Bruker Corporation (NASDAQ: BRKR) today reported its financial

results for the three and nine months ended September 30, 2008. On

February 26, 2008, Bruker BioSciences Corporation closed its

acquisition of the Bruker BioSpin Group, and renamed itself Bruker

Corporation. Under US GAAP, this transaction is accounted for as an

acquisition of businesses under common control, and as a result all

one-time transaction costs are expensed in the period in which they

are incurred, rather than being added to goodwill. In addition,

expenses incurred subsequent to the consummation of the

acquisition, such as interest expenses incurred on acquisition

related debt, are not reflected in the financial results of periods

prior to the date of the acquisition, as they typically would be in

pro-forma financials in acquisitions of unrelated parties. After

the closing of the transaction all historical financial statements

are required to be restated by combining the historical

consolidated financial statements of Bruker BioSciences Corporation

with those of the Bruker BioSpin Group. Accordingly, the financial

results for the three and nine months ended September 30, 2008 and

2007, included within this release, represent the combined

historical consolidated financial statements of Bruker BioSciences

Corporation with those of the Bruker BioSpin Group. Financial

Results In the third quarter of 2008, revenue was $242.1 million,

compared to revenue of $241.8 million in the third quarter of 2007.

Excluding the effects of foreign currency translation, third

quarter 2008 revenue decreased by 7% year-over-year. Net income in

the third quarter of 2008 was $17.8 million, or $0.11 per diluted

share, compared to net income of $26.7 million, or $0.16 per

diluted share, in the third quarter of 2007. Included in GAAP EPS

in the third quarter of 2008 were non-cash stock-based compensation

expenses of $1.1 million, or ($0.01) per diluted share, compared to

non-cash stock-based compensation expenses of $0.5 million, or

($0.00) per diluted share, in the third quarter of 2007. For the

nine months ended September 30, 2008, revenue increased 15% to

$792.0 million, compared to revenue of $687.6 million during the

nine months ended September 30, 2007. Excluding the effects of

foreign currency translation, revenue for the nine months ended

September 30, 2008 increased by 6% year-over-year. Net income

during the nine months ended September 30, 2008 was $38.8 million,

or $0.23 per diluted share, compared to net income of $58.7

million, or $0.36 per diluted share, during the nine months ended

September 30, 2007. Included in GAAP EPS for the nine months ended

September 30, 2008 were Bruker BioSpin acquisition-related expenses

of ($0.04) per diluted share, interest expense on

acquisition-related debt of ($0.03) per diluted share, and non-cash

stock-based compensation expenses of ($0.02) per diluted share,

with a cumulative effect of ($0.08) per diluted share. For

comparison, included in net income for the nine months ended

September 30, 2007 were acquisition related charges of $0.5

million, or ($0.00) per diluted share, non-cash stock-based

compensation expenses of ($0.01) per diluted share, and there was

no acquisition-related interest expense, with a cumulative effect

of ($0.01) per diluted share. Frank Laukien, President and Chief

Executive Officer of Bruker Corporation, stated: �As expected,

while we have exceeded our annualized revenue growth goal so far in

2008, since our February 2008 merger we have experienced

significant quarterly revenue fluctuations. As in previous years,

we expect strong revenues in our fourth quarter of 2008, as our

bookings and backlog have remained healthy. During the first nine

months of 2008, our margins, adjusted for acquisition expenses,

have been below our goals. Therefore, in August 2008, we began to

take aggressive steps to reaccelerate our gross margin improvement

programs, to reduce operating and interest expenses, and to further

reduce our exposure to currency fluctuations, as well as to improve

our effective tax rate.� Dr. Laukien continued: �We expect that our

cost-cutting initiatives will already have noticeable positive

effects in the fourth quarter of 2008 and first quarter of 2009,

and that by the middle of 2009 we will see annualized reductions in

our overall costs of greater than $12 million. Moreover, we

anticipate that our recent significant new product roll-outs, major

product introductions planned within the next 12 months, and the

stronger U.S. dollar, all will contribute positively to our gross

margins in 2009 and 2010.� William Knight, Chief Financial Officer,

added: �We believe that despite the current economic uncertainty,

our diverse portfolio of products and solutions, our global

footprint, and our greater than 50% share of revenue derived from

universities, medical schools, non-profit research institutions and

government labs, position us well for being resilient in a

recession, and for continuing our positive long-term growth and

margin expansion trends. However, our year-to-date profitability is

below our expectations so we are actively pursuing productivity

initiatives that are expected to save the Company $12-15 million

annually, once fully effective. Implementation of these initiatives

is expected to result in one-time restructuring expenses and tax

charges of approximately $6 million.� USE OF NON-GAAP FINANCIAL

MEASURES In addition to the financial measures prepared in

accordance with generally accepted accounting principles (GAAP), we

use certain non-GAAP financial measures, including adjusted EPS.

Adjusted EPS excludes acquisition-related charges, interest expense

on acquisition-related debt, and foreign exchange gains and losses.

We believe the inclusion of these non-GAAP measures helps investors

to gain a better understanding of our core operating results and

future prospects, consistent with how management measures and

forecasts the Company�s performance, especially when comparing such

results to previous periods or forecasts. However, the non-GAAP

financial measures included in this press release are not meant to

be a better presentation or a substitute for results prepared in

accordance with GAAP. EARNINGS CONFERENCE CALL Bruker Corporation

will host an operator-assisted earnings conference call at 9 a.m.

Eastern Daylight Time on Thursday, October 30, 2008. To listen to

the webcast, investors can go to www.bruker.com and click on the

live web broadcast symbol. The webcast will be available through

the Company web site for 30 days. Investors can also listen and

participate on the telephone by calling 888-339-2688, or

+1-617-847-3007 outside the US and Canada. Investors should refer

to the Bruker Corporation Earnings Call. A telephone replay of the

conference call will be available one hour after the conference

call by dialing 888-286-8010, or +1-617-801-6888 outside the US and

Canada, and then entering replay pass code 32922679. CAUTIONARY

STATEMENT Any statements contained in this press release that do

not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities

Litigation Reform Act of 1995. Any forward-looking statements

contained herein are based on current expectations, but are subject

to a number of risks and uncertainties. The factors that could

cause actual future results to differ materially from current

expectations include, but are not limited to, risks and

uncertainties relating to the integration of businesses we have

acquired or may acquire in the future, changing technologies,

product development and market acceptance of our products, the cost

and pricing of our products, manufacturing, competition, dependence

on collaborative partners and key suppliers, capital spending and

government funding policies, changes in governmental regulations,

intellectual property rights, litigation, and exposure to foreign

currency fluctuations. These and other factors are identified and

described in more detail in our filings with the SEC, including,

without limitation, our annual report on Form 10-K for the year

ended December 31, 2007, our most recent quarterly reports on Form

10-Q and our current reports on Form 8-K. We disclaim any intent or

obligation to update these forward-looking statements other than as

required by law. Bruker Corporation CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (in thousands, except per share data) � �

� � � Three Months Ended September 30, Nine Months Ended September

30, 2008 2007 2008 2007 � Product revenue $ 209,936 $ 215,838 $

695,820 $ 607,624 Service revenue 30,638 24,848 92,328 77,605 Other

revenue � 1,490 � � 1,074 � � 3,817 � � 2,409 � Total revenue

242,064 241,760 791,965 687,638 � Cost of product revenue 113,841

115,424 380,673 332,883 Cost of service revenue � 18,153 � � 15,228

� � 59,455 � � 49,184 � Total cost of revenue � 131,994 � � 130,652

� � 440,128 � � 382,067 � � Gross profit margin 110,070 111,108

351,837 305,571 � Operating Expenses: Sales and marketing 44,173

38,327 133,717 110,818 General and administrative 17,675 15,580

51,657 42,435 Research and development 33,089 26,841 100,808 80,462

Acquisition related charges � - � � 544 � � 6,153 � � 544 � Total

operating expenses � 94,937 � � 81,292 � � 292,335 � � 234,259 � �

Operating income 15,133 29,816 59,502 71,312 � Foreign exchange

gains (losses), net 3,177 (2,928 ) (5,864 ) (2,436 ) Interest and

other income (expense), net � (2,363 ) � 4,508 � � (1,984 ) � 6,980

� � Income before income tax provision and minority interest in

consolidated subsidiaries 15,947 31,396 51,654 75,856 Income tax

provision (benefit) � (1,966 ) � 4,616 � � 12,500 � � 16,923 � �

Income before minority interest in consolidated subsidiaries 17,913

26,780 39,154 58,933 Minority interest in consolidated subsidiaries

� 73 � � 109 � � 313 � � 255 � Net income $ 17,840 � $ 26,671 � $

38,841 � $ 58,678 � � Net income per share: Basic $ 0.11 � $ 0.16 �

$ 0.24 � $ 0.36 � Diluted $ 0.11 � $ 0.16 � $ 0.23 � $ 0.36 � �

Weighted average shares outstanding: Basic � 162,847 � � 161,922 �

� 162,531 � � 161,351 � Diluted � 165,918 � � 164,224 � � 165,606 �

� 164,029 � Bruker Corporation CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) � � � � September 30, � December 31, 2008

2007 � ASSETS � Current assets: Cash and short-term investments $

87,367 $ 344,554 Accounts receivable, net 156,068 185,217

Inventories 456,814 447,688 Other current assets � 71,473 � 57,238

Total current assets 771,722 1,034,697 � Property and equipment,

net 219,317 207,588 Intangible and other assets � 86,471 � 69,346 �

Total assets $ 1,077,510 $ 1,311,631 � LIABILITIES AND

SHAREHOLDERS' EQUITY � Current liabilities: Short-term borrowings $

44,276 $ 35,591 Accounts payable 46,528 52,293 Customer deposits

201,084 233,466 Other current liabilities � 217,465 � 239,841 Total

current liabilities 509,353 561,191 � Long-term debt 169,703 8,605

Other long-term liabilities 103,274 105,445 Minority interest in

subsidiaries 810 538 � Total shareholders' equity � 294,370 �

635,852 � Total liabilities and shareholders' equity $ 1,077,510 $

1,311,631

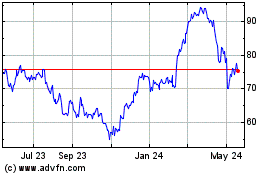

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Jul 2023 to Jul 2024