| PROSPECTUS |

|

Filed Pursuant to Rule

424(b)(4)

Registration No. 333-275115

|

240,000 Ordinary Shares

888,890 Warrants to purchase 888,890 Ordinary Shares

648,890 Pre-Funded Warrants to Purchase 648,890 Ordinary Shares

Brenmiller

Energy Ltd.

We are offering on a “best efforts”

basis, 240,000 ordinary shares, no par value per share, or Ordinary Shares and 888,890 accompanying warrants, or the Warrants, to

purchase an aggregate of up to 888,890 Ordinary Shares at public offering price of $4.50 per Ordinary Share and accompanying Warrant.

Each Warrant will have an exercise price of $5.00 per Ordinary Share, will be exercisable upon issuance, and will expire five years from

the date of issuance.

We are also offering to those purchasers whose

purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related

parties, beneficially owning more than 9.99% of our outstanding Ordinary Shares immediately following the consummation of this offering,

if the purchaser so chooses, 648,890 pre-funded warrants, or the Pre-Funded Warrants, in lieu of Ordinary Shares that would otherwise

result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding

Ordinary Shares. Each Pre-Funded Warrant will be immediately exercisable for one Ordinary Share and may be exercised at any time until

all of the Pre-Funded Warrants are exercised in full. The purchase price of each Pre-Funded Warrants will equal the price per share at

which the Ordinary Shares are being sold to the public in this offering, minus $0.0001, and the exercise price of each Pre-Funded Warrant

will be $0.0001, per share. For each pre-funded warrant we sell, the number of Ordinary Shares we are offering will be decreased on a

one-for-one basis. There is no established public trading market for the Warrants or Pre-Funded Warrants, and we do not expect a market

to develop. We do not intend to apply for a listing of the Warrants or Pre-Funded Warrants on any national securities exchange. This offering

also relates to the Ordinary Shares issuable upon exercise of any Warrants and Pre-Funded Warrants sold in this offering.

For purposes of clarity, each Ordinary Share or

Pre-Funded Warrant to purchase one Ordinary Share is being sold together with a Warrant to purchase one Ordinary Share.

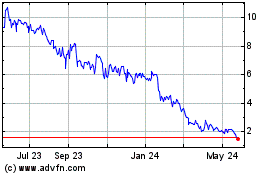

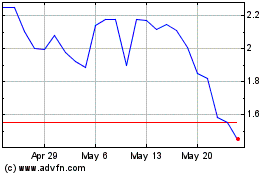

Our Ordinary Shares are listed on the Nasdaq Capital

Market, or Nasdaq, under the symbol “BNRG.” The last reported sale price on Nasdaq of our Ordinary Shares on January 19, 2024

was $5.98 per Ordinary Share.

We are an emerging growth company, as defined

in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and a “foreign private issuer”, as defined in Rule 405

under the U.S. Securities Act of 1933, as amended, or the Securities Act, and are eligible for reduced public company reporting requirements.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page 10.

Neither the U.S. Securities and Exchange Commission,

or the SEC, nor any state or other foreign securities commission has approved nor disapproved these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

We have engaged A.G.P./Alliance Global Partners

as our exclusive placement agent to use its best efforts to solicit offers to purchase our securities in this offering. The placement

agent has no obligation to purchase any securities from us or to arrange for the purchase or sale of any specific number or dollar amount

of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public

offering amount, placement agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less

than the total maximum offering amounts set forth in this prospectus. We have agreed to pay the placement agent the placement agent fees

set forth in the table below. See “Plan of Distribution” in this prospectus for more information.

The securities will be offered at a fixed price

and are expected to be issued in a single closing. The offering will terminate on January 31, 2024, unless completed sooner or unless

we decide to terminate the offering (which we may do at any time in our discretion) prior to that date; however, our Ordinary Shares

underlying the Pre-Funded Warrants and the Warrants will be offered on a continuous basis pursuant to Rule 415 under the Securities Act.

We expect to enter into a securities purchase agreement relating to the offering with those investors that choose to enter into such

an agreement on the day that the registration statement of which this prospectus forms a part is declared effective and that the closing

of the offering will end two trading days after we first enter into a securities purchase agreement relating to the offering. The offering

will settle delivery versus payment (“DVP”)/receipt versus payment (“RVP”) (on the closing date we will issue

the Ordinary Shares directly to the account(s) at the placement agent identified by each purchaser; upon receipt of such shares, the

placement agent shall promptly electronically deliver such shares to the applicable purchaser, and payment therefor shall be made by

the placement agent (or its clearing firm) by wire transfer to us.

We

and the placement agent have not made any arrangements to place investor funds in an escrow account or trust account since the placement

agent will not receive investor funds in connection with the sale of the securities offered hereunder. As stated above, because this

is a best efforts offering, the placement agent does not have an obligation to purchase any securities, and, as a result, there is a

possibility that we may not be able to sell the securities. There is no minimum offering requirement as a condition of closing of this

offering. Because there is no minimum offering amount required as a condition to closing this offering, we may sell fewer than all of

the securities offered hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will

not receive a refund in the event that we do not sell an amount of securities sufficient to pursue our business goals described in this

prospectus. In addition, because there is no escrow account and no minimum offering amount, investors could be in a position where they

have invested in our company, but we are unable to fulfill all of our contemplated objectives due to a lack of interest in this offering.

Further, any proceeds from the sale of securities offered by us will be available for our immediate use, despite uncertainty about whether

we would be able to use such funds to effectively implement our business plan. See the section entitled “Risk Factors—Risks

Related to this Offering and Ownership of our Securities” for more information.

| | |

Per

Ordinary

Share and

Warrant | | |

Per

Pre-Funded

Warrant

and Warrant | | |

Total | |

| Public offering price | |

$ | 4.50 | | |

$ | 4.4999 | | |

$ | 3,999,940 | |

| Placement agent fees(1) | |

$ | 0.315 | | |

$ | 0.3149 | | |

$ | 279,996 | |

| Proceeds to us (before expenses) | |

$ | 4.19 | | |

$ | 4.185 | | |

$ | 3,719,944 | |

| (1) |

Represents a

cash fee equal to 7.0% of the aggregate purchase price paid by investors in this offering,

provided, however, in the case of certain identified investors, the placement agent fee will

be 3.5% of the gross proceeds in this offering. We have also agreed to reimburse the placement

agent for certain of its offering-related expenses and pay the placement agent a non-accountable

expense allowance. See “Plan of Distribution” beginning on page 106 of

this prospectus for a description of the compensation to be received by the placement agent. |

We anticipate that delivery of the Ordinary

Shares and Pre-Funded Warrants, together with accompanying Warrants, is expected to be made on or about January 25, 2024, subject to

customary closing conditions.

Exclusive Placement

Agent

A.G.P.

The date of this prospectus is January 22, 2024

TABLE OF CONTENTS

You should rely only on

the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred

you. We have not authorized anyone to provide you with different information. We are offering to sell

our securities, and seeking offers to buy our securities, only in jurisdictions where offers and sales are permitted.

The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of

delivery of this prospectus or any sale of our securities.

For investors outside of

the United States: Neither we nor the placement agent have done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to

inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,”

“us,” “our,” the “Company” and “Brenmiller” refer to Brenmiller Energy Ltd. and its wholly

owned subsidiaries, Brenmiller Energy (Rotem) Ltd., a company incorporated under the laws of the State of Israel, Brenmiller Energy Inc.,

a company incorporated under the laws of Delaware, United States and Brenmiller Energy NL B.V., a company incorporated under the laws

of the Netherlands.

Our

reporting currency is the U.S. dollar and our functional currency has historically been the

New Israeli Shekel. Beginning with our Annual Report on Form 20-F for the year ended December

31, 2023 (and in conjunction with the change in reporting framework from IFRS to U.S. GAAP

discussed below), the Company will change its reporting currency from New Israeli Shekel

to U.S. dollars. In addition, effective January 1 2024, the Company has determined that its

functional currency is the U.S. dollar; in accordance with IAS 21 (Foreign currencies) (IFRS)

and ASC 830 (Foreign Currency Matters) (U.S. GAAP), the change in functional currency is

accounted for on a prospective basis beginning with the date of the change in functional

currency. Unless otherwise expressly stated or the context otherwise requires, references

in this prospectus to “NIS” are to New Israeli Shekels, to “dollars”,

“USD” or “$” are to U.S. dollars, and to “EUR” or “€”

are to the Euro. This prospectus contains translations of NIS amounts into U.S. dollars.

Unless otherwise noted, all translations from NIS to U.S. dollars in this prospectus were

made at a rate of NIS 3.70 per $1.00 per U.S. dollar, the exchange rate as of June 30, 2023,

published by the Bank of Israel. The aforementioned exchange rate is provided solely for

your convenience and may differ from the actual rates used in the preparation of the consolidated

financial statements included in this prospectus and other financial data appearing in this

prospectus.

This prospectus includes

statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications

and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they

obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the

information. Although we believe that these sources are reliable, we have not independently verified the information contained in such

publications.

In this prospectus, MW means

megawatt, the standard term of measurement for bulk electricity (one megawatt is equal to 1 million watts). MWh means a megawatt

hour, equaling 1,000 kilowatts of electricity generated per hour and is used to measure electric output.

This prospectus contains

trademarks, trade names and service marks, which are the property of their respective owners. Solely for convenience, trademarks, trade

names and service marks referred to in this prospectus may appear without the ®, ™ or SM symbols, but such references are not

intended to indicate, in any way, that we will not assert, to the fullest extent permitted under applicable law, our rights or the right

of the applicable licensor to these trademarks, trade names and service marks. We do not intend our use or display of other parties’

trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or

endorsement or sponsorship of us by, these other parties.

The financial statements

included in this prospectus are reported in accordance with International Financial Reporting Standards, or IFRS, as issued by the International

Accounting Standards Board, or IASB. On December 31, 2023, we began to prepare our financial statements in accordance with U.S. Generally

Accepted Accounting Principles, or U.S. GAAP. Accordingly, the financial statements included in this prospectus as of and for the six

months ended June 30, 2023 are our last report under IFRS and, beginning with our financial statements as of December 31, 2023, we will

report under U.S. GAAP.

On

November 13, 2023 our shareholders approved at a special general meeting an adjustment of the Company’s share capital at a ratio

of 10-for-1, with respect to the Company’s authorized and issued and outstanding Ordinary Shares, such that every ten Ordinary

Shares were converted into one Ordinary Share, and/or any Ordinary Shares issuable pursuant to exercise or conversion of outstanding

convertible securities such as options, restricted share units and/or warrants issued by the Company, or the Reverse Share Split. Unless

the context expressly dictates otherwise, all reference to share and per share amounts referred to herein reflect the Reverse Share Split.

The number of Ordinary Shares

to be outstanding immediately after this offering assumes that all of the Ordinary Shares offered hereby are sold and is based on 2,223,342

Ordinary Shares outstanding as of January 16, 2024. This number excludes:

| |

● |

an aggregate of 128,220

Ordinary Shares issuable upon the exercise of outstanding options to purchase Ordinary shares, at exercise prices ranging between

NIS 3 to NIS 800 (approximately $0.8 to $216.2) per Ordinary Share, issued to directors, officers, service providers and employees

issued under our 2013 global incentive option plan, or our Equity Incentive Plan; |

| |

|

|

| |

● |

an aggregate of 1,125 Ordinary

Shares with respect to 1,125 restricted share units we have granted to directors, employees, and service providers; and |

| |

● |

an aggregate of 522,427

Ordinary Shares issuable upon the exercise of outstanding warrants to purchase Ordinary Shares, at exercise prices ranging between

NIS 44 to NIS 180 (approximately $11.9 to $48.6) per Ordinary Share, issued to certain investors in connection with private placements. |

PROSPECTUS

SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing

in our securities. Before you decide to invest in our securities, you should read the entire prospectus carefully, including the “Risk

Factors” section and the financial statements and related notes appearing at the end of this prospectus.

Our Company

We are a technology company

that develops, produces, markets and sells thermal energy storage, or TES, systems based on our proprietary and patented bGen™

technology. The use of our technology enables better renewable integration, increases energy efficiency and reduces carbon emissions

by allowing constant and reliable energy while stabilizing the intermittent nature of renewable sources.

We believe that climate change

is the greatest challenge of our times. A major contributor to climate change is carbon emissions being emitted to the atmosphere. To

combat this, countries and organizations have set and are continuing to set targets for themselves and various industries to reduce their

carbon emissions. In order to meet such carbon emission targets, we believe it is necessary to ban the use of fossil fuels and, instead,

rely on renewable energy sources and systems that result in carbon capture, energy storage, efficient energy recovery, and the reuse

of wasted heat. Our bGen™ TES system stores energy and can recover wasted heat from available energy resources to provide one consistent

energy output. By doing so, the bGen™ TES system can precisely match energy supplies with the demand and bridges the gap between

renewable energy and conventional power sources. Accordingly, we believe TES systems such as our bGen™ system have become essential

to the renewable energy market to ensure the reliability and stability of energy supplies.

We have developed our bGen™

technology over the last ten years and have tested it across three generations of demonstration units at various sites globally. Our

bGen™ technology uses crushed rocks to store heat at temperatures of up to 1400 degrees Fahrenheit and is comprised of three key

elements inside one unit: thermal storage, heat exchangers, and a steam generator. The use of crushed rock as a means of storage results

in no hazardous challenges to the environment and enhances system durability so that even after tens of thousands of charge and discharge

cycles, the storage material does not need to be replaced because the storage material does not suffer from degradation in performance.

Additionally, the bGen™ technology can be charged with multiple heat sources, such as residual heat, biomass, and renewables, as

well as from electrical sources using embedded electric heathers within the TES system. The TES system dispatches thermal energy on demand

in the form of steam, which can be saturated for industrial use, or in the form of a superheated steam, which can be used to activate

steam turbines.

Recent

Developments

Reverse Share Split, Increase in the Company’s

Registered Share Capital and cancellation of the Nominal Value of the Company’s Ordinary Shares

On

November 13, 2023 our shareholders approved at a special general meeting an adjustment of the Company’s share capital at a ratio

of 10-for-1, with respect to the Company’s authorized and issued and outstanding Ordinary Shares, such that every ten Ordinary

Shares were converted into one Ordinary Share, and/or any Ordinary Shares issuable pursuant to exercise or conversion of outstanding

convertible securities such as options, restricted share units and/or warrants issued by the Company. The Reverse Share Split took effect

on December 4, 2023.

In

addition, our shareholders also approved an increase to the Company’s authorized share capital by 100,000,000 Ordinary Shares and

the cancellation of the nominal value of the Company’s Ordinary Shares, or the Increase of Authorized Share Capital. Accordingly,

after giving effect to the Increase of Share Capital and the Reverse Share Split, the authorized share capital of the Company is 15,000,000

Ordinary Shares, no par value per share.

Approval from the Israeli Ministry of Finance

to supply electric process heat to Wolfson Hospital, Israel

In August 2023, we received

final approval from the Israeli Ministry of Finance to supply electric process heat to Wolfson Hospital, a public medical center located

near Tel Aviv in Holon, Israel. The Israeli Ministry of Finance announced it has approved a budget of up to NIS 14 million (approximately

$3.7 million) for Wolfson Hospital to procure TES equipment from the Company. The Israeli Ministry of Finance estimates that the use

of electric heat, provided via Brenmiller’s bGen™ ZERO thermal energy storage system, has the potential to save Wolfson Hospital

up to $1.3 million annually and reduce the hospital’s local carbon footprint by 3,900 tons per year. A final agreement between

Wolfson Hospital and the Company is under preparation and is expected to be signed by the end of the first quarter of 2024.

On January 15, 2024, we received

a grant of $450,000 from the Israel Innovation Authority of the Ministry of Economy and Industry, or the IIA, in connection with our

project at Wolfson Hospital, subject to us raising additional funding in the amount of NIS 12.5 million by March 15, 2024 and entering

a final agreement with Wolfson Hospital by the end of the first quarter of 2024.

2022 Private Placement

On

November 29, 2022, we entered into definitive securities purchase agreements with certain

investors, part of whom are existing shareholders, including Mr. Avraham Brenmiller, our

controlling shareholder, Chief Executive Officer and the Chairman of our board of directors,

for the issuance in a private placement of units consisting of one Ordinary Share and one

non-registrable and non-tradeable warrant, for a total of 199,636 Ordinary Shares and 199,636

associated warrants, at a price of NIS 53.3 (approximately $15.5) per unit, based on an exchange

rate of NIS/USD 3.438 published on November 28, 2022, or the 2022 Private Placement. The

warrants are exercisable on the issuance date of each unit with a premium of 15% of the share

price, representing an exercise price of NIS 61.3 (approximately $17.8) per share, and have

a term of five years from the issuance date.

On December 6, 2022, one

of the parties participating in the 2022 Private Placement and one additional investor agreed to purchase 34,191 additional units on

the same terms as agreed for the 2022 Private Placement, or the Additional Investment.

The completion of the 2022

Private Placement and the Additional Investment were subject to the approval of our shareholders at an extraordinary general meeting

which was convened on January 24, 2023. At such meeting, our shareholders approved, among other things, the 2022 Private Placement and

the Additional Investment.

On February 16, 2023, the

2022 Private Placement and the Additional Investment were completed, resulting in gross proceeds to us of approximately $3.59

million and our issuance to such investors an aggregate of 233,827 Ordinary Shares and 233,827 warrants to purchase Ordinary Shares at

an exercise price of NIS 61.3 per share. The warrants are exercisable until February 16, 2028.

The

investors in the 2022 Private Placement and the Additional Investment received piggyback

registration rights for their Ordinary Shares and shares underlying the associated warrants.

On June 29, 2023, we filed a registration statement with the SEC to register the resale of

the warrant shares. Upon effectiveness of such registration statement on July 10, 2023, the

aforementioned piggyback rights expired.

Grant from Israeli Ministry of Environmental

Protection and Tempo Agreement to Replace Fossil Fuel Boilers with 32 MWh Thermal Energy Storage System

On

April 5, 2023, we received approval from the Israeli Ministry of Environmental Protection

for a NIS 2.2 million (approximately $595,000) grant for the purpose of and conditioned upon

the building and installation of our industry-leading bGen™ TES system at a beverage

plant owned and operated by Tempo Beverages Ltd. (“Tempo”). Tempo, partially

owned by Heineken International B.V., is a producer of beverages for brands including Heineken,

Pepsi, Nestle, and Pernod Richard. The approved grant is to fund the clean energy project

outlined in a Memorandum of Understanding between Brenmiller and Tempo. On October 11,

2023, we announced that we signed a contract with Tempo to replace the heavy fuel

oil boilers at its plant in Netanya, Israel, with our bGen™ ZERO thermal energy storage

system. Our bGen ZERO system that will be installed at the Tempo plant will produce sustainable

process steam using solar photovoltaic (“PV”) energy and off-peak grid power

when electricity rates are most affordable. We estimate that using thermal energy storage

in place of fossil fuel boilers will eliminate the use of approximately 2,000 tons of heavy

fuel oil annually and mitigate over 6,200 tons of carbon emissions each year. The project

is expected to be completed by the end of 2024.

Dimona Israel Production Facility

As of June 30, 2023, we have

received the majority of the equipment for the Dimona facility build-out. The production facility is planned to be Industry 4.0 compliant

and will have a fully automated production line with a production capacity of up to 4 GWh of the Company’s patented bGen TES modules

annually. The Company expects that the Dimona facility will be operational by the end of 2023 and plans to ramp-up the production line

during 2024 and increase its production capacity in order to reach its full production capacity target of 4 GWh annually. The equipment

purchase order was financed through a non-dilutive €7.5 million credit facility agreement with the European Investment Bank, or

EIB, out of which an amount of €4 million was withdrawn in July 2022 by the Company, and an additional amount of up to €3.5

million can be drawn within a period of 36 months from signing the agreement, or March 31, 2024.

Term Sheet with Leading Global Clean Energy

Utility Partner

On April 20, 2023, we signed

a non-binding Term Sheet with one of the largest producers of clean energy in the world and Green Enesys Group toward a definitive agreement

to jointly identify, build, and accelerate electrification by using renewable energies and Brenmiller’s TES system to electrify

heat and achieve full decarbonization for their clients. The Utility identified Brenmiller’s TES system as a leading decarbonization

technology. The two companies expect to join forces with Green Enesys to accelerate TES deployments and provide a quick response to the

global economy’s USD $1.7 - $3.6 trillion need for net-zero heat. Under the terms of this agreement, Brenmiller’s bGen units

will be produced at its gigawatt-scale production facility in Israel. The parties have the option to implement a joint production line

in Europe to be used for the Utility’s projects. The non-binding term sheet also includes the option for the Utility to become

a strategic investor for a minority stake in the Company. Brenmiller’s patented bGen™ technology enables industrial- and

utility-scale decarbonization by absorbing electricity from renewables, using it to charge the storage system, and converting it into

clean heat according to customers’ needs. Brenmiller’s TES technology bridges the gap between the time that renewable energy

is produced and when demand peaks.

At-The-Market Offering

On June 9, 2023, we entered

into a Sales Agreement with A.G.P./Alliance Global Partners, or the Sales Agent, pursuant to which we may offer and sell Ordinary Shares,

from time to time, to or through the Sales Agent as agent or principal Ordinary Shares in an “at-the-market” offering, as

defined in Rule 415(a)(4) promulgated under the Securities Act, for an aggregate offering price of up to $9.35 million. We will pay the

Sales Agent a commission equal to 3.0% of the gross sales price per share sold pursuant to the terms of the Sales Agreement. We are not

obligated to sell any Ordinary Shares under the Sales Agreement and no assurance can be given as to the price or number of such shares

that we will sell or the dates on which any such sales will take place. As of January 17, 2024, we have sold 88,844 Ordinary Shares under

the Sales Agreement for aggregate gross proceeds of $667,716.

Delisting from TASE and Series 3 Warrants

On

March 23, 2023 we announced that we initiated a process to voluntarily delist our Ordinary

Shares from the Tel Aviv Stock Exchange (TASE). On June 28, 2023, we announced that we postponed

the date of the voluntary delisting of our securities from the TASE to September 11, 2023

in order to allow us to complete the procedure for changing the terms of our Series 3 tradable

warrants by the delisting date of our securities from trading on the TASE. On August 6, 2023,

the Israeli Court approved the arrangement to change the terms of our Series 3 Tradable Warrants

as follows: (i) to reduce the exercise price from NIS 700 per share to NIS 13 per share;

and (ii) to shorten the exercise period until September 5, 2023 (instead of November 15,

2024), or the Arrangement. The approved Arrangement enabled the Series 3 Tradable Warrant

holders to exercise their warrants for Ordinary Shares of the Company prior to the voluntary

delisting of the Company’s securities from the TASE on September 11, 2023. As

a result, 18,811 Ordinary Shares were issued as a result of exercise of Series 3 Tradable

Warrants, resulting in gross proceeds to us of approximately $65,274. The remaining Series

3 Tradable Warrants expired. Our securities were voluntarily delisted from the TASE on September

11, 2023.

June 2023 Private Placement

On June 12, 2023, we entered

into a definitive securities purchase agreement with Snowdrop Holding SA for the issuance and sale in a private placement offering of

248,778 units, each unit consisting of one Ordinary Share and one non-tradeable warrant to purchase one Ordinary Share at a price per

unit of $1.00, for aggregate gross proceeds of approximately $2.5 million. The warrants have an exercise price of NIS 44 (approximately

$11.9) per warrant and may be exercised beginning on June 12, 2024 until June 12, 2028. The offering closed on June 15, 2023.

bGen™ ZERO

On August 9, 2023, we unveiled

the next generation of our market-leading, high-performance TES system, the bGen™ ZERO as part of our strategic focus to deliver

cost-efficient, zero-carbon emissions heat. By electrifying heat, the bGen ZERO is designed to address growing market demand for decarbonization

solutions in the industrial and power sectors.

The bGen ZERO offers a modular,

flexible design with fast charge and discharge times, all without the use of hazardous materials. Additional highlights and improvements

from prior bGen™ systems include:

| ● | Improved

Efficiency: 33% reduction in heat loss, 99% charging efficiency, 97% cycle efficiency (power

to heat), and 98% year-round availability. |

| | | |

| ● | Boosted

Energy Density: 34% improvement in energy density and 40% improvement in discharge power. |

| | | |

| ● | Swift

Response and Continuous Operation: Engineered for fast one second response rate and uninterrupted

operation at maximum capacity, tailored for high demands of the power grid for reserve power

and stability. |

| ● | Compact

and Modular: Fully modular, productized solution that ensures the highest quality standards,

rapid on-site installation, and commissioning. Occupies minimal space due to its unlimited

storage height. |

| | | |

| ● | Impressive

Steam Power Generation: Delivers substantial steam power generation, offering a stable steam

supply for various power, commercial and industrial applications. |

| | | |

| ● | Smart

and Safe Operations: Features an intelligent module operation package with predictive maintenance

and optimized performance based on market prices one day ahead, coupled with storage performance

insights. Remote control operation via the Brenmiller control center. Robust cyber protection

measures to ensure security and reliability. |

Term Sheet with Green Enesys and Viridi

On

August 23, 2023, we signed a term sheet with European renewable energy developers Green Enesys

and Viridi to establish a new joint venture (“JV”) in Spain. The new entity will

deliver our products, including the bGen™ and recently unveiled bGen™ ZERO, through

our Energy as a Service, or EaaS, business model, beginning in Spain, Germany, and France.

Under the JV, we will maintain all of our intellectual property and will manufacture all

bGen™ modules for the JV’s projects in Spain, Germany and France at our new production

facility in Dimona, Israel. Establishing the JV and the activities contemplated by the JV

are subject to negotiation and execution of definitive agreements.

Corporate Information

We

are an Israeli corporation based in Rosh Haayin, Israel, and were incorporated in Israel

in 2012 as Brenmiller Energy Consulting Ltd. On July 2, 2013, we filed a name change certificate

to change our name to Brenmiller Energy Ltd. In August 2017, we became a public company in

Israel and our Ordinary Shares were listed for trade on the TASE. On May 25, 2022, our Ordinary

Shares were listed and began trading on Nasdaq. On March 23, we announced our intension to

voluntary delist our securities from trading on the TASE, which took effect on September

11, 2023 (the last trading day was September 7, 2023). Our principal executive offices are

located at 13 Amal St. 4th Floor, Park Afek, Rosh Haayin, 4809249 Israel. Our telephone number

in Israel is +972-77-693-5140. Our website address is https://bren-energy.com/. The information

contained on, or that can be accessed through, our website is not part of this prospectus

and is not incorporated by reference herein. We have included our website address in this

prospectus solely as an inactive textual reference.

Implications of Being an Emerging Growth Company

We are an “emerging

growth company,” as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified

by the JOBS Act. As such, we are eligible to, and intend to, take advantage of certain exemptions from various reporting requirements

applicable to other public companies that are not “emerging growth companies” such as not being required to comply with the

auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act. We could remain an

“emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in

which our annual gross revenues exceeds $1.235 billion, (b) the date that we become a “large accelerated filer”

as defined in Rule 12b-2 under the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the

market value of our Ordinary Shares that are held by non-affiliates exceeds $700 million as of the last business day of our most

recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in nonconvertible debt

during the preceding three-year period.

Implications of being a “Foreign Private

Issuer”

We are subject to the information

reporting requirements of the Exchange Act that are applicable to “foreign private issuers,” and under those requirements,

we file reports with the SEC. As a foreign private issuer, we are not subject to the same requirements that are imposed upon U.S. domestic

issuers by the SEC. Under the Exchange Act, we are subject to reporting obligations that, in certain respects, are less detailed and

less frequent than those of U.S. domestic reporting companies. For example, we are not required to issue quarterly reports, proxy statements

that comply with the requirements applicable to U.S. domestic reporting companies, or individual executive compensation information that

is as detailed as that required of U.S. domestic reporting companies. We also have four months after the end of each fiscal year to file

our annual report with the SEC and are not required to file current reports as frequently or promptly as U.S. domestic reporting companies.

Our officers, directors, and principal shareholders are exempt from the requirements to report transactions in our equity securities

and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act. As a foreign private issuer, we are

not subject to the requirements of Regulation FD (Fair Disclosure) promulgated under the Exchange Act. In addition, as a foreign private

issuer, we are permitted to follow certain home country corporate governance practices instead of those otherwise required under the

Nasdaq Stock Market rules for domestic U.S. issuers and are not required to be compliant with all Nasdaq Stock Market rules as would

domestic U.S. issuers. See “Risk Factors—Risks Related to the Offering and Ownership of our Securities” for

additional information. These exemptions and leniencies will reduce the frequency and scope of information and protections available

to you in comparison to those applicable to a U.S. domestic reporting company. We intend to take advantage of the exemptions available

to us as a foreign private issuer during and after the period we qualify as an “emerging growth company.”

Summary Risk Factors

Our business is subject

to numerous risks, as more fully described in the section titled “Risk Factors” immediately following this prospectus summary.

You should read these risks in full before you invest in our securities. The following is a summary of such risks.

Risks Related to Our Business and Industry

| |

● |

We are highly dependent on the successful development, marketing and sale of our proprietary technology; |

| |

● |

we are highly dependent on our key employees; |

| |

● |

we may face business disruption and related risks resulting from the outbreak of the COVID-19 pandemic,

which could have a material adverse effect on our business and results of operations; |

| |

● |

our field of business is generally new and we may not be aware of all of the risks that our company

will face; |

| |

● |

our future growth depends on pivoting our business from our previous products and services to our

TES system with our bGen™ technology. This change in our products and services also makes it difficult to evaluate our current

business and future prospects and may increase the risk that we will not be successful; |

| ● | we

are exposed to risk relating to volatility in the commodity price of fossil fuels, which

could have a material adverse impact on prices of alternative energies and related products.

It is possible that revenues received from the sale of alternative energy and related products

may be insufficient to cover our costs and we may never be profitable; |

| ● | alternative

energies are becoming increasingly important in the United States and world economy, causing

increasing investment devoted to improvements and development of new alternatives and technologies; |

| |

● |

we may be subject to unexpected maintenance warranty expenses or service claims that could reduce

our profits; |

| |

● |

we are dependent upon third-party manufacturers and suppliers making us vulnerable to supply shortages

and problems, increased costs and quality or compliance issues, any of which could harm our business; |

| |

● |

we are dependent upon third-party service providers to provide a high quality of service, which if

not met, may impact the utility of our products, our business, operating results and reputation; |

| |

● |

we are dependent on the use of certain raw materials and changes in the price or availability of

such raw materials may impact our ability to efficiently produce our products; |

| |

● |

we need to obtain and uphold permits, certifications and authorization in various jurisdictions; |

| |

● |

the field of energy storage integration is relatively new and still developing, and the regulation

of the field is also changing and developing; |

Risks Related to Our Financial Condition and Capital Requirements

| ● | Our

management has concluded and the report of our independent registered public accounting firm

contains an explanatory paragraph that indicates that a material uncertainty exists that

may cast significant doubt (or raise substantial doubt as contemplated by PCAOB standards)

about our ability to continue as a going concern, which could prevent us from obtaining new

financing on reasonable terms or at all; |

| |

● |

we have not generated significant revenue from the sale of our current products, expect to incur

operating losses in the future and may never be profitable; |

| |

|

|

| |

● |

we expect to be exposed to fluctuations in the rate of energy tariffs, interest rates, and currency

exchange rates, which could adversely affect our results of operations; |

| |

● |

we may enter into agreements to operate projects at a financial loss in order to penetrate certain

markets; |

| |

● |

we expect that we will need to raise substantial additional funding, which may not be available on

acceptable terms, or at all, which may require us to curtail, delay or adjust our commercialization and product development efforts,

expansion to new markets, or other activities; and |

| |

● |

our revenues and efforts to become profitable may be impacted by our need to pay royalties on government

grants and other agreements, which may also include terms subjecting us to penalties if we are in default of material terms. |

Risks Related to Our Intellectual

Property

| |

● |

If we are unable to obtain and maintain effective patent rights for our products and services, we

may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how,

such proprietary information may be used by others to compete against us; |

| |

● |

intellectual property rights of third parties could adversely affect our ability to commercialize

our products and services, and we might be required to litigate or obtain licenses from third parties in order to develop or market

our product candidates. Such litigation or licenses could be costly or not available on commercially reasonable terms; and |

| |

● |

we may be involved in lawsuits to protect or enforce our intellectual property, which could be expensive,

time consuming, and unsuccessful. |

Risks Related to this Offering and Ownership of our Securities

| |

● |

The market price of our Ordinary Shares may be highly volatile and fluctuate substantially, which

could result in substantial loses for purchasers of our Ordinary Shares; |

| |

|

|

| |

● |

future sales of our Ordinary Shares could

reduce the market price of our Ordinary Shares; |

| |

● |

our principal shareholders, officers and directors currently beneficially own approximately 36.9%

of our Ordinary Shares. They will therefore be able to exert significant control over matters submitted to our shareholders for approval; |

| |

● |

the market price of our Ordinary Shares may be highly volatile, and you could lose all or part of

your investment; |

| |

● |

we may be a “passive foreign investment company,” or PFIC, for U.S. federal income tax

purposes in the current taxable year or may become one in any subsequent taxable year. There generally would be negative tax consequences

for U.S. taxpayers that are holders of the Ordinary Shares if we are or were to become a PFIC; |

| |

● |

our securities are traded on more than one market or exchange and this may result in price variations;

and |

| |

● |

there

is no public market for the Pre-Funded Warrants and Warrants being offered in this offering and holders of our Pre-Funded Warrants

and Warrants will have no rights as shareholders until they acquire our Ordinary Shares. |

Risks Related to our Incorporation and Our Operations in Israel

| |

● |

Potential political, economic and military instability in Israel, where our headquarters, members

of management, production facilities and employees are located, may adversely affect our results of operations; |

| |

● |

we received grants from the IIA and from the Israeli Ministry of Energy that may require us to pay

royalties and restrict our ability to transfer technologies or know-how outside of Israel; |

| |

● |

it may be difficult to enforce a judgment of a U.S. court against us and our executive officers and

directors and the Israeli experts named in this prospectus in Israel or the United States, to assert U.S. securities laws claims

in Israel or to serve process on our executive officers and directors and these experts; |

| |

● |

your rights and responsibilities as a shareholder will be governed in key respects by Israeli laws,

which differs in some material respects from the rights and responsibilities of shareholders of U.S. companies; and |

| |

● |

we may become subject to claims for remuneration or royalties for assigned service invention rights

by our employees, which could result in litigation and adversely affect our business. |

THE

OFFERING

| Ordinary Shares currently issued and outstanding |

|

2,223,342 Ordinary Shares |

| |

|

|

| Ordinary Shares offered by us |

|

240,000 Ordinary Shares |

| |

|

|

| Warrants offered by us |

|

888,890 Warrants to purchase up to 888,890 Ordinary Shares, which will be exercisable during the period commencing on the date of their issuance and ending five years from such date at an exercise price of $5.00 per Ordinary Share. |

| |

|

|

| Pre-Funded Warrants offered by us |

|

We are also offering to those purchasers whose purchase of Ordinary Shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 9.99% of our outstanding Ordinary Shares immediately following the consummation of this offering, if the purchaser so chooses, 648,890 Pre-Funded Warrants, in lieu of Ordinary Shares that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% (or, at the election of such purchaser, 9.99%) of our outstanding Ordinary Shares. Each Pre-Funded Warrant and the accompanying Warrant will be exercisable for one share of our Ordinary Shares. The purchase price of each Pre-Funded Warrant will be equal to the price per Ordinary Share at which the Ordinary Shares are being sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001 per share. The Pre-Funded Warrants are exercisable immediately and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. This offering also relates to the Ordinary Shares issuable upon exercise of any Pre-Funded Warrants sold in this offering. For each Pre-Funded Warrant we sell, the number of Ordinary Shares we are offering will be decreased on a one-for-one basis. Because we will issue Warrants to purchase one Ordinary Share for each and Ordinary Share for each Pre-Funded Warrant sold in this offering, the number of Warrants sold in this offering will not change as a result of a change in the mix of the Ordinary Shares and Pre-Funded Warrants sold. |

|

|

| |

|

|

|

|

| Ordinary Shares to be outstanding after this offering |

|

2,463,342 Ordinary Shares (assuming none of the Warrants or Pre-Funded Warrants issued in this offering are exercised) |

|

|

| |

|

|

|

|

| Use of proceeds |

|

We expect to receive approximately $3.4 million

in net proceeds from the sale of Ordinary Shares, Warrants and Pre-Funded Warrants offered by us in this offering, after deducting

the placement agent fees and commissions and estimated offering expenses payable by us.

However, this is a best efforts offering with

no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of these securities offered

pursuant to this prospectus; as a result, we may receive significantly less in net proceeds.

We intend to use the net proceeds from this offering

for general and administrative corporate purposes, including working capital and capital expenditures.

The amounts and schedule of our actual expenditures

will depend on multiple factors. As a result, our management will have broad discretion in the application of the net proceeds of this

offering. See “Use of Proceeds” for more information about the intended use of proceeds from this offering. |

|

|

| |

|

|

|

|

| Risk factors |

|

You should read the “Risk Factors” section starting on page 10 of this prospectus for a discussion of the factors you should consider carefully before deciding to purchase these securities. |

|

|

| |

|

|

|

|

| Best Efforts Offering |

|

We have agreed to offer and sell the securities offered hereby to the purchasers through the placement agent. The placement agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 106 of this prospectus. |

|

|

| |

|

|

|

|

| Nasdaq symbol |

|

“BNRG” |

|

|

The number of Ordinary Shares

to be outstanding immediately after this offering assumes that all of the Ordinary Shares offered hereby are sold and is based on 2,223,342

Ordinary Shares outstanding as of January 16, 2024. This number excludes:

| |

● |

an aggregate

of 128,220 Ordinary Shares issuable upon the exercise of outstanding options to purchase Ordinary shares, at exercise prices ranging

between NIS 3 to NIS 800 (approximately $0.8 to $216.2) per Ordinary Share, issued to directors, officers, service providers and

employees issued under our 2013 global incentive option plan; |

| |

● |

an aggregate

of 1,125 Ordinary Shares with respect to 1,125 restricted share units we have granted to directors, employees, and service providers;

and |

| ● | an

aggregate of 522,427 Ordinary Shares issuable upon the exercise of outstanding warrants to

purchase Ordinary Shares, at exercise prices ranging between NIS 44 to NIS 180 (approximately

$11.9 to $48.6) per Ordinary Share, issued to certain investors in connection with private

placements. |

Unless otherwise indicated,

all information in this prospectus assumes we sell only Ordinary Shares and accompanying Warrants and none

of the Warrants or Pre-Funded Warrants issued in this offering are exercised.

SUMMARY

CONSOLIDATED FINANCIAL DATA

The following tables summarize

our consolidated financial data as of and for the periods ended on the dates indicated below. We have derived the following statement

of operations data as of and for the years ended December 31, 2022 and 2021 from our audited consolidated financial statements included

elsewhere in this prospectus. The consolidated statement of operations data for the period of six months ended June 30, 2023 and

2022 is derived from our unaudited interim condensed consolidated financial statements as of June 30, 2023 also included elsewhere in

this prospectus. Our historical results as of a particular date or for a particular period are not necessarily indicative of the results

that may be expected in the future. The following summary financial data should be read in conjunction with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes included

elsewhere in this prospectus.

| |

|

Year

Ended

December 31, |

|

|

Six

Months Ended

June 30, |

|

| U.S.

dollars in thousands, except per share data |

|

2022 |

|

|

2021 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated

Statement of Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| Licensing

fees |

|

|

1,500 |

|

|

|

- |

|

|

|

- |

|

|

|

1,500 |

|

| Thermal

energy storage units sold |

|

|

- |

|

|

|

285 |

|

|

|

- |

|

|

|

- |

|

| Other

Engineering services |

|

|

20 |

|

|

|

110 |

|

|

|

580 |

|

|

|

20 |

|

| Revenues |

|

$ |

1,520 |

|

|

$ |

395 |

|

|

|

580 |

|

|

|

1,520 |

|

| Costs

and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost

of revenues |

|

|

(1,935 |

) |

|

|

(4,051 |

) |

|

|

(1,132 |

) |

|

|

(883 |

) |

| Research,

development and engineering expenses, net |

|

|

(4,618 |

) |

|

|

(3,700 |

) |

|

|

(1,664 |

) |

|

|

(2,467 |

) |

| Marketing

and project promotion expenses, net |

|

|

(1,222 |

) |

|

|

(747 |

) |

|

|

(683 |

) |

|

|

(612 |

) |

| General

and administrative expenses |

|

|

(4,465 |

) |

|

|

(2,586 |

) |

|

|

(2,398 |

) |

|

|

(2,328 |

) |

| Share

in loss of joint venture |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(29 |

) |

| Rotem

1 project – Impairment and closure loss, net |

|

|

(171 |

) |

|

|

(82 |

) |

|

|

- |

|

|

|

- |

|

| Other

expenses, net |

|

|

(737 |

) |

|

|

(295 |

) |

|

|

2 |

|

|

|

38 |

|

| Operating

loss |

|

|

(11,628 |

) |

|

|

(11,066 |

) |

|

|

(5,295 |

) |

|

|

(4,761 |

) |

| Financial

income |

|

|

919 |

|

|

|

1,073 |

|

|

|

270 |

|

|

|

964 |

|

| Financial

expenses |

|

|

(358 |

) |

|

|

(355 |

) |

|

|

(119 |

) |

|

|

(154 |

) |

| Financial

income (expenses), net |

|

|

561 |

|

|

|

718 |

|

|

|

151 |

|

|

|

810 |

|

| Net

loss |

|

$ |

(11,067 |

) |

|

|

(10,348 |

) |

|

|

(5,144 |

) |

|

|

(3,951 |

) |

| Loss

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.76 |

) |

|

$ |

(0.87 |

) |

|

|

(0.29 |

) |

|

|

(0.28 |

) |

| Diluted |

|

$ |

(0.76 |

) |

|

$ |

(0.94 |

) |

|

|

(0.29 |

) |

|

|

(0.28 |

) |

| Weighted

average number of shares outstanding used in computing basic loss per share(1) |

|

|

14,627,761 |

|

|

|

11,934,472 |

|

|

|

17,498,762 |

|

|

|

14,018,290 |

|

| Weighted

average number of shares outstanding used in computing diluted loss per share(1) |

|

|

14,627,761 |

|

|

|

12,119,472 |

|

|

|

17,498,762 |

|

|

|

14,018,290 |

|

| Pro-forma

Loss per share (basic) |

|

$ |

(7.6 |

) |

|

$ |

(8.7 |

) |

|

|

(2.9 |

) |

|

|

(2.8 |

) |

| Pro-forma

Loss per share (diluted) |

|

$ |

(7.6 |

) |

|

$ |

(9.4 |

) |

|

|

(2.9 |

) |

|

|

(2.8 |

) |

| Pro-forma

Weighted average number of shares outstanding used in computing basic loss per share |

|

|

1,462,776 |

|

|

|

1,193,447 |

|

|

|

1,749,876 |

|

|

|

1,401,829 |

|

| Pro-forma

Weighted average number of shares outstanding used in computing diluted loss per share |

|

|

1,462,776 |

|

|

|

1,211.947 |

|

|

|

1,749,876 |

|

|

|

1,401,829 |

|

| (1) | The

data presented do not give effect to the Reverse Share

Split. |

| | |

As of June 30, 2023 | |

| U.S. dollars in thousands | |

Actual | | |

Pro

Forma(1) | | |

Pro Forma

As Adjusted(2) | |

| | |

| | |

| | |

| |

| Consolidated Statement of Financial Position: | |

| | |

| | |

| |

| Cash and Cash equivalents | |

$ | 6,740 | | |

$ | 7,364 | | |

| 10,789 | |

| Total assets | |

| 14,294 | | |

| 14,918 | | |

| 18,343 | |

| Total non-current liabilities, excluding lease and royalty-related liabilities (3) | |

| 4,353 | | |

| 4,353 | | |

| 7,377 | |

| Accumulated deficit | |

| (111,897 | ) | |

| (111,897 | ) | |

| (111,897 | ) |

| Total equity | |

| 4,865 | | |

| 5,683 | | |

| 6,085 | |

| (1) | Pro

forma gives effect to: (i) the issuance of 15,265 Ordinary Shares in connection with

the exercise of 15,265 pre-funded warrants issued in a 2021 private placement; (ii) the issuance

and sale of 88,844 Ordinary Shares from July 1, 2023 to the date of this prospectus under

the Sales Agreement; (iii) the issuance of 18,811 Ordinary Shares as a result of exercise

of Series 3 Tradable Warrants; (iv) the issuance of an aggregate of 25,270 Ordinary Shares

with respect to 25,270 restricted share units we have granted to directors, employees and

service providers; and (v) the issuance of 1,805 Ordinary Shares as a result of exercise

of a service provider Options; (vi) the Reverse Share Split and Increase of Authorized Share

Capital, as if such events had occurred on June 30, 2023. |

| (2) |

Pro forma as adjusted gives further effect to the sale in this offering of 240,000 Ordinary Shares, 888,890 accompanying Warrants at a public offering price of $4.50 per share, and 648,890 Pre-Funded Warrants at a public offering price of $4.4999 per Pre-Funded Warrant and accompanying Warrant, after deducting estimated placement agent fees and expenses and estimated offering expenses payable by us, as if the sale of the Ordinary Shares, Warrants and Pre-Funded Warrants had occurred on June 30, 2023. |

| (3) | The total non-current

liabilities, excluding lease and royalty-related liabilities, do not include the following:

(i) $738 thousand lease liabilities; and (ii) $1,507 thousand royalty liabilities in respect

of EIB credit facility agreement. |

RISK

FACTORS

Investing in our securities

involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other

information in this prospectus, including the financial statements and related notes, before deciding whether to purchase the Ordinary

Shares. If any of the following risks are realized, our business, operating results, financial condition and prospects could be materially

and adversely affected. In that event, the price of the Ordinary Shares could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Industry

We are highly dependent on the successful

development, marketing and sale of our proprietary technology.

Our proprietary technology

is the basis of our business. As a result, the success of our business plan is highly dependent on our ability to remain competitive

by selling our TES systems to customers in our two main focus areas, the industrial heat sector and utility thermal power plants. To

the best of our knowledge, our technology and know-how are proprietary. However, there is no certainty that potential customers will

prefer our technology over that of other companies currently existing or that will exist in the future. Additionally, some of our competitors

may have more capital resources and access to liquidity than we do and are able to make more investments in research and development

than us. If any new or existing competitor develops a product that is perceived as more efficient than, lower in cost than, or generally

preferable to our current or future products, our financial results may be negatively impacted.

Furthermore, we are at an

important stage of our operations and we are currently demonstrating our technology to the market through the use of development projects

and operating pilots on the premises of a number of our significant customers in Israel and abroad. If we do not succeed in showcasing

our technology to the marketplace, this may have a material adverse effect on our operations and sales.

We are highly dependent on our key employees.

Our future growth and success

depend to a large extent on the continued services of members of our current management including, in particular, Mr. Avraham Brenmiller,

who serves as our Chief Executive Officer and the Chairman of our board of directors. Any of our employees and consultants may leave

the Company at any time, subject to certain notice periods. The loss of the services of any of our executive officers or any key employees

or consultants may adversely affect our ability to execute our business plan and harm our operating results. Our operational success

will substantially depend on the continued employment of senior executives, technical staff, and other key personnel. The loss of key

personnel may have an adverse effect on our operations and financial performance.

We may face business disruption and related

risks resulting from the COVID-19 pandemic, which could have a material adverse effect on our business and results of operations.

While the final implications

of the COVID-19 pandemic are difficult to estimate at this stage, it is clear that it has affected the lives of a large portion of the

global population. We cannot predict the future impacts the COVID-19 pandemic, including the emergence of new strains such as the Omicron

or Delta variant, may have on our business, results of operations and financial condition. In addition, while certain COVID-19 mitigation

actions that were implemented during the pandemic have since been relaxed, no assurance can be made that such actions, or other measures,

will not be reimposed in the future. Although to date these restrictions have not materially impacted our operations, the effect on our

business, from the spread of COVID-19 and the COVID-19 mitigation actions implemented by the governments of the State of Israel, the

United States and other countries, may worsen over time.

We will continue to monitor

the impact of COVID-19 us and we may take further actions that alter our business operations as may be required by federal, state, local

authorities and any other relevant jurisdiction, or that we determine are in the best interests of our company and employees.

Our field of business is generally new

and we may not be aware of all of the risks that we will face.

The field of TES is comprised

of technologies that are still in their early stages with limited implementations and track record. While we attempt to anticipate the

risks we and holders of our Ordinary Shares may face resulting from our operations, there may be certain risks specific to our sector

to which we have yet to be exposed or made aware. Further, there may be certain risks that will develop depending on the manner in which

the field develops. For example, because TES is comprised of new technologies, the terms of commercial engagement with our customers

require finding solutions to finance the working capital and collateral required for the establishment of a particular project. Unless

we find the required financing, we may have difficulty entering into new commercial contracts. Accordingly, holders of our Ordinary Shares

may be unable to anticipate all of the risks that are associated with the Company.

Our future growth depends on pivoting our

business from our previous products and services to our TES system with our bGen™ technology and changing the feedstock for our

bGen™ technology. This change in our products and services also makes it difficult to evaluate our current business and future

prospects and may increase the risk that we will not be successful.

Our business focus has shifted

from operating concentrated solar thermal plants set to supply electricity to the sale of TES, based on our patented bGen™

technology. Our success as a company and ability to generate revenues in the future is dependent on the success of our pilot projects,

the satisfaction of our customers, our ability to adopt the application of our bGen™ technology to use different types of feedstock,

and our ability to commercialize our technology. In addition, attracting new customers to our bGen™ technology may involve evaluation

processes during the pilot stage that prospective clients may not be willing to engage in before experiencing satisfying results with

our products and services, while we will continue to accrue research, development and engineering expenses. If we are not successful

in our pilot projects using our bGen™ technology, we may not be able to expand our business, reach our targeted industrial facilities

market and power plants market or achieve commercialization of our bGen™ technology, which could cause a material adverse effect

to our business, financial condition, results of operations and prospects.

We are exposed to risk relating to volatility

in the commodity price of fossil fuels, which could have a material adverse impact on prices of alternative energies and

related products. It is possible that revenues received from the sale of alternative energy and related products may be insufficient

to cover our costs and we may never be profitable.

We expect to generate a portion

of our revenues from the sale of products related to the production and use of alternative energy as a commodity. Some of the significant

incentives for consumers to use our intended products and services are the rising cost and scarcity of fossil fuels such as oil, natural

gas and coal. As a result, we will be exposed to the fluctuating commodity prices applicable to fossil fuels. Historically, fossil fuel

prices have been volatile and we expect such volatility to continue. Furthermore, future supply of and demand for fossil fuels are unpredictable.

There are many entities in the fossil fuels commodities markets, such large energy companies, cartels, and governments, that are of far

greater size and influence than us and which can often cause significant movement in the short- and long-term supply and prices of fossil

fuels. Fluctuations in the commodity price of fossil fuels may have a materially adverse impact on our profitability. We have to factor

these fluctuations into our business plan in order to mitigate the associated commodity price risk. There is a risk that we may expend

large sums of money to generate alternative energy products and yet a market never properly develops for them and thus we never become

profitable due to the market volatility of fossil fuels.

Alternative energies are becoming

increasingly important in the United States and world economy, causing increasing investment devoted to improvements and development

of new alternatives and technologies.

As a result of increasing

interest and investment in the development of alternative energy sources, it is expected that there will be significant developments

during the next decade. The development and implementation of new technologies may cause a reduction in the costs or use of certain alternative

energies or result in better alternatives. It cannot be predicted when new technologies may become available, the rate of acceptance

of new technologies by competitors and customers, or the costs associated with such new technologies. In addition, advances in the development

of alternatives energies could significantly reduce demand for or eliminate the need for certain other technologies. Any advances in

technology may require significant capital expenditures to remain competitive. In addition, they may have an impact on the efficacy of

our operations and future results of operations and financial condition.

We may be subject to unexpected maintenance

warranty expenses or service claims that could reduce our profits.

We generally provide our

customers with a maintenance warranty period of two years in connection with the sale of our TES units. This warranty covers defects

in material and workmanship. As a result, we may bear the risk of warranty claims after we have completed the installation of a TES unit.

Upon completion of installation of a TES unit, we intend to record an estimated liability for potential warranty or service claims. Our

failure to predict accurately future warranty claims, including if claims are in excess of our recorded lability, could adversely affect

our financial results.

We are dependent upon third-party manufacturers

and suppliers making us vulnerable to supply shortages and problems, increased costs and quality or compliance issues, any of which could

harm our business.

We rely on third parties

to manufacture and supply us with proprietary custom subcomponents. We rely on a limited number of suppliers who provide us with materials

and components as well as manufacture and assemble certain components of our products. Accordingly, in the event equipment must be repaired

or replaced, our operations may be interrupted, and, in turn, our financial results may be negatively impacted. Further, we may encounter

expenses in the event that the equipment requires a repair.

Additionally, our suppliers

may encounter problems themselves during manufacturing for a variety of reasons, including, for example, failure to follow specific protocols

and procedures, failure to comply with applicable legal and regulatory requirements, equipment malfunction and environmental factors,

failure to properly conduct their own business affairs and infringement of third-party intellectual property rights, any of which could

delay or impede their ability to meet our requirements. Our reliance on these third-party suppliers also subjects us to other risks that

could harm our business, including:

| |

● |

we may not be able to obtain an adequate supply in a timely manner or on commercially reasonable

terms; |

| |

|

|

| |

● |

our suppliers, especially new suppliers, may make errors in manufacturing that could negatively affect

the efficacy or safety of our products or cause delays in shipment; |

| |

|

|

| |

● |

we may have difficulty locating and qualifying alternative suppliers; |

| |

|

|

| |

● |

switching components or suppliers may require product redesign, which could significantly impede

or delay our commercial activities; |

| |

|

|

| |

● |

the occurrence of a fire, natural disaster or other catastrophe impacting one or more of our suppliers

may affect their ability to deliver products to us in a timely manner; and |

| |

|

|

| |

● |

our suppliers may encounter financial or other business hardships unrelated to our demand, which

could inhibit their ability to fulfill our orders and meet our requirements. |

We may not be able to quickly

establish additional or alternative suppliers, if necessary, in part because we may need to undertake additional activities to establish

such suppliers. Any interruption or delay in obtaining products from our third-party suppliers, or our inability to obtain products from

qualified alternate sources at acceptable prices in a timely manner, could impair our ability to meet the demand of our customers and

cause them to switch to competing products.

We are dependent upon third-party service

providers. If such third-party service providers fail to maintain a high quality of service, the utility of our products could be impaired,

which could adversely affect the penetration of our products, our business, operating results and reputation.

The success of certain services

and products that we provide are dependent upon third-party service providers. Such service providers include engineering, procurement,

and construction companies which are responsible for preparing the infrastructure for installing our prototype systems and the maintenance

and operation service companies at the next stages after commissioning of our sites. As we expand our commercial activities, an increased

burden will be placed upon the quality of such third-party providers. If third-party providers fail to maintain a high quality of service,

our products, business, reputation and operating results could be adversely affected. In addition, poor quality of service by third-party

service providers could result in liability claims and litigation against us for damages or injuries.

In particular, we are dependent

upon industrial production floors and operation managers of utility plants, or other similar service provides, on which we operate to

consistently operate the site and ensure the proper utilization of our energy storage output.

We are dependent on the use of certain

raw materials and changes in the price or availability of such raw materials may impact our ability to efficiently produce our products.

We use certain raw materials

in the production of our energy storage elements, including metal sheet rolls, processed metal parts, piping accessories, construction

and support metal parts, and stainless-steel pipes. We use purchased parts for assemblies, such as pumps, heat exchangers, insulation

units, control items such as control electronics and controlled valves, heating elements, and fasteners such as screws and rivets. Although