London Stock Exchange, Deutsche Börse agree to $30 million merger -- Update

16 March 2016 - 7:39PM

Dow Jones News

By Ian Walker in London and Eyk Henning in Frankfurt

London Stock Exchange Group PLC and Deutsche Börse AG on

Wednesday agreed to an all-share merger, creating Europe's biggest

securities-markets operator worth more than $30 billion.

The companies said the combination would generate about EUR450

million ($499.9 million) of cost savings a year and offer the

opportunity to boost revenues.

"It is the right time to make such a transformational deal,"

Deutsche Borse Chief Executive Carsten Kengeter said, adding that

the combined company would be the world's largest exchange operator

by income. Mr. Kengeter will be CEO of the combined company.

Of the merged entity, 45.6% will be owned by LSE shareholders

and the rest by Deutsche Börse shareholders. LSE shareholders will

get 0.4421 shares in the new company for each LSE share they hold

and Deutsche Börse shareholders will get one new share for each of

theirs.

The combined company will be worth about $30.5 billion based on

Tuesday's closing share prices.

The two exchange operators announced last month that they were

in talks. Since then, U.S. rival Intercontinental Exchange Inc.,

the operator of the New York Stock Exchange, has said it was

considering making an offer for LSE. Chicago's CME Group Inc. might

also be in the running, according to a person familiar with the

matter. Hong Kong Exchanges & Clearing Ltd. has said it is

closely watching the discussions between LSE and Deutsche

Börse.

The agreed deal especially puts pressure on ICE to come forward

with a counterproposal, according to people familiar with the

transaction.

The expected EUR450 million in cost savings is higher than what

most analysts had expected and could make the combination more

attractive to shareholders of both companies, increasing the

chances of a deal going through.

Still, the planned tie-up of the two European rivals isn't a

done deal as it would face a number of hurdles, such as regulatory

approval by the European Union's antitrust authority and local

supervisors. The EU in 2012 blocked a proposed merger of Deutsche

Börse and NYSE Euronext.

The management team of the combined company will be led by

Deutsche Borse's Mr. Kengeter as CEO, while LSE Chairman Donald

Brydon will chair the board.

On completion, LSE CEO Xavier Rolet will step down but become

adviser to the chairman and deputy chairman to assist with a

successful transition.

The newly created exchange would be domiciled in London with a

head office in both London and Frankfurt.

Mr. Kengeter said the terms of the deal won't be changed if the

U.K. votes to leave the European Union in a referendum later this

year.

However, the companies have created a referendum committee to

examine the "ramifications" of the U.K. potentially leaving the EU.

They add that "the outcome of that vote might well affect the

volume or nature of the business carried out by the combined

group," but add that "the outcome of the referendum is not a

condition of the merger." Joachim Faber, the Deutsche Börse chair,

will lead the committee.

Giles Turner in London contributed to this article.

Write to Ian Walker at ian.walker@wsj.com and Eyk Henning at

eyk.henning@wsj.com

(END) Dow Jones Newswires

March 16, 2016 04:24 ET (08:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

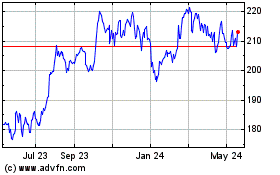

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

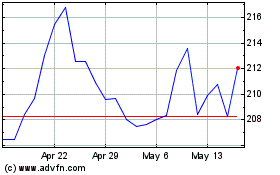

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024