UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-40460

KANZHUN LIMITED

18/F, GrandyVic Building,

Taiyanggong Middle Road

Chaoyang District, Beijing 100020

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

KANZHUN LIMITED |

| |

|

|

|

| |

By |

: |

/s/ Yu Zhang |

| |

Name |

: |

Yu Zhang |

| |

Title |

: |

Director and Chief Financial Officer |

Date: December 15, 2023

Exhibit 99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

KANZHUN

LIMITED

看準科技有限公司

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock

Code: 2076)

(Nasdaq

Stock Ticker: BZ)

GRANT

OF SHARE AWARDS

On

December 15, 2023, the Company granted an aggregate of 2,848,692 share awards in the form of RSUs (the “Share Awards”)

(representing the same number of Class A Ordinary Shares) to two independent non-executive Directors (the “Director Grants”)

and 43 employees pursuant to the Post-IPO Share Scheme (the “Employee Grants”, together with the Director Grants,

the “Grants”).

The Grants are

subject to the terms and conditions of the Post-IPO Share Scheme and the award agreements entered into between the Company and each of

the Grantees. The principal terms of the Post-IPO Share Scheme were set out in the section headed “Statutory and General Information

– D. Share Incentive Plans – 2. Post-IPO Share Scheme” in Appendix IV to the listing document of the Company dated December

16, 2022.

The Share Awards

will be satisfied through utilizing the Class A Ordinary Shares held by the depositary of the ADSs for bulk issuance of ADSs reserved

for future issuances upon the exercise or vesting of awards granted under the Post-IPO Share Scheme.

Details of the Grants are as follows:

| Date

of the Grants |

December

15, 2023 |

| |

|

| Number of Grantees |

45,

including (i) in relation to the Director Grants, two independent non-executive Directors, namely Ms. Shangyu Gao (“Ms.

Gao”) and Mr. Yan Li (“Mr. Li”); and

(ii) in relation to the Employee Grants, 43 employees |

| |

|

| Number of Share Awards

granted |

2,848,692

Class A Ordinary Shares |

| |

|

| Issue price of Share Awards

granted per Share Award |

Nil |

| |

|

| Closing

price of the Class A Ordinary Shares on the Date of the Grants |

HK$57.85 per Share |

Vesting Periods of the Share Awards

For the Director

Grants, the Share Awards shall vest in equal portions on the date of the Director Grants and the first anniversary of the date of the

Director Grants, respectively, subject to Ms. Gao and Mr. Li’s continued directorship with the Company on such vesting dates. The

vesting periods for part of the Share Awards to be granted to Ms. Gao and Mr. Li are shorter than 12 months because the Share Awards granted

under the Director Grants have a mixed vesting schedule, such that the relevant Share Awards vest evenly over a period of one year, which

is pursuant to the terms of the Post-IPO Share Scheme and Rule 17.03F of the Listing Rules.

For the Employee

Grants, (i) approximately 94.49% of the Share Awards under the Employee Grants shall vest in equal portions on each of the first, second,

third and fourth anniversary of the date of the Employee Grants, respectively, subject to the Grantee’s continued employment relationship

with the Company on such vesting dates; (ii) approximately 4.74% of the Share Awards under the Employee Grants may have vesting period

shorter than 12 months subject to the fulfillment of the relevant performance target, pursuant to the terms of the Post-IPO Share Scheme

and Rule 17.03F of the Listing Rules; and (iii) approximately 0.77% of the Share Awards under the Employee Grants shall vest in equal

portions on the date of the Employee Grants and the first anniversary of the date of the Employee Grants, respectively, subject to the

Grantee’s continued employment relationship with the Company on such vesting dates. The vesting period of the Share Awards aforementioned

in (iii) are shorter than 12 months because the Share Awards have a mixed vesting schedule, such that the relevant Share Awards vest evenly

over a period of one year, which is pursuant to the terms of the Post-IPO Share Scheme and Rule 17.03F of the Listing Rules.

Performance Target

A portion of the

Share Awards representing approximately 4.74% of the Share Awards under the Employee Grants shall be vested subject to a performance target

relating to achievement of a technological development milestone. The vesting of the remaining portion of the Share Awards under the Grants

is not subject to any performance target.

In respect of the

Director Grants, as the relevant Share Awards (i) form part of the compensation stipulated in the respective director agreements of Ms.

Gao and Mr. Li entered into with the Company, and (ii) are subject to clawback mechanism as detailed below, the Compensation Committee

is of the view that it is not necessary to set any performance target for the Director Grants. This arrangement aligns with the purpose

of the Post-IPO Share Scheme to incentivize, retain, reward, compensate and/or providing benefits to the services of valuable employees

or directors and encourage such persons to contribute to the long-term growth and profitability of the Group, and is consistent with the

grants of Share Award to other Directors, which will also not be subject to any performance target.

Clawback mechanism

The Share Awards are subject to clawback

in the event that:

| • | the Grantee ceases to be a selected participant by reason of

the termination of employment or contractual engagement with the Group or Related Entity for cause or without notice or with payment

in lieu of notice; |

| • | the Grantee has been convicted of a criminal offence involving his/her integrity or honesty; or |

| • | in the reasonable opinion of the scheme administrator, the Grantee has engaged in serious misconduct

or breaches the terms of the Post-IPO Share Scheme in any material respect. |

Listing Rules Implications

Under the Director

Grants, all the Share Awards were granted to the following independent non-executive Directors, each being a connected person of the Company,

details of which are as follows:

| Name of Grantee |

Position |

Number

of Share Awards granted |

| |

|

|

| Ms.

Gao |

Independent

non-executive Director |

8,424 |

| |

|

|

| Mr. Li |

Independent

non-executive Director |

8,424 |

Pursuant

to Rule 17.04(1) of the Listing Rules, the grant of Share Awards to Ms. Gao and Mr. Li had been approved by the independent

non-executive Directors (other than Ms. Gao and Mr. Li on their respective Director Grants to themselves). The Director Grants would

not result in the shares issued and to be issued in respect of all options and awards granted to either Ms. Gao or Mr. Li under the

Director Grants in the 12-month period up to and including the date of such grant representing in aggregate to exceed 0.1% limit for

the purpose of Rule 17.04(3) of the Listing Rules.

The grantees under

the Employee Grants are employees of the Group and do not fall under any of the following categories: (a) a Director, chief executive,

or substantial shareholder of the Company, or an associate of any of them; (b) a participant with share options and awards granted and

to be granted in the 12-month period up to and including the date of such grant in aggregate to exceed 1% individual limit for the purpose

of Rule 17.03D of the Listing Rules; or (c) a related entity participant or service provider with options and awards granted and to be

granted in any 12-month period exceeding 0.1% of the relevant class of Shares in issue.

Reason for and benefits of the Grants

The reasons for the

grants of Share Awards are to reward continued efforts for the success of the Company and provide incentives for the Grantees to exert

maximum efforts, and to provide a means by which more employees may be given an opportunity to benefit from increases in value of the

Shares through the granting of the Share Awards. Such Grants will encourage them to work towards enhancing the value of the Company and

the Shares for the benefits of the Company and the Shareholders as a whole. In addition, the Director Grants form part of the compensation

stipulated in the respective director agreements of Ms. Gao and Mr. Li entered with the Company.

Class A Ordinary

Shares available for future grant under the Post-IPO Share Scheme

As at the date

of this announcement and following the Grants, the number of Class A Ordinary Shares available for future grant under the scheme mandate

limit of the Post-IPO Share Scheme is 60,441,502.

Definitions

In this announcement,

unless the context otherwise requires, the following expressions shall have the following meanings:

| “ADSs” |

American

Depositary Shares, each representing two Class A Ordinary Shares |

| |

|

| “Articles

of Association” |

the fifteenth

amended and restated articles of association of the Company conditionally adopted by special resolutions of the Shareholders on December

14, 2022, which took effect upon the listing of the Company’s Class A Ordinary Share on the Main Board of The Stock Exchange

of Hong Kong Limited |

| |

|

| “Board” |

the board of

Directors of the Company |

| |

|

| “Class

A Ordinary Share(s)” |

class A ordinary

shares in the share capital of the Company with a par value of US$0.0001 each, conferring a holder of Class A Ordinary Share one

vote per Share on any resolution tabled at the Company’s general meeting |

| |

|

| “Class

B Ordinary Share(s)” |

class B ordinary

shares in the share capital of the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such

that a holder of a Class B Ordinary Share is entitled to ten votes per Share on any resolution tabled at the Company’s general

meeting, save for resolutions with respect to any Reserved Matters, in which case they shall be entitled to one vote per Share |

| |

|

| “Company” |

KANZHUN LIMITED

(看準科技有限公司), a company with limited liability incorporated in the Cayman Islands

on January 16, 2014 |

| |

|

| “Director(s)” |

the director(s)

of the Company |

| |

|

| “Grantee(s)” |

the employee(s)

of the Group who were granted Share Awards in accordance with the Post-IPO Share Scheme on the Date of the Grants |

| |

|

| “Group” |

the Company,

its subsidiaries and its consolidated affiliated entities |

| |

|

| “Holding

Company” |

a company of

which the Company is a subsidiary |

| “HK$” |

Hong

Kong dollars, the lawful currency of Hong Kong |

| |

|

| “Listing

Rules” |

the Rules Governing

the Listing of Securities on The Stock Exchange of Hong Kong Limited, as amended, supplemented or otherwise modified from time to

time |

| |

|

| “Post-IPO Share Scheme” |

the share incentive

plan conditionally approved and adopted on December 14, 2022, which took effect upon the listing of the Company’s Class A Ordinary

Share on the Main Board of The Stock Exchange of Hong Kong Limited |

| |

|

| “Related

Entity” |

(i) a Holding

Company; (ii) subsidiaries of the Holding Company other than members of the Group; or (iii) any company which is an associate of

the Company |

| |

|

| “Reserved

Matters” |

those matters

resolutions with respect to which each Share is entitled to one vote at general meetings of the Company pursuant to the Articles

of Association, being (i) any amendment to the Memorandum or Articles, including the variation of the rights attached to any class

of shares, (ii) the appointment, election or removal of any independent non-executive Director, (iii) the appointment or removal

of the Company’s auditors, and (iv) the voluntary liquidation or winding-up of the Company |

| |

|

| “RSU(s)” |

restricted share units |

| |

|

| “Share(s)” |

the Class A

Ordinary Shares and the Class B Ordinary Shares in the share capital of the Company, as the context so requires |

| |

|

| “Shareholder(s)” |

the shareholders

of the Company |

| |

|

| “US$” |

U.S. dollars,

the lawful currency of the United States of America |

| |

By

order of the Board |

| |

KANZHUN

LIMITED |

| |

Mr. Peng

Zhao |

| |

Founder,

Chairman and Chief Executive Officer |

Hong Kong, December

15, 2023

As

at the date of this announcement, the Board of the Company comprises Mr. Peng Zhao, Mr. Yu Zhang, Mr. Xu Chen, Mr. Tao Zhang and Ms. Xiehua

Wang as the executive directors, Mr. Haiyang Yu as the non-executive director, Mr. Yonggang Sun, Mr. Yan Li and Ms. Shangyu Gao as the

independent non-executive directors.

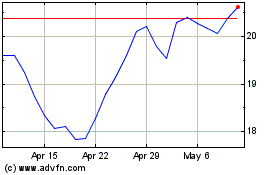

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From Mar 2024 to May 2024

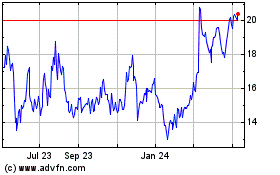

Kanzhun (NASDAQ:BZ)

Historical Stock Chart

From May 2023 to May 2024