Dow Extends Gains

27 January 2017 - 5:51AM

Dow Jones News

By Akane Otani and Georgi Kantchev

The Dow Jones Industrial Average edged higher Thursday,

extending gains after it closed above 20000 for the first time

ever.

The blue-chip index of 30 stocks rose 40 points, or 0.2%, to

20108. The S&P 500 fell less than 0.1%, and the Nasdaq

Composite was near unchanged.

Moves in major indexes were muted, with the S&P 500 flipping

between slight gains and losses for much of the morning after

indexes surged to a trifecta of records in the previous session.

While shares of financial companies ticked higher, putting the Dow

industrials on course to squeeze out a fresh closing high, declines

in shares of health-care and tech companies kept other broad

indexes under pressure.

Qualcomm shares fell 5.6% after the chip maker reported after

the bell Wednesday that its net income -- dented by fees for

alleged antitrust violations -- plunged 54% in the latest

quarter.

Meanwhile, Verizon shares lost 1.2% after The Wall Street

Journal reported that the company is exploring a combination with

Charter Communications. Shares of Charter jumped 6.7%.

Many investors say they remain optimistic but cautious about the

path forward for U.S. stocks, as they weigh the benefits of

regulatory rollbacks and infrastructure spending under President

Donald Trump against the potential of a trade war. In the latest

sign of his intent to pursue protectionism, Mr. Trump sent Twitter

messages Thursday putting pressure on Mexico to pay for a wall he

wants built on the border.

The Mexican peso tumbled, with the dollar recently up 1.2%

against the currency. Mexican President Enrique Peña Nieto canceled

a planned meeting with Mr. Trump.

"This quarter is going to be bumpy," said Rick Anderson, chief

investment officer of Chicago-based Hull Investments, who said his

firm kept cash on the sidelines this week to guard against

potential stock swings.

The key question, many investors say, is whether Mr. Trump's

pro-growth policies -- including tax cuts and fiscal stimulus --

will be enough to offset any harm stemming from his

protectionism.

"We are all watching Trump's Twitter feed, but we don't know how

much of his pro-growth policies he will be able to achieve," said

Neil Dwane, global strategist at Allianz Global Investors. "It

might not be enough."

The dollar and government bond yields rose, and gold, a haven

asset, fell. The WSJ Dollar Index, which tracks the dollar against

a basket of 16 other currencies, was recently up 0.6%, coming off

its second lowest close of the year. The yield on the 10-year U.S.

Treasury note inched up to 2.532% from 2.523% Wednesday, according

to Tradeweb. Bond yields rise as prices fall.

Gold fell 0.9% to $1,186.60 an ounce, on course for its third

consecutive session of declines. Investor appetite for the metal --

whose price tends to rise when market uncertainty rises -- has

diminished in recent sessions as risk assets like stocks have

gained.

Elsewhere, the Stoxx Europe 600 gained 0.2%, helped by the tech

and real-estate sectors, while markets from Frankfurt to Hong Kong

pushed higher. Japan's Nikkei 225 Index rose 1.8% and Hong Kong's

Hang Seng Index advanced 1.4% -- its biggest one-day gain since

Nov. 10.

Markets in China, South Korea, Taiwan and Vietnam will be closed

Friday, with China closed through next Thursday, due to the Lunar

New Year holiday.

Write to Akane Otani at akane.otani@wsj.com and Georgi Kantchev

at georgi.kantchev@wsj.com

(END) Dow Jones Newswires

January 26, 2017 13:36 ET (18:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

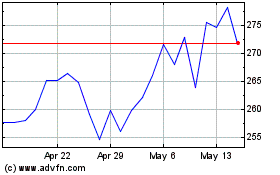

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

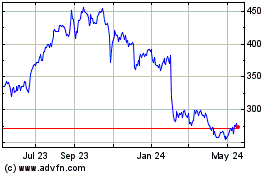

Charter Communications (NASDAQ:CHTR)

Historical Stock Chart

From Jul 2023 to Jul 2024