UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of March 2024

Commission file number: 001-41402

BRENMILLER

ENERGY LTD.

(Translation of registrant’s name into English)

13 Amal St. 4th Floor, Park Afek

Rosh Haayin, 4809249 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F

☐

CONTENTS

On March 6, 2024, Brenmiller

Energy Ltd. (the “Company”), made available a presentation on its website. A copy of the presentation is attached hereto as

Exhibit 99.1.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Brenmiller Energy Ltd. |

| |

|

| Date: March 6, 2024 |

By: |

/s/ Ofir Zimmerman |

| |

|

Name: |

Ofir Zimmerman |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

March 2024 Nasdaq: BNRG

2 Nasdaq: BNRG Disclaimer This presentation of Brenmiller Energy Ltd. (the “ Company ” , “ Brenmiller ” or “ Brenmiller Energy ” ), the oral presentation of the information contained in this presentation and any question and answer session that may follow contain “ forward - looking statements ” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Statements that are not statements of historical fact may be deemed to be forward - looking sta tements. For example, the Company is using forward - looking statements in this presentation when it discusses: the Company ’ s belief that thermal energy storage will play a major role in the energy transition; the Company ’ s expectations to enter into at least two additional projects during 2024 ; the Company ’ s plans to establish a global network of JVs with local developers and distributers; the potential of the Company ’ s first factory to support sales of up to $ 200 M,; the Company ’ s aim to open additional plants, and the Company ’ s forecast for additional growth in the U.S and EU. Without limiting the generality of the foregoing, words such as “ plan, ” “ project, ” “ potential, ” “ seek, ” “ target, ” “ may, ” “ will, ” “ expect, ” “ believe, ” “ anticipate, ” “ intend, ” “ could, ” “ estimate ” or “ continue ” are intended to identify forward - looking statements. Readers are cautioned that certain important factors may affect the Company ’ s actual results and could cause such results to differ materially from any forward - looking statements that may be made in this presentation. Factors that may affect the Company ’ s results include, but are not limited to, the Company ’ s planned level of revenues, capital expenditures and research, development and engineering expenses, the demand for and market acceptance of its products, impact of competitive products and prices, product development, commercialization or technological difficulties, the success or failure of negotiations and trade, legal , s ocial and economic risks, the risks associated with the adequacy of existing cash resources, and political, economic and military instability in the Middle East, specifical ly in Israel. The forward - looking statements contained or implied in this presentation are subject to other risks and uncertainties, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company ’ s Annual Report on Form 20 - F for the year ended December 31 , 2022 filed with the Securities and Exchange Commission's on March 21 , 2023 , which is available on the SEC ’ s website, www.sec.gov . The information in this presentation, the oral presentation of it and any question and answer session that may follow does no t c onstitute or form part of, and should not be construed as an offer or the solicitation of an offer to subscribe for or purchase securities of the Company, and nothing con tained therein shall form the basis of or be relied on in connection with any contract or commitment whatsoever. No representation, warranty or undertaking, express or implied, is made as to, and no reliance should be placed on, the fairn ess , accuracy, completeness or correctness of the information or the opinions contained herein. The information herein has not been independently verified and will not be up dated. The information, including but not limited to forward - looking statements, applies only as of the date of this document and is not intended to give any assuranc es as to future results. The Company expressly disclaims any obligation or undertaking to disseminate any updates or revisions to the Information, including any f ina ncial data or forward - looking statements, and, except as required by law, will not publicly release any revisions it may make to the information that may result from a ny change in the Company ’ s expectations, any change in events, conditions or circumstances on which these forward - looking statements are based, or other events or circumstan ces arising after the date of this presentation. Market data used in the information contained herein not attributed to a specific source are estimates of the Com pany and have not been independently verified.

3 Nasdaq: BNRG ABOUT Brenmiller Energy Ltd. Nasdaq listed: BNRG Employees As of March 2024 52 Founded Capital Investments since inception 2012 $ 100 M We are a clean - tech company that develops, manufactures and sells our Thermal Energy Storage ( “ TES ” ) solutions to decarbonize heat for industry and power plants

4 Nasdaq: BNRG FOUNDED Product development Full scale demonstration Manufacturing plant IPO TEL AVIV Pilot and marketing agreement with NYPA First U. S. patent granted First commercial pilot Corporate finance for manufacturing enhancement First power plant pilot purchase order Purchase agreement with Tempo IDF pilot commissioning Purchase agreement with Wolfson Hospital BRENMILLER Milestones NASDAQ LISTING 2012 2014 2016 2018 2020 2022 2024 Pilots R& D Commercial

5 Nasdaq: BNRG BY AVI BRENMILLER, CEO & CHAIRMAN ▪ We entered our first year of commercial sales signing first 2 milestone projects, we expect at least 2 additional projects to be signed in 2024 ▪ Our goal is to rapidly ramp revenues ▪ Our current focus is small - medium sized electricity - to - heat projects in the range of $ 5 - 15 M and we seek to expand to larger projects in the near term as revenues grow ▪ We focus on grant - backed projects to improve margins and returns; Current grant and tax incentive plans in the EU and US are attractive ▪ To accelerate our growth, we plan to establish a global network of JVs with local developers and distributers ▪ Our first factory supports potential sales of up to $ 200 M and we aim to open additional plants during 2027 - 2028 , as we forecast additional growth in the U.S. and EU Strategic Outlook We believe Thermal Energy Storage will play a major role in energy transition – decarbonization of the industrial sector, providing flexibility for power plants, and supporting the grid stability. “ Avi Brenmiller , CEO & Chairman

6 Nasdaq: BNRG Latest Updates ▪ 2024 Bloomberg NEF Pioneers finalist ▪ SUNY project handover in New York ▪ Wolfson Hospital to purchase a 12 MWh TES system for $ 3.55 m ▪ $ 4 m equity raise completed in January 2024 ▪ $ 450 K grant from Israeli Innovation authority ▪ TIME ’ s 2023 list of best inventions ▪ MoU with Green Enesys & Virdi RE to develop hydrogen and e - methanol projects ▪ Energy - as - a - Service agreement signed with Tempo (Heineken) to supply 32 MWh TES system

7 Nasdaq: BNRG Industry Updates Government grant and corporate funding are picking up

8 Nasdaq: BNRG bGen Heat battery based on crushed rocks enabling transition from fossil fuels to renewable energy THERMAL ENERGY STORAGE

9 Nasdaq: BNRG Embedded Electrical heaters Power - to - Heat bGen ZERO 100 ƒ - 500 ƒ Steam Hot air 97 % Efficiency Modular 10 MWh - 1,000 MWh Unlimited Cycles 30 + years Low - Cost materials Simple O&M Nasdaq: BNRG

10 Nasdaq: BNRG ▪ Rocks are crushed to small bits ▪ Thin metal cells ( “ bCells ” ) are filled with the crushed rocks ▪ bCells are stacked in to 12 meters modules ▪ Electrical heaters are embedded ▪ Modules are assembled on - site to a structure ▪ Structure is insulated and connected to plant From Rocks to Thermal Energy Storage

11 Nasdaq: BNRG Production Plant: Ready to ramp up ▪ European Investment Bank credit facility funding capital expenditure for automated bGen factory and increasing production capacity ▪ Plant is designed to produce bGen modules with an annual capacity of up to 4,000 MWh ▪ Production capacity is to potentially support sales of up to $ 200 million per year ▪ Factory is planned according to industry 4.0 standards, and would help the company to meet future demand and expected to increase profitability World ’ s First TES Gigafactory

Source: REN 21 2022 % of global final energy use by sector, cooling and transport electricity reallocated Electricity - 17 % Transportation - 32 % Heating & Cooling - 51 % Heat for industry, homes and commercial buildings is the largest energy end - use Global Energy Use By Sector

13 Nasdaq: BNRG 74 % Heat 30 % Natural Gas 45 % Coal 15 % Oil 9 % Renewables Renewable Based Heat is Crucial for Net - zero Emissions 26 % 74 % Electricity Heat Other , 13 % Industry , 32 % Transport , 31 % Residential , 24 % Global Final Energy Consumption Energy Sources for Industrial Heat Industrial heat accounts for of global energy consumption ¼ Industrial heat is heavily based on fossil fuels Source : International Energy Agency, Renewable energy for industry, 2017

14 Nasdaq: BNRG Source: McKinsey & Company Global energy Perspective 2022 Global Industrial energy consumption by sector in Exajoules, 2019 BGEN OPERATION TEMPERATURES IN THE RANGE OF 100 ° - 500 ° C TES potential in mid - temperature process heat

15 Nasdaq: BNRG Source: McKinsey & Company Global energy Perspective 2022 LEVELIZED COST OF HEAT FOR SELECTED TECHNOLOGIES, $/MWH Renewables + TES is now competitive

16 Nasdaq: BNRG 200MW PV + 800MWh TES 80MW Gas boilers Technology $250m $10m Capex $5/MWh Maintenance $50/MWh Gas + Carbon tax + Maintenance Opex 400,000MWh per year X 5 $/MWh X 20 years + Initial Capex = $290,000,000 400,000MWh per year X 50* $/MWh X 20 years + Initial Capex = $410,000,000 Total expense over project lifetime Zero emissions Fixed energy costs No dependency on gas supply Not affected by weather condition Added values 400 GWH ANNUAL STEAM CONSUMPTION IN AN INDUSTRIAL PLANT Illustrative Business Case Gas Boiler vs. PV+TES * Based on natural gas price of $ 30 / MWh + $ 80 /ton carbon tax

17 Nasdaq: BNRG Sale of thermal energy storage solutions to industrial facilities and power plants ▪ Complete turn - key projects ▪ After sale services ▪ Warranty ▪ Maintenance ▪ Optimization BUSINESS MODEL # 1 Equipment Sale

18 Nasdaq: BNRG Seeking JVs with leading global clean energy utilities to provide clean steam and grid services Customer benefits: ▪ Reducing energy costs with no capital expenditures ▪ Reducing operational risk ▪ Green certificates and carbon emission savings BUSINESS MODEL # 2 Energy - as - a - service

19 Nasdaq: BNRG 49 % 12 % 39% ▪ Brenmiller to finance, build and maintain ▪ Revenue stream: ▪ Sale of steam ▪ Grid services, capacity payments ▪ Buying energy at day - ahead prices Energy - as - a - service BUSINESS CASE REVENUE STREAMS Capacity Steam Energy

20 Nasdaq: BNRG GAS POWER PLANT COAL POWER PLANTS Converting retiring power plants to grid storage Flexible operation for changing grid 0 200 400 600 Electricity Output (MW) ▪ Energy shifting ▪ Fast ramp - up for spot market ▪ Additional revenue stacking from capacity payments, grid balancing and frequency regulation ▪ Utilizing existing infrastructure allows reduction of Capex ▪ Highly efficient for long duration storage ( 4 + hours) ▪ Storing surplus renewable energy and supplying during peak hours Thermal Energy Storage For Power Plants

21 Nasdaq: BNRG Largest TES System in the World Connected to a Gas Power Plant ▪ Storage capacity of up to 24 MWh ▪ Enables shifting energy from off - peak hours to peak hours – improving revenues from energy sales ▪ The power plant will generate additional revenue streams by improved response times to the grid

22 Nasdaq: BNRG Sales process / project development & opportunities Building the Pipeline – Focus on Europe and US

23 Nasdaq: BNRG Biomass to Heat Storage System Continuous biomass combustion while delivering fluctuating output Commissioned Projects Thermal Storage Based Co - Generation Hybrid charging: Exhaust gas and electricity

24 Nasdaq: BNRG 12 MWh bGen Power - to - Heat TES Off - peak Grid Electricity to Saturated Steam 32 MWh bGen Power - to - Heat TES PV & Grid Electricity to Saturated Steam ▪ Tempo, partially owned by Heineken International B.V., is one of Israel ’ s largest producers and distributors of beverages for brands including Heineken and Pepsi ▪ bGen ZERO will be installed at Tempo ’ s beverage plant in Netanya to generate sustainable process steam using off - peak electricity and solar PV, mitigating over 6,200 tons of carbon emissions each year ▪ Brenmiller estimates Tempo ’ s energy cost savings to reach $ 7.5 M over 15 years ▪ BGen ZERO has potential to save Wolfson Hospital up to $ 1.3 M annually and reduce the hospital ’ s local carbon footprint by 3,900 tons per year ▪ Project benefits from up to $ 450,000 grant from Israel Innovation Authority ▪ Wolfson to pay $ 3.55 M over 7 years Recently Signed Projects

BRENMILLER

THERMAL ENERGY STORAGE Thank You

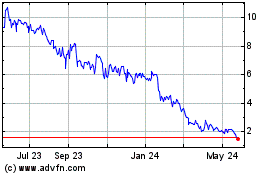

Brenmiller Energy (NASDAQ:BNRG)

Historical Stock Chart

From Apr 2024 to May 2024

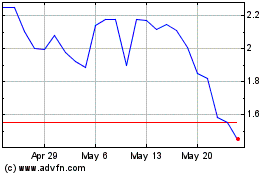

Brenmiller Energy (NASDAQ:BNRG)

Historical Stock Chart

From May 2023 to May 2024