London Stock Exchange, Deutsche Börse Agree to $30 Billion Merger -- 3rd Update

17 March 2016 - 1:17AM

Dow Jones News

By Eyk Henning in Frankfurt, and Shayndi Raice and Giles Turner in London

London Stock Exchange Group PLC and Germany's Deutsche Börse AG

agreed on Wednesday to create Europe's biggest stock exchange

operator that would pose a formidable challenge to larger U.S.

rivals.

The agreement, which would create a $30 billion company by

market value, now sets the stage for a potentially ferocious

bidding war, as U.S. competitors like Intercontinental Exchange

Group Inc. and CME Group Inc. consider their next move.

Rival bidders appeared soon after LSE and Deutsche Börse said

last month they were in talks about a combination. ICE, operator of

the New York Stock Exchange, said it was considering a bid for LSE.

A spokesman for ICE declined Wednesday to comment beyond the

company's previous statement. Other potential deal-crashers include

CME Group Inc., which The Wall Street Journal previously reported

was also considering a bid, and Hong Kong Exchanges & Clearing

Ltd., which said previously it is closely watching the discussions

between LSE and Deutsche Börse.

Shareholders of both companies said they are expecting a rival

to jump into the fray. Wednesday's all-share merger leaves room for

ICE to counter with a more tempting cash bid.

"We don't want a full share deal," said one large U.K.-based LSE

shareholder.

"We would expect some cash" from an ICE bid.

For the merger to go through, at least 75% of shares in Deutsche

Börse need to be tendered, while at least 75% of LSE shareholders

need to vote in favor of the deal.

If completed, the European exchange deal would generate about

EUR450 million ($499.9 million) of cost savings while boosting

revenues, the companies said. However, they said the cost savings

will require an initial investment of EUR600 million.

The figure, which is above what most analysts expected, would

allow Europe to push back against U.S. competitors. Those rivals

have increasingly mounted challenges to Europe's exchanges on their

own turf, particularly in the derivatives market with instruments

such as futures and options that command higher margins and are

harder for rivals to replicate.

"It is the right time to make such a transformational deal,"

Deutsche Börse Chief Executive Carsten Kengeter said.

But the timing is also potentially sensitive, as the U.K. gets

set to vote later this year on whether or not to leave the European

Union. Exchanges have long been a focus of national pride.

Mr. Kengeter said the terms of the deal won't be changed if the

U.K. votes to leave the EU.

However, the companies have created a referendum committee to

examine the "ramifications" of the U.K. leaving the EU. The

companies admitted that "the outcome of that vote might well affect

the volume or nature of the business carried out by the combined

group." Joachim Faber, the Deutsche Börse chairman, will lead the

committee.

The deal would also undergo significant antitrust scrutiny by

the EU and local supervisors. The EU in 2012 blocked a proposed

union of Deutsche Börse and NYSE Euronext.

The linkup is dependent on receiving competition clearance from

the EU, U.S. and Russia. The exchanges have already begun

discussions with a number of regulators.

If merged the entity, will be 45.6% owned by LSE shareholders

and the rest by Deutsche Börse shareholders.

The combined company will have more than 10,000 employees and

over 3,200 companies listed on its markets, with a joint market cap

of EUR7.1 trillion, as of year-end 2015. The combined total income

of EUR4.7 billion in 2015 means the new entity would be the world's

biggest exchange group.

The combined company will be led by Deutsche Börse's Mr.

Kengeter as CEO, while LSE Chairman Donald Brydon will chair the

board. The LSE's Chief Financial Officer David Warren will be the

group's finance chief.

On completion, LSE CEO Xavier Rolet will step down but become

adviser to the chairman and deputy chairman to assist with a

successful transition.

The newly created exchange would be domiciled in London with a

head office in both London and Frankfurt.

Both companies have hired a battery of financial advisers to

ensure the deal goes through. Deutsche Börse is working with

Perella Weinberg Partners LP, Deutsche Bank AG and Bank of America

Corp., while LSE is advised by Robey Warshaw LLP, Goldman Sachs

Inc. and J.P. Morgan Chase & Co., among others.

Ulrike Dauer in Frankfurt and Ian Walker in London contributed

to this article.

Write to Eyk Henning at eyk.henning@wsj.com, Shayndi Raice at

shayndi.raice@wsj.com and Giles Turner at giles.turner@wsj.com

(END) Dow Jones Newswires

March 16, 2016 10:02 ET (14:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

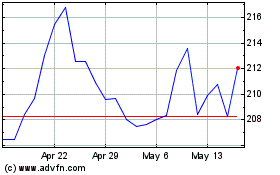

CME (NASDAQ:CME)

Historical Stock Chart

From Jun 2024 to Jul 2024

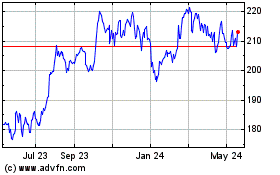

CME (NASDAQ:CME)

Historical Stock Chart

From Jul 2023 to Jul 2024