Avance® Nerve Graft Across All Gap Lengths and Nerve Types 28 • Analyzed 35 peer-reviewed studies with 711 allograft, 670 autograft, and 178 conduit repairs, over four decades. “Lans et al., A systematic review and meta-analysis of nerve gap repair: Comparative effectiveness of allografts, autografts, and conduits” – Journal of Plastic and Reconstructive Surgery1 revolutionizing the science of nerve repair® • There were no statistical differences between allograft and autograft outcomes over all gap lengths for both sensory and motor nerve repairs. • Allograft and autograft repairs delivered significantly better rates of meaningful sensory recovery in short gaps as compared to conduit repairs; 87.1% and 81.6% vs. 62.2%, respectively, p<0.05. • The cost analysis found that allograft does not represent an increased economic burden compared to autograft. *statistically significant difference 1Lans J, Eberlin KR, Evans PJ, Mercer D, Greenberg JA, Styron JF. A Systematic Review and Meta-Analysis of Nerve Gap Repair: Comparative Effectiveness of Allografts, Autografts, and Conduits. Plast Reconstr Surg. 2023 May 1;151(5):814e-827e. doi: 10.1097/PRS.0000000000010088. Epub 2022 Dec 26.

Procedure Costs of Peripheral Nerve Graft Reconstruction Raizman et al. PRS Global Open1 29revolutionizing the science of nerve repair® • Retrospective study of U.S. all-payer data on facility procedure costs from 2018 to 2020. Included over 1,300 nerve repairs. Conclusions: • No significant differences in procedure costs for autograft and allograft repair in either inpatient or outpatient setting. • OR time was significantly shorter for allograft repairs, in both outpatient and inpatient settings. Procedure Costs of Nerve Repair 1Raizman NM, Endress RD, Styron JF, Emont SL, Cao Z, Park LI, Greenberg JA. Procedure Costs of Peripheral Nerve Graft Reconstruction. Plast Reconstr Surg Glob Open. 2023 Apr 10;11(4):e4908. doi: 10.1097/GOX.0000000000004908. eCollection 2023 Apr.

30 Focus on building awareness among clinicians and patients • Increasing omnichannel engagement with clinicians and patients • Continuing clinical conference participation both virtually and in-person as appropriate • Ongoing patient ambassador program • Garnering positive media attention • Growing social media presenceB u il d M a rk e t A w a re n e s s resensation.com rethink-pain.comrevolutionizing the science of nerve repair®

Knowledge is power: continued education and advocacy efforts with patients, clinicians and key legislators elevates the problems associated with numbness.

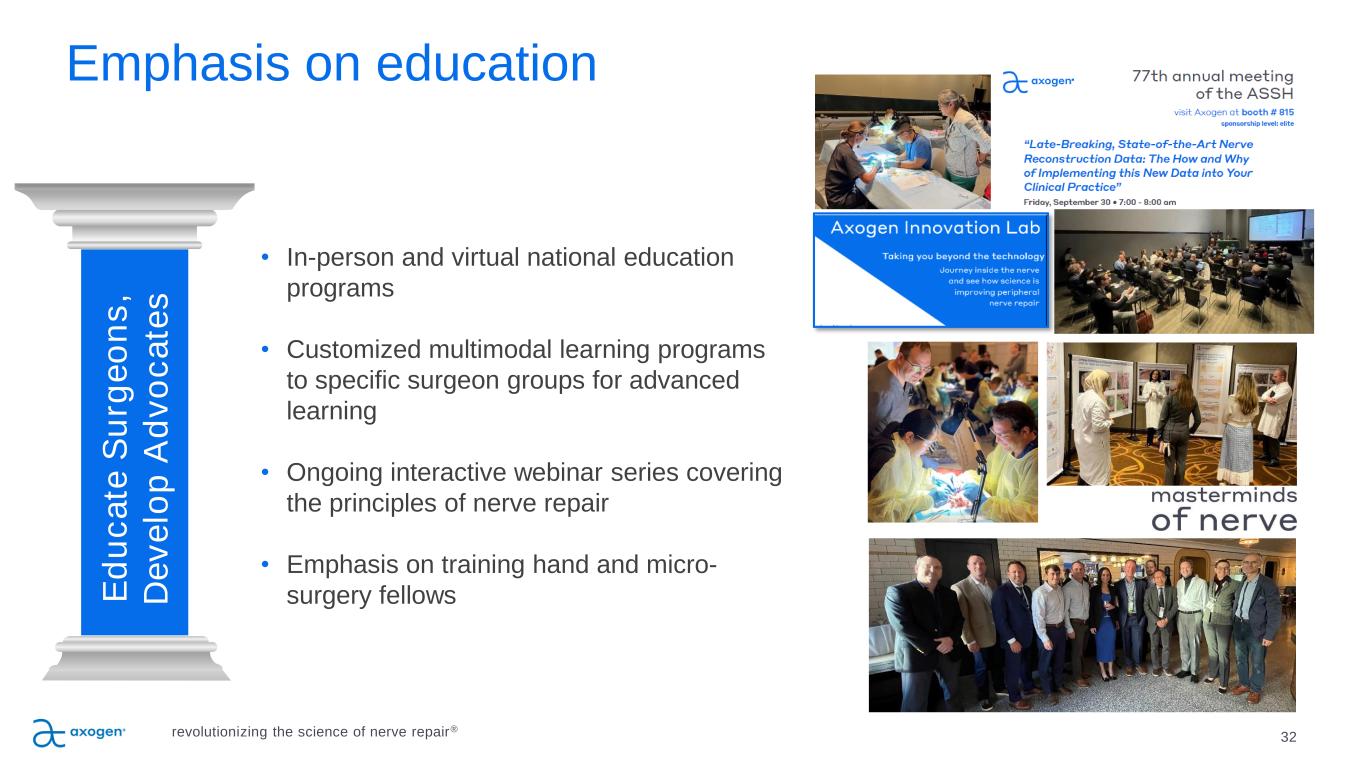

32 P IL L A R 2 Emphasis on education • In-person and virtual national education programs • Customized multimodal learning programs to specific surgeon groups for advanced learning • Ongoing interactive webinar series covering the principles of nerve repair • Emphasis on training hand and micro- surgery fellows E d u c a te S u rg e o n s , D e v e lo p A d v o c a te s revolutionizing the science of nerve repair®

33 P IL L A R 4 Focused sales execution, increasing market penetration P IL L A R 3 E x e c u te S a le s P la n Sales execution focused on driving results • Continue driving penetration in Core Accounts • Approximately 5,100 potential U.S. accounts perform nerve repair • 372 Core Accounts as of September 30, 2023 • Core Accounts now represent approximately 65% of total revenue, up from 60% in prior quarters Broad sales reach • U.S. direct sales team o 116 direct sales professionals at the end of Q3 2023 • Supplemented by independent agencies • Revenue from direct sales channel represented approximately 90% of total revenue revolutionizing the science of nerve repair®

34 P IL L A R 5 Opportunities in nerve repair Pain Iatrogenic injuries, post-traumatic, migraine, TKA and TKH pain, amputations, symptomatic neuromas, and nerve compressions Core business anchored in Trauma and Upper Extremity, and expanded to Breast, OMF and Pain. Further Market Expansion in Corneal Neurotization and Podiatry. revolutionizing the science of nerve repair® Breast Neurotization Autologous Flap Reconstruction; Breast Implant Reconstruction Urology Prostatectomy OMF Mandible Tumor Reconstruction; Iatrogenic Nerve Injuries, Extremities (Trauma and Compression) Acute trauma, revision carpal tunnel and cubital tunnel Head & Neck OB/GYN General Surgery Cardio Thoracic Orthopedic Podiatry Vascular Corneal Neurotization

Committed to our patients, the communities we serve, and our pursuit of advancing the science of nerve repair in ethical and sustainable ways Diversity, Equity, and Inclusion - Being the Company where exceptional people want to work Cybersecurity – Data Privacy, Training, and Policies Compliance – Quality Management System, Regulatory, and Good Manufacturing Practices Governance – Framework for Ethics Codes and Accountability Environment – Responsible, Sustainable Operations People Sustainability Business revolutionizing the science of nerve repair®

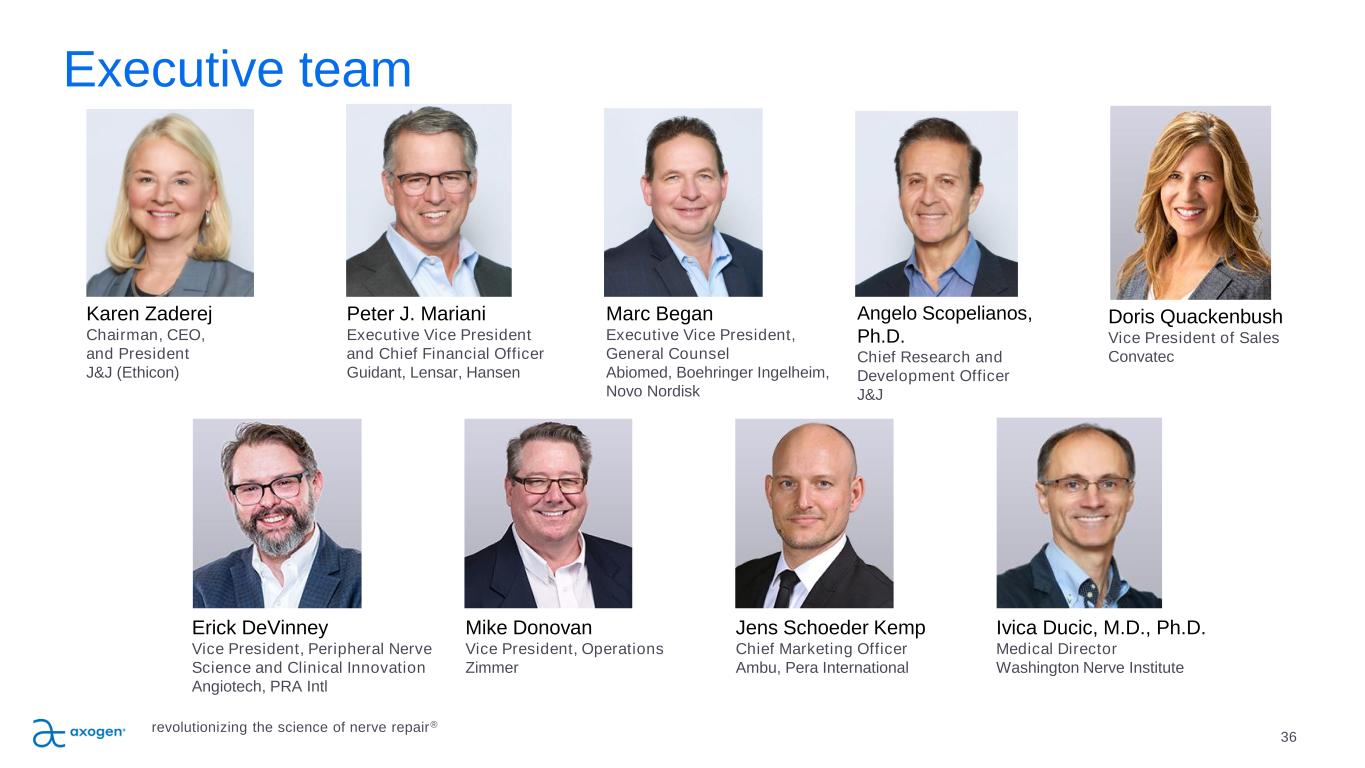

Executive team 36 Doris Quackenbush Vice President of Sales Convatec revolutionizing the science of nerve repair® Erick DeVinney Vice President, Peripheral Nerve Science and Clinical Innovation Angiotech, PRA Intl Mike Donovan Vice President, Operations Zimmer Ivica Ducic, M.D., Ph.D. Medical Director Washington Nerve Institute Jens Schoeder Kemp Chief Marketing Officer Ambu, Pera International Marc Began Executive Vice President, General Counsel Abiomed, Boehringer Ingelheim, Novo Nordisk Angelo Scopelianos, Ph.D. Chief Research and Development Officer J&J Karen Zaderej Chairman, CEO, and President J&J (Ethicon) Peter J. Mariani Executive Vice President and Chief Financial Officer Guidant, Lensar, Hansen

Appendix • Key Clinical Data • Historical Core and Active Accounts • CMS outpatient and ASC reimbursement rates • Total Addressable Market • Cash, debt, and capital structure • Axogen product portfolio and indications for use 37revolutionizing the science of nerve repair®

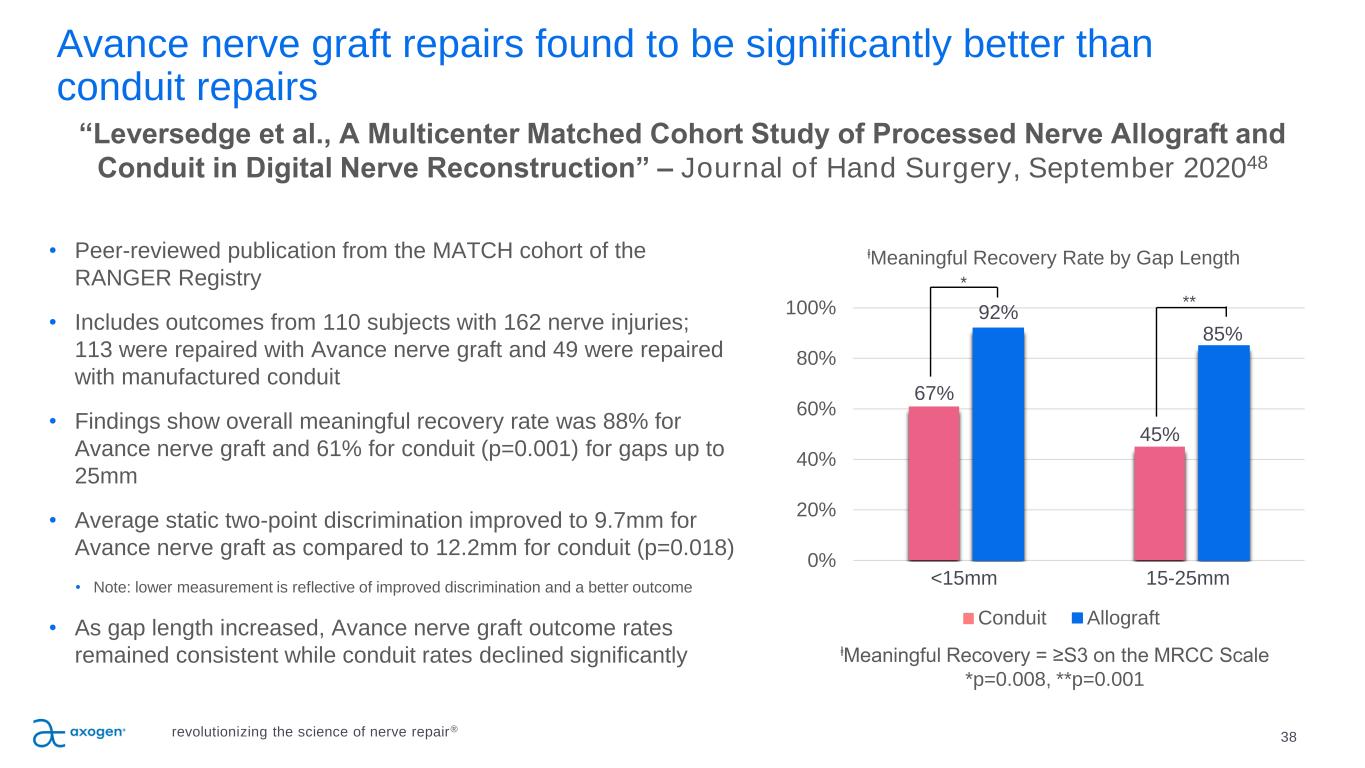

Avance nerve graft repairs found to be significantly better than conduit repairs 38 • Peer-reviewed publication from the MATCH cohort of the RANGER Registry • Includes outcomes from 110 subjects with 162 nerve injuries; 113 were repaired with Avance nerve graft and 49 were repaired with manufactured conduit • Findings show overall meaningful recovery rate was 88% for Avance nerve graft and 61% for conduit (p=0.001) for gaps up to 25mm • Average static two-point discrimination improved to 9.7mm for Avance nerve graft as compared to 12.2mm for conduit (p=0.018) • Note: lower measurement is reflective of improved discrimination and a better outcome • As gap length increased, Avance nerve graft outcome rates remained consistent while conduit rates declined significantly “Leversedge et al., A Multicenter Matched Cohort Study of Processed Nerve Allograft and Conduit in Digital Nerve Reconstruction” – Journal of Hand Surgery, September 202048 0% 20% 40% 60% 80% 100% Meaningful Recovery Rate by Gap Length Conduit Allograft <15mm 15-25mm Meaningful Recovery = ≥S3 on the MRCC Scale *p=0.008, **p=0.001 67% 92% 45% 85% * ** revolutionizing the science of nerve repair®

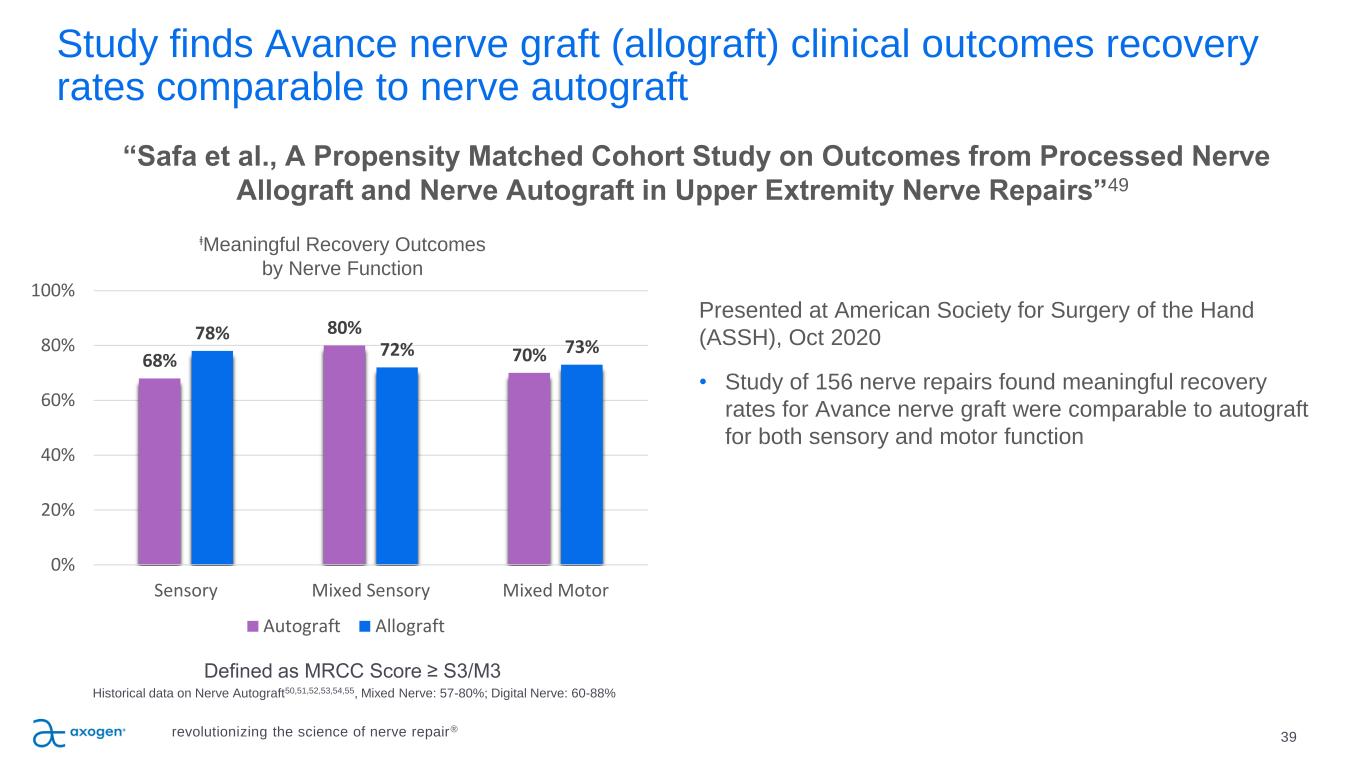

Study finds Avance nerve graft (allograft) clinical outcomes recovery rates comparable to nerve autograft 39 “Safa et al., A Propensity Matched Cohort Study on Outcomes from Processed Nerve Allograft and Nerve Autograft in Upper Extremity Nerve Repairs”49 Presented at American Society for Surgery of the Hand (ASSH), Oct 2020 • Study of 156 nerve repairs found meaningful recovery rates for Avance nerve graft were comparable to autograft for both sensory and motor function Defined as MRCC Score ≥ S3/M3 Historical data on Nerve Autograft50,51,52,53,54,55, Mixed Nerve: 57-80%; Digital Nerve: 60-88% 68% 80% 70% 78% 72% 73% 0% 20% 40% 60% 80% 100% Sensory Mixed Sensory Mixed Motor ⱡMeaningful Recovery Outcomes by Nerve Function Autograft Allograft revolutionizing the science of nerve repair®

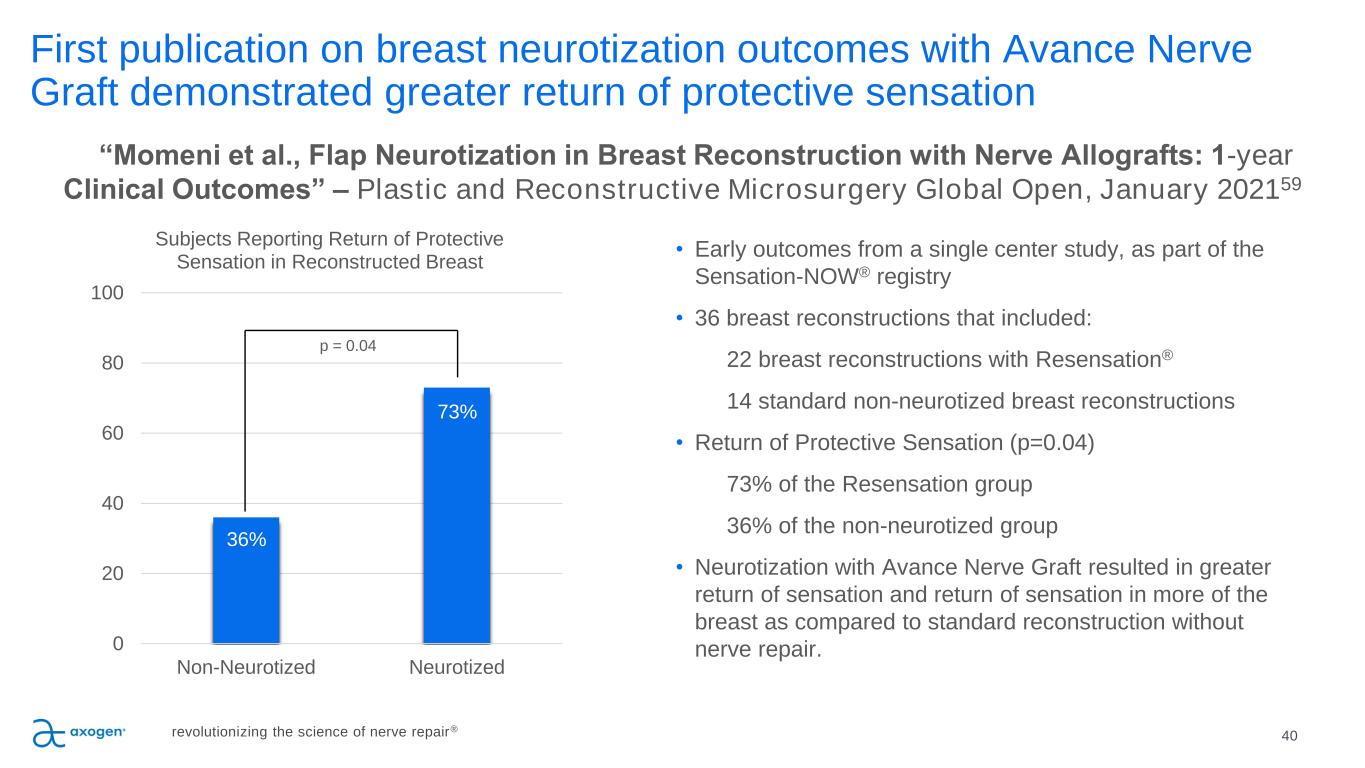

First publication on breast neurotization outcomes with Avance Nerve Graft demonstrated greater return of protective sensation 40 • Early outcomes from a single center study, as part of the Sensation-NOW® registry • 36 breast reconstructions that included: 22 breast reconstructions with Resensation® 14 standard non-neurotized breast reconstructions • Return of Protective Sensation (p=0.04) 73% of the Resensation group 36% of the non-neurotized group • Neurotization with Avance Nerve Graft resulted in greater return of sensation and return of sensation in more of the breast as compared to standard reconstruction without nerve repair. “Momeni et al., Flap Neurotization in Breast Reconstruction with Nerve Allografts: 1-year Clinical Outcomes” – Plastic and Reconstructive Microsurgery Global Open, January 202159 36% 73% 0 20 40 60 80 100 Non-Neurotized Neurotized Subjects Reporting Return of Protective Sensation in Reconstructed Breast p = 0.04 revolutionizing the science of nerve repair®

Axogen sponsored REPOSESM pilot study analysis demonstrates clinically significant improvement for subjects with chronic neuropathic pain when using Axoguard Nerve Cap® following neurectomy60 41 15-subject, single arm pilot phase evaluating reduction in pain from baseline following surgical excision of the neuroma and placement of the Axoguard Nerve Cap • Significant & clinically meaningful reduction in pain • Significant and clinically meaningful improvements in Fatigue, Physical Function, Sleep Disturbance, Pain Interference, Pain Intensity, and Pain Behavior as measured by the validated PROMIS® measures • Positive indicators for reduction in pain medication burden, including opioids • No recurrence of neuroma 0 20 40 60 80 100 Baseline 2 Weeks 1 month 3 month 6 month 9 month 12 Month 1 0 0 -p o in t V is u a l A n a lo g S c a le ( V A S ) Clinically meaningful reduction in pain sustained through 12 months Minimal Clinically Important Difference (MCID): 17mm Δ 3 months: -69 ± 23; p < 0.0001 Δ 12 months: -80 ± 13; p < 0.0001 revolutionizing the science of nerve repair®

Historical Core and Active Accounts 42revolutionizing the science of nerve repair® * Axogen voluntarily suspended market availability of Avive® Soft Tissue Membrane on June 1, 2021. Active and Core Account metrics are Adjusted for past Avive revenue. Core Accounts now represent ~65% of revenue, up from approximately 60% in prior quarters Core Accounts ≥$100,000 revenue in the last 12 months Active Accounts typically contribute ≈85% of total revenue Top 10% of Active Accounts typically contribute ≈35% of total revenue Active Accounts 6 orders in the last 12 months 237 256 265 294 283 282 285 298 331 332 350 347 372 248 269 274 306 292 294 288 299 331 332 350 347 372 Core ex-Avive Total Core 845 859 875 921 930 941 916 940 952 968 994 974 1016875 893 919 959 954 951 926 941 952 968 994 974 1016 Active ex-Avive Total Active Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 Q123 Q223 Q323 Core Acccounts 248 269 274 306 292 294 288 299 331 332 350 347 372 *Adjusted Core Accounts237 256 265 294 283 282 285 298 331 332 350 347 372 Q320 Q420 Q121 Q221 Q321 Q421 Q122 Q222 Q322 Q422 Q123 Q223 Q323 Active Accounts 875 893 919 959 954 951 926 941 952 968 994 974 1016 *Adjusted Active Acctounts845 859 875 921 930 941 923 940 952 968 994 974 1016

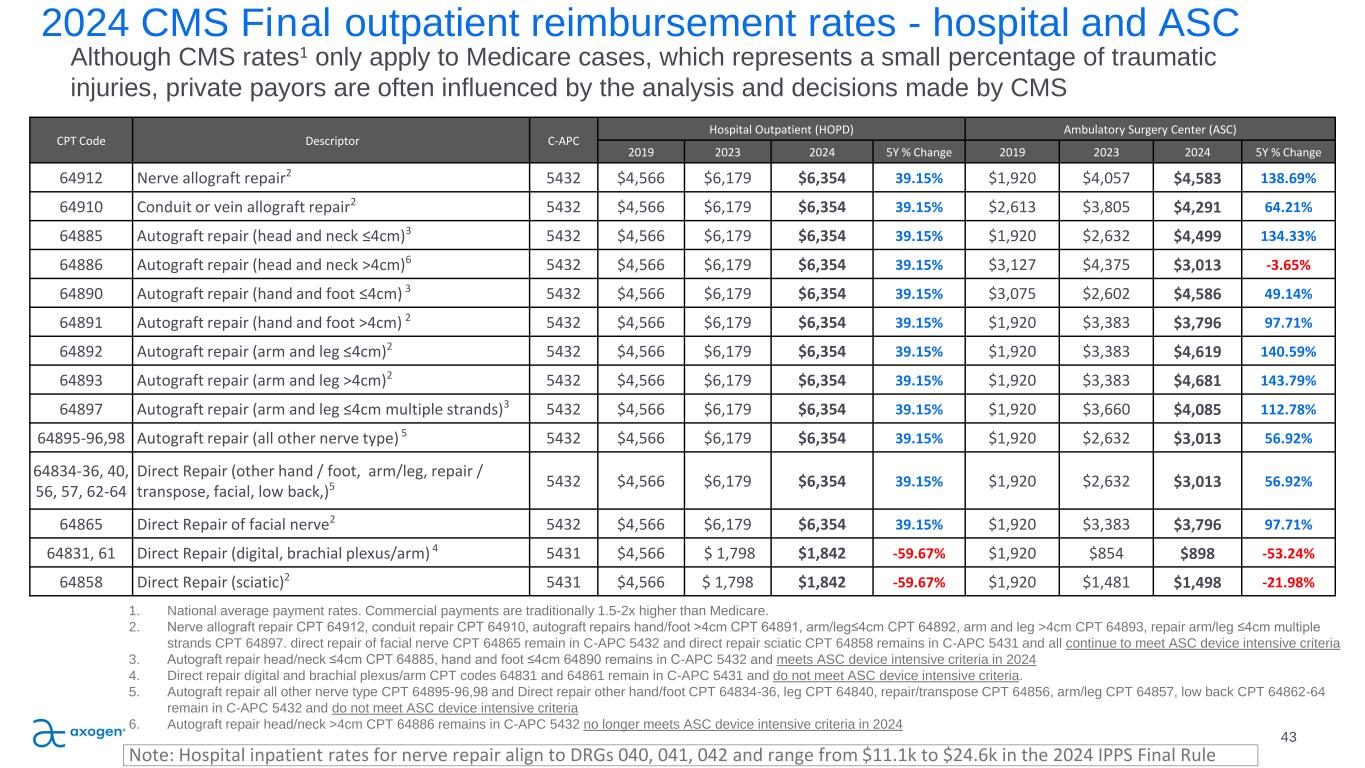

CPT Code Descriptor C-APC Hospital Outpatient (HOPD) Ambulatory Surgery Center (ASC) 2019 2023 2024 5Y % Change 2019 2023 2024 5Y % Change 64912 Nerve allograft repair2 5432 $4,566 $6,179 $6,354 39.15% $1,920 $4,057 $4,583 138.69% 64910 Conduit or vein allograft repair2 5432 $4,566 $6,179 $6,354 39.15% $2,613 $3,805 $4,291 64.21% 64885 Autograft repair (head and neck ≤4cm)3 5432 $4,566 $6,179 $6,354 39.15% $1,920 $2,632 $4,499 134.33% 64886 Autograft repair (head and neck >4cm)6 5432 $4,566 $6,179 $6,354 39.15% $3,127 $4,375 $3,013 -3.65% 64890 Autograft repair (hand and foot ≤4cm) 3 5432 $4,566 $6,179 $6,354 39.15% $3,075 $2,602 $4,586 49.14% 64891 Autograft repair (hand and foot >4cm) 2 5432 $4,566 $6,179 $6,354 39.15% $1,920 $3,383 $3,796 97.71% 64892 Autograft repair (arm and leg ≤4cm)2 5432 $4,566 $6,179 $6,354 39.15% $1,920 $3,383 $4,619 140.59% 64893 Autograft repair (arm and leg >4cm)2 5432 $4,566 $6,179 $6,354 39.15% $1,920 $3,383 $4,681 143.79% 64897 Autograft repair (arm and leg ≤4cm multiple strands)3 5432 $4,566 $6,179 $6,354 39.15% $1,920 $3,660 $4,085 112.78% 64895-96,98 Autograft repair (all other nerve type) 5 5432 $4,566 $6,179 $6,354 39.15% $1,920 $2,632 $3,013 56.92% 64834-36, 40, 56, 57, 62-64 Direct Repair (other hand / foot, arm/leg, repair / transpose, facial, low back,)5 5432 $4,566 $6,179 $6,354 39.15% $1,920 $2,632 $3,013 56.92% 64865 Direct Repair of facial nerve2 5432 $4,566 $6,179 $6,354 39.15% $1,920 $3,383 $3,796 97.71% 64831, 61 Direct Repair (digital, brachial plexus/arm) 4 5431 $4,566 $ 1,798 $1,842 -59.67% $1,920 $854 $898 -53.24% 64858 Direct Repair (sciatic)2 5431 $4,566 $ 1,798 $1,842 -59.67% $1,920 $1,481 $1,498 -21.98% 2024 CMS Final outpatient reimbursement rates - hospital and ASC 43 Although CMS rates1 only apply to Medicare cases, which represents a small percentage of traumatic injuries, private payors are often influenced by the analysis and decisions made by CMS 1. National average payment rates. Commercial payments are traditionally 1.5-2x higher than Medicare. 2. Nerve allograft repair CPT 64912, conduit repair CPT 64910, autograft repairs hand/foot >4cm CPT 64891, arm/leg≤4cm CPT 64892, arm and leg >4cm CPT 64893, repair arm/leg ≤4cm multiple strands CPT 64897. direct repair of facial nerve CPT 64865 remain in C-APC 5432 and direct repair sciatic CPT 64858 remains in C-APC 5431 and all continue to meet ASC device intensive criteria 3. Autograft repair head/neck ≤4cm CPT 64885, hand and foot ≤4cm 64890 remains in C-APC 5432 and meets ASC device intensive criteria in 2024 4. Direct repair digital and brachial plexus/arm CPT codes 64831 and 64861 remain in C-APC 5431 and do not meet ASC device intensive criteria. 5. Autograft repair all other nerve type CPT 64895-96,98 and Direct repair other hand/foot CPT 64834-36, leg CPT 64840, repair/transpose CPT 64856, arm/leg CPT 64857, low back CPT 64862-64 remain in C-APC 5432 and do not meet ASC device intensive criteria 6. Autograft repair head/neck >4cm CPT 64886 remains in C-APC 5432 no longer meets ASC device intensive criteria in 2024 Note: Hospital inpatient rates for nerve repair align to DRGs 040, 041, 042 and range from $11.1k to $24.6k in the 2024 IPPS Final Rule

2024 Center for Medicare and Medicaid Services (CMS): Final Physician Fee Schedule (PFS) revolutionizing the science of nerve repair™ 44November 6, 2023 CPT Codes3 Descriptor Physician Fee Schedule (PFS) 2019 2023 2024 5Y % Change 64912 Nerve allograft repair $804 $908 $883 9.78% 64910 Conduit or vein allograft repair $825 $772 $752 -8.80% 64885 to 64898* Autograft repair $1,096 to $1,495 $1,065 to $1,444 $1,035 to $1,404 -5.54% to -6.12% 64831 to 64861* Direct Repair $713 to $1,604 $708 to $1,560 $689 to $1,522 -3.34% to -5.11% *excludes add-on procedure codes

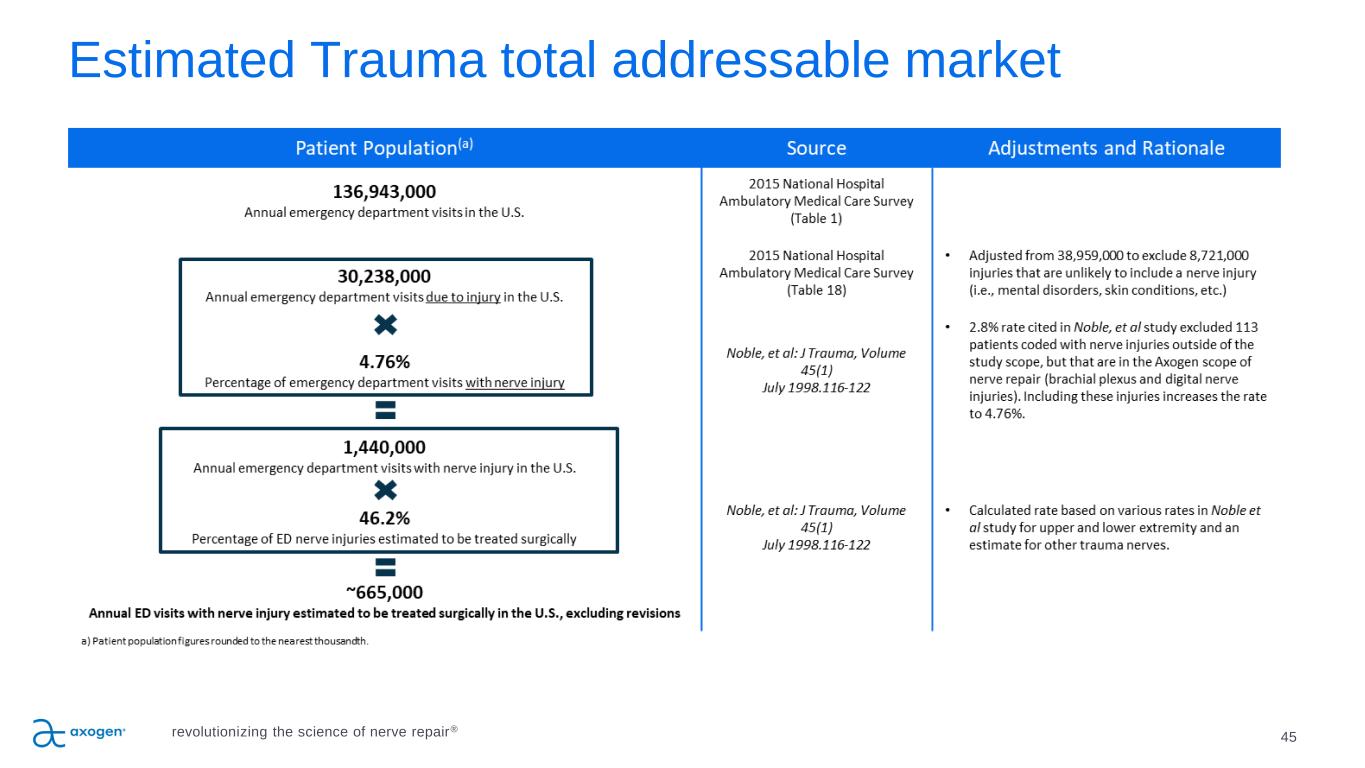

45 Estimated Trauma total addressable market revolutionizing the science of nerve repair®

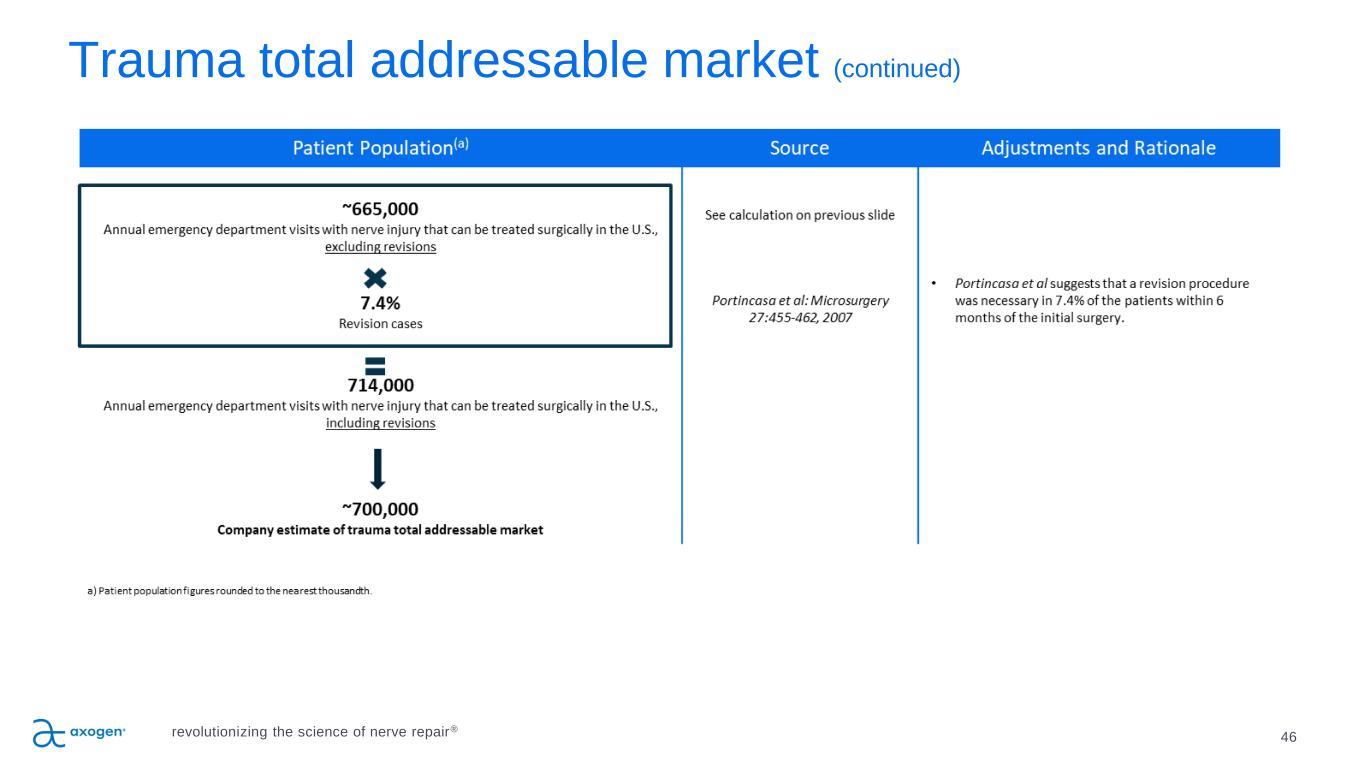

Trauma total addressable market (continued) 46revolutionizing the science of nerve repair®

Projected Incidence(a) Weighted Average Procedure Value Estimated Total Addressable Market Trauma Transection injuries >5mm (b) Transection injuries <5mm Protection (c) 700,000 100% 203,000 29% 198,000 29% 293,000 42% $2,715 $5,515 $1,200 $1,825 $1,900M 100% $1,120M 59% $238M 12% $535M 28% Carpal and Cubital Tunnel Protection 130,000 $2,100 $270M Oral and Maxillo-Facial (OMF) 56,000 $5,400 $300M Breast Reconstruction Neurotization 24,500 f laps (15,000 pat ients) $10,200 $250M Totals >900,000 (potent ia l ) >$2.7B a) Estimated Annual incidence of PNI surgery are figures rounded to the nearest thousandth except for Breast Reconstruction Neurotization (rounded to nearest hundredth). b) Transection injuries > 5mm assumes a factor of 1.22 nerve repairs per procedures, and utilization of the Axogen portfolio of products, based upon data observed in the RANGER® registry. c) Protection includes non-transected compression and crush injuries including protection from surrounding soft tissue attachments. 47 Estimated $2.7B value of market opportunity in existing applications revolutionizing the science of nerve repair®

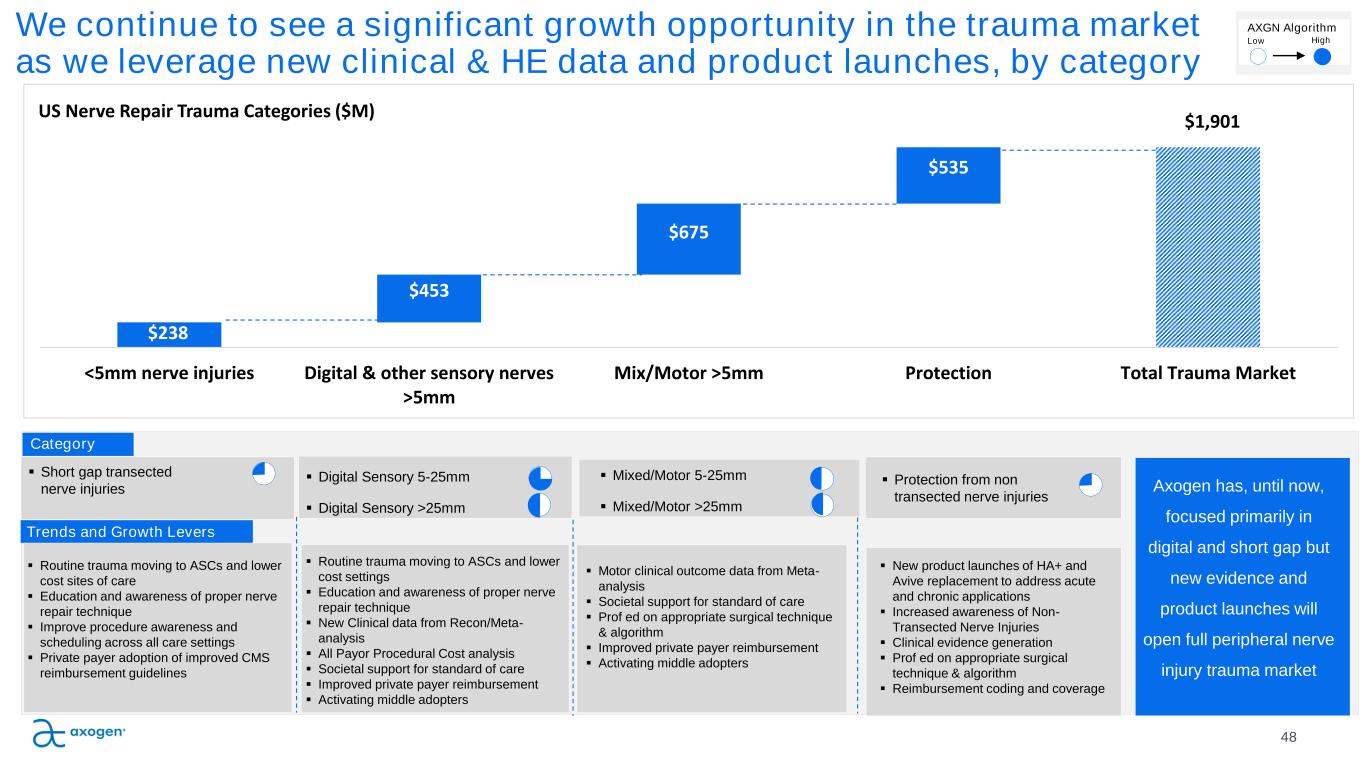

$238 $1,901 $453 $675 $535 <5mm nerve injuries Digital & other sensory nerves >5mm Mix/Motor >5mm Protection Total Trauma Market US Nerve Repair Trauma Categories ($M) We continue to see a significant growth opportunity in the trauma market as we leverage new clinical & HE data and product launches, by category 48 ▪ Digital Sensory 5-25mm ▪ Digital Sensory >25mm ▪ Protection from non transected nerve injuries ▪ Short gap transected nerve injuries Category Trends and Growth Levers ▪ Routine trauma moving to ASCs and lower cost settings ▪ Education and awareness of proper nerve repair technique ▪ New Clinical data from Recon/Meta- analysis ▪ All Payor Procedural Cost analysis ▪ Societal support for standard of care ▪ Improved private payer reimbursement ▪ Activating middle adopters ▪ Mixed/Motor 5-25mm ▪ Mixed/Motor >25mm ▪ Motor clinical outcome data from Meta- analysis ▪ Societal support for standard of care ▪ Prof ed on appropriate surgical technique & algorithm ▪ Improved private payer reimbursement ▪ Activating middle adopters ▪ New product launches of HA+ and Avive replacement to address acute and chronic applications ▪ Increased awareness of Non- Transected Nerve Injuries ▪ Clinical evidence generation ▪ Prof ed on appropriate surgical technique & algorithm ▪ Reimbursement coding and coverage ▪ Routine trauma moving to ASCs and lower cost sites of care ▪ Education and awareness of proper nerve repair technique ▪ Improve procedure awareness and scheduling across all care settings ▪ Private payer adoption of improved CMS reimbursement guidelines Axogen has, until now, focused primarily in digital and short gap but new evidence and product launches will open full peripheral nerve injury trauma market AXGN Algorithm HighLow

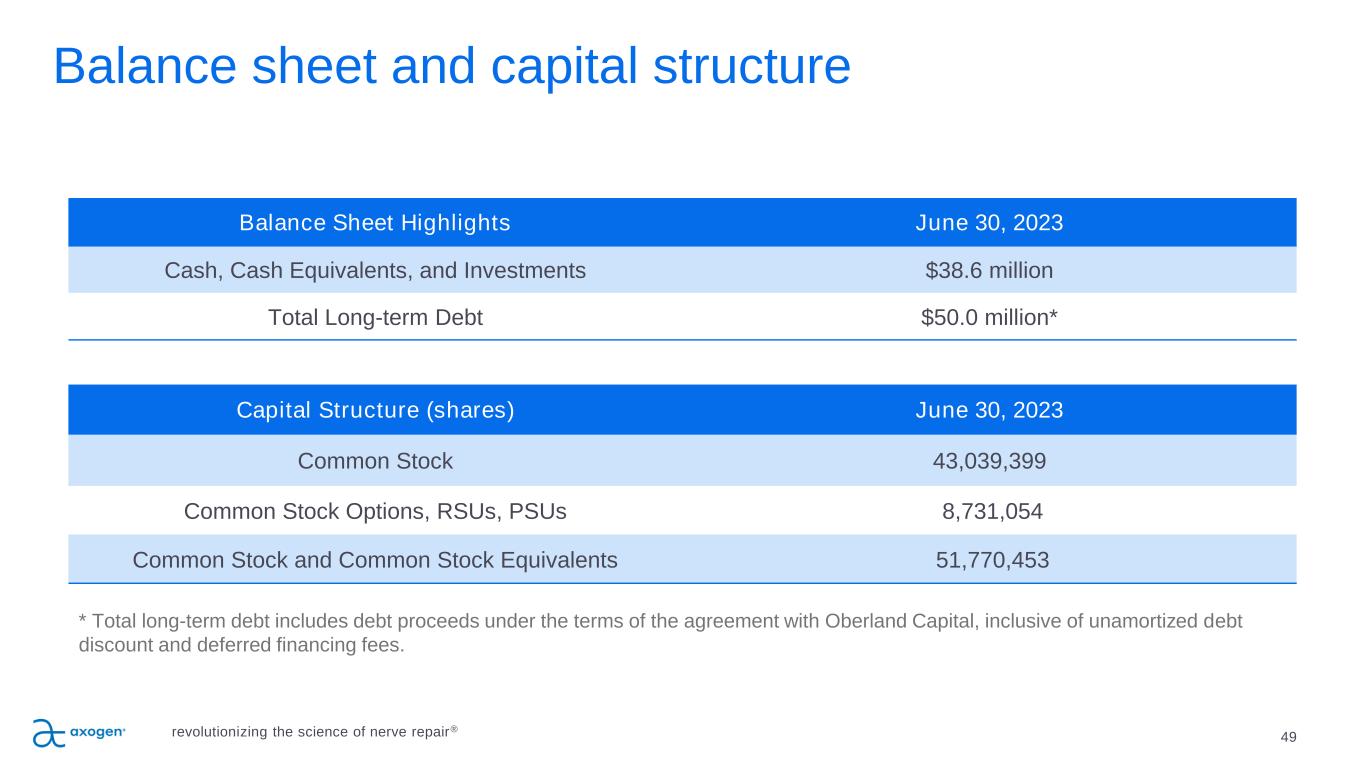

49 Balance Sheet Highlights June 30, 2023 Cash, Cash Equivalents, and Investments $38.6 million Total Long-term Debt $50.0 million* Capital Structure (shares) June 30, 2023 Common Stock 43,039,399 Common Stock Options, RSUs, PSUs 8,731,054 Common Stock and Common Stock Equivalents 51,770,453 Balance sheet and capital structure * Total long-term debt includes debt proceeds under the terms of the agreement with Oberland Capital, inclusive of unamortized debt discount and deferred financing fees. revolutionizing the science of nerve repair®

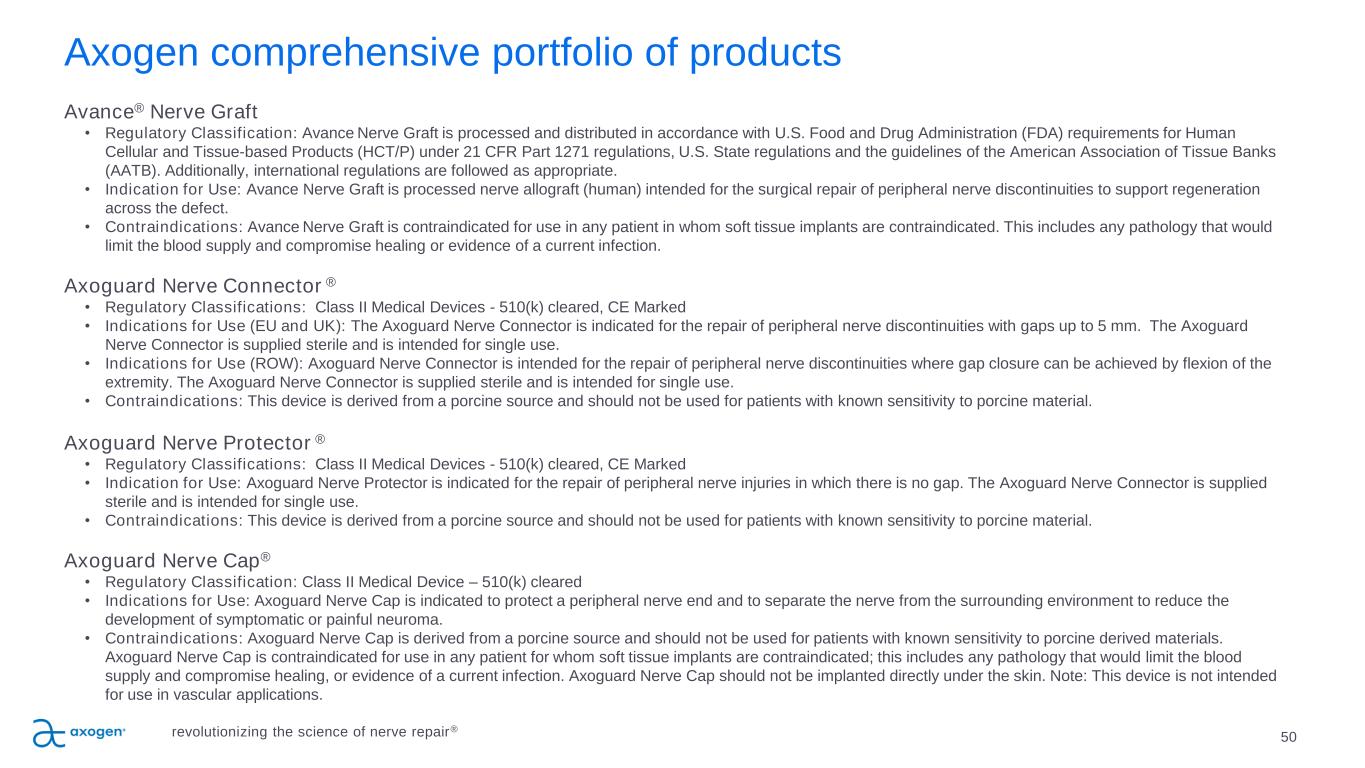

Axogen comprehensive portfolio of products Avance® Nerve Graft • Regulatory Classification: Avance Nerve Graft is processed and distributed in accordance with U.S. Food and Drug Administration (FDA) requirements for Human Cellular and Tissue-based Products (HCT/P) under 21 CFR Part 1271 regulations, U.S. State regulations and the guidelines of the American Association of Tissue Banks (AATB). Additionally, international regulations are followed as appropriate. • Indication for Use: Avance Nerve Graft is processed nerve allograft (human) intended for the surgical repair of peripheral nerve discontinuities to support regeneration across the defect. • Contraindications: Avance Nerve Graft is contraindicated for use in any patient in whom soft tissue implants are contraindicated. This includes any pathology that would limit the blood supply and compromise healing or evidence of a current infection. Axoguard Nerve Connector ® • Regulatory Classifications: Class II Medical Devices - 510(k) cleared, CE Marked • Indications for Use (EU and UK): The Axoguard Nerve Connector is indicated for the repair of peripheral nerve discontinuities with gaps up to 5 mm. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • Indications for Use (ROW): Axoguard Nerve Connector is intended for the repair of peripheral nerve discontinuities where gap closure can be achieved by flexion of the extremity. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • Contraindications: This device is derived from a porcine source and should not be used for patients with known sensitivity to porcine material. Axoguard Nerve Protector ® • Regulatory Classifications: Class II Medical Devices - 510(k) cleared, CE Marked • Indication for Use: Axoguard Nerve Protector is indicated for the repair of peripheral nerve injuries in which there is no gap. The Axoguard Nerve Connector is supplied sterile and is intended for single use. • Contraindications: This device is derived from a porcine source and should not be used for patients with known sensitivity to porcine material. Axoguard Nerve Cap® • Regulatory Classification: Class II Medical Device – 510(k) cleared • Indications for Use: Axoguard Nerve Cap is indicated to protect a peripheral nerve end and to separate the nerve from the surrounding environment to reduce the development of symptomatic or painful neuroma. • Contraindications: Axoguard Nerve Cap is derived from a porcine source and should not be used for patients with known sensitivity to porcine derived materials. Axoguard Nerve Cap is contraindicated for use in any patient for whom soft tissue implants are contraindicated; this includes any pathology that would limit the blood supply and compromise healing, or evidence of a current infection. Axoguard Nerve Cap should not be implanted directly under the skin. Note: This device is not intended for use in vascular applications. 50revolutionizing the science of nerve repair®

Axogen comprehensive portfolio of products (Cont’d) revolutionizing the science of nerve repair® 51 • Axoguard HA+ Nerve Protector™ • Regulatory Classifications: Class II Medical Devices - 510(k) cleared • Indication for Use: Axoguard HA+ Nerve Protector is indicated for the management of peripheral nerve injuries where there is no gap. • Contraindications: Axoguard HA+ Nerve Protector base membrane is derived from a porcine source and the lubricant coating is composed of sodium hyaluronate and sodium alginate. The Axoguard HA+ Nerve Protector should not be used for patients with known sensitivity to porcine, alginate, or hyaluronate materials. NOTE: This device is not intended for use in vascular applications.

nasdaq: axgn 52revolutionizing the science of nerve repair®