TWC Bids for Optimum West - Analyst Blog

26 December 2012 - 11:30PM

Zacks

Time Warner Cable

Inc. (TWC), the second largest cable multi service

operator (MSO) in the U.S., has made a bid to acquire

Cablevision Systems Corp.’s (CVC) business unit –

Optimum West. The acquisition will make Time Warner Cable a key

player in four distinct US markets.

If the cable MSO succeeds in buying Optimum West then it could add

up to 300,000 cable customers in Montana, Wyoming Colorado and

Utah. However, none of the companies have disclosed the financial

details of the deal, which is expected to be reached either in

January or February 2013.

In 2010, Cablevision Systems had purchased a controlling stake in

smaller cable rival Bresnan Systems from Providence Equity Partners

for a total consideration of $1.37 billion and renamed it as

Optimum West. However, since November 2012, the company has been

trying to sell the cable assets, attracting the interest of several

bidders in due course.

According to Bloomberg, other than Time Warner Cable, currently

there are two more potential bidders for the cable firm, which

include Charter Communications Inc. (CHTR) and

Suddenlink Communications. The deal, if completed, will be the

second acquisition by Time Warner Cable in quick succession after

it acquired Insight Communications for $3 billion, eventually

adding 760,000 cable customers in Indiana, Kentucky and Ohio.

At the end of the third quarter of 2012, the company’s Residential

Video subscribers’ base was 12.159 million. Time Warner Cable lost

nearly 140,000 residential video subscribers in the previous

quarter amidst stiff competition from telecom service providers

like Verizon Communication Inc. (VZ) and

AT&T Inc. (T), which are capturing market

share from cable MSOs by offering fiber-based TV to its

subscribers. Furthermore, they are also facing challenges from the

non-cable operators, which provide live video streaming services

over the Internet.

We believe bidding for the cable firm is a strategic move by the

company to revamp its falling pay TV business. Apart from enhancing

the company’s impressive customer base, the acquisition of Optimum

West business could also boost its top line. On the flip side,

continuous acquisitions could increase the company’s leverage,

which in turn could hurt its margin.

We retain our long-term Neutral recommendation on Time Warner Cable

Inc. Also, it has a Zacks #3 Rank, implying a short-term Hold

rating.

CHARTER COMM-A (CHTR): Free Stock Analysis Report

CABLEVISION SYS (CVC): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

TIME WARNER CAB (TWC): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

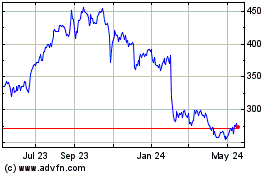

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

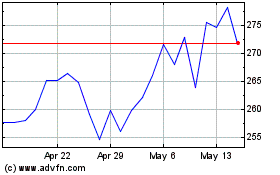

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024